In the intricate landscape of financial transactions, the meticulous documentation of payments stands as a cornerstone of transparency and accountability. A well-structured tenant rent receipt template serves as an indispensable tool for both landlords and tenants, ensuring that every rent payment is formally acknowledged and recorded. This foundational document provides undeniable proof of payment, mitigating potential disputes and fostering a professional landlord-tenant relationship built on trust and clarity. It is a critical component for effective financial management and record-keeping within the rental sector.

The primary purpose of such a template extends beyond simple acknowledgment; it empowers both parties with a clear, concise record of their financial interactions. For tenants, it offers peace of mind and an essential record for personal budgeting or tax purposes, serving as a vital payment receipt. Landlords, conversely, benefit from streamlined record-keeping, simplified accounting, and robust documentation for legal or audit requirements. Embracing a standardized approach through a dedicated template transforms what could be a point of contention into a seamless, professional exchange.

The Importance of Clear and Professional Financial Documentation

Professionalism in financial transactions is not merely a matter of courtesy; it is a fundamental requirement for sound business practices and legal compliance. Clear and professional documentation, such as a meticulously crafted payment receipt or an invoice form, establishes an unequivocal record of monetary exchanges. This clarity is paramount in preventing misunderstandings, resolving discrepancies, and safeguarding the interests of all involved parties. Ambiguity in financial dealings can lead to significant complications, including legal challenges and eroded trust.

Beyond dispute resolution, robust documentation supports efficient financial management. It enables businesses and individuals to track income and expenses accurately, a crucial process for budgeting, financial analysis, and tax preparation. For entities managing multiple transactions, be it rental payments, sales records, or service receipts, a consistent approach to documentation provides an invaluable audit trail. This systematic record-keeping ensures that every transaction can be traced, verified, and accounted for, reflecting a commitment to integrity and meticulousness.

Key Benefits of Using Structured Templates for Tenant Rent Receipt Template

The primary advantage of employing a standardized tenant rent receipt template lies in its ability to ensure accuracy, transparency, and consistency in record-keeping. A pre-defined layout guarantees that all essential information is captured for every transaction, eliminating omissions that could lead to future complications. This structured approach fosters an environment where financial records are not only complete but also easily retrievable and understandable, offering robust proof of transaction whenever required.

Utilizing a template significantly streamlines the administrative process. Instead of manually drafting each receipt, which can be time-consuming and prone to human error, a template allows for quick population of fields, ensuring uniformity across all issued documents. This efficiency is particularly valuable for landlords managing multiple properties or a large number of tenants. Furthermore, the inherent consistency provided by such a form reinforces professionalism, projecting an image of reliability and organization to tenants and other stakeholders. It elevates the standard of business documentation, making financial interactions smoother and more predictable.

Customizing Financial Templates for Various Purposes

While primarily discussed in the context of rental payments, the principles underlying a robust tenant rent receipt template extend far beyond real estate. The core design of a well-structured payment acknowledgment can be customized to serve a multitude of financial purposes across diverse sectors. Its adaptable nature makes it an invaluable asset for any entity or individual engaged in financial exchanges that require formal documentation. The foundational elements, such as sender, recipient, amount, date, and description, remain universally applicable.

This versatility allows for the transformation of a basic receipt into various specialized forms of business documentation. For instance, with minor adjustments, it can function as a sales record for retail transactions, detailing purchased items and quantities. Similarly, it can be adapted into a service receipt for contractors, outlining work performed and hours billed. Non-profit organizations frequently modify such templates to create donation acknowledgments, providing donors with official proof for tax deductions. Even for internal business processes, the structure can be tailored for expense records or business reimbursements, ensuring employees are properly compensated and company finances are meticulously tracked. The underlying framework offers a flexible solution for nearly any proof of transaction.

Examples of When Using This Template is Most Effective

The strategic application of a standardized receipt template proves highly effective in numerous scenarios, cementing its status as an indispensable financial tool. Its utility spans across various personal and professional contexts, providing clarity and accountability where financial transactions occur. From recurring monthly payments to one-time exchanges, the consistency and detail offered by this form are invaluable.

- Residential Rental Payments: Essential for landlords to provide tenants with proof of monthly rent payment, security deposits, or other associated fees, preventing disputes over whether rent was paid.

- Commercial Property Leases: Businesses often require formal documentation for tax and accounting purposes; this template ensures all commercial rent payments are meticulously recorded.

- Security Deposit Returns: When a security deposit is returned, a receipt can acknowledge the transaction, detailing any deductions made and the final amount disbursed.

- Partial Payments or Installments: For arrangements where a full payment is made in multiple parts, this form clearly documents each installment received, keeping both parties informed.

- Prepaid Rent: If a tenant pays several months’ rent in advance, the document provides comprehensive proof of the total amount received and the period it covers.

- Miscellaneous Rental Charges: For charges outside of standard rent, such as pet fees, late fees, or maintenance reimbursements, this receipt serves as formal acknowledgment.

- Proof for Tax Filings: Both landlords and tenants can utilize the compiled receipts as critical evidence for their respective income and expense declarations during tax season.

Tips for Design, Formatting, and Usability

Creating an effective payment receipt template involves careful consideration of design, formatting, and usability, ensuring it serves its purpose efficiently in both print and digital formats. The layout should prioritize clarity and readability, making it straightforward for anyone to understand the transaction details at a glance. A professional aesthetic not only enhances credibility but also reinforces the importance of the financial record. Simplicity often triumphs over complexity in such business documentation.

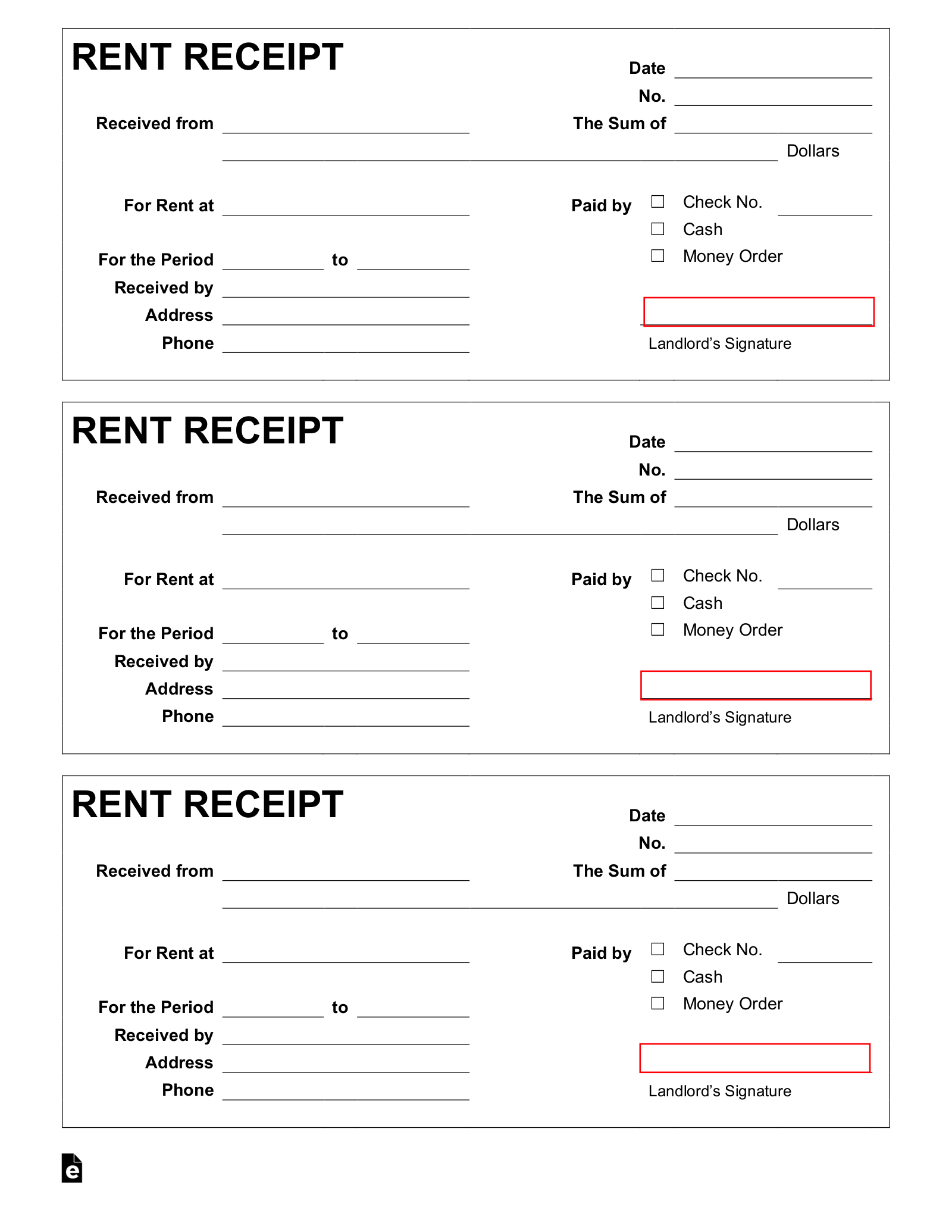

For optimal usability, the template should feature clearly defined fields for all essential information. This includes the date of payment, the amount received, the period covered, the method of payment (e.g., check, cash, electronic transfer), and the names and contact details of both the payer and the recipient. Incorporating a unique receipt number for each transaction aids in tracking and referencing. Branding elements, such as a company logo or specific color scheme, can be subtly integrated without distracting from the core information, lending a professional touch.

When designing for digital versions, consider using fillable PDF forms or spreadsheet templates that allow for easy data entry and calculation. Ensure the file format is widely accessible and compatible across different devices. For print versions, choose a font that is legible and a layout that doesn’t consume excessive paper or ink. Adequate spacing between fields and clear headings contribute significantly to readability. Both versions should include a clear disclaimer stating that this document serves as official proof of transaction. The ability to easily save, print, and share the receipt is paramount for modern business communication, enhancing the overall utility of the financial template.

The Enduring Value of a Structured Financial Record

Ultimately, the strategic implementation of a high-quality tenant rent receipt template is not merely a formality; it is a vital component of sound financial governance and effective business communication. This essential document provides a verifiable audit trail for every payment, serving as an unimpeachable proof of transaction. Its consistent use cultivates an environment of transparency, minimizing disputes and fostering trust between parties. By standardizing the acknowledgment of funds, the template becomes a reliable cornerstone for accurate financial reporting and legal compliance.

Investing time in creating or adopting a robust payment receipt template yields significant returns in efficiency, professionalism, and peace of mind. It simplifies the often-complex task of financial record-keeping, ensuring that all necessary details are consistently captured and readily accessible. From an invoice form for services rendered to a detailed expense record for business operations, the underlying principles of a well-designed financial template contribute immeasurably to operational excellence. It is an indispensable asset for anyone committed to reliable, accurate, and efficient financial documentation.