In the intricate landscape of financial transactions, meticulous record-keeping stands as a cornerstone of transparency, accountability, and legal compliance. Whether for individuals managing shared living expenses or property owners overseeing rental agreements, the formal acknowledgment of financial exchanges is paramount. A meticulously designed room rent receipt template serves precisely this critical function, providing undeniable proof of payment and fostering clear communication between parties. This essential document is not merely a formality; it is a vital tool for preventing disputes, simplifying tax preparations, and maintaining accurate financial ledgers for both payer and recipient.

The utility of a well-structured receipt extends across various scenarios, benefiting tenants who require evidence of their payments, landlords needing precise records for income reporting, and even co-tenants splitting expenses. By standardizing the information captured for each transaction, it eliminates ambiguity and ensures that all relevant details are systematically recorded. Such a document transforms an informal exchange of funds into a verifiable business transaction, embodying principles of good financial governance and professional conduct.

The Imperative of Clear Financial Documentation

Accurate and professional documentation forms the bedrock of sound financial management in any context, from personal budgeting to corporate accounting. Every financial transaction, regardless of its scale, necessitates a corresponding record to validate its occurrence and details. This principle holds particularly true for recurring payments like rent, where consistency and verifiability are crucial for long-term financial health and legal protection. Without robust documentation, the potential for misunderstandings, payment disputes, and legal challenges significantly increases.

Beyond merely preventing conflict, well-maintained financial records are indispensable for various practical applications. They are fundamental for tax reporting, allowing individuals and businesses to accurately declare income and expenses, thereby ensuring compliance with fiscal regulations. Furthermore, in the event of an audit or a legal inquiry, a comprehensive collection of payment receipts provides concrete evidence, substantiating financial claims and demonstrating adherence to agreed-upon terms. A clear payment receipt, therefore, reflects professionalism and cultivates an environment of trust between all transacting parties.

Key Benefits of Utilizing a Structured Template

Employing a structured approach to generate payment acknowledgments offers substantial advantages, significantly enhancing the efficiency and reliability of financial operations. Foremost among these benefits is the assurance of accuracy. A pre-designed template includes standardized fields that prompt the user to capture all necessary information, reducing the likelihood of omissions or errors that can plague handwritten or ad-hoc receipts. This systematic approach ensures that critical details like dates, amounts, and payment methods are consistently recorded.

Transparency is another cornerstone benefit. A well-laid-out receipt clearly itemizes what has been paid for, the period it covers, and any outstanding balances, leaving no room for misinterpretation. This level of clarity builds confidence and establishes a clear financial trail. Moreover, consistency in record-keeping is achieved effortlessly through such a template. Every proof of transaction generated will follow the same format, making it far simpler to review, reconcile, and audit financial records over time, streamlining administrative tasks and saving valuable time for both individuals and businesses.

Customization Across Diverse Transaction Types

While often associated with residential tenancy, the foundational structure of this financial template is remarkably versatile, allowing for extensive customization across a broad spectrum of transaction types. The core elements of any receipt—payer, recipient, amount, date, and description—are universally applicable. This inherent adaptability means that with minor modifications, the underlying layout can serve various purposes beyond rent collection.

For instance, the template can be readily adapted to function as a sales record for retail businesses, detailing products purchased and quantities. It can transform into a service receipt for independent contractors or service providers, outlining the work performed and associated charges. With slight adjustments, it also proves invaluable as a donation acknowledgment for non-profit organizations, providing donors with proof of their charitable contributions for tax purposes. Furthermore, businesses can customize this form to process employee expense reimbursements or generate a simplified billing statement for clients, demonstrating its broad utility as a versatile business documentation tool. Its ability to be reframed for almost any payment receipt need underscores its fundamental design for clear financial communication.

When to Effectively Employ This Receipt Format

The strategic use of a robust receipt template can streamline operations and bolster financial integrity in numerous scenarios. Its applications span personal financial management to professional business operations.

- Monthly Rent Payments: The primary use case, providing tenants with irrefutable proof of rent paid and landlords with accurate income records for each rental period.

- Security Deposit Acknowledgments: Documenting the receipt of initial security deposits at the commencement of a tenancy, including details about the amount and the conditions for its return.

- Utility Bill Contributions: When a landlord or lead tenant collects utility payments from occupants, this form can serve as a detailed expense record for those contributions.

- Shared Household Expenses: For co-living situations where expenses like internet, cleaning services, or communal supplies are divided, the document offers clear proof of transaction for each member’s contribution.

- Ad-hoc Property-Related Payments: Any additional payments made by a tenant to a landlord, such as late fees, pet fees, or repair charges, can be formally acknowledged using this template.

- Small Business Income Recording: Beyond rentals, small businesses and sole proprietors can adapt this file to record incoming payments for services rendered or goods sold, functioning as a basic invoice form or sales record.

- Professional Service Fees: Freelancers or consultants can utilize a modified version to issue a service receipt to clients, confirming payment for work completed.

- Any Transaction Requiring Verifiable Proof: Essentially, any situation where a formal, documented acknowledgment of money received is required to prevent future disputes or for auditing purposes.

Design, Formatting, and Usability Considerations

The effectiveness of any financial document hinges not only on its content but also on its design, formatting, and overall usability. A well-designed template is intuitive, professional, and easy to interpret, whether in print or digital format.

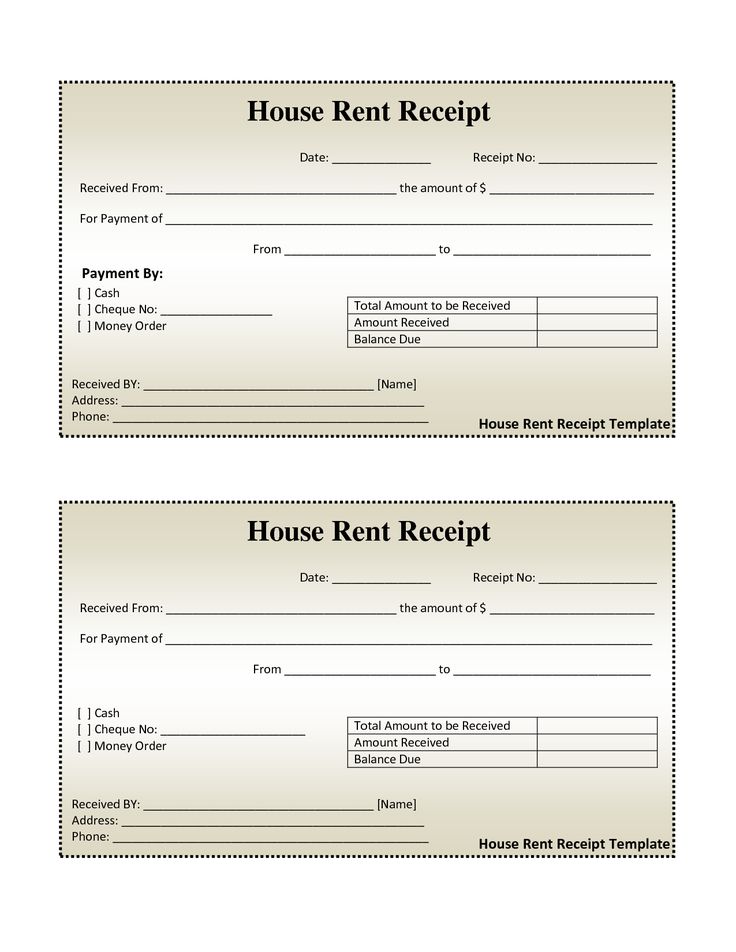

Essential Fields and Structure:

Every payment receipt should include core information clearly delineated. This typically encompasses:

- Date of Payment: The exact date the funds were received.

- Amount Received: Clearly stated in both numerals and words to prevent misinterpretation.

- Payer’s Name: The full name of the individual or entity making the payment.

- Recipient’s Name/Business Name: The full name of the individual or entity receiving the payment.

- Description/Purpose of Payment: A precise explanation, such as "room rent for [Month, Year]," "security deposit," or "service fee for [Service Description]."

- Payment Method: How the payment was made (e.g., cash, check, bank transfer, digital payment platform).

- Receipt Number: A unique identifier for tracking.

- Outstanding Balance: If applicable, any remaining amount due after this payment.

- Signature Lines: For both the recipient and, optionally, the payer, to acknowledge receipt and agreement.

- Contact Information: For the recipient, including address, phone, and email.

Clarity and Readability:

The layout should prioritize clarity. Use clear, legible fonts and adequate spacing between fields. Headings for each section should be prominent, guiding the eye through the information. Avoid jargon and keep descriptions concise and unambiguous.

Branding:

For landlords or businesses, incorporating a logo and company branding elements can enhance professionalism and reinforce identity. This subtle touch adds credibility to the business documentation.

Print vs. Digital Versions:

Consideration must be given to both print and digital usability. For print, ensure the template is printer-friendly, avoiding excessive colors or elements that consume too much ink. For digital versions (e.g., PDF), ensure it is easily viewable on various devices, possibly allowing for digital signatures for added convenience and security. The digital format also facilitates easier archival as an expense record.

Security and Integrity:

While the template itself doesn’t secure the transaction, it’s vital to handle the information it contains with discretion. If sensitive data like bank account numbers are used, ensure they are redacted or handled in compliance with privacy regulations. The integrity of the document, once issued, should be maintained, discouraging alterations.

A Foundation for Financial Integrity and Efficiency

The value of a meticulously structured financial template cannot be overstated in today’s demanding financial environment. It transcends its basic function as a simple acknowledgment of funds received, evolving into a critical instrument for maintaining financial integrity, fostering accountability, and ensuring legal compliance. By standardizing the process of documenting payments, the template eliminates ambiguities and provides a clear, verifiable record that benefits all parties involved in a transaction.

Ultimately, this essential tool is more than just a piece of paper or a digital file; it is a commitment to precision and transparency in financial dealings. It serves as a tangible proof of transaction, an invaluable expense record, and a foundational piece of business documentation that supports sound financial practices. Adopting and consistently utilizing such a reliable, accurate, and efficient financial record tool empowers individuals and businesses alike to manage their financial obligations with confidence, clarity, and unwavering professionalism, safeguarding against future discrepancies and contributing to long-term financial health.