Effective financial record-keeping is a cornerstone of sound business practice, providing a transparent and auditable trail for every transaction. In an era where precision and accountability are paramount, standardizing documentation processes becomes not merely beneficial but essential. This article delves into the utility and importance of a well-designed lumper receipt template, a foundational tool for acknowledging payments and verifying exchanges across various business and organizational contexts. It serves as a formal acknowledgment, offering clear proof of payment for goods, services, or financial contributions, benefiting both the payor and the payee by establishing an unambiguous record.

This structured approach to documentation is invaluable for a wide array of entities, from small businesses and large corporations to non-profit organizations and individual contractors. It streamlines operations, reduces potential discrepancies, and strengthens financial integrity. By adopting a consistent format, organizations can ensure that every transaction, regardless of its nature, is systematically recorded, making financial management more efficient and reliable for all parties involved.

The Imperative of Clear Financial Documentation

In the complex landscape of modern commerce and non-profit operations, the importance of clear, accurate, and professional documentation cannot be overstated. Every financial interaction, from a simple sale to a significant donation, necessitates a reliable payment receipt or proof of transaction. This is not merely a matter of good practice; it is a critical component for legal compliance, tax reporting, and internal auditing. Without meticulously kept records, businesses risk encountering disputes, facing regulatory penalties, and struggling with accurate financial analysis.

Standardized documentation helps to mitigate these risks by providing an undeniable record of an exchange. It offers clarity in financial statements, supports expenditure justifications, and ensures that all parties have a common understanding of the transaction’s terms. Whether for internal reconciliation or external scrutiny, the ability to produce a clear and concise sales record or invoice form is fundamental to operational transparency and stakeholder confidence. Such precision fosters trust and provides a solid basis for all subsequent financial decisions.

Core Benefits of a Structured Lumper Receipt Template

Adopting a structured lumper receipt template offers a multitude of benefits that extend beyond simple record-keeping, enhancing efficiency, accuracy, and overall financial governance. First, it ensures remarkable consistency across all transactions. Every receipt issued will follow the same format, containing all necessary fields, which simplifies data entry, reconciliation, and subsequent retrieval. This standardization is crucial for maintaining organized business documentation and preventing errors that often arise from ad-hoc processes.

Secondly, a well-designed template significantly improves transparency. By clearly itemizing the transaction details—such as the amount, date, purpose, and parties involved—it minimizes ambiguity and potential misunderstandings. This transparency is vital for building trust with clients, customers, and donors, while also providing a clear paper trail for internal auditing and external verification. Furthermore, utilizing a standardized financial template can dramatically increase efficiency. Automating the creation of these documents saves time, reduces administrative burdens, and allows staff to focus on more strategic tasks, ultimately streamlining the entire payment acknowledgment process. It also makes for a robust expense record.

Customization for Diverse Transactional Needs

The fundamental structure of a receipt is universally applicable, but its specific fields and emphasis can be tailored to suit a wide array of transactional contexts. A versatile lumper receipt template can be highly customized to meet the unique requirements of various industries and organizational types. For instance, while a retail business might prioritize itemized lists of goods sold and sales tax, a service provider would focus on detailing the hours worked or the specific services rendered. This adaptability ensures that the document remains relevant and effective, regardless of its specific application.

Consider its application in different scenarios:

- Sales Transactions: The template can be modified to function as a detailed

sales record, including product codes, quantities, unit prices, and applicable discounts. - Service Provision: For service industries, it can serve as a

service receipt, outlining the scope of work, service dates, and hourly rates, ensuring clarity for clients and internal accounting. - Rent Payments: Landlords can adapt the template to acknowledge monthly rent payments, specifying the period covered and any outstanding balances.

- Donations: Non-profit organizations can customize it into an official

donation acknowledgment, which is crucial for tax-deductible contributions, often including the organization’s tax ID number and a statement of non-quid pro quo. - Business Reimbursements: Employees seeking reimbursement for business expenses can use

this formto meticulously document their out-of-pocket costs, complete with vendor details and expense categories, ensuring accurate tracking ofexpense recordsubmissions.

The flexibility of the template allows organizations to maintain consistency in their overarching documentation strategy while addressing the granular details specific to each type of financial exchange. This ensures that every billing statement or payment confirmation is both comprehensive and contextually appropriate.

Effective Scenarios for Utilizing a Lumper Receipt Template

The practical applications for a well-designed receipt are extensive, proving invaluable in situations where immediate, tangible proof of a transaction is required. Such a document provides clarity and security for both the giver and the receiver, serving as a critical piece of business documentation.

Here are several scenarios where utilizing the receipt is particularly effective:

- Cash Transactions: When cash changes hands for goods or services,

this formprovides the only tangible proof of payment, crucial for both the buyer’s record and the seller’s reconciliation. - Partial Payments or Installments: Documenting partial payments for a larger purchase or service helps track the remaining balance and prevents disputes regarding payment progress.

- Event Registrations: Acknowledging fees paid for workshops, conferences, or events ensures participants have proof of their enrollment and payment.

- Donation Collections: For non-profits, issuing a formal receipt immediately upon receiving contributions, particularly cash or in-kind donations, is vital for donor relations and tax purposes.

- Vendor Payments: When paying vendors or contractors, particularly for smaller services or materials, having a signed receipt from the payee offers confirmation of disbursement.

- Advance Payments or Deposits: Confirming the receipt of an upfront deposit for future services or products, clarifying the amount received and the remaining balance.

- Subscription Renewals: Acknowledging the renewal of membership fees or subscriptions, providing members with a record of their active status.

- Delivery Confirmations: While not exclusively a payment receipt, it can be adapted to confirm the physical receipt of delivered items where payment is also exchanged, merging

proof of transactionwith delivery acknowledgment. - Mobile Service Payments: For businesses operating on-the-go (e.g., plumbers, electricians), providing an immediate

service receipthelps professionalize the transaction and satisfies customer expectations.

In each of these instances, the document serves to formalize the exchange, providing a clear audit trail and reducing the potential for confusion or disagreement. Its utility spans across virtually any scenario where money or value is transferred and needs to be formally recorded.

Design, Formatting, and Usability Best Practices

The efficacy of any financial template hinges not just on its content, but also on its design, formatting, and overall usability. A well-designed receipt should be clear, professional, and easy to complete, whether in print or digital format. Attention to these details ensures that the layout is intuitive for the issuer and easily understandable for the recipient.

Essential Design Elements:

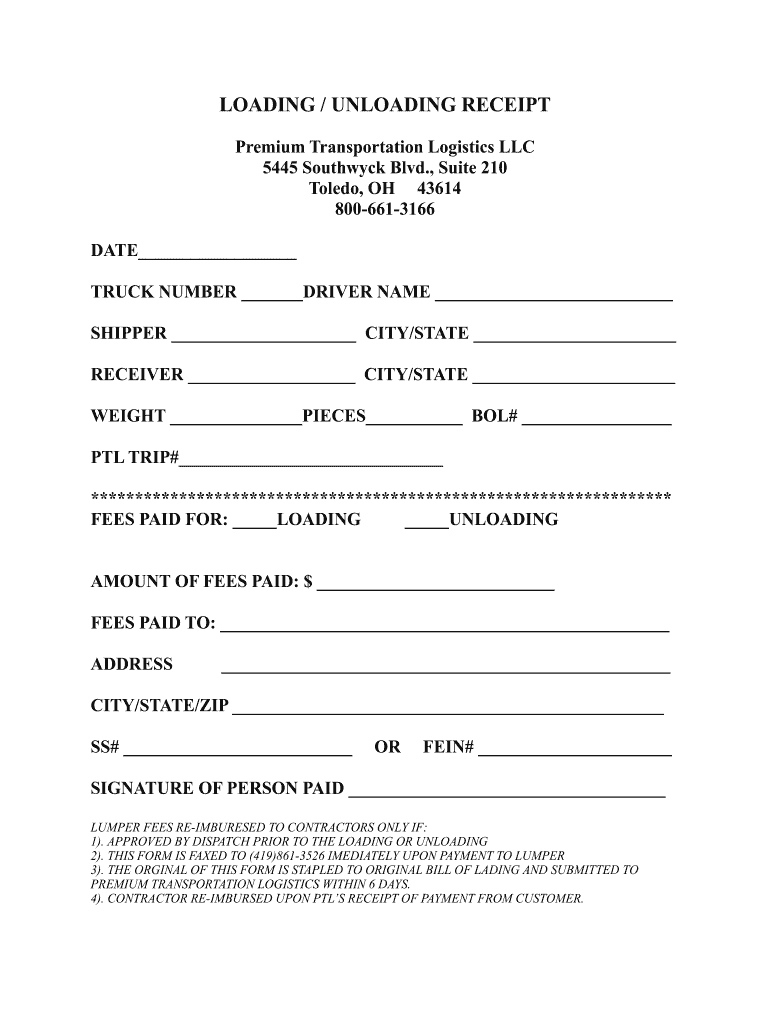

* **Clear Headings and Fields:** Use bold and clear labels for fields such as “Date,” “Amount Received,” “Payer,” “Payee,” “Description of Payment,” and “Payment Method.” This ensures quick data input and comprehension.

* **Company Branding:** Include your company’s logo, name, address, and contact information prominently. This reinforces brand identity and provides essential contact details.

* **Unique Receipt Number:** Every receipt should have a unique, sequential number. This is crucial for tracking, auditing, and preventing duplicate entries.

* **Monetary Details:** Clearly state the amount in both numeric and written (word) form to prevent errors and ensure clarity. Specify the currency.

* **Signature Lines:** Provide clear spaces for the authorized signature of the receiver and, optionally, the payer. This adds a layer of authenticity and agreement.

* **Terms and Conditions/Notes:** A section for any specific terms, return policies, or additional notes relevant to the transaction can be highly beneficial.

Formatting for Readability:

* **Legible Typography:** Choose professional, easy-to-read fonts in appropriate sizes. Avoid overly decorative or small fonts that hinder readability.

* **Ample Whitespace:** Ensure sufficient whitespace between sections and fields. This reduces visual clutter and makes `the file` less intimidating to read and complete.

* **Logical Flow:** Arrange information logically, typically starting with date and receipt number, followed by payer/payee details, transaction description, and then financial specifics.

Usability for Print and Digital:

* **Print Versions:**

* **Paper Size:** Design for standard paper sizes (e.g., Letter, A4) to ensure easy printing.

* **Duplicate Copies:** Consider carbon copy or multi-part forms for situations requiring duplicate receipts for different parties (e.g., payer, payee, accounting).

* **Writeable Fields:** Ensure sufficient space for manual entry if the receipt is to be filled out by hand.

* **Digital Versions:**

* **Fillable PDFs:** Create interactive PDF forms that can be completed electronically, saved, and emailed.

* **Searchable Text:** Ensure that the text within the digital receipt is searchable, facilitating quick retrieval and data extraction.

* **Integration:** Design `the template` for potential integration with accounting software or CRM systems, allowing for automated data transfer and improved efficiency.

* **Responsive Design:** If accessed via web, ensure `the layout` is responsive for various devices.

By meticulously attending to these design and formatting principles, organizations can create a payment receipt that is not only functional but also reflects professionalism and commitment to clear communication. A well-executed financial template minimizes errors, enhances the user experience, and reinforces trust in the organization’s administrative processes.

The Indispensable Value of a Reliable Financial Tool

In conclusion, the strategic adoption of a high-quality lumper receipt template transcends the simple act of acknowledging a payment; it embodies a commitment to financial accuracy, operational transparency, and robust business documentation. This essential tool serves as a tangible proof of transaction, safeguarding both the entity issuing it and the party receiving it from potential disputes and misunderstandings. Its structured format ensures that every critical detail of a financial exchange is consistently captured, forming a reliable record for auditing, tax purposes, and future reference.

By streamlining the process of creating and managing payment receipt documents, businesses and organizations can significantly enhance their efficiency, reduce administrative burdens, and bolster their financial integrity. The ability to customize the template for diverse scenarios—from sales and services to rent payments and donation acknowledgment—underscores its versatility and indispensable role in a wide spectrum of financial activities. Investing in a well-designed, user-friendly receipt system is not merely a matter of administrative convenience; it is a fundamental aspect of sound financial governance and effective communication.

Ultimately, a meticulously implemented receipt system empowers organizations to maintain impeccable financial records, foster trust with their stakeholders, and operate with unparalleled clarity and professionalism. It stands as a testament to an organization’s dedication to accuracy, making it an invaluable asset in today’s demanding financial landscape.