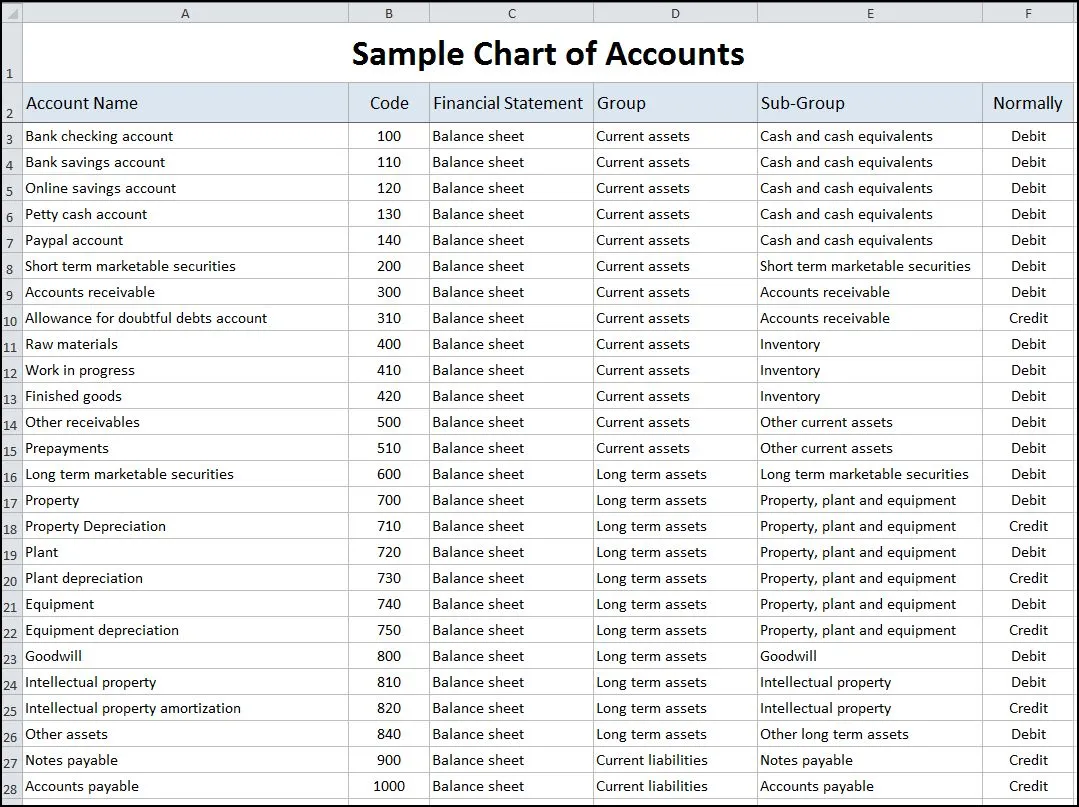

Effective financial management, whether for an individual’s personal assets or the operational finances of a small enterprise, necessitates a robust framework for categorizing transactions. The personal chart of accounts template serves as a foundational instrument, offering a standardized, hierarchical structure to classify all monetary inflows and outflows. This meticulously designed document provides a comprehensive blueprint, ensuring that every financial event is recorded systematically, thereby facilitating precise tracking, reporting, and analytical processes for any financially conscious individual or entity.

This template is meticulously crafted to empower users with an organized system for their financial data. It enables a clear distinction between assets, liabilities, equity, revenues, and expenses, which is paramount for generating accurate financial statements and understanding one’s true fiscal position. Adopting this structured approach is crucial for anyone seeking to gain deeper insights into their spending habits, investment performance, or overall financial health, moving beyond rudimentary record-keeping to sophisticated financial analysis.

The Imperative of Visual Organization and Professional Data Presentation

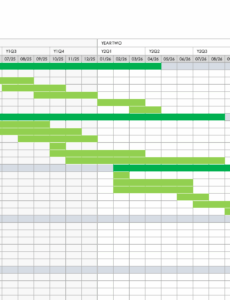

In today’s data-rich environment, the ability to organize and present information clearly is not merely an advantage but a necessity. For financial data, a well-structured and visually coherent chart of accounts enhances comprehension and reduces the cognitive load associated with complex datasets. Professional data presentation transforms raw figures into actionable insights, making it possible to identify trends, pinpoint inefficiencies, and make informed decisions with greater confidence.

Visual organization transcends mere aesthetics; it underpins the integrity and utility of financial reporting. When data is presented professionally, it lends credibility to the analysis and ensures that stakeholders, whether they are personal financial advisors or family members, can readily interpret the information. Utilizing robust chart design principles and an infographic layout, these templates ensure that the underlying financial architecture is transparent and easily navigable, critical for both ongoing management and periodic review.

Key Benefits of Structured Templates and Visual Layouts

Structured templates offer a multitude of advantages, significantly streamlining the process of financial classification and analysis. They provide a pre-defined framework that reduces the time and effort required to establish a comprehensive accounting system from scratch. This consistency ensures uniformity in data entry, which is vital for accurate aggregation and comparative analysis over time.

Furthermore, leveraging visual layouts in financial instruments enhances user engagement and understanding. A well-designed template, incorporating elements of data visualization, transforms potentially overwhelming financial details into an accessible format. This not only aids in initial setup but also facilitates ongoing maintenance, making the process of tracking income and expenditures more intuitive and less prone to error. Such a systematic approach supports robust data tracking and fosters a proactive stance toward financial management.

Adapting the Template for Diverse Applications

The inherent flexibility of a well-designed chart of accounts extends its utility far beyond basic personal finance. While its core function is to categorize financial transactions, the underlying principles of hierarchical data organization can be readily adapted for a myriad of purposes. This adaptability makes the template an invaluable tool across various professional and personal domains.

From crafting detailed business reports for startups to organizing data for academic projects requiring meticulous categorization, the structure provides a solid backbone. It can be particularly effective in performance tracking for specific projects or departments, enabling users to monitor budgetary allocations and expenditure against projections. For in-depth financial analysis, a consistent and clear classification system is indispensable, allowing for sophisticated trend analysis and variance reporting. The utility of the personal chart of accounts template, therefore, transcends its initial financial scope, becoming a versatile organizational tool.

Examples of Effective Implementation

The application of a structured chart of accounts is highly effective in various scenarios, offering clarity and precision where complex data needs careful management. Its systematic approach ensures that every piece of information contributes meaningfully to the overall understanding.

- Small Business Financial Reporting: Entrepreneurs can adapt the template to create a streamlined system for tracking operational expenses, revenue streams, and asset depreciation, simplifying tax preparation and profit-and-loss statements.

- Household Budgeting and Expense Tracking: Families can use this layout to meticulously categorize spending across various budget lines such as groceries, utilities, housing, and entertainment, gaining granular control over their household finances.

- Project-Based Financial Management: Individuals or teams managing specific projects can customize the chart to track project-specific income and expenditures, facilitating accurate cost-benefit analysis and budget adherence.

- Investment Portfolio Analysis: Investors can employ the template to categorize different types of investments, dividend income, capital gains, and associated fees, enabling a clearer assessment of portfolio performance and diversification.

- Academic Research Data Organization: Researchers can apply the hierarchical structure to organize data points from studies, ensuring consistent categorization for quantitative analysis and clear presentation in academic papers.

- Non-Profit Grant Tracking: Non-profit organizations can utilize this form to segment grant funds, track expenditures against specific program objectives, and ensure compliance with donor requirements.

- Performance Dashboard Creation: By linking the categorized data to a performance dashboard, users can visualize key financial metrics through bar graphs, pie charts, and other visual aids, providing an immediate snapshot of financial health.

Design Principles for Enhanced Usability and Impact

Effective design of any data file is paramount for its usability and long-term impact. When constructing or customizing a chart, focusing on clarity, consistency, and intuitive navigation will significantly enhance its value. A well-designed template is not just about organizing numbers; it is about creating a logical flow that supports informed decision-making and efficient data retrieval.

Employing clear labeling conventions and a consistent numbering system is fundamental to the chart’s integrity. Each account should have a unique identifier and a descriptive name that accurately reflects its purpose. Thoughtful report formatting ensures that when the data is extracted or viewed, it is presented in an easily digestible manner, reinforcing the professional and authoritative tone of the financial documentation.

Optimizing for Digital and Print Formats

Given the dual nature of modern documentation, a chart of accounts template must be optimized for both digital consumption and print reproduction. For digital versions, features such as hyperlinks to related accounts or embedded instructions can significantly enhance usability. Search functionality and compatibility with various software platforms are also critical for seamless integration into existing digital workflows.

When preparing the document for print, considerations shift to readability and physical presentation. This includes optimizing font sizes, ensuring adequate margins, and selecting a clear, legible typeface. The judicious use of white space prevents visual clutter, allowing the eye to comfortably navigate through the data. Furthermore, consistent header and footer information, along with page numbering, ensures that a printed version remains coherent and easy to reference, much like a professional financial statement.

The strategic deployment of a robust chart of accounts template offers an unparalleled advantage in mastering financial oversight and communication. It transforms the often-daunting task of financial management into a structured, manageable process, yielding dividends in clarity and efficiency. By providing a common language for all financial transactions, it becomes an indispensable tool for anyone committed to rigorous record-keeping and sophisticated financial analysis.

Ultimately, this layout is more than just a list of accounts; it is a powerful communication instrument. Its capacity to present complex financial data in an organized, visually accessible format makes it a time-saving solution for data tracking and an effective vehicle for conveying financial health. Embracing this disciplined approach empowers users to move beyond rudimentary financial awareness towards proactive, data-driven decision-making, ensuring that every financial move is backed by solid, interpretable information.