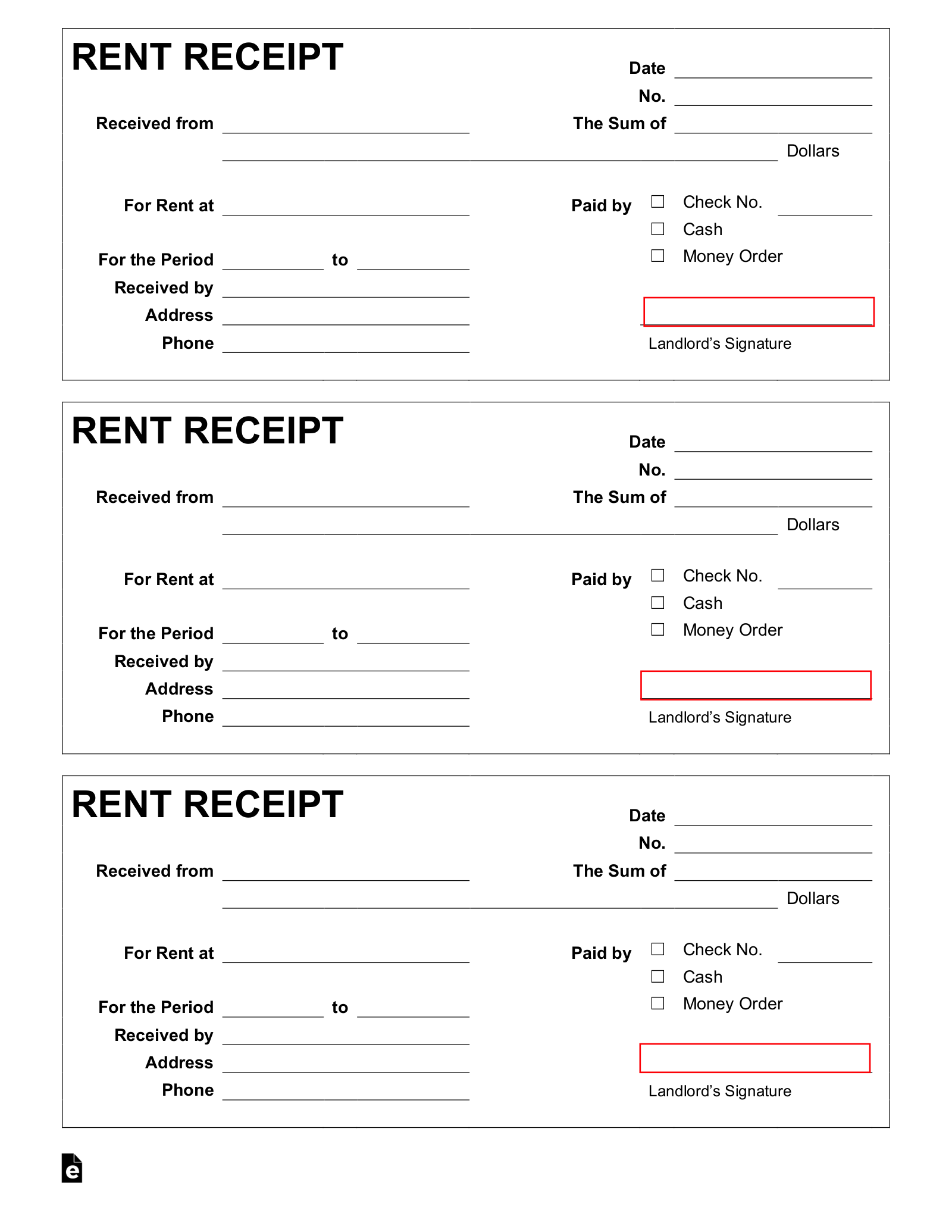

In the intricate landscape of financial transactions, the humble receipt serves as a cornerstone of trust, accountability, and legal validity. For those involved in property management or leasing, the significance of a meticulously crafted and consistently utilized rental official receipt template cannot be overstated. This essential document provides unequivocal proof of payment, acting as a verifiable record for both the payer and the payee in a rental agreement. It transcends a mere slip of paper, embodying clarity and professionalism in every exchange.

The primary purpose of a comprehensive rental official receipt template is to formalize the financial aspects of a lease, offering transparency and protection to all parties. Landlords, property managers, and tenants alike benefit immensely from its systematic application. It safeguards against misunderstandings, facilitates accurate record-keeping for tax purposes, and provides an indispensable audit trail. Utilizing such a template is not merely a best practice; it is a fundamental element of effective business documentation and responsible financial stewardship in the rental sector.

The Imperative of Clear and Professional Financial Documentation

Clear and professional documentation stands as a pillar of integrity and efficiency in all financial and business transactions. In an era where accountability is paramount, the absence of proper records can lead to disputes, legal complications, and a breakdown of trust. Official receipts, detailed invoices, and comprehensive payment records are not just administrative formalities; they are critical components of a robust financial ecosystem.

For businesses and individuals alike, maintaining accurate documentation ensures compliance with regulatory requirements, facilitates seamless auditing processes, and provides an undisputed reference point for all transactions. A well-documented history of financial exchanges minimizes ambiguity, strengthens legal positions, and contributes significantly to operational transparency. This commitment to detail reinforces professional relationships and underpins sound financial management.

Key Benefits of Utilizing a Structured Receipt Template

Adopting a structured template for official receipts, particularly one tailored for rental payments, offers a multitude of advantages that streamline operations and enhance financial integrity. This systematic approach ensures that every transaction is recorded with precision and consistency, establishing a reliable proof of transaction for all stakeholders. The key benefits derived from such a practice are profound and far-reaching.

Firstly, a well-designed receipt template significantly enhances accuracy. By providing predefined fields for all necessary information—such as dates, amounts, payment methods, and descriptions—it minimizes the risk of human error and omissions. This level of detail is crucial for maintaining precise financial records and ensuring that all transactions are correctly accounted for, preventing discrepancies that can complicate budgeting or tax preparation.

Secondly, these standardized documents foster unparalleled transparency. Each party receives an identical, clear record of the transaction, eliminating potential misunderstandings regarding payment received or owed. This openness builds trust between landlords and tenants, fostering a more harmonious business relationship. It unequivocally details what was paid, by whom, to whom, and for what period, leaving no room for doubt.

Finally, the consistent application of a structured template ensures uniformity across all financial interactions. This not only projects a highly professional image but also significantly improves the efficiency of record-keeping. When every receipt follows the same layout and includes the same essential data, retrieving and referencing past transactions becomes a quick and straightforward process. The rental official receipt template helps ensure accuracy, transparency, and consistency in record-keeping, making it an invaluable tool for any financial operation.

Customization for Diverse Transactional Needs

While particularly vital for rental agreements, the underlying principles of a well-structured receipt template are universally applicable across a broad spectrum of transactional needs. The foundational layout, designed to capture essential payment details, can be readily adapted to serve various purposes, making it a versatile financial template for numerous business scenarios.

For instance, a sales record template can be derived by simply adjusting the description fields to detail goods purchased, quantities, and unit prices. Similarly, a service receipt can document specific services rendered, hours worked, or project milestones achieved. These adaptations maintain the core integrity of the transaction record while tailoring it to the specific nature of the exchange.

Beyond sales and services, this adaptable framework is invaluable for non-commercial contexts too. A donation acknowledgment form, for example, shares many elements with a payment receipt, providing benefactors with official proof of their contributions for tax purposes. Even for internal operations, such as business reimbursements, a standardized expense record ensures employees are properly compensated and company finances are meticulously tracked.

Furthermore, the structure can evolve into a more comprehensive invoice form or a detailed billing statement, especially when integrated into larger accounting systems. Its flexibility underscores its utility as a foundational component for robust business documentation, capable of supporting a wide array of financial interactions from simple cash payments to complex recurring charges.

When is a Receipt Template Most Effective?

The strategic deployment of a dedicated receipt template significantly enhances clarity and efficiency in numerous financial scenarios. Its utility extends beyond mere compliance, proving instrumental in fostering organized financial management and mitigating potential disputes. This form is particularly effective in situations demanding verifiable proof of transaction and meticulous record-keeping.

Here are several examples illustrating when using a well-designed receipt template is most impactful:

- Regular Monthly Rent Payments: Providing tenants with a clear, consistent receipt for their monthly rent instills confidence and creates an indisputable record for both parties.

- Security Deposit Collections: Documenting the exact amount of a security deposit, the date received, and the conditions under which it is held is crucial for compliance and dispute prevention.

- Utility Reimbursements from Tenants: When landlords cover utilities and bill tenants, a specific receipt for these reimbursements ensures transparency and accurate expense tracking.

- One-Time Payments: For late fees, repair costs, or other incidental charges, a dedicated receipt prevents ambiguity and provides a clear record of the payment’s purpose.

- Proof of Payment for Tax Purposes: Both landlords (for income) and tenants (for potential deductions) benefit from having organized receipts to present to tax authorities.

- Dispute Resolution Involving Payment History: In the event of a disagreement over past payments, a comprehensive receipt serves as objective evidence, facilitating a swift and fair resolution.

- Documentation for Internal Accounting and External Audits: Businesses and property management companies rely on consistent receipt generation for accurate internal financial reporting and to successfully navigate external audits.

- Collecting earnest money or application fees: Ensuring all upfront, non-refundable, or refundable fees are clearly documented from the outset.

- Recording partial payments: For agreements that allow installments, a receipt template can clearly show the amount paid and the outstanding balance.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial document, including a payment receipt, hinges significantly on its design, formatting, and overall usability. A well-designed receipt is not only functional but also reflects professionalism and attention to detail. Whether intended for print or digital distribution, adhering to certain best practices can greatly enhance its utility and impact.

Clarity and Readability: The foremost consideration is ensuring the document is easy to read and understand. This involves selecting clean, professional fonts and maintaining an appropriate font size. Ample white space around text blocks and between sections prevents a cluttered appearance, guiding the reader’s eye through the essential information without visual fatigue. Headings and subheadings should clearly delineate different data points.

Essential Fields: Every receipt must capture critical information to serve its purpose effectively. Key fields should include:

- Date of payment and the period covered (e.g., “Rent for January 2024”).

- The exact amount paid, clearly stated in both figures and words to prevent ambiguity.

- Name of the payer (tenant) and payee (landlord/property management).

- Property address or unit number for which the payment is made.

- Method of payment (e.g., cash, check number, bank transfer reference, credit card).

- A brief description of the payment’s purpose (e.g., “Monthly Rent,” “Security Deposit,” “Late Fee”).

- Signature lines for both parties, signifying agreement and receipt of funds.

- Contact information for the payee for any follow-up inquiries.

Branding and Professionalism: Incorporating a company logo, business name, and contact details enhances the document’s professional appearance and reinforces brand identity. This also makes the receipt instantly recognizable and easier to verify. A consistent brand aesthetic across all business documentation builds trust and credibility.

Print vs. Digital Versions: While the core content remains the same, considerations for print and digital versions differ. For print, ensure the layout is clean and that all information fits comfortably on standard paper sizes. For digital distribution, typically as a PDF, prioritize security and accessibility. Digital receipts should be easily downloadable, viewable across various devices, and, where appropriate, allow for digital signatures. Encrypted or password-protected files may be necessary for sensitive information.

Accessibility: Beyond visual clarity, consider accessibility for all users. Using clear language, avoiding jargon, and ensuring the document’s structure is logical helps everyone understand the information presented. The ultimate goal is to create a form that is effortlessly navigable and provides undeniable proof of transaction.

Conclusion

In conclusion, the strategic implementation of a meticulously designed receipt template represents an indispensable asset for effective financial management within the rental sector and beyond. It serves as far more than a simple acknowledgment of funds exchanged; it is a foundational component of reliable business documentation, ensuring accuracy, transparency, and consistency in every transaction. The benefits extend from streamlined record-keeping and enhanced compliance to fostering stronger, trust-based relationships between landlords and tenants.

By providing a standardized framework for capturing essential information, this template minimizes errors, resolves potential disputes swiftly, and provides invaluable proof of transaction for all parties involved. Its adaptability across various financial interactions—from rent payments to service receipts and donation acknowledgments—underscores its versatility and profound utility. Investing in a robust, user-friendly template is an investment in professional integrity and operational efficiency.

Ultimately, a well-executed receipt, whether in print or digital format, stands as an authoritative financial template. It is a testament to an organization’s commitment to accountability and clarity. For anyone managing property or processing payments, leveraging such a tool is not merely advantageous; it is an essential practice that underpins sound financial health and promotes peace of mind for everyone involved.