Effective financial documentation stands as a cornerstone of accountability and transparency for individuals, businesses, and charitable organizations alike. A meticulously structured receipt serves not merely as a simple acknowledgement but as a critical component in maintaining accurate records for tax purposes, internal auditing, and fostering trust with stakeholders. This comprehensive guide delves into the significance of robust receipt generation, highlighting the particular utility of a well-designed salvation army donation receipt template for both donors and recipient organizations, ensuring clarity and compliance in every transaction.

For donors, particularly those making charitable contributions, receiving a formal receipt is essential for substantiating tax deductions. For organizations like The Salvation Army, providing clear, consistent, and compliant documentation is paramount for demonstrating good governance and facilitating donor stewardship. Understanding the core elements and best practices for developing and utilizing such a template can significantly streamline administrative processes, enhance financial integrity, and provide invaluable proof of transaction for all parties involved.

The Indispensable Role of Clear and Professional Documentation

In an environment increasingly focused on regulatory compliance and fiscal transparency, the importance of clear and professional documentation in all financial and business transactions cannot be overstated. Each payment receipt, invoice form, or sales record contributes to an organization’s financial narrative, impacting everything from daily operations to long-term strategic planning. Accurate records are fundamental for meeting legal obligations, conducting internal audits, and providing a verifiable audit trail for external review.

Furthermore, professionally presented documentation instills confidence. It signals to donors, customers, and partners that an organization operates with precision, integrity, and a commitment to best practices. Conversely, poorly documented transactions can lead to confusion, disputes, and potential legal or financial repercussions, underscoring the necessity for standardized and reliable tools in financial management.

Key Benefits of Structured Templates in Financial Record-Keeping

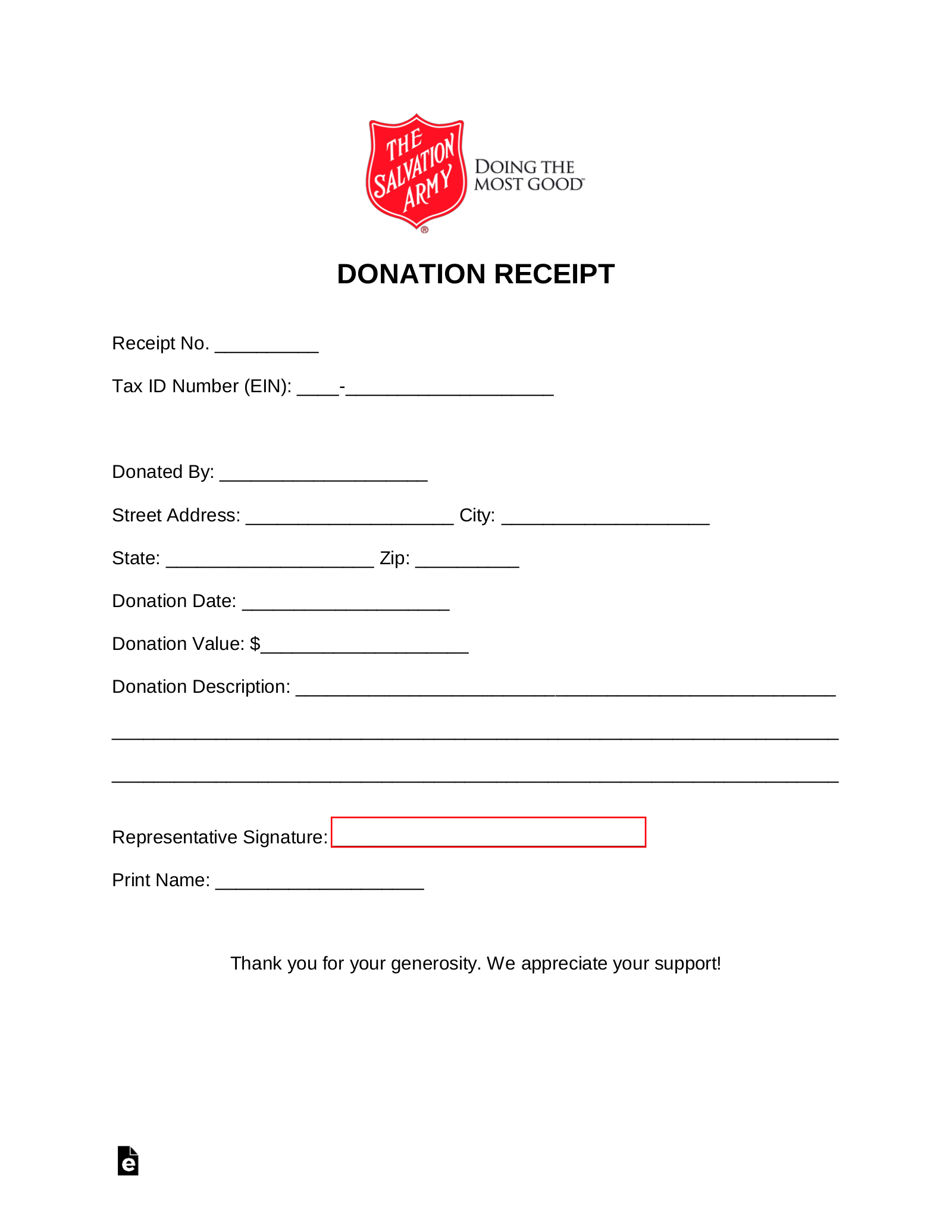

Utilizing a structured template, such as a salvation army donation receipt template, offers a multitude of benefits that extend beyond mere compliance. These templates are meticulously designed to ensure accuracy, enhance transparency, and promote consistency across all record-keeping activities. By standardizing the format and content of receipts, organizations can minimize errors and ensure that all necessary information is captured consistently.

Structured templates streamline the documentation process, reducing the time and effort required to generate individual receipts. They act as an efficient financial template, pre-populating essential fields and guiding the user to include all pertinent details, from donor information to the nature and value of the contribution. This systematic approach not only improves operational efficiency but also significantly strengthens the overall integrity of an organization’s financial records, making auditing and reporting much simpler.

Customization for Diverse Financial Applications

While the focus might initially be on donation acknowledgment, the principles underlying a well-structured receipt template are broadly applicable across various financial contexts. A robust financial template can be easily customized to serve multiple purposes, demonstrating its versatility in diverse business and operational scenarios. Its fundamental design, emphasizing clear fields for sender, recipient, amount, and date, makes it an adaptable tool for a wide array of financial acknowledgments.

For instance, the core layout used for a charitable donation can be effortlessly modified into an invoice form for services rendered, a billing statement for product sales, or a service receipt for consultations. Similarly, the structure lends itself to documenting rent payments, business reimbursements, or even internal expense record submissions. This adaptability ensures that an organization can maintain a consistent professional image and standardized record-keeping practices across all its financial transactions, regardless of their specific nature.

When a Structured Template Is Most Effective

The application of a well-designed receipt template proves most effective in scenarios demanding precision, formal acknowledgment, and verifiable record-keeping. These are situations where both the sender and recipient benefit from a clear, undisputed proof of transaction. Utilizing such a template minimizes ambiguity and provides a tangible record for future reference, dispute resolution, or tax preparation.

Here are specific examples of when employing a structured template is highly advantageous:

- Charitable Giving: Providing donors with a formal

donation acknowledgmentfor tax deduction purposes. This includes cash, in-kind contributions, and volunteer hours. - Retail Sales: Issuing clear

sales recorddocuments to customers, detailing items purchased, quantities, prices, and total amount, essential for returns and warranties. - Service Provision: Generating a

service receiptafter completing a project or providing professional consultation, outlining services rendered, hours, and fees. - Rental Payments: Documenting

rent paymentsfor tenants and landlords, which is crucial for lease agreements and financial tracking. - Business Expenses: Creating

expense recordreceipts for employees submittingbusiness reimbursements, ensuring all necessary information for accounting is present. - Invoice Payments: Acknowledging the receipt of payment against an

invoice form, confirming that a balance has been settled. - Account Settlements: Providing a formal

payment receiptwhen an outstanding balance on abilling statementis fully or partially paid. - Asset Transfers: Documenting the transfer of goods or assets, even if no monetary exchange occurs, for inventory or internal audit purposes.

In each of these instances, the document serves as an undeniable record, strengthening financial controls and fostering a professional image. It transforms a simple transaction into a formally acknowledged event, critical for business documentation and regulatory adherence.

Design, Formatting, and Usability Best Practices

The efficacy of any financial template is not solely in its content but also significantly in its design, formatting, and overall usability. A well-designed receipt should be intuitive, professional, and accessible, whether presented in print or digital format. Attention to these details enhances user experience and reinforces the document’s credibility.

For both print and digital versions, consider the following best practices:

- Clarity and Legibility: Use a clean, sans-serif font that is easily readable. Ensure sufficient white space around text fields to prevent clutter. Text should be adequately sized for all users.

- Essential Fields: Clearly define and label all required fields. These typically include organization name and contact information, donor/customer name and contact, date of transaction, description of item/service/donation, quantity, unit price, total amount, payment method, and a unique receipt number.

- Branding Consistency: Incorporate organizational branding, such as logos, color schemes, and fonts, to maintain a consistent professional image. This reinforces authenticity and brand recognition.

- Digital Accessibility: For digital versions, ensure the file is accessible to users with disabilities, adhering to WCAG (Web Content Accessibility Guidelines) standards. Use proper heading structures and alt text for images.

- Print-Friendly Layout: Design

the layoutto be print-friendly, avoiding excessive background colors or images that consume ink. Ensure margins are appropriate for standard paper sizes. - Security Features: For highly sensitive transactions, consider incorporating security features such as watermarks, digital signatures, or tamper-evident seals for physical copies. Digital files can benefit from encryption and secure storage.

- User Instructions: Provide clear, concise instructions for filling out

this formwhere necessary, especially for fields that might require specific formatting or information. - Unique Identifiers: Implement a system for unique

receiptnumbering to facilitate easy tracking, referencing, and reconciliation of transactions. - Review and Testing: Regularly review

the templatefor accuracy, completeness, and ease of use. Test it with various users to gather feedback and make necessary improvements.

Adhering to these design and usability principles ensures that the file not only fulfills its primary function as a financial record but also enhances the overall communication and professional standing of the issuing entity.

The Enduring Value of a Structured Financial Tool

In conclusion, the strategic implementation of a well-designed financial template is an indispensable asset for any entity engaged in financial transactions. From a simple payment receipt to a comprehensive donation acknowledgment, the consistent use of a structured approach elevates record-keeping practices to a standard of excellence. This proactive measure significantly contributes to operational efficiency by streamlining administrative tasks and reducing the potential for human error.

Ultimately, such a reliable proof of transaction tool embodies accuracy, transparency, and consistency, crucial for cultivating trust with all stakeholders. It serves as a verifiable business documentation cornerstone, facilitating regulatory compliance, simplifying audits, and providing an unquestionable record of financial interactions. Embracing this form of organized financial communication is not merely a procedural step but a fundamental investment in the integrity and sustained success of an organization.