In any professional or academic environment, the integrity of financial transactions is paramount. Maintaining meticulous records is not merely a best practice; it is a fundamental requirement for transparency, accountability, and legal compliance. Whether for educational institutions, businesses, or individuals, a clear and comprehensive record of payments provides essential proof of transaction, facilitating audits, tax preparations, and dispute resolution.

This principle holds particularly true for educational payments, where significant sums are exchanged, and students or their sponsors require definitive documentation. A well-designed tuition fee receipt template serves as an indispensable tool in this regard, offering a standardized, professional, and easily verifiable acknowledgment of funds received. It benefits both the payer, who gains crucial proof of payment, and the recipient institution, which maintains accurate financial records, ensuring smooth administrative operations.

The Imperative of Clear Financial Documentation

The backbone of sound financial management rests upon accurate and unambiguous documentation. Every financial transaction, regardless of its size or nature, necessitates a corresponding record that clearly delineates the exchange. Such records serve as verifiable evidence, crucial for internal accounting, external audits, and adherence to regulatory standards.

Well-structured documents are pivotal in preventing misunderstandings, mitigating potential disputes, and ensuring that all parties involved have a shared understanding of financial commitments and payments. They support transparent operations, enhance trust between entities, and provide the necessary data for informed financial decision-making and strategic planning. The absence of such clarity can lead to significant administrative burdens and legal complications, underscoring the vital role of meticulous financial record-keeping.

Key Benefits of a Structured Tuition Fee Receipt Template

Adopting a structured template for financial acknowledgments, such as a tuition fee receipt template, offers a multitude of advantages that extend beyond mere record-keeping. These templates are specifically designed to streamline the documentation process, embedding efficiency and reliability into every transaction. Their inherent design promotes precision and reduces the likelihood of human error, which is crucial in financial contexts.

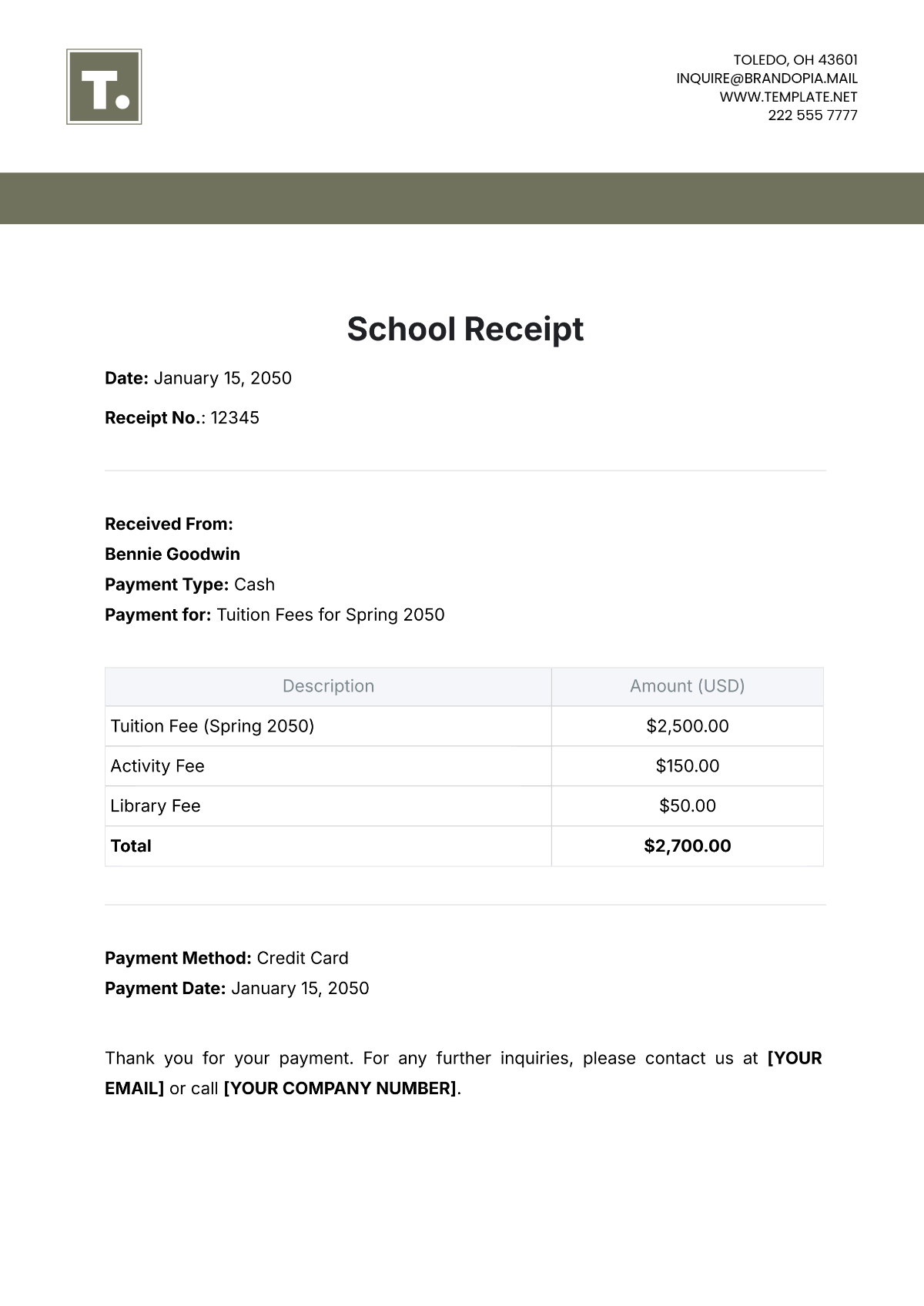

Firstly, such a template ensures accuracy by providing designated fields for all critical information, guiding the entry process and minimizing omissions or mistakes. This structured approach means that details like payment amount, date, payer information, and purpose are consistently captured, creating a robust payment receipt. Secondly, it fosters transparency, clearly itemizing charges and payments, which leaves no room for ambiguity regarding what has been paid for and any outstanding balances. This level of detail builds trust and clarity for all stakeholders.

Finally, the consistent application of a standardized tuition fee receipt template guarantees uniformity across all transactions. This consistency is invaluable for financial reporting, internal reconciliation, and external compliance reviews, simplifying the tracking of funds and ensuring that every proof of transaction adheres to the same high standards. Such a systematic approach underpins solid business documentation and facilitates robust expense record management for both the institution and the individual.

Customizing the Template for Diverse Financial Transactions

While specifically named for educational payments, the foundational structure of a robust tuition fee receipt template is remarkably versatile and adaptable. The core principles of documenting a financial exchange—identifying payer, payee, amount, date, and purpose—remain constant across various types of transactions. This inherent flexibility allows for the modification of fields and sections to suit different financial acknowledgment needs beyond tuition fees.

For instance, the layout can be readily adapted to serve as an invoice form, a sales record, or a billing statement, simply by adjusting the "Purpose of Payment" and "Breakdown of Charges" sections. This adaptability makes the template an invaluable asset for any entity requiring formal documentation of received funds, transforming it into a multipurpose financial template. Integrating semantic terms such as service receipt, donation acknowledgment, or business documentation further highlights its broad utility.

Adapting for Non-Educational Payments

The adaptable nature of this financial template means its utility extends far beyond educational institutions. Businesses across various sectors can easily modify the layout to suit their specific transactional requirements. For example, a service-based business can re-label the "Tuition Fees" section to "Service Rendered" and detail the specific services provided. Similarly, a retail operation can use it as a sales record, itemizing products purchased and sales tax applied. The framework remains consistent, while the specific content changes to reflect the nature of the transaction. This flexibility makes it an efficient tool for generating proof of transaction for almost any payment scenario.

Specialized Financial Acknowledgments

Beyond general sales and services, the template’s structure lends itself well to more specialized financial acknowledgments. Landlords, for instance, can utilize a modified version to issue rent payment receipts, clearly stating the rental period, property address, and amount received. Charitable organizations can adapt it into a donation acknowledgment, providing donors with official documentation for tax purposes and fulfilling IRS requirements for substantiating contributions. Furthermore, businesses can use the template for processing and documenting employee expense reimbursements, ensuring clear tracking of disbursed funds and maintaining accurate expense records. This adaptability underscores the comprehensive utility of a well-designed payment receipt system.

When to Utilize This Essential Document Most Effectively

The effective use of a structured receipt document is critical in numerous financial scenarios, ensuring clarity and compliance. Its primary application lies in educational contexts, but its benefits are far-reaching across various sectors where clear financial tracking is essential.

- Tuition Payments: For initial enrollment fees, semester charges, specific course costs, or administrative fees.

- Proof of Payment for Financial Aid: To document the application of scholarships, grants, or student loan disbursements against a student’s account.

- Tax Deduction Purposes: Providing students or parents with detailed expense records necessary for claiming education tax credits or deductions for student loan interest.

- Auditing and Compliance: Essential for educational institutions to maintain transparent financial records for internal and external audits, ensuring regulatory adherence.

- Personal Financial Record-Keeping: Allowing individuals to track their educational expenses accurately for budgeting, financial planning, and future reference.

- General Business Transactions: Issuing proof of transaction for products sold or services rendered, serving as a sales record.

- Donation Acknowledgments: For non-profit organizations to provide official receipts to donors, crucial for tax deductions and donor relations.

- Rent Payment Verification: Landlords can use it to issue formal receipts to tenants, confirming monthly rent payments.

- Employee Expense Reimbursements: Companies can document the repayment of business-related expenses to employees, ensuring clarity and accountability.

Design, Formatting, and Usability Best Practices

The efficacy of any financial document, including a payment receipt, is heavily influenced by its design, formatting, and overall usability. A professionally presented receipt instills confidence, facilitates easy comprehension, and reinforces the credibility of the issuing entity. Attention to these details ensures that both print and digital versions are equally effective and professional.

For design, clarity and conciseness are paramount. The layout should feature clear headings, a logical flow of information, and ample white space to prevent visual clutter. Incorporating the institution’s or business’s logo and branding elements enhances professionalism and reinforces identity. Essential information should be prominently displayed, ensuring that critical details are easily locatable at a glance.

Formatting considerations extend to font choice, text size, and paragraph spacing. Utilizing legible fonts (e.g., Arial, Calibri, Times New Roman) in appropriate sizes ensures readability for all users. Consistent spacing between elements improves visual organization, making the document easier to scan and comprehend. The strategic use of bold text or distinct colors (sparingly) can highlight crucial fields without overwhelming the reader.

Usability for digital versions demands specific attention. The file should ideally be provided in a universally accessible format, such as PDF, to ensure consistent viewing across different devices and operating systems. If the document is intended to be filled out digitally, it should incorporate interactive, fillable fields. Implementing digital signature capabilities can further streamline the process, enhancing security and efficiency.

For print versions, ensuring clear print quality is essential. The design should account for standard paper sizes (e.g., Letter, A4) and minimize the use of heavy backgrounds or intricate graphics that may consume excessive ink or obscure text. Adequate space for manual entries, such as an authorized signature or stamp, should be provided if the document is intended for physical signing. The goal is to produce a versatile financial template that functions seamlessly in both digital and physical forms.

Key Elements to Include in the Receipt Template

To ensure comprehensive and legally sound financial documentation, every receipt template should meticulously include specific information. These elements are critical for establishing a clear record of payment, providing proof of transaction, and facilitating various administrative processes.

Essential Information

- Issuer’s Name/Logo: Clearly identifies the educational institution or business receiving the payment.

- Recipient’s Name (Payer): The full legal name of the individual or entity making the payment.

- Receipt Number: A unique alphanumeric identifier for each transaction, crucial for tracking and auditing.

- Date of Payment: The exact date the payment was received.

- Payment Method: Specifies how the payment was made (e.g., Cash, Check, Credit Card, Bank Transfer, Online Payment).

- Amount Paid: Both the numerical value and the written-out amount (e.g., "$1,250.00" and "One Thousand Two Hundred Fifty Dollars and Zero Cents") to prevent discrepancies.

- Purpose of Payment: A concise description of what the payment covers (e.g., "Fall 2024 Tuition," "Service Fee," "Rent for October 2024").

- Breakdown of Charges: An itemized list detailing what the total amount comprises (e.g., Tuition, Activity Fees, Lab Fees, Books, Late Fees).

- Outstanding Balance (if any): Clearly indicates any remaining amount due after the current payment.

- Authorized Signature/Stamp: A physical or digital signature from an authorized representative of the issuing entity, confirming receipt.

Optional Enhancements

- Terms and Conditions: Reference to or direct inclusion of relevant policies, such as refund policies or withdrawal procedures.

- Refund Policy Link: A link or brief statement directing the recipient to the institution’s refund policy.

- Contact Information for Inquiries: Phone number, email address, or departmental contact for questions regarding the payment.

- Tax ID (EIN): The institution’s or business’s Employer Identification Number, which can be essential for tax reporting purposes for the payer.

- Billing Period: For recurring payments like tuition or rent, specifying the period the payment covers.

Conclusion

In the complex landscape of financial transactions, the value of a meticulously prepared financial template cannot be overstated. A well-constructed document serves as a cornerstone for accountability and clarity across all sectors, from educational institutions to commercial enterprises. It stands as a reliable, accurate, and efficient financial record tool, embodying professionalism and ensuring that every payment is properly acknowledged and documented.

The adoption of a standardized form not only streamlines administrative processes but also significantly mitigates potential disputes by providing unambiguous proof of transaction. It fosters an environment of trust and transparency, essential for healthy financial relationships. Whether used for educational expenses, service fees, or donations, this indispensable asset bolsters robust record-keeping practices and facilitates clear communication between all parties involved.

Ultimately, investing in a high-quality template reflects a commitment to precision and integrity in financial operations. It is a fundamental component of effective business documentation, safeguarding both the interests of the payer and the financial integrity of the recipient, ensuring that every financial exchange is recorded with impeccable detail and professionalism.