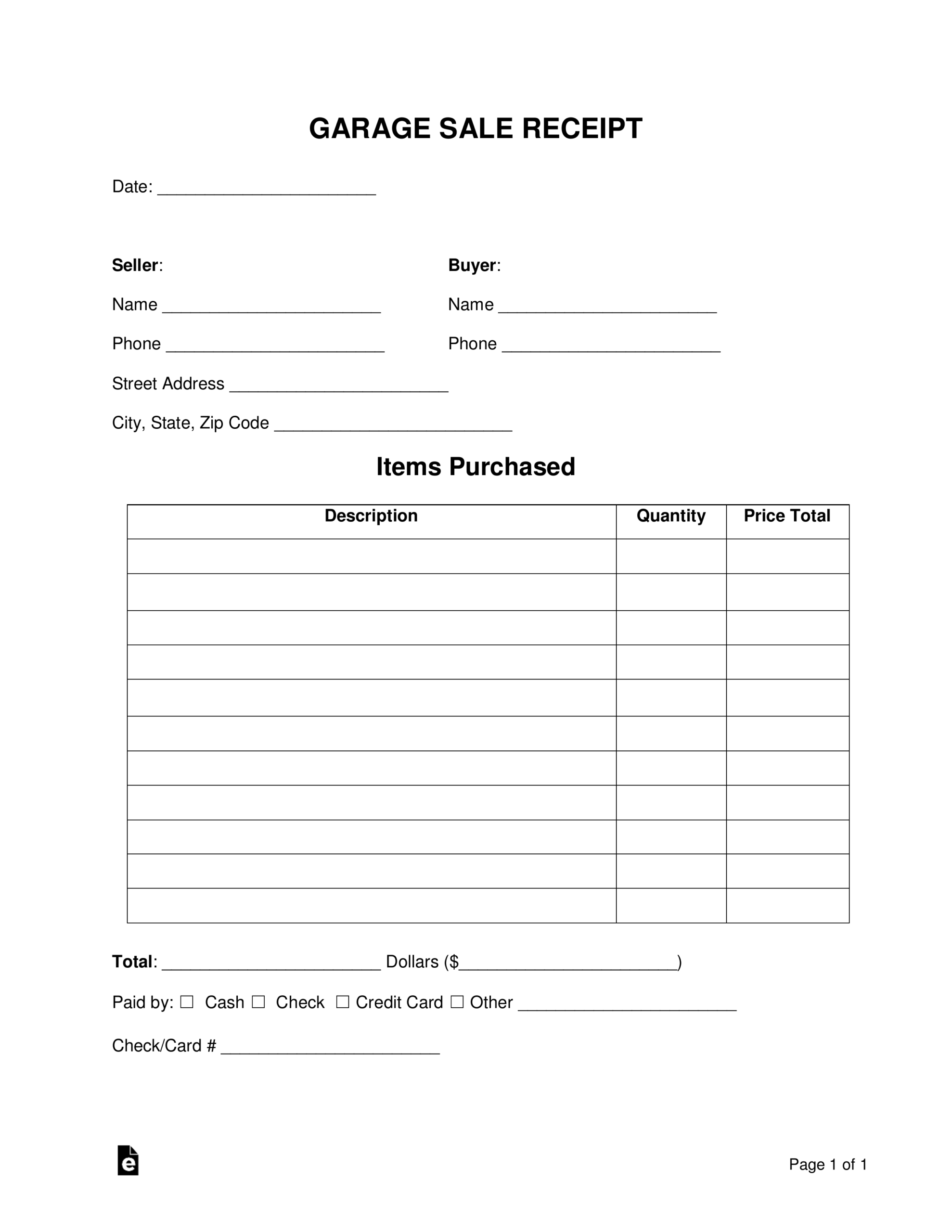

In any transaction, regardless of scale, the meticulous recording of details is paramount for clarity and accountability. A well-designed garage sale receipt template serves as an indispensable tool for individuals and small operations alike, providing a structured method for documenting exchanges. This foundational document transitions an informal agreement into a recognized proof of transaction, offering tangible benefits to both parties involved. It establishes a clear record, preventing misunderstandings and fostering trust in every interaction.

The utility of a robust garage sale receipt template extends beyond simple proof of purchase; it is a versatile instrument for managing various financial records. For sellers, it facilitates organized sales tracking and inventory reconciliation, while for buyers, it provides essential documentation for returns, budgeting, or even tax purposes, depending on the item’s nature. This article will explore the comprehensive advantages of adopting such a standardized form, detailing its applications, customization potential, and best practices for its effective utilization in diverse scenarios.

The Importance of Clear and Professional Documentation

Clear and professional documentation is the bedrock of sound financial management and ethical business practices. In an era where transparency is increasingly valued, formal records lend credibility to every exchange, from the simplest sale to complex contractual agreements. Such documentation minimizes ambiguities, ensuring that all parties possess an identical understanding of the terms and conditions of a transaction. It provides an objective account, reducing the potential for disputes or misinterpretations that can arise from verbal agreements alone.

Beyond dispute resolution, meticulous record-keeping through professional documents supports legal compliance and financial auditing. Whether for personal budgeting, a small business’s tax obligations, or demonstrating due diligence, a comprehensive paper trail is invaluable. It serves as a historical archive, detailing the flow of assets and liabilities over time, which is critical for future reference, analysis, and strategic planning. Adopting standardized forms elevates the perception of professionalism, irrespective of the transaction’s magnitude.

Key Benefits of Using a Structured Garage Sale Receipt Template

Adopting a structured garage sale receipt template offers profound advantages for ensuring accuracy, transparency, and consistency in record-keeping. This type of document standardizes the information captured for each transaction, eliminating omissions and promoting a uniform approach to data collection. It transforms an otherwise informal exchange into a professionally managed process, benefiting both the provider and the recipient of goods or services. The inherent design of these templates guides users to include all necessary details, thereby enhancing the integrity of the financial record.

Enhanced Accuracy and Detail

A primary benefit of using a pre-formatted template is the significant improvement in accuracy. These forms typically include dedicated fields for essential information such as date, item description, quantity, price, and total amount, ensuring no critical detail is overlooked. By prompting for specific data, the template minimizes errors that can occur when generating receipts from scratch. This systematic approach guarantees a comprehensive sales record for every transaction, bolstering the reliability of financial tracking.

Improved Transparency and Trust

Presenting a clear, itemized payment receipt immediately fosters trust between parties. Both the seller and the buyer receive an identical, unambiguous record of the transaction, detailing exactly what was purchased and for how much. This transparency helps to prevent future disputes by providing incontrovertible proof of transaction. It reflects an organized and honest approach to commerce, enhancing the perception of credibility for the party issuing the receipt.

Streamlined Record-Keeping and Analysis

Structured templates are invaluable for efficient record-keeping. When all receipts follow a consistent layout, data entry into spreadsheets or accounting software becomes significantly faster and less prone to error. This consistency makes it easier to track sales trends, manage inventory, and reconcile financial statements at the end of a period. Such an organized collection of sales records simplifies budgeting, tax preparation, and overall financial analysis, offering a clear overview of transactional activity.

Customizing the Template for Diverse Applications

The fundamental design of a garage sale receipt template is highly adaptable, allowing for extensive customization to suit various transactional needs beyond simple item sales. While initially conceived for informal sales, its structure provides a versatile foundation for documenting a wide array of financial exchanges. This flexibility makes the template a valuable asset for individuals and small operations requiring a clear, standardized record for different types of payments or acknowledgments. The ability to modify fields and add specific details ensures its applicability across numerous scenarios.

Sales Transactions

For direct sales, whether at a garage sale, craft fair, or online marketplace, the template efficiently records the item(s) sold, unit price, quantity, and total. Customization might involve adding fields for unique product identifiers, serial numbers, or specific conditions of sale, such as "as-is" disclaimers. This ensures that the payment receipt is comprehensive for both new and used goods. It serves as an unequivocal proof of purchase, essential for buyer confidence and seller accountability.

Service Provision

When offering services, the template can be adapted into a service receipt by replacing item descriptions with details of the service rendered. Fields could include hours worked, hourly rate, specific tasks performed, and any associated material costs. This provides a clear billing statement for clients, detailing the scope and cost of the work. It helps ensure both parties have an agreed-upon record of the service transaction, which is crucial for professional accountability.

Rental Payments

For landlords or individuals receiving rent, this form can function as a streamlined rent payment receipt. Customizations would include fields for the rental period, property address, tenant name, and payment method, along with any late fees or specific inclusions. Having a consistent proof of payment is vital for both tenant and landlord, offering a clear financial template for rental income and expense tracking. It provides a formal record of financial obligations being met.

Donation Acknowledgments

Charitable organizations or individuals receiving donations can modify the layout to serve as a donation acknowledgment form. Key fields would include the donor’s name and contact information, the date of donation, a description of the donated item or monetary amount, and a statement regarding its tax-deductible status, if applicable. This type of document is crucial for tax purposes and for formally thanking contributors. It acts as an official record of philanthropic contributions.

Business Reimbursements

For small businesses or individuals tracking expenses, the file can be customized for business reimbursements. This would involve fields for the employee’s name, purpose of the expense, itemized costs, and approval signature. Such a record is vital for internal accounting, ensuring accurate expense records and compliance with company policies. It provides a clear audit trail for operational expenditures, reinforcing effective business documentation practices.

When is a Garage Sale Receipt Template Most Effective?

The utility of a robust garage sale receipt template is evident in various practical scenarios where a clear and immediate record of exchange is beneficial.

- Informal Sales: When selling items at a community event, flea market, or directly from home, the document provides immediate proof of purchase for the buyer and a sales record for the seller.

- Proof of Delivery/Handover: For items transferred between individuals, such as borrowed equipment or items exchanged as part of a trade, the receipt confirms the exchange date and condition.

- Small Business Transactions: Micro-businesses or sole proprietors can use the template for recording cash sales, ensuring every payment receipt contributes to accurate daily revenue tracking without the complexity of a full invoice form.

- Tracking Personal Assets: When selling personal items of value, such as electronics or collectibles, the form establishes a clear transaction history for potential future reference or warranty claims.

- Donations to Non-Profits: Organizations can adapt the template to acknowledge non-cash donations, detailing the item and date received, which is important for donor records and potential tax deductions.

- Service-Based Freelancing: Freelancers offering services like tutoring, yard work, or consulting can use the layout to provide clients with a simple service receipt detailing the work performed and the amount paid.

Design, Formatting, and Usability Tips

An effective receipt template is not merely about its content but also its presentation and ease of use. Thoughtful design and formatting enhance readability, professionalism, and overall usability, whether the document is printed or accessed digitally. Attention to these details ensures that the file is not only informative but also reflects positively on the issuer. A well-designed template simplifies the recording process and makes the information readily accessible and understandable.

Essential Elements of an Effective Receipt

Every effective receipt, regardless of its specific application, should contain several core components. These include the date of transaction, the names of both the payer and the recipient, a clear description of the goods or services, the quantity and unit price (if applicable), the total amount paid, and the method of payment. Optionally, fields for a receipt number, tax amount, and a signature line for both parties can significantly enhance the document’s integrity. Ensuring these elements are prominently displayed and logically organized is crucial for clarity.

Formatting for Clarity and Professionalism

Regarding formatting, simplicity and consistency are key. Use clear, legible fonts and an appropriate font size to ensure readability. Employ headings and distinct sections to organize information logically, making it easy to locate specific details quickly. Utilizing bold text for totals and important fields can draw the eye to critical information. A clean layout with adequate white space prevents the receipt from appearing cluttered, reinforcing a professional image. Consistent branding, even with a simple logo, can also subtly reinforce identity.

Print vs. Digital Considerations

When designing the template, consider its intended medium. For print versions, ensure sufficient margins and a layout that prints cleanly without cutting off information. Digital versions, conversely, should be designed for screen readability, perhaps with interactive fields for easy data input. Creating both PDF and editable document formats can cater to various user preferences and technological capabilities. A digital file should ideally be fillable and saveable, allowing for efficient digital record-keeping and sharing.

Conclusion

The adoption of a standardized receipt template, even for seemingly minor transactions, represents a significant step towards greater financial clarity and professionalism. This versatile document transcends its basic function as a mere proof of transaction, evolving into a fundamental tool for meticulous record-keeping across numerous applications. By systematizing the collection of vital information, it inherently fosters accuracy, transparency, and consistency, which are indispensable qualities in all financial dealings.

Whether utilized as a payment receipt for goods sold, a detailed service receipt for work rendered, or a formal donation acknowledgment, the template significantly streamlines administrative processes. It transforms potential ambiguities into clear, irrefutable records, thereby mitigating disputes and cultivating trust between parties. This adherence to best practices in documentation elevates every exchange, providing peace of mind and an organized financial trail.

Ultimately, investing in a robust and adaptable template empowers individuals and small operations with a reliable, accurate, and efficient financial record tool. It serves as a testament to diligent management, ensuring that every transaction is not just completed, but also meticulously documented. Embracing the structured approach offered by such a template is a strategic decision that underpins sound financial hygiene and promotes effective communication in all economic interactions.