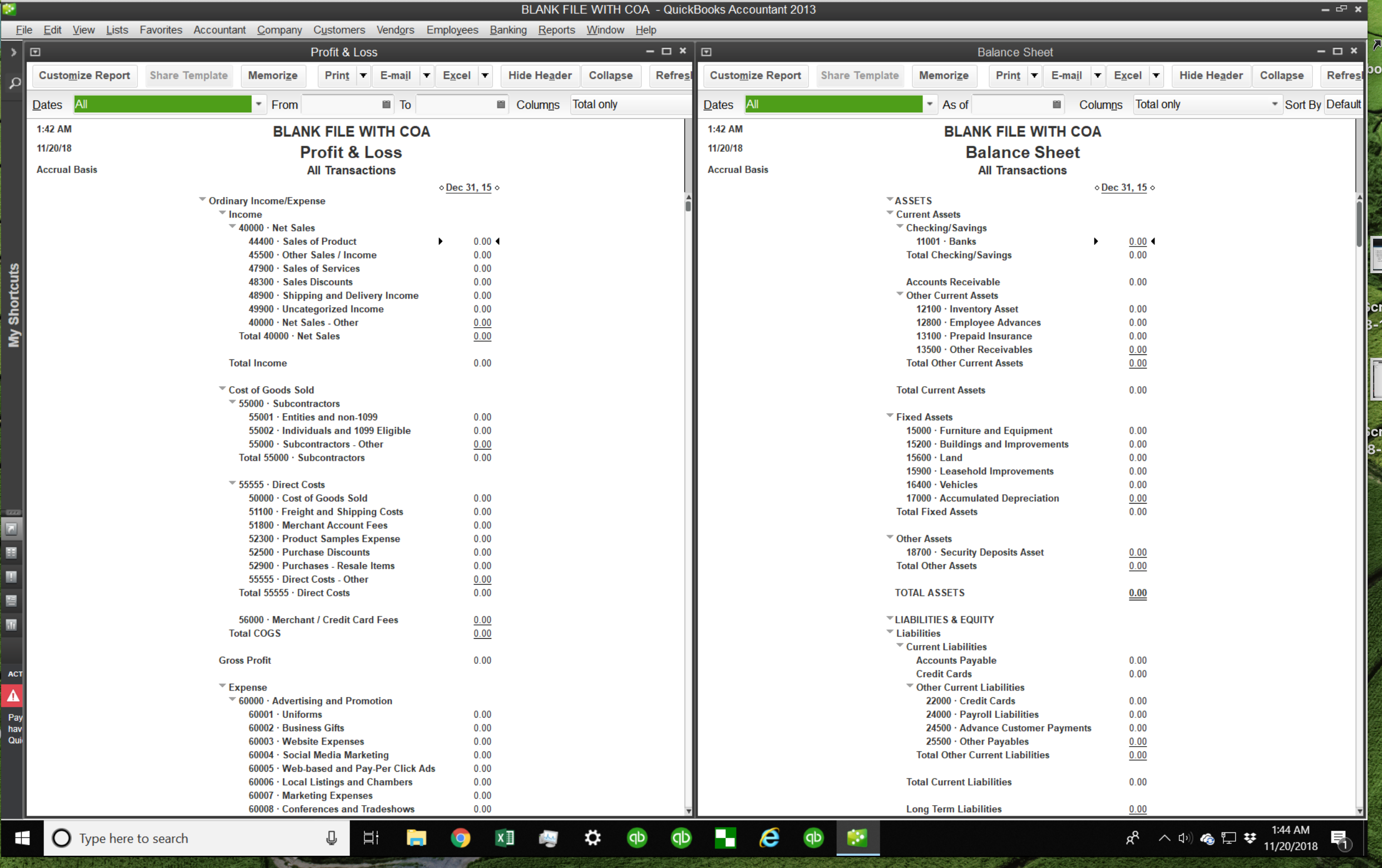

Effective financial management is paramount for any organization seeking to maintain clarity, achieve operational efficiency, and make informed strategic decisions. A robust chart of accounts forms the backbone of this financial infrastructure, classifying every transaction into appropriate categories. For businesses utilizing Intuit’s QuickBooks platform, a well-structured quickbooks chart of accounts template is not merely a convenience; it is a foundational element that ensures consistent data entry, simplifies reporting, and provides a standardized framework for financial analysis. This article delves into the critical role and multifaceted benefits of adopting such a template.

The utility of a predefined chart extends beyond mere categorization. It serves as a blueprint that guides accounting personnel, facilitates accurate period-end closing procedures, and offers a comprehensive overview of a company’s financial health. By standardizing account names and numbering conventions, the template significantly reduces ambiguity and the potential for errors, thereby enhancing the integrity and reliability of financial data across the entire organization.

The Importance of Visual Organization and Professional Data Presentation

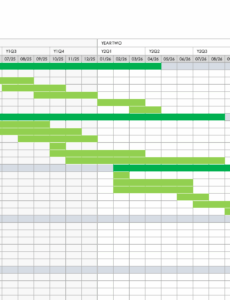

The ability to present complex financial data in a clear, organized, and visually appealing manner is crucial for internal stakeholders and external audiences alike. Professional data presentation transforms raw numbers into actionable insights, enabling quicker comprehension and more effective decision-making. Visual organization, whether through data visualization techniques, concise charts, or well-structured reports, directly impacts how information is received and understood.

An intelligently designed chart of accounts template inherently promotes this visual clarity. It establishes a logical hierarchy for accounts, grouping similar items and highlighting relationships that might otherwise be obscured in a flat list. This structure aids in creating more intuitive financial statements, performance dashboards, and analytical reports, where users can readily identify trends, anomalies, and key performance indicators. The emphasis on clean formatting and logical arrangement within the template ultimately supports superior chart design and overall data presentation.

Key Benefits of Using Structured Templates, Visuals, or Layouts

Adopting structured templates, predefined visuals, and consistent layouts for financial data offers a multitude of advantages that streamline operations and enhance analytical capabilities. These tools provide a standardized approach to information management, ensuring uniformity and reducing the potential for inconsistencies across different reports or users. Employing a comprehensive quickbooks chart of accounts template provides a consistent framework from the outset, which is invaluable.

Firstly, such templates accelerate the setup process for new companies or projects, drastically cutting down the time and effort required to establish a robust accounting system. This efficiency gain allows finance teams to focus on analysis rather than on initial configuration. Secondly, they improve accuracy by minimizing manual data entry errors and ensuring that every transaction is categorized according to established guidelines. A well-designed template acts as a guide, making it harder for users to misclassify entries.

Moreover, structured layouts facilitate easier collaboration among team members. When everyone uses the same visual and organizational standards, information sharing becomes more efficient, and discrepancies are easier to identify and resolve. This standardization also significantly simplifies the auditing process, as auditors can quickly navigate and understand the underlying data structure. The benefits extend to advanced data tracking and trend analysis, as consistent data points allow for more reliable comparisons over time.

How This Template Can Be Adapted for Various Purposes

The fundamental structure provided by a quickbooks chart of accounts template offers remarkable adaptability, extending its utility far beyond standard accounting practices. While its primary function is financial reporting, the principles of hierarchical organization and standardized categorization can be effectively leveraged across diverse applications. This inherent flexibility makes it a valuable asset for numerous organizational and analytical needs.

For instance, in business reports, the underlying structure of the chart can inform the breakdown of operational expenses, revenue streams, or departmental budgets, providing a consistent framework for financial narratives. When applied to academic projects, especially those involving case studies or financial modeling, the template can serve as a foundation for organizing hypothetical accounts and illustrating financial flows in a structured manner.

In performance tracking, the template’s logic can be adapted to categorize key performance indicators (KPIs) or operational metrics, allowing for clear demarcation between different areas of performance, such as sales efficiency, marketing spend effectiveness, or production costs. For financial analysis, the consistent account numbering and grouping directly support sophisticated trend analysis, ratio calculations, and variance analysis, offering a stable dataset against which to measure financial health and growth. The versatility of this diagram allows for a more comprehensive and integrated approach to data organization, promoting clarity in varied analytical contexts.

Examples of When Using a Quickbooks Chart Of Accounts Template Is Most Effective

The application of a well-designed quickbooks chart of accounts template proves invaluable in numerous scenarios, ensuring consistency, improving data integrity, and streamlining financial processes. Its structured approach is particularly beneficial when precision and clarity are paramount.

- New Business Formation: When establishing a new business, using a predefined template provides a ready-made financial structure, preventing common setup errors and ensuring immediate compliance with accounting best practices. This accelerates the process of getting the financial system operational.

- Industry-Specific Accounting: Businesses in specialized industries (e.g., construction, non-profit, retail) often have unique reporting requirements. A tailored quickbooks chart of accounts template can incorporate industry-specific accounts and sub-accounts, ensuring that all relevant financial activities are accurately captured and reported according to industry standards.

- Scaling Operations: As a business grows and introduces new products, services, or departments, the template facilitates the seamless integration of new financial activities. It provides a scalable framework that can accommodate expansion without disrupting the existing financial reporting structure.

- Mergers and Acquisitions: During M&A activities, integrating the financial systems of two entities can be complex. Utilizing a standardized template helps to align chart of accounts structures, making it easier to consolidate financial statements and identify synergies or redundancies.

- External Audits and Compliance: For businesses undergoing regular audits, a standardized and logically organized chart of accounts significantly simplifies the audit process. It demonstrates strong internal controls and provides auditors with a clear path to verify transactions and account balances.

- Budgeting and Forecasting: A consistent chart of accounts is critical for accurate budgeting and forecasting. It ensures that historical data is categorized uniformly, allowing for reliable comparisons and the projection of future financial performance based on sound, comparable data.

Tips for Better Design, Formatting, and Usability

Optimizing the design, formatting, and usability of any financial record, including a chart of accounts, is essential for maximizing its effectiveness. A well-structured layout not only looks professional but also enhances readability and reduces the likelihood of errors, whether it is for print or digital consumption. Prioritizing clarity and logical flow is fundamental.

Firstly, consider logical numbering conventions. Implement a hierarchical numbering system (e.g., 1000s for Assets, 2000s for Liabilities) that allows for easy identification of account types and leaves room for future expansion. This approach simplifies navigation through the data file. Secondly, use clear and consistent naming conventions. Each account name should be concise, descriptive, and uniform throughout the chart. Avoid jargon where possible and ensure that all team members understand what each account represents.

For visual clarity, leverage formatting tools effectively. Utilize bolding for main categories and indentation for sub-accounts to create a visual hierarchy. This infographic layout aids in distinguishing between different levels of detail. Employ consistent font styles and sizes to maintain a polished appearance. When designing for digital use, ensure the template is easily searchable and filterable. For print versions, consider adequate margins and white space to prevent a cluttered appearance.

Regarding usability, provide clear documentation or a key explaining the purpose of each account, especially for specialized or less intuitive categories. This enhances the accessibility of the record for new users. Integrate comment sections or notes fields within the digital template for specific instructions or context relevant to certain accounts. Regularly review and update the data file to reflect changes in business operations or accounting standards. Implementing these design and usability principles will transform a functional tool into an exceptionally effective communication and management instrument.

The establishment of a robust and intuitively organized chart of accounts is a foundational step toward exemplary financial management. By employing a meticulously designed template, organizations can ensure unparalleled consistency in their financial record-keeping, thereby fostering a data-driven environment where informed decisions are the norm. This structured approach not only saves valuable time in data entry and reporting but also significantly elevates the accuracy and reliability of all financial outputs.

Ultimately, a well-implemented chart of accounts template serves as a powerful communication tool, transforming complex financial data into a clear, understandable narrative. Its visual effectiveness and logical structure empower stakeholders with the insights needed to guide strategic planning, track performance, and maintain a competitive edge. Embracing such a comprehensive and adaptable template is not merely an administrative task; it is a strategic investment in the future clarity and precision of an organization’s financial landscape.