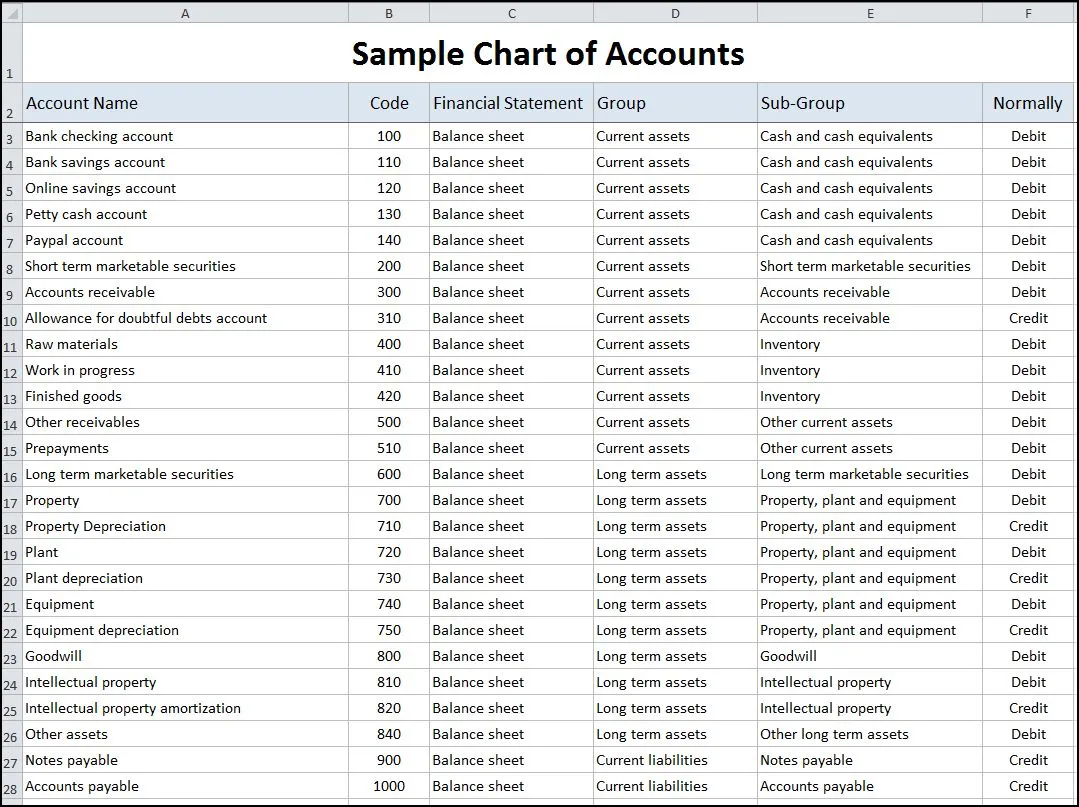

Effective personal financial management hinges on structured organization, offering clarity and control over an individual’s or family’s economic landscape. A well-defined household chart of accounts template serves as a foundational blueprint, categorizing all financial transactions—income, expenses, assets, and liabilities—into a logical, hierarchical framework. This systematic approach is indispensable for accurate record-keeping, facilitating informed decision-making, and simplifying complex financial analysis for anyone committed to robust fiscal health.

The primary purpose of this template is to provide a standardized, yet adaptable, system for tracking monetary flows and balances. Individuals, families, and even small entrepreneurs operating from a personal financial perspective can significantly benefit from the structure it imparts. By clearly delineating where money originates and where it is allocated, the document empowers users to identify spending patterns, evaluate saving opportunities, and ultimately achieve greater financial stability and foresight.

The Imperative of Visual Clarity in Financial Management

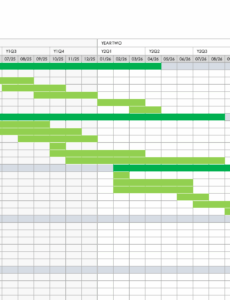

Visual organization is paramount in transforming raw financial data into intelligible, actionable insights. In an era dominated by information overload, presenting complex numerical data through professional data presentation significantly enhances comprehension and retention. For financial management, this means moving beyond mere lists of transactions to structured representations that highlight trends, anomalies, and key performance indicators.

Professional data presentation ensures that stakeholders, whether individuals reviewing their monthly budget or families planning for long-term goals, can quickly grasp the overall financial picture. Utilizing principles of effective data visualization, such as consistent labeling and intuitive grouping, helps to demystify complex financial relationships. This clarity is crucial for making objective decisions, as it minimizes misinterpretation and focuses attention on critical financial metrics. A thoughtfully organized financial framework acts as a powerful tool for effective communication, both for self-assessment and when discussing finances with advisors or family members.

Advantages of a Standardized Financial Framework

Implementing a structured template for financial charting offers numerous tangible benefits that streamline the management process. Primarily, it establishes consistency across all financial records, ensuring that every transaction is categorized uniformly over time. This standardization is critical for accurate data tracking and reduces the likelihood of errors, which often arise from ad-hoc or inconsistent categorization methods.

Moreover, a well-designed financial framework significantly enhances the efficiency of financial analysis. By providing pre-defined categories, the template accelerates the input process and simplifies the generation of comprehensive financial reports. This structured approach facilitates easier auditing, whether for tax purposes or personal review, and supports more effective trend analysis. The clear layout aids in identifying patterns in spending and income, enabling proactive adjustments to financial strategies. Such a presentation template also promotes better communication among family members regarding shared financial responsibilities and goals.

Versatile Applications of a Structured Account System

The underlying principles of a well-organized household chart of accounts template extend far beyond basic personal budgeting. Its systematic approach to categorization and tracking can be adapted with remarkable flexibility across various domains requiring precise financial or quantitative oversight. The structured nature of such a chart makes it an invaluable asset for numerous analytical and reporting purposes, demonstrating its robust utility.

For instance, businesses can leverage its logic to create simplified departmental budgets or project expense tracking systems, even if their primary accounting is more complex. Academic projects involving financial modeling or case studies benefit from a clear, consistent classification scheme for data analysis. In performance tracking, whether for personal career goals or a specific investment portfolio, adapting the categories allows for detailed monitoring of inflows, outflows, and asset valuations. Furthermore, advanced financial analysis, such as evaluating investment returns or calculating net worth, becomes significantly more manageable when data is pre-organized into logical accounts. The adaptability of this framework underscores its foundational role in any scenario demanding clear, classified financial or quantitative data presentation.

Optimal Scenarios for Utilizing the Template

A meticulously structured financial template proves invaluable in a multitude of practical scenarios, providing clarity and facilitating informed decision-making. Its application enhances transparency and control over financial aspects, making it an indispensable tool for proactive fiscal management.

- Budget Creation and Adherence: Establishing and maintaining a realistic budget becomes significantly simpler when all income and expense categories are clearly defined, allowing for precise allocation and monitoring of funds.

- Tax Preparation: Categorized income and expenses streamline the process of gathering necessary documentation for tax filing, ensuring all deductions and credits are properly accounted for and minimizing audit risk.

- Debt Management Strategy: Tracking specific debt categories and their associated payments allows for a clearer view of outstanding liabilities, aiding in the formulation and execution of effective debt reduction plans.

- Savings Goal Tracking: Clearly defined savings accounts for specific objectives (e.g., down payment, education, retirement) enable consistent monitoring of progress towards financial milestones.

- Estate Planning: A comprehensive overview of assets and liabilities, systematically organized, simplifies the process of estate planning and ensures clarity for beneficiaries.

- Financial Goal Setting and Monitoring: From planning a major purchase to achieving long-term investment targets, the template provides a structured method to track progress and adjust strategies as needed.

- Managing Side Gigs or Freelance Income: Segregating income and expenses related to supplemental work from personal finances offers a clearer picture of profitability and tax obligations.

- Analyzing Spending Habits: Detailed categorization helps in identifying areas of discretionary spending that can be optimized, fostering greater financial discipline.

Enhancing Usability and Aesthetic Appeal

Optimizing the design, formatting, and overall usability of any financial chart is critical for its long-term adoption and effectiveness. A well-designed visual or data file should be intuitive, comprehensive, and aesthetically pleasing, whether in print or digital format. This requires careful consideration of how information is presented and interacted with.

Begin by ensuring logical grouping of accounts, structuring them from broad categories to more specific sub-accounts (e.g., "Expenses" > "Housing" > "Rent," "Utilities"). Employ clear and consistent naming conventions throughout the entire layout, avoiding jargon or overly technical terms that might confuse users. For readability, select professional, sans-serif fonts and maintain adequate white space between sections. Strategic use of color can aid in differentiating major categories or highlighting critical data points, but should be used sparingly to avoid visual clutter.

When developing for digital platforms, consider features like interactive elements, expandable sections, and integration capabilities with spreadsheet software or personal finance applications. For print versions, ensure the chart is legible, with appropriate font sizes and clear line breaks, and that it fits standard paper dimensions without requiring excessive scrolling or zooming. Incorporating elements like a simple performance dashboard or the ability to generate a bar graph or pie chart from the data can significantly enhance the record’s analytical utility. Regularly reviewing and updating the chart based on evolving financial needs or software capabilities ensures its continued relevance and ease of use. This continuous refinement transforms a basic document into a powerful data visualization tool for trend analysis and detailed report formatting.

The continuous refinement of this data file, coupled with a commitment to clarity and precision, transforms it from a simple accounting tool into a dynamic instrument for financial empowerment. It fosters a proactive approach to money management, enabling users to anticipate needs, react strategically to changes, and plan for future success with confidence. By embracing the principles of structured organization and visual excellence, individuals and families can navigate their financial journeys with greater understanding and control, turning complex data into actionable wisdom.

In essence, this foundational template provides more than just a place to log numbers; it offers a coherent framework for understanding and mastering one’s financial narrative. Its inherent design promotes transparency, encourages analytical thinking, and serves as an indispensable reference for assessing financial health over time. Leveraging this structured approach allows for significant time savings in data reconciliation and reporting, ultimately driving more informed, data-driven decisions for a secure and prosperous financial future.