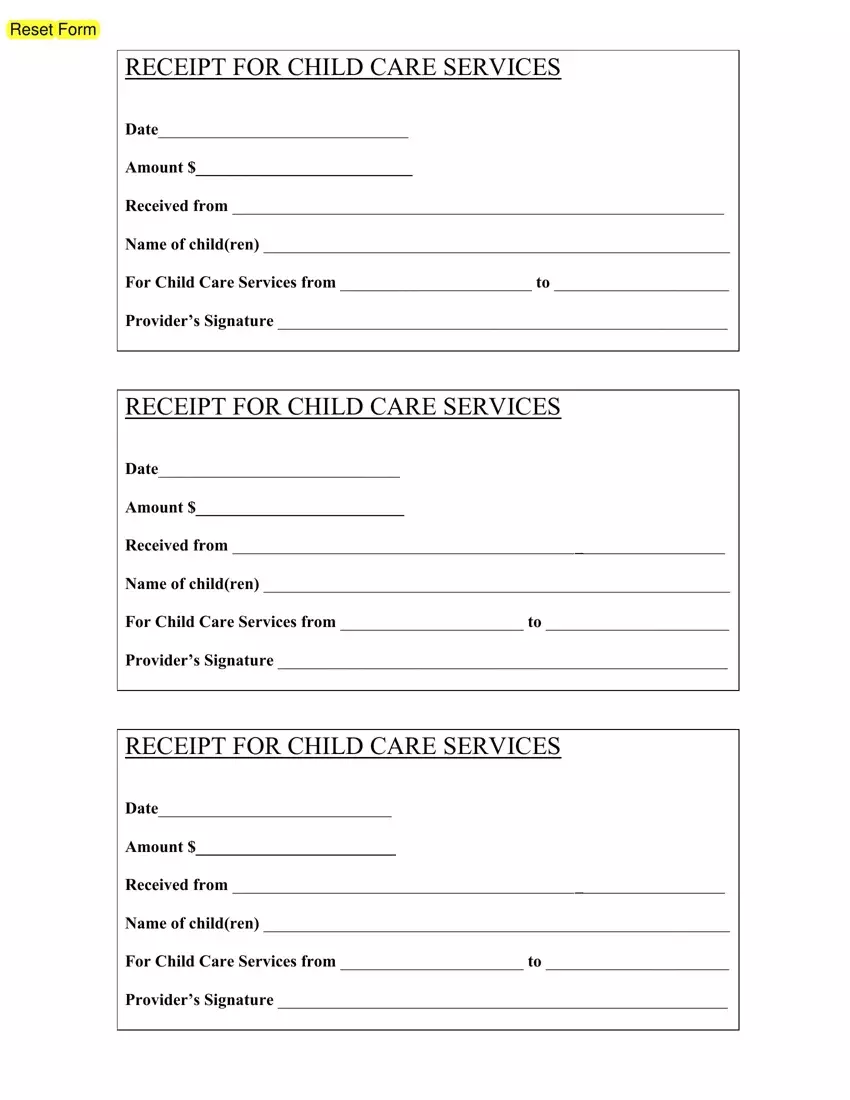

In the intricate landscape of financial transactions, particularly within the sensitive and highly regulated child care sector, the importance of meticulous record-keeping cannot be overstated. A well-structured, clear, and professional document serves as the cornerstone for transparency, accountability, and legal compliance for both providers and parents. It acts as an official record of payments made and services rendered, essential for tax purposes, reimbursement claims, and robust financial management.

This comprehensive guide delves into the utility and design of a child care receipt template, an indispensable tool designed to streamline administrative processes, minimize disputes, and foster trust between all parties. For parents, it provides tangible proof of expenditure, crucial for end-of-year tax deductions or employer-sponsored child care assistance programs. For providers, it ensures accurate accounting, facilitates auditing, and upholds a professional image, demonstrating commitment to clarity and integrity in all business dealings. A robust child care receipt template is an indispensable tool that benefits everyone involved in the child care ecosystem.

The Imperative of Clear Financial Documentation

In any business endeavor, especially one involving personal finances and critical services like child care, clear and professional documentation is not merely a formality; it is a fundamental requirement. It underpins effective communication, prevents misunderstandings, and establishes a definitive timeline of transactions. Without proper records, both parties are vulnerable to discrepancies, which can lead to disputes, lost revenue, or missed tax benefits.

Well-maintained business documentation, such as a meticulously prepared payment receipt, serves as verifiable proof of transaction. This is crucial for internal auditing, external regulatory checks, and maintaining a transparent relationship with clients. For child care providers, accurate records safeguard against potential legal challenges and contribute to a reputation of reliability and professionalism. For parents, these documents are vital for managing household budgets, securing tax credits, or substantiating expense records for employer reimbursement programs.

Core Benefits of a Structured Template

The primary function of a child care receipt template extends beyond simple acknowledgment of payment; it is a strategic asset for ensuring accuracy, transparency, and consistency in financial record-keeping. Utilizing a predefined layout significantly reduces the potential for human error, ensuring that all necessary information is captured consistently across every transaction. This standardization is invaluable for maintaining organized financial records.

A structured template provides a transparent breakdown of costs, detailing service dates, rates, and any additional fees, which promotes clarity for both parties. This level of detail helps to avoid misunderstandings about billing and ensures that parents fully comprehend what they are paying for. Furthermore, consistent documentation simplifies year-end financial reporting, makes audit processes more efficient, and reinforces a professional image. The template becomes a reliable source of information, fostering trust and operational efficiency.

Versatility and Customization Beyond Child Care

While the focus here is specifically on a child care receipt template, the foundational elements and design principles of such a document offer remarkable versatility, making them adaptable for a myriad of other financial transactions. The core concept of providing a clear, itemized proof of payment transcends specific industries, proving invaluable in various business and personal contexts. The structure of this type of template can be readily customized to serve different purposes effectively.

For instance, the layout can be modified into a general service receipt for contractors, consultants, or freelancers acknowledging payment for their work. It can be adapted as a sales record for small retail businesses, detailing product purchases. Property owners can use a modified version as a rent payment receipt, while non-profit organizations might transform it into a donation acknowledgment form. Even for internal business reimbursements, a structured form ensures all expenses are properly documented. The underlying format provides a robust framework for any type of payment receipt, billing statement, or invoice form requiring detailed transaction information.

Practical Applications: When to Utilize the Template

Implementing a standardized template for financial acknowledgments is most effective in scenarios where clear, verifiable proof of transaction is critical for record-keeping, compliance, or personal financial management. The consistent application of the document ensures that all relevant details are captured and easily retrievable. This approach safeguards both the service provider and the client, fostering an environment of trust and accountability.

Here are several examples of when utilizing the template is most effective:

- Regular Tuition Payments: For weekly, bi-weekly, or monthly child care tuition fees, providing a receipt upon each payment ensures ongoing documentation of financial commitment and receipt.

- One-Time Fees: When collecting enrollment fees, activity fees, or late payment charges, the receipt serves as a clear record for these specific, often variable, expenses.

- Tax Documentation: Parents require official expense records for claiming child care tax credits or deductions. A detailed receipt simplifies this process significantly.

- Employer Reimbursement: Many employers offer child care benefits or flexible spending accounts (FSAs). The document provides the necessary proof of payment for employees to submit for reimbursement.

- Proof of Service: Beyond just payment, the receipt can confirm the dates and types of services rendered, which is essential for attendance tracking and service validation.

- Auditing and Reconciliation: Child care providers benefit from having consistent receipts for internal financial reconciliation and in preparation for potential audits by regulatory bodies or financial institutions.

- Dispute Resolution: In the rare event of a payment dispute, the structured receipt serves as definitive evidence, helping to quickly and amicably resolve disagreements.

Design, Formatting, and Usability Best Practices

Designing a highly effective financial document, whether for print or digital distribution, requires careful consideration of its purpose, users, and the information it needs to convey. The goal is to create a layout that is clear, intuitive, and easy to complete while ensuring all critical data points are consistently captured. Usability is paramount, allowing both providers to issue and parents to understand the receipt effortlessly.

Key Elements for Inclusion

Every comprehensive receipt should contain specific fields to ensure its completeness and validity. These typically include:

- Provider Information: Full legal name, business address, contact number, and potentially a logo for professional branding.

- Parent/Guardian Information: Full name(s), contact number, and email address.

- Child’s Information: Full name(s) of the child or children for whom services were rendered.

- Receipt Number: A unique identifier for each transaction, crucial for tracking and reconciliation.

- Date of Payment: The exact date the payment was received.

- Service Period: The specific dates for which the child care services were provided (e.g., "Week of October 23-27, 2023").

- Description of Services: A clear, itemized breakdown of charges, such as daily rates, hourly fees, late pickup charges, activity fees, or supply costs.

- Amount Due/Paid: The total sum expected and the actual amount received.

- Payment Method: How the payment was made (e.g., cash, check, credit card, bank transfer).

- Balance Due (if any): Any remaining outstanding balance after the current payment.

- Authorized Signature Line: A space for the provider or an authorized representative to sign, confirming receipt.

- Disclaimer/Notes: Any relevant terms, conditions, or special notes, such as "Thank you for your business!" or "This receipt serves as proof of payment for tax purposes."

Print vs. Digital Considerations

Modern business practices necessitate adaptability for both physical and digital formats. When designing the template, consider how it will function in each environment. For print versions, ensure the layout is clean, legible, and includes sufficient space for manual entries and signatures. Use standard paper sizes to avoid printing issues.

For digital versions, which are increasingly common, the file should be easily shareable and viewable across various devices. PDF format is often preferred for its universal compatibility and ability to preserve formatting. Editable formats like Microsoft Word or Google Docs can also be useful for providers to quickly fill out the form. Ensure that the digital layout is responsive and readable on mobile phones and tablets, facilitating easy access and saving for parents. The template should be designed to be straightforward to complete electronically, perhaps with fillable fields, and then saved or printed as a permanent record.

Concluding Thoughts on the Value of a Structured Template

In summary, implementing a meticulously designed and consistently utilized template for financial records is a strategic imperative in the child care sector. This essential document transcends its basic function as a mere payment receipt, evolving into a powerful tool that upholds professional standards, ensures financial transparency, and cultivates trust between providers and families. Its structured format minimizes administrative burdens, eradicates ambiguity, and provides a clear audit trail for all transactions.

By embracing such a reliable financial template, child care providers not only enhance their operational efficiency but also reinforce their commitment to integrity and excellent client service. Parents, in turn, gain peace of mind from having clear, verifiable expense records for tax purposes and financial planning. Ultimately, this robust form stands as a testament to effective business communication, serving as a cornerstone for responsible financial management and fostering long-lasting, positive relationships within the child care community.