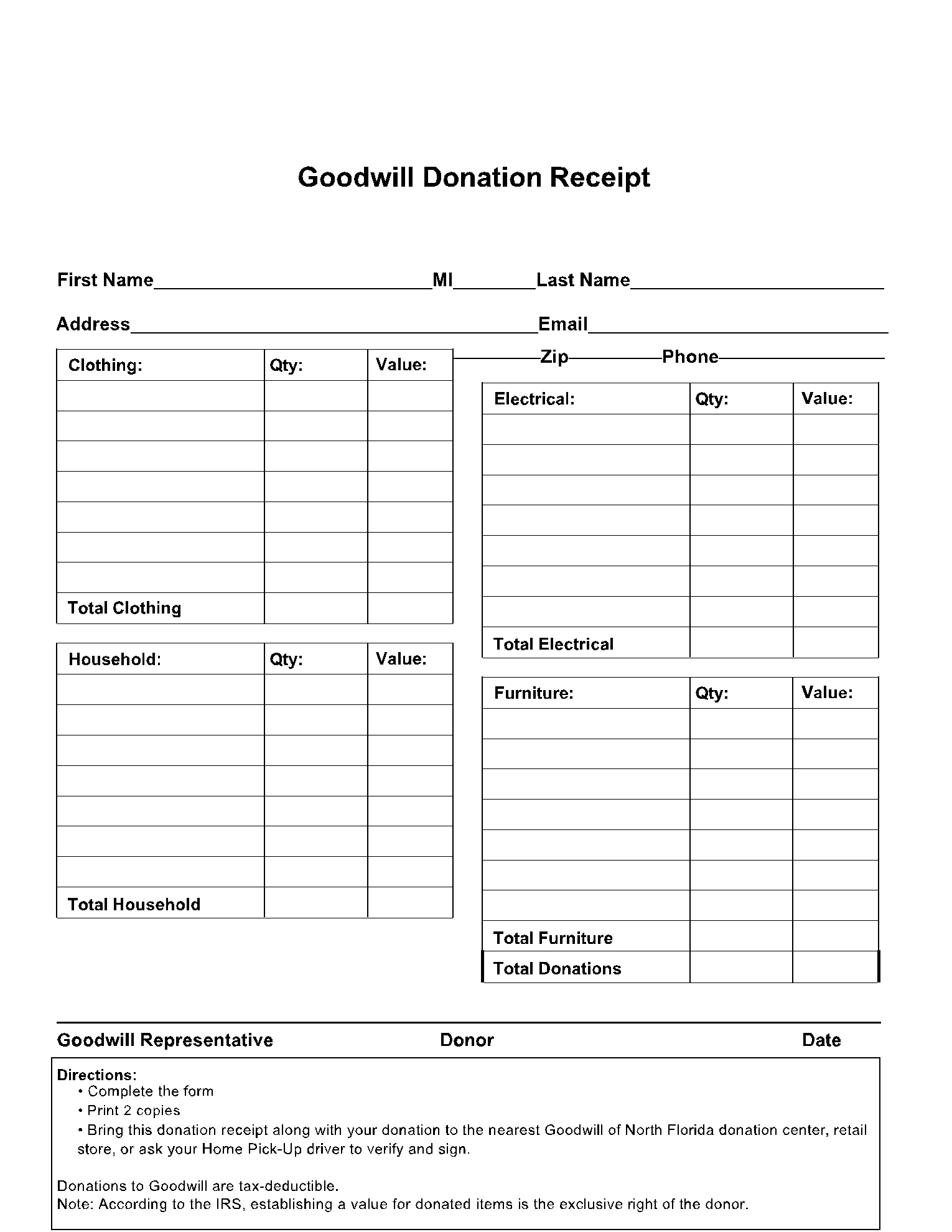

Accurate and professional documentation stands as a cornerstone of sound financial practice, particularly within the realm of charitable contributions. For organizations such as thrift stores that regularly receive non-cash donations, providing donors with appropriate acknowledgment is not merely a courtesy but often a legal necessity. A well-structured thrift store donation receipt template serves as an indispensable tool, ensuring both parties maintain clear and verifiable records of these valuable exchanges.

The primary purpose of such a document is to offer proof of contribution, which donors can utilize for tax deduction purposes in accordance with IRS regulations. Simultaneously, it provides the receiving organization with a systematic method for tracking inventory, managing donor relationships, and ensuring compliance. This symmetrical benefit underscores its importance for seamless operations and effective financial management, benefiting individual donors, non-profit entities, and regulatory bodies alike.

The Imperative of Clear Financial Documentation

In any business or charitable transaction, clear and unambiguous documentation is paramount. It forms the backbone of accountability, transparency, and legal compliance. Whether dealing with a simple payment receipt or a complex invoice form, the principle remains the same: every exchange of value warrants a precise record. This meticulous approach safeguards against disputes, facilitates auditing processes, and underpins the credibility of an organization.

For entities accepting donations, comprehensive business documentation is particularly critical. It provides concrete proof of transaction, demonstrating due diligence and adherence to both internal policies and external regulatory requirements. Without a standardized approach to tracking contributions, an organization risks inefficiencies, potential financial discrepancies, and challenges in substantiating its charitable activities to stakeholders or governmental agencies.

Key Benefits of a Structured Donation Receipt Template

Adopting a structured thrift store donation receipt template offers a multitude of benefits that extend beyond mere compliance. It fundamentally enhances the operational efficiency and professional image of the organization. By standardizing the information captured, it significantly reduces the likelihood of errors, ensuring that all essential details—from donor information to item descriptions and estimated values—are consistently recorded.

This type of financial template ensures consistency across all interactions, presenting a unified and professional front to donors. It simplifies the auditing process by providing easily accessible and uniformly formatted expense records. Furthermore, a clear and well-organized receipt strengthens donor relations, demonstrating an organization’s commitment to transparency and meticulous record-keeping, thereby fostering trust and encouraging future contributions.

Adaptability Across Various Transaction Types

While specifically designed for charitable contributions, the core design principles of a thrift store donation receipt template are remarkably adaptable across a broad spectrum of financial transactions. The fundamental structure—capturing details of parties involved, date, description of transaction, and value—is universally applicable. This underlying flexibility allows the framework to be customized for numerous other purposes, serving as a versatile business documentation tool.

For instance, the layout can be easily modified to function as a sales record for merchandise sold by the thrift store, detailing items purchased and their prices, effectively becoming a payment receipt. Similarly, with minor adjustments, it can serve as a service receipt for paid services, a rent payment acknowledgment, or a general invoice form for business-to-business transactions. Its versatility makes it a valuable asset for diverse operational needs, encompassing everything from a simple billing statement to a comprehensive donation acknowledgment.

When a Donation Receipt Template Proves Most Effective

Implementing a standardized donation receipt template is particularly advantageous in several key scenarios, ensuring efficiency and accuracy where it matters most.

- High Volume of Daily Donations: When a thrift store receives numerous items throughout the day, a template streamlines the process of issuing acknowledgments quickly and consistently.

- IRS-Compliant Documentation: It is essential for donations exceeding certain monetary thresholds to comply with IRS guidelines for non-cash contributions, requiring specific information on the proof of transaction.

- Professional Branding and Image: A well-designed receipt reinforces the organization’s professionalism and attention to detail, enhancing its public image.

- Tracking Non-Cash Contributions: Beyond monetary value, the template helps track the type and quantity of items received, which is crucial for inventory management and reporting.

- Multiple Donation Drop-Off Points: Ensuring consistency across various locations or intake personnel is simplified through a standardized document.

- Donor Record-Keeping: It provides donors with an official expense record, simplifying their tax preparation and personal financial management.

Design, Formatting, and Usability Best Practices

Creating an effective donation receipt requires careful consideration of its design, formatting, and overall usability. The objective is to produce a document that is not only professional and clear but also easy to complete and understand for both staff and donors.

Essential Content Fields

Every receipt, regardless of its specific application (be it a donation acknowledgment or a service receipt), must contain key pieces of information. For a donation receipt, this typically includes:

- Organization Information: Full legal name, address, and Employer Identification Number (EIN).

- Donor Information: Full name, address, and contact details.

- Date of Donation: The precise date the contribution was made.

- Description of Donated Items: A clear, itemized list of goods received, sufficient for identification.

- Estimated Value: While the organization cannot appraise non-cash donations, it often indicates "Donor’s estimated value" or a disclaimer.

- No Goods/Services Received Statement: A crucial IRS requirement stating that no goods or services were provided in exchange for the donation (or detailing any if applicable).

- Signature Lines: For the donor (optional) and an authorized representative of the organization.

- Disclaimers: Any pertinent legal or organizational disclaimers regarding valuation or tax advice.

Formatting and Layout

The visual presentation of the financial template significantly impacts its usability and perceived professionalism. Employ clear, legible fonts and ensure adequate spacing between fields to prevent clutter. Headings should be prominent, guiding the user through the form efficiently. A clean, organized layout helps to reduce errors and makes the document easy to read and file. Incorporating the organization’s logo and branding elements enhances recognition and reinforces its identity.

Usability for Print and Digital Versions

Consider both physical and digital applications. For print versions, ensure the receipt is easy to fill out by hand, with sufficient space for written information. For digital iterations, optimize the file for electronic completion (e.g., fillable PDF forms) and digital storage. Providing the option to generate and send the receipt via email adds convenience for donors and reduces administrative burden. The flexibility to function as a digital payment receipt or a printed proof of transaction enhances its overall utility.

Conclusion

In the complex landscape of financial record-keeping, a robust and well-designed donation receipt template stands as an invaluable asset. It transcends its basic function as a mere acknowledgment, evolving into a strategic tool that underpins organizational integrity, operational efficiency, and legal compliance. By standardizing the documentation process, this financial template ensures accuracy in every transaction, whether it’s a contribution of goods or a service receipt.

The commitment to utilizing such a dependable form reflects an organization’s dedication to transparency and professional conduct. It not only streamlines internal processes, making auditing and reporting more straightforward, but also builds trust with donors, who appreciate clear and timely proof of their generous contributions. Ultimately, an effective donation acknowledgment is an indispensable element of responsible stewardship, fostering a culture of precision and accountability that benefits all stakeholders.