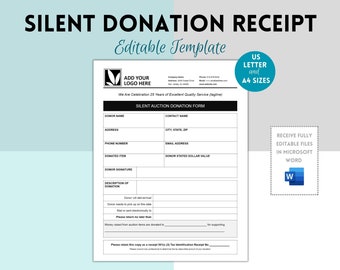

In the intricate landscape of financial transactions and philanthropic endeavors, the importance of clear, accurate, and professional documentation cannot be overstated. For organizations, particularly those engaged in fundraising activities such as silent auctions, a robust system for acknowledging contributions is not merely a courtesy but a fundamental requirement for transparency, accountability, and legal compliance. This foundational need underscores the value of a well-designed silent auction donation receipt template.

This essential document serves multiple critical purposes, benefiting both the donating entity and the recipient organization. It provides donors with verifiable proof of their contribution, which is often crucial for tax deduction purposes in the United States. Concurrently, it furnishes the receiving organization with an organized record of all donations, facilitating accurate bookkeeping, audit preparedness, and donor relationship management. Ultimately, leveraging a standardized template streamlines administrative processes, ensuring consistency and professionalism across all donor interactions.

The Imperative of Meticulous Financial Documentation

The bedrock of sound financial management for any entity, whether a non-profit, a small business, or a large corporation, is meticulous documentation. Every transaction, from the smallest expense to the largest donation, requires a traceable record to uphold fiscal integrity. Without comprehensive and easily accessible documentation, organizations risk inaccuracies in financial reporting, difficulties during audits, and potential legal or compliance issues.

Clear and professional documentation acts as a verifiable narrative of financial activity. It provides tangible proof of transaction, establishes accountability, and contributes significantly to an organization’s credibility. For donors, a formal receipt validates their generosity and empowers them to claim rightful tax benefits. For organizations, it offers an indisputable audit trail, essential for internal reviews, external audits, and demonstrating responsible stewardship of funds and donated goods.

Core Advantages of a Structured Donation Receipt Template

Adopting a structured template for donation receipts offers a multitude of benefits, elevating administrative efficiency and bolstering organizational integrity. A standardized layout inherently promotes accuracy by ensuring all necessary fields are consistently captured for every donation. This systematic approach minimizes errors that can arise from manual entry or inconsistent record-keeping practices.

Beyond accuracy, a well-designed template significantly enhances transparency. Donors receive a clear, itemized account of their contribution, fostering trust and a clear understanding of the value acknowledged. Internally, this form provides a consistent format for data entry, making it easier to track and reconcile donations, thereby contributing to robust financial transparency. Furthermore, using a template ensures consistency in branding and messaging, presenting a professional image to all stakeholders. This consistency in documentation is vital for maintaining a reliable financial record and streamlining the overall accounting process.

Customizing Your Receipt Template for Diverse Transactional Needs

While specific fields are necessary for a silent auction donation receipt template, the underlying structure of a good receipt form is remarkably versatile. Its adaptability allows organizations to customize it for a wide array of transactional needs beyond just donations. Businesses, for instance, can modify this template to serve as a sales record or a service receipt, detailing goods sold or services rendered, along with payment terms and dates.

For landlords, adapting the document into a rent payment receipt provides tenants with proof of payment and maintains a clear financial ledger. Similarly, when it comes to business reimbursements, a tailored version of the template can be used to acknowledge expenses paid back to employees, ensuring proper financial tracking. The core principle remains consistent: providing a clear, itemized, and dated acknowledgment of a financial exchange, making this type of financial template an indispensable tool across various sectors.

Optimal Scenarios for Employing a Donation Acknowledgment Form

The utility of a detailed donation acknowledgment form extends across numerous scenarios, providing essential documentation and fostering professional relationships. Here are examples of when using this template is most effective:

- Silent Auctions: Acknowledging donated items (goods, services, experiences) for a fundraising event, detailing their fair market value.

- Charitable Contributions: Providing proof of cash donations, in-kind gifts, or pledges to non-profit organizations.

- Membership Dues: Issuing receipts for membership fees, often partially tax-deductible for certain organizations.

- Fundraising Galas & Events: Documenting ticket purchases where a portion may be tax-deductible as a donation.

- Capital Campaigns: Acknowledging significant contributions towards specific organizational projects or endowments.

- Volunteer Expense Reimbursements: While not a donation receipt, a similar structured form can acknowledge reimbursements made to volunteers, ensuring accurate expense records.

- General Merchandise Sales (Non-Profit Retail): For items sold where a portion of the sale might be considered a donation or for general sales tracking within a non-profit.

- Program Service Fees: Documenting payments for services provided by a non-profit, such as educational workshops or community classes, where a receipt is required for the payer.

In each instance, the receipt provides a clear, official record, crucial for the donor’s tax purposes and the organization’s financial accountability.

Design, Formatting, and Usability Best Practices for Effective Receipts

The efficacy of any financial document hinges not just on its content but also on its presentation and ease of use. For a donation receipt template, thoughtful design and formatting are paramount for both print and digital versions. A clean, uncluttered layout ensures that essential information is immediately discernible, preventing confusion and enhancing professionalism.

Key design elements include a clear header featuring the organization’s logo and contact information, ensuring immediate identification. Fields for donor details, donation date, description of the item or cash amount, fair market value (if applicable for in-kind donations), and a clear statement regarding the non-deductibility of goods or services received in exchange for the donation should be prominently placed. Use of legible fonts, appropriate spacing, and consistent alignment contribute significantly to readability. For digital versions, ensure the file is easily downloadable and fillable, perhaps in PDF format, and consider responsive design for viewing across various devices. Both print and digital layouts should offer ample space for signatures and any required legal disclaimers, making the document legally sound and user-friendly.

Conclusion

In the dynamic world of charitable giving and financial transactions, the silent auction donation receipt template stands as an indispensable tool for non-profit organizations and their generous supporters. It transcends mere administrative paperwork, embodying principles of transparency, accuracy, and mutual accountability. By providing a clear, standardized framework for acknowledging contributions, this template simplifies complex record-keeping tasks while simultaneously building trust and strengthening donor relationships.

Ultimately, adopting a meticulously designed and consistently utilized financial template is a strategic investment in an organization’s long-term operational efficiency and financial integrity. It ensures that every donation, whether monetary or in-kind, is documented with the utmost precision, safeguarding both the donor’s tax interests and the organization’s compliance obligations. Such a robust system for financial documentation is not just a best practice; it is a fundamental pillar of responsible and effective organizational management in today’s environment.