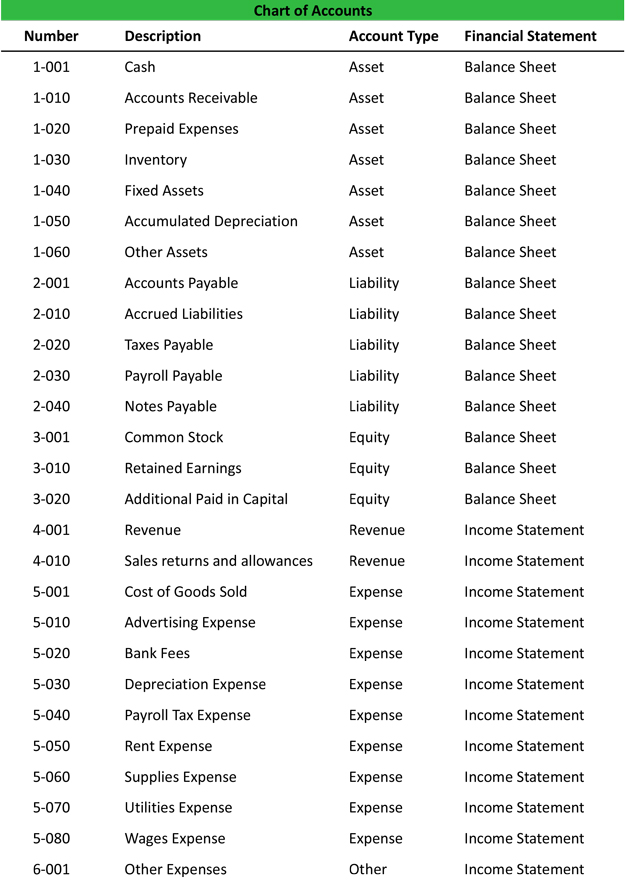

A robust financial infrastructure is the bedrock of any successful enterprise, and at its core lies a meticulously organized chart of accounts. To ensure clarity, consistency, and efficient data retrieval, a well-structured chart of accounts numbering template is indispensable. This foundational document provides a systematic framework for categorizing every financial transaction, enabling businesses to accurately record, track, and analyze their economic activities with unparalleled precision. It serves as the definitive roadmap for an organization’s financial narrative, dictating how revenues, expenses, assets, liabilities, and equity are classified.

The comprehensive template offers substantial benefits to a wide array of stakeholders, including financial controllers, accountants, auditors, and business executives. By standardizing the numbering convention and account definitions, the template streamlines the often complex processes of financial reporting and analysis. It facilitates seamless integration with accounting software, reduces the likelihood of data entry errors, and ensures that all financial statements consistently reflect the organization’s true financial position and performance. This systematic approach empowers decision-makers with reliable, granular data essential for strategic planning and operational oversight.

The Imperative of Visual Organization in Data Presentation

In today’s data-rich environment, the ability to present complex financial information clearly and concisely is paramount. Visual organization is not merely an aesthetic preference; it is a critical component of effective business communication. A professionally organized chart significantly enhances readability and comprehension, transforming raw financial data into actionable insights. When financial records are structured logically, users can quickly identify trends, anomalies, and key performance indicators.

Professional data presentation, supported by principles of data visualization and infographic layout, ensures that even non-financial stakeholders can grasp the implications of financial figures. Clear visual hierarchies and consistent formatting prevent misinterpretations and foster confidence in the reported data. This deliberate organization extends beyond basic lists, often integrating elements that support a performance dashboard or a comprehensive financial report, making complex information accessible and impactful.

Core Benefits of Utilizing Structured Templates for Financial Data

The adoption of structured templates for chart creation offers a multitude of tangible advantages for any organization. Primarily, it instills a much-needed layer of consistency across all financial operations. Every transaction, regardless of its origin, is classified uniformly, eliminating ambiguities and ensuring that financial reports are always comparable and reliable. This standardization is critical for internal analysis and external compliance.

Furthermore, a well-designed template significantly improves efficiency in data entry and retrieval. Accountants can quickly locate appropriate accounts, reducing the time spent on manual classification and minimizing input errors. This efficiency directly contributes to faster month-end closings and more agile financial reporting cycles. The structured nature also underpins robust trend analysis, allowing organizations to track financial performance over time with greater accuracy and identify patterns that inform future strategies.

Versatility and Adaptability Across Diverse Applications

While fundamentally designed for financial categorization, the underlying principles of a chart of accounts numbering template extend far beyond traditional accounting functions. Its adaptable structure makes it a powerful tool for organizing data in various contexts. In business reports, it can serve as a model for structuring operational KPIs, departmental budgets, or project costs, providing a clear hierarchy for tracking progress and expenditure.

Academic projects, particularly those involving financial modeling or economic analysis, can leverage the template’s logical framework to categorize variables and outcomes. For performance tracking, whether financial or non-financial, the structured approach aids in defining and organizing metrics, allowing for consistent data collection and comparative analysis. Its utility in financial analysis is self-evident, providing the foundation for variance analysis, forecasting, and scenario planning, ensuring that all data inputs are consistently aligned and easily referenced. For instance, when integrating new departments or consolidating subsidiaries, a robust chart of accounts numbering template ensures that diverse financial structures can be harmonized efficiently, preventing data siloes and facilitating unified reporting.

Strategic Scenarios for Implementing a Chart Of Accounts Numbering Template

The application of a comprehensive chart of accounts numbering template proves most effective in several strategic scenarios, offering clarity and structure where it is most needed.

- Setting up a new business’s financial system: Establishing a robust numbering system from inception prevents future reclassification headaches and ensures immediate clarity in financial reporting.

- Restructuring an existing chart for better granularity: Organizations often outgrow their initial chart structures; a template provides a methodical way to expand or refine accounts for more detailed financial insights.

- Mergers and acquisitions for integrating financial records: When combining entities, a standardized template is crucial for consolidating disparate charts of accounts into a cohesive, unified system.

- Preparing for an audit to demonstrate financial integrity: A well-organized chart, derived from a clear template, significantly simplifies the audit process by making financial data transparent and easily verifiable.

- Developing departmental budgets and cost centers: The template provides the necessary framework for allocating expenses and revenues to specific departments or projects, facilitating accurate budget management.

- Implementing new accounting software: A predefined chart structure from the template streamlines the migration process, ensuring all historical data maps correctly to the new system.

- Creating a multi-entity financial reporting system: For organizations operating multiple subsidiaries or legal entities, the template enables consistent reporting standards across all units, simplifying consolidation.

In each of these instances, the layout minimizes confusion, enhances data integrity, and supports informed decision-making by providing a clear and accessible financial blueprint.

Enhancing Design, Formatting, and Usability for Optimal Impact

To maximize the effectiveness of any data structure, superior design and formatting are crucial for usability, whether in print or digital formats. The clarity of numbering conventions, such as sequential, block, or hierarchical systems, directly impacts how intuitive the chart is to navigate. Consistent application of these conventions across all financial accounts is non-negotiable for maintaining logical order and ease of reference.

Beyond the numbering, attention to report formatting details like font choice, color schemes, and consistent spacing significantly influences readability. These elements contribute to the visual coherence of the diagram, making it less daunting to review extensive lists of accounts. For digital versions, integrating features such as interactive filters, search functions, and collapsible sections can dramatically improve user experience, turning a static list into a dynamic data tracking tool. For print, legibility and sensible page breaks are vital, ensuring that the visual remains clear and easy to follow without losing context. Effective chart design, potentially incorporating elements like bar graph or pie chart representations for summary views, can further enhance analytical capabilities.

The template, when thoughtfully designed, becomes more than just a list of numbers; it transforms into an intuitive infographic layout that simplifies complex financial relationships. It serves as a visual guide that helps users quickly locate specific accounts, understand their relationships, and extract the necessary information without unnecessary effort. This meticulous approach to design and usability is critical for transforming raw data into a truly functional and accessible record.

The practical value of a meticulously designed chart of accounts numbering template cannot be overstated. It stands as a time-saving, data-driven, and visually effective communication tool, providing the backbone for sound financial management. By standardizing financial classification, it ensures unparalleled consistency, reduces errors, and significantly streamlines reporting processes, allowing organizations to dedicate more resources to analysis rather than reconciliation.

Ultimately, this robust financial architecture empowers businesses to navigate their financial landscape with confidence and clarity. It fosters an environment of transparency and precision, essential for both day-to-day operations and long-term strategic planning. As an indispensable component of modern business governance, the template serves as a powerful instrument for achieving financial excellence and sustaining organizational growth.