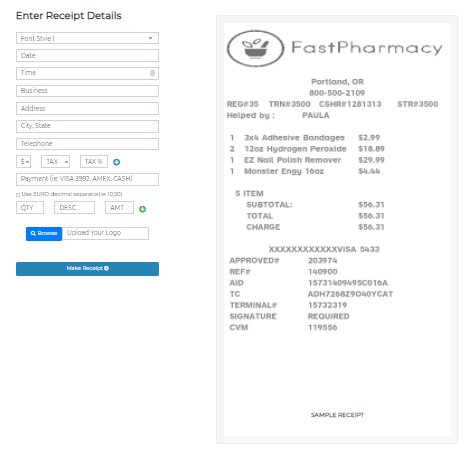

In the intricate landscape of modern business operations, particularly within sectors that handle frequent transactions and require meticulous record-keeping, the importance of structured documentation cannot be overstated. A well-designed pharmacy receipt template stands as a prime example of such essential documentation, serving as a critical tool for both service providers and consumers. This foundational element ensures clarity, fosters trust, and provides an indisputable record of financial exchanges. It is not merely a piece of paper but a comprehensive proof of transaction, instrumental for financial reconciliation, legal compliance, and effective customer service.

The primary purpose of such a template is to standardize the process of acknowledging payments received, thereby streamlining administrative tasks and enhancing overall operational efficiency. For businesses, it facilitates accurate accounting, simplifies audits, and provides a clear audit trail. For consumers, it offers a tangible record for personal finance management, tax purposes, insurance claims, and warranty validation. Whether dealing with a simple over-the-counter sale or a complex prescription fulfillment, a standardized pharmacy receipt template benefits all parties involved by providing a consistent, clear, and comprehensive overview of each transaction.

The Imperative of Clear and Professional Documentation

Clear and professional documentation is the cornerstone of effective business communication and robust financial management. In any transaction, especially those involving the exchange of goods or services for payment, a formal record provides an objective account of what transpired. This level of clarity prevents disputes, establishes accountability, and builds confidence among stakeholders. Without standardized documentation, businesses risk operational inconsistencies, legal challenges, and a diminished reputation.

Financial transactions, in particular, demand scrupulous attention to detail and an unwavering commitment to accuracy. A comprehensive payment receipt acts as an official record, validating the transfer of funds and detailing the specifics of the purchase. This is crucial for internal auditing, external regulatory compliance, and for maintaining transparent relationships with customers and suppliers. Moreover, in an increasingly digital world, the ability to generate, store, and retrieve professional documentation efficiently is a key differentiator for successful enterprises.

Key Benefits of a Structured Pharmacy Receipt Template

Adopting a structured pharmacy receipt template offers a multitude of advantages that extend beyond mere record-keeping. Foremost among these is the assurance of accuracy. By pre-defining the fields for critical information such as item descriptions, quantities, prices, taxes, and totals, the template minimizes the potential for human error during the transaction process. This systematic approach ensures that every detail is captured precisely, which is vital for financial integrity and customer satisfaction.

Furthermore, a well-designed template significantly enhances transparency. It clearly itemizes all charges, discounts, and applicable taxes, leaving no room for ambiguity regarding the final cost. This level of detail empowers consumers with a complete understanding of their purchase and supports businesses in demonstrating fair and consistent pricing practices. Consistent formatting across all receipts also reinforces professional branding and establishes a predictable, reliable experience for every customer. The template ensures that every financial exchange is recorded uniformly, fostering a consistent and auditable record-keeping system that is invaluable for operational stability and growth.

Customizing the Template for Diverse Financial Transactions

While specifically tailored for pharmaceutical transactions, the underlying principles of a well-structured receipt form are universally applicable across various business operations. A robust template can be customized to serve a broad spectrum of financial documentation needs, adapting its fields and presentation to suit different contexts. This flexibility makes it an invaluable asset for any organization requiring meticulous record-keeping and clear proof of transaction.

The adaptability of this document means it can be transformed from a detailed sales record for retail goods to a simplified service receipt for professional consultations. Its modular nature allows for modification of sections, inclusion of specific disclaimers, or integration of unique branding elements. By understanding the core components of an effective payment acknowledgment, businesses can leverage the foundational structure of a receipt template to create bespoke documents for virtually any financial exchange, ensuring consistency while meeting diverse operational requirements.

Sales Receipts

For retail sales, the template can be adapted to explicitly list each item purchased, its unit price, quantity, and the subtotal. It would also clearly display any sales tax applied, discounts, and the final amount due. This detailed sales record is essential for inventory management, sales analysis, and providing customers with a comprehensive breakdown of their purchase. It acts as a primary form of business documentation for retail transactions.

Service Receipts

When providing services, the template can be modified to detail the nature of the service rendered, the date and duration, the hourly or fixed rate, and any associated material costs. A service receipt provides proof of transaction for consultations, repairs, or professional engagements. It ensures both the service provider and the client have a clear understanding of the work performed and the charges incurred, functioning as a vital component of billing statements.

Rent Payments and Lease Agreements

For property management, a customized version can serve as a rent payment acknowledgment. This would include details such as the tenant’s name, property address, rental period, amount paid, and the method of payment. Such a document provides crucial financial documentation for both landlords and tenants, offering a clear record for accounting and legal purposes. It verifies the fulfillment of lease agreement obligations.

Donation Acknowledgments

Non-profit organizations can adapt the template into a donation acknowledgment. This would clearly state the donor’s name, the amount donated, the date of the contribution, and a statement confirming the tax-deductible nature of the gift, where applicable. This form is essential for both donor recognition and for compliance with IRS regulations, serving as a critical financial template.

Business Reimbursements and Expense Records

Within an organization, the template can be utilized for processing employee expense reimbursements. It would detail the nature of the expense, the amount, the date incurred, and the project or department it relates to. This standardized expense record streamlines internal accounting processes and ensures accurate allocation of costs, providing vital business documentation. It serves as an internal invoice form for tracking expenditures.

Effective Applications of the Pharmacy Receipt Template

The utility of a well-crafted pharmacy receipt template extends across numerous scenarios, proving indispensable for both individuals and organizations seeking to maintain precise financial records. Its structured format ensures that all necessary information is captured consistently, making it an invaluable tool for various administrative and financial tasks. The reliability of this template streamlines processes and enhances accountability across diverse applications.

Here are examples of when utilizing this document is most effective:

- Insurance Claims Processing: When submitting claims for prescription medications or medical supplies, a detailed pharmacy receipt provides the necessary proof of purchase and expenditure, accelerating reimbursement.

- Tax Preparation and Audits: Individuals and businesses can use these receipts as verifiable expense records for tax deductions related to healthcare costs or business-related medical purchases.

- Personal Budgeting and Expense Tracking: For consumers, the receipt serves as a clear record of healthcare spending, aiding in personal financial planning and monitoring.

- Inventory Management for Healthcare Facilities: Pharmacies and clinics can use the details on their receipts to reconcile sales with inventory levels, ensuring accurate stock control and minimizing discrepancies.

- Tracking Flexible Spending Account (FSA) and Health Savings Account (HSA) Expenditures: The itemized nature of the receipt is crucial for demonstrating eligible expenses when using these health-related accounts.

- Product Returns or Exchanges: Should a customer need to return an item, the receipt provides definitive proof of purchase, date, and price, facilitating a smooth transaction.

- Compliance and Regulatory Oversight: For pharmacies, maintaining comprehensive receipt records is vital for demonstrating adherence to regulatory requirements and for internal or external audits.

- Quality Control and Patient Safety: In specific instances, the batch number or other identifying information on a receipt can be crucial for tracking product recalls or addressing adverse events.

- Dispute Resolution: In case of a billing discrepancy or a query about a charge, the detailed receipt offers an undeniable record to resolve issues promptly and amicably.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template, including the specific pharmacy receipt, hinges significantly on its design, formatting, and overall usability. A well-designed document is not only aesthetically pleasing but also highly functional, ensuring that information is easily digestible and accurate. Whether intended for print or digital distribution, adhering to certain best practices can significantly enhance the utility and professionalism of the receipt.

Careful consideration of layout, font choices, and information hierarchy contributes to a template that is both efficient to complete and clear to interpret. The goal is to create a seamless experience for both the issuer and the recipient of the document. This attention to detail reflects positively on the business, reinforcing its commitment to precision and customer service.

Clarity and Legibility

Prioritize clear, readable fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12pt for body text). Use bolding or slightly larger fonts for key information such as the total amount, date, and vendor name. Ample white space around text blocks and between line items improves readability, preventing the document from appearing cluttered and overwhelming. This ensures that the payment receipt can be quickly understood.

Branding and Professionalism

Incorporate your pharmacy’s logo, contact information, and perhaps a subtle color scheme that aligns with your brand identity. This not only reinforces your professional image but also makes the receipt instantly recognizable. A consistent look across all business documentation builds trust and strengthens brand recall. The layout should reflect a commitment to professionalism.

Digital Accessibility and Print Optimization

Design the template to be easily viewable and navigable on various digital devices (smartphones, tablets, computers). Ensure that when printed, the document maintains its formatting, with all information fitting neatly onto standard paper sizes without cutting off crucial details. Consider creating separate versions optimized for each medium if necessary, ensuring the file is universally accessible.

Essential Data Fields

A comprehensive receipt should include several non-negotiable data fields to ensure its completeness and utility as a proof of transaction. These fields are critical for financial reconciliation, legal compliance, and customer information.

- Company Name and Contact Information: Full legal name of the pharmacy, address, phone number, and website.

- Receipt Number/Transaction ID: A unique identifier for each transaction, crucial for tracking and auditing.

- Date and Time of Transaction: Essential for historical record-keeping and for reconciling payments.

- Customer Information: (Optional, based on privacy regulations) Patient name, or simply "Customer."

- Itemized List of Products/Services: Detailed description of each item, quantity, and unit price.

- Subtotal: The total cost before taxes or discounts.

- Discounts/Coupons: Any reductions applied, clearly itemized.

- Sales Tax: The amount of tax applied, with the tax rate if required.

- Total Amount Due/Paid: The final amount of the transaction.

- Payment Method: How the payment was made (e.g., cash, credit card, debit, insurance).

- Credit Card Details (partial): Last four digits of the card number for verification, if applicable.

- Pharmacist/Technician ID: The identifier of the staff member who processed the transaction.

- Return/Exchange Policy: A brief statement or reference to the policy.

- Signature Line: (Optional) For acknowledgment of receipt, if physical signatures are required.

The Enduring Value of a Robust Financial Tool

Ultimately, the systematic implementation of a well-designed financial template, such as a pharmacy receipt, transcends mere administrative convenience; it embodies a commitment to financial integrity, operational excellence, and customer trust. By providing a clear, accurate, and consistent proof of transaction, this form safeguards against disputes, facilitates seamless financial management, and supports regulatory compliance. Its value as a reliable sales record and expense record is paramount for any entity engaged in commercial activity.

Adopting a standardized approach to generating these essential documents ensures that every interaction is professionally recorded, contributing to an unimpeachable audit trail. This consistency not only streamlines internal processes but also enhances the perceived professionalism of the business in the eyes of its customers and partners. In an era where data accuracy and transparency are highly valued, the deployment of such a robust financial template is not just a best practice, but a strategic imperative.

The enduring impact of a meticulously maintained financial template resonates across all facets of a business, from daily operations to long-term strategic planning. It serves as a testament to an organization’s dedication to clarity and accountability, establishing a foundation of trust that is invaluable in fostering lasting relationships with clients and stakeholders. This integral piece of business documentation continues to be an indispensable asset, ensuring precision and confidence in every financial exchange.