Achieving financial objectives, whether personal or corporate, necessitates meticulous planning and systematic tracking. In this context, setting financial goals and tracking progress often benefits from a structured visual tool, such as a well-designed saving money challenge chart template. This document serves as a foundational instrument for individuals and organizations aiming to quantify, monitor, and ultimately reach specific monetary milestones through a methodical approach.

This template is designed to provide a clear, actionable framework for visualizing progress, fostering accountability, and sustaining motivation throughout various financial initiatives. It caters to a diverse audience, from individuals embarking on personal savings challenges to businesses tracking departmental budget adherence or project-specific financial allocations. The core utility lies in its capacity to transform abstract financial targets into tangible, monitorable data points.

The Importance of Visual Organization and Professional Data Presentation

Effective data visualization is paramount in today’s information-rich environment. Professional data presentation, particularly through well-structured charts and graphs, significantly enhances comprehension and facilitates quicker decision-making. When financial data is presented visually, complex relationships, trends, and deviations become immediately apparent, bypassing the need for extensive textual analysis.

A professionally organized chart eliminates ambiguity and provides an unambiguous narrative of progress or challenges. It transforms raw numbers into actionable insights, allowing stakeholders to identify areas requiring attention or celebrate achieved milestones with clarity. This clarity is indispensable for maintaining focus on long-term objectives and adjusting strategies as needed.

Poorly presented data, conversely, can lead to misinterpretations, wasted time, and suboptimal financial decisions. Therefore, investing in a robust visual organization strategy, underpinned by consistent chart design principles, is not merely an aesthetic choice but a critical component of effective financial management and communication. It ensures that all parties interpret information uniformly and accurately.

Key Benefits of Using Structured Templates for Chart Creation and Presentation

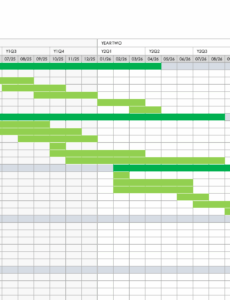

Utilizing structured templates for chart creation offers a multitude of strategic advantages, streamlining the process of data analysis and presentation. These predefined layouts ensure consistency across all visual representations, which is crucial for maintaining a professional standard in business reports and financial analyses. Consistency also aids in comparative analysis over time or across different projects.

Structured templates inherently reduce the potential for errors. By providing a fixed framework for data input and display, they minimize the risk of mislabeling, incorrect scaling, or omission of critical data points. This precision is vital for financial accuracy and the integrity of any performance dashboard.

Furthermore, a well-designed template significantly enhances efficiency. It eliminates the need to create charts from scratch for each new data set or challenge, saving valuable time and resources. This allows users to focus on data interpretation and strategic planning rather than on the mechanics of chart design. The ability to quickly generate visually compelling charts supports timely communication and agile decision-making within any operational context. This systematic approach supports better trend analysis and more reliable data tracking.

Adaptability for Various Purposes

The fundamental principles underlying a saving money challenge chart template are broadly applicable across an extensive range of sectors and functions, extending far beyond personal finance. Its inherent structure, designed for tracking progress against a defined goal, makes it a versatile tool for diverse analytical and reporting needs. This template can be seamlessly adapted to serve as a cornerstone for various professional and academic applications.

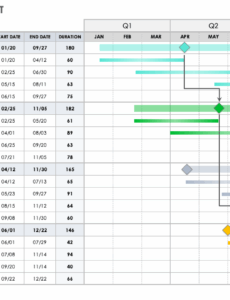

In business, this adaptable framework can be repurposed for tracking project budgets, monitoring sales performance against targets, or visualizing quarterly revenue growth. It offers a clear infographic layout for presenting complex financial or operational data to stakeholders. Departments can use it to track departmental spending against allocated budgets, identify cost-saving opportunities, or monitor the efficiency of specific initiatives.

Academically, the template’s structure is valuable for visualizing research progress, tracking grant expenditures, or demonstrating statistical trends in experimental data. Students can employ it for project management, monitoring study hours, or budgeting personal expenses while at university. The core idea of setting a target and visually charting progress remains universally effective.

Examples of When Using a Saving Money Challenge Chart Template Is Most Effective

The application of a structured chart template proves most effective in scenarios demanding clear, continuous tracking against defined financial or performance objectives. Its visual nature excels at simplifying complex data into digestible insights.

- Personal Financial Goal Achievement: Tracking progress towards a down payment for a house, saving for a major purchase, or building an emergency fund. The visual cues help maintain motivation and clarity on the amount saved versus the goal.

- Small Business Cash Flow Management: Monitoring weekly or monthly cash inflows and outflows against budgeted projections. This helps in identifying potential shortfalls or surpluses early.

- Project Budget Adherence: Visualizing expenditure against a project’s allocated budget to ensure costs remain within defined limits and to identify any overspending areas promptly.

- Sales Performance Tracking: Charting sales team performance against quarterly targets, allowing for quick assessment of progress and identification of top performers or areas needing improvement.

- Debt Reduction Strategies: Illustrating the incremental reduction of debt over time, providing a tangible representation of progress towards financial freedom.

- Investment Growth Monitoring: Visually tracking the growth of an investment portfolio against a set target or benchmark, aiding in long-term financial planning.

- Event Budget Planning: Managing expenditures for corporate events, conferences, or personal milestones, ensuring costs are kept within the designated budget.

Tips for Better Design, Formatting, and Usability

Optimizing a saving money challenge chart template for both print and digital dissemination requires careful attention to detail in design, formatting, and usability. A well-designed chart not only conveys information effectively but also enhances the professional appeal of the document.

Clarity and Simplicity: Prioritize clean, uncluttered designs. Avoid excessive data labels, unnecessary gridlines, or overly complex color schemes. The primary goal is to make the data immediately understandable. Employ a minimalist infographic layout to highlight key information.

Appropriate Chart Type Selection: Choose the chart type that best represents your data. Bar graphs are excellent for comparing discrete categories, pie charts for showing proportions of a whole, and line graphs are ideal for illustrating trends over time. For tracking cumulative progress, a stacked bar or area chart can be highly effective.

Color Palette: Use a consistent and limited color palette. Colors should be distinctive but not jarring. Consider accessibility guidelines, ensuring sufficient contrast for color-blind individuals. A monochromatic scheme with varying shades can also provide sophistication.

Typography: Select legible fonts. Use different font sizes and weights to establish a clear hierarchy, making titles, labels, and data points easy to distinguish. Maintain consistency in font usage throughout the template.

Data Labels and Axis Formatting: Ensure all axes are clearly labeled with appropriate units. Data labels should be present but not overwhelm the visual. Format numbers consistently (e.g., currency symbols, percentage signs) and use commas for thousands.

Interactivity for Digital Versions: For digital formats, consider incorporating interactive elements. Tooltips that display detailed data on hover, clickable segments that reveal sub-charts, or filtering options can significantly enhance user engagement and analytical depth. This transforms a static chart into a dynamic performance dashboard.

Print Readability: When designing for print, ensure that colors reproduce well on paper. Check that text remains legible even when printed in black and white or grayscale. Provide ample margins and ensure the chart fits comfortably on standard paper sizes without excessive scaling. Pay close attention to report formatting to maintain a professional appearance.

Responsiveness for Digital Displays: Design digital versions to be responsive, adapting seamlessly across various screen sizes—from large monitors to mobile devices. This ensures usability and accessibility for all users, regardless of their viewing platform. This attention to presentation template detail ensures maximum impact and user satisfaction.

Implementing these design and formatting principles ensures that any chart template, including a saving money challenge chart template, serves as a powerful, intuitive, and professional communication tool. It elevates the visual presentation of data, fostering greater engagement and clearer understanding among its intended audience.

The consistent application of such a structured visual tool ultimately streamlines financial monitoring and objective achievement. It serves not merely as a record-keeping device but as an integral component of a robust financial strategy. This proactive approach to data management transforms abstract financial figures into a compelling, trackable narrative, providing clarity and direction.

By adopting a standardized approach to tracking progress, organizations and individuals alike can significantly enhance their capacity for informed decision-making. The value derived from a well-utilized data record extends beyond simple reporting, becoming a catalyst for sustained financial discipline and strategic growth.