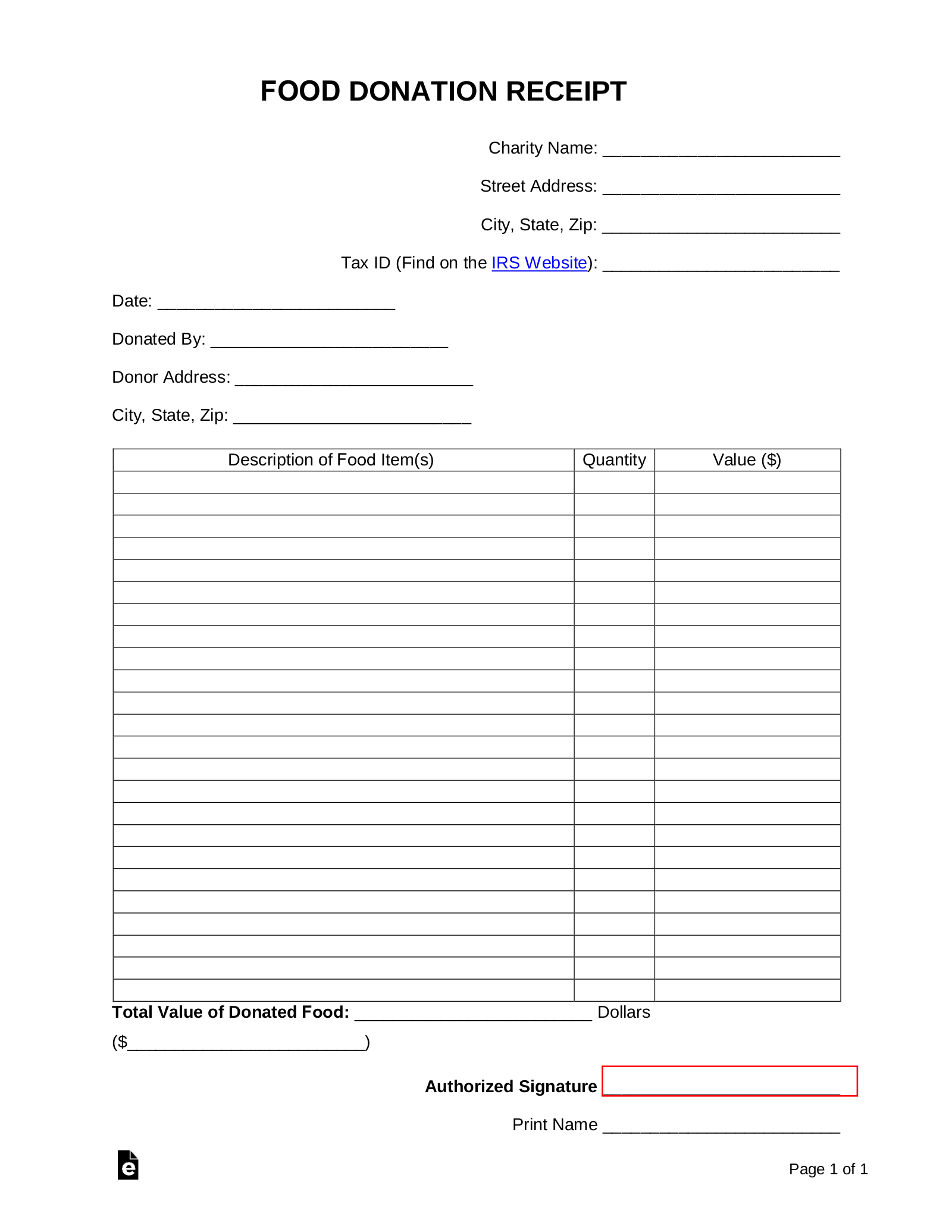

In the intricate landscape of financial accountability and philanthropic activity, meticulous documentation stands as a cornerstone of integrity and transparency. For entities involved in charitable giving, particularly in the realm of food donations, the necessity for a standardized, clear, and comprehensive record is paramount. A well-constructed food donation receipt template serves as an indispensable tool, offering concrete proof of contribution for donors and establishing an auditable trail for recipient organizations. This foundational document ensures that both parties can accurately track and report their activities, fostering trust and facilitating compliance with regulatory requirements.

The primary purpose of such a template extends beyond mere acknowledgment; it functions as a critical component for tax deductions for donors and robust financial record-keeping for non-profits and other recipient organizations. Without a formal, well-structured receipt, donors may face challenges in substantiating their charitable contributions, potentially missing out on tax benefits. Simultaneously, recipient organizations rely on these precise records to demonstrate responsible stewardship, meet auditing standards, and provide clear transparency to stakeholders and regulatory bodies. The effective implementation of a food donation receipt template thus simplifies complex administrative tasks, ensuring clarity and accuracy in every transaction.

The Imperative of Clear Financial Documentation

The bedrock of any credible financial operation, whether for a commercial enterprise or a non-profit organization, is its commitment to clear and professional documentation. Every transaction, from the smallest expense to the largest donation, requires a meticulously maintained record to ensure financial integrity and operational transparency. In an era of heightened scrutiny and complex regulatory frameworks, robust documentation is not merely a best practice; it is a fundamental requirement for legal compliance and ethical conduct.

Such precise record-keeping serves multiple vital functions. It provides an undeniable audit trail, which is crucial for internal reviews, external audits, and government oversight. Moreover, comprehensive documentation protects all parties involved by clearly outlining the terms and nature of a transaction, thereby mitigating disputes and fostering an environment of mutual trust. For businesses and charitable organizations alike, the ability to produce accurate and consistent financial records underpins their credibility and operational longevity.

Key Benefits of a Structured Food Donation Receipt Template

Adopting a structured food donation receipt template offers a multitude of advantages, significantly enhancing the efficiency and reliability of donation processing. This specific layout is engineered to capture all essential information consistently, thereby eliminating ambiguities and reducing the potential for errors. For donors, it provides a formal and verifiable proof of transaction, crucial for substantiating tax-deductible contributions to the IRS. This clear acknowledgment reinforces donor confidence and encourages continued philanthropic engagement.

Recipient organizations, on the other hand, benefit from streamlined record-keeping, ensuring that every donation is accurately logged for financial reporting and auditing purposes. The consistency offered by a standardized template facilitates easier data entry, reduces administrative overhead, and supports the generation of reliable financial statements. It also projects a professional image, demonstrating to donors and stakeholders that the organization operates with high standards of accountability and transparency. Ultimately, utilizing a pre-designed receipt template safeguards both parties, ensuring legal compliance and fostering operational excellence.

Versatility: Customizing the Template for Diverse Transactions

While initially designed for charitable contributions, the fundamental structure of a robust receipt template is remarkably versatile, allowing for extensive customization across a broad spectrum of financial transactions. The core elements — sender, recipient, date, description of goods or services, and value — are universally applicable, making these forms adaptable to various business and personal needs. This adaptability transforms a simple donation acknowledgment into a multifaceted business documentation tool.

For instance, the template can be easily modified to serve as a payment receipt for services rendered, detailing hourly rates, materials used, and total charges. It can also function as an invoice form for small businesses, outlining products sold and payment terms. Property managers can adapt it for rent payments, specifying the period covered and any outstanding balances. Furthermore, it can be customized for business reimbursements, providing a clear expense record for employees submitting claims. The underlying architecture of a well-designed financial template, irrespective of its original intent, offers a flexible framework for generating precise and auditable proof of transaction for almost any financial exchange. Its capacity to be repurposed underscores its value as a fundamental financial template.

When to Utilize a Food Donation Receipt Template Effectively

The effective deployment of a food donation receipt template is crucial for ensuring proper documentation, maintaining financial integrity, and facilitating compliance across various scenarios. Its utility extends to a range of individuals and organizations engaged in charitable food distribution and receipt. Identifying the optimal times and contexts for using this specific document maximizes its benefits for both donors and recipients.

Key situations where employing a food donation receipt template is most effective include:

- Non-profit Organizations Receiving Food Donations: Charities, food banks, and shelters that regularly accept food contributions require this form to provide official acknowledgment to donors, track inventory, and maintain accurate records for auditing and annual reporting.

- Businesses Donating Surplus Food: Restaurants, grocery stores, and food manufacturers often donate excess inventory to prevent waste. A formal receipt allows these businesses to document their charitable contributions for potential tax deductions and demonstrate corporate social responsibility.

- Individuals Contributing Food Items to Charities: When individuals make substantial food donations, particularly those that are tax-deductible, they need a clear donation acknowledgment to support their claims during tax season.

- Tracking In-Kind Contributions for Financial Reporting: Beyond cash, in-kind donations like food have a measurable value. The template helps organizations assign and track this value accurately for their financial statements and grant reporting.

- Providing Documentation for Tax-Deductible Gifts: Any entity seeking to claim a tax deduction for a food donation must possess a properly completed and signed receipt from the receiving organization, confirming the nature and estimated value of the contribution.

- Facilitating Grant Compliance: Many grants require detailed reporting on all forms of income, including in-kind donations. The consistent use of such a document ensures that all food contributions are properly accounted for, meeting grant reporting requirements.

- Ensuring Internal Audit Readiness: Organizations maintaining precise records with this document are better prepared for internal audits, demonstrating robust financial controls and accountability for all incoming resources.

These instances highlight the critical role that a specialized donation acknowledgment plays in fostering transparency, ensuring compliance, and optimizing the administrative processes associated with charitable food giving. The consistent use of this form elevates the professionalism and reliability of all parties involved in the donation chain.

Design, Formatting, and Usability Best Practices

Designing and formatting a receipt template for optimal usability and professionalism is crucial, whether it’s intended for print or digital distribution. The layout should prioritize clarity, readability, and ease of completion, ensuring that all necessary information can be accurately captured without confusion. A clean and uncluttered design enhances the professional image of the issuing entity and facilitates efficient record-keeping.

For both print and digital versions, essential elements include:

- Clear Headings and Fields: Use distinct headings (e.g., "Donor Information," "Recipient Organization," "Donation Details") and clearly labeled fields (e.g., "Date of Donation," "Description of Items," "Estimated Value"). This guides the user through the form and ensures no critical information is overlooked.

- Essential Information Inclusion: Every receipt should include the name and contact information of both the donor and the recipient organization, the date of the donation, a detailed description of the donated items, and an estimated fair market value of the donation (if applicable for tax purposes). It should also specify the tax-exempt status of the recipient organization (e.g., 501(c)(3) status).

- Branding Elements: Incorporate the organization’s logo and contact information prominently. This reinforces brand identity and provides immediate recognition.

- Legal Disclaimers and Signatures: Include space for authorized signatures from the recipient organization, confirming receipt. A small disclaimer regarding the donor’s responsibility to determine the fair market value for tax purposes is also advisable.

- Readability: Employ professional, legible fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12 points for body text). Use sufficient white space to prevent the document from appearing cramped or overwhelming.

- Digital Versatility: For digital forms, ensure compatibility with common software (e.g., PDF, Microsoft Word, Google Docs). Editable PDF forms with fillable fields can significantly enhance usability, allowing for electronic completion and submission. These forms should also be easily printable.

- Accessibility: Consider users with varying needs. Ensure sufficient contrast between text and background, and for digital documents, ensure they are compatible with screen readers where possible.

By adhering to these design and formatting principles, the resulting document becomes not just a record, but an effective communication tool that streamlines administrative processes and upholds the highest standards of professional conduct. This meticulous approach to creating the receipt reflects an organization’s commitment to precision and accountability.

A thoughtfully designed financial template, regardless of whether it’s an invoice form or a donation acknowledgment, significantly contributes to operational efficiency and strengthens stakeholder confidence. The consistency of the layout helps in quick data entry and retrieval, crucial for managing a high volume of transactions. Such a robust expense record or service receipt becomes a testament to the organization’s dedication to transparent and efficient business documentation. The strategic arrangement of information within the template ensures that all relevant data is captured, making it a reliable proof of transaction for any audit or financial review.

In conclusion, the careful crafting of such a receipt, encompassing both its content and presentation, elevates its utility from a mere piece of paper to an indispensable element of robust financial management. It underscores the importance of every payment receipt or donation acknowledgment as a critical piece of the broader financial puzzle, reflecting professionalism and meticulous attention to detail.

The Indispensable Value of a Reliable Financial Record

In summary, the role of a meticulously crafted receipt template transcends simple acknowledgment, establishing itself as a vital component of sound financial governance and transparent operations. Its consistent application offers profound benefits, from simplifying tax compliance for donors to providing robust audit trails for recipient organizations. This essential document streamlines administrative processes, mitigates potential disputes, and significantly enhances the credibility and professionalism of all parties involved in charitable contributions.

By embracing a standardized and well-designed template, organizations can ensure that every transaction is accurately recorded, fostering an environment of trust and accountability. This commitment to precise documentation not only meets regulatory requirements but also reinforces an organization’s dedication to ethical practices and efficient resource management. Ultimately, this crucial financial record serves as an indispensable tool, bolstering the integrity of philanthropic efforts and contributing to the sustained success of charitable initiatives.