In the intricate landscape of financial management and tax compliance, the ability to meticulously document every relevant transaction is not merely a best practice; it is a fundamental requirement. For businesses, individuals, and non-profit organizations alike, proving the legitimacy of expenses or contributions directly impacts tax obligations and financial transparency. This is precisely where a robust tax deductible receipt template serves as an indispensable tool, streamlining the often-complex process of record-keeping. It transforms what could be a chaotic collection of notes and ad-hoc papers into an organized, verifiable ledger.

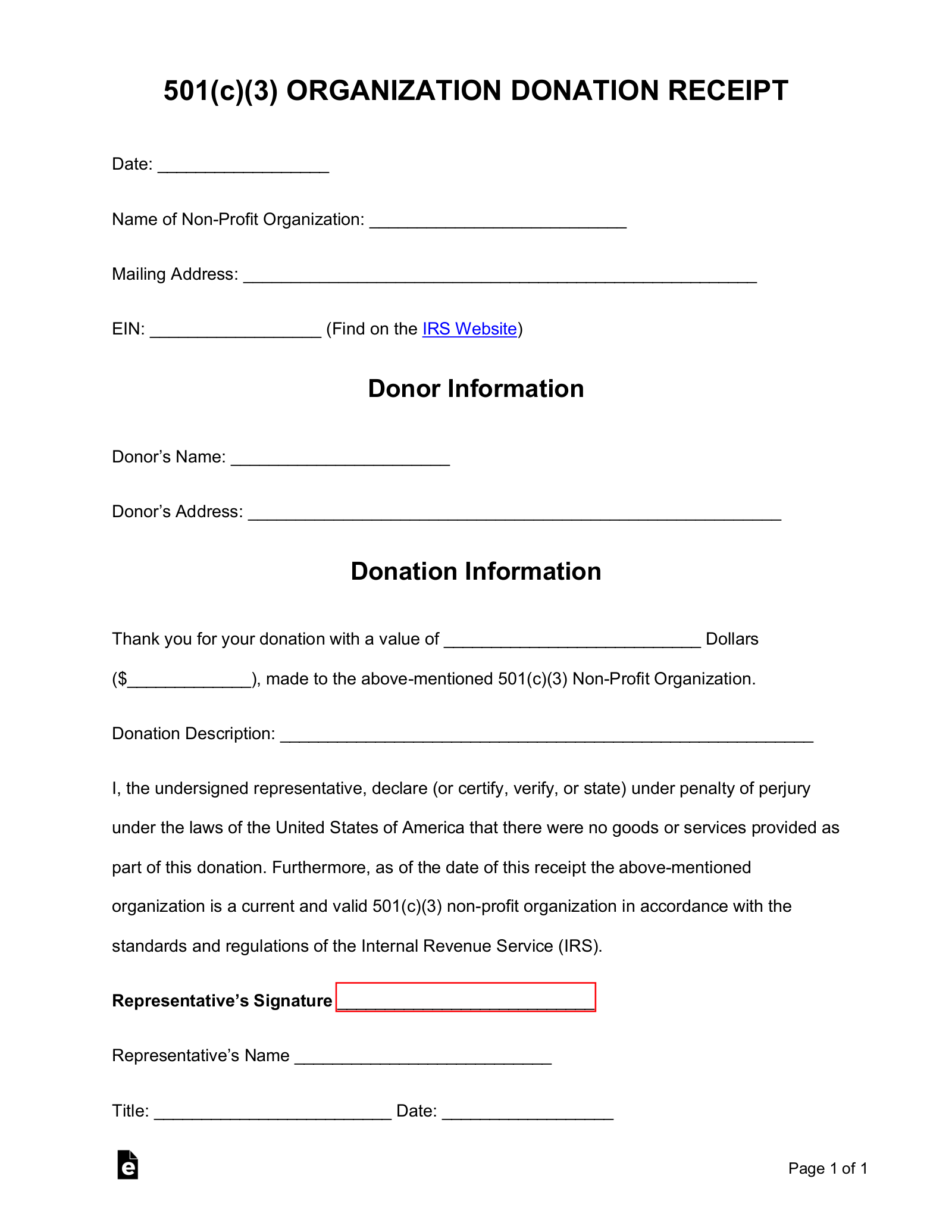

The primary purpose of such a standardized document is to provide undeniable proof of payment or donation, qualifying it for potential tax deductions as per Internal Revenue Service (IRS) guidelines. Both the issuing party and the recipient benefit immensely from its structured approach. For the issuer, it solidifies their professional standing and internal accounting. For the recipient, it offers a clear, acceptable record to present during tax preparation or in the event of an audit, thereby minimizing stress and potential discrepancies. Its adoption reflects a commitment to precision and regulatory adherence in financial operations.

The Indispensable Role of Clear Financial Documentation

Professional documentation is the bedrock of sound financial management in any enterprise, regardless of its size or sector. It establishes a verifiable paper trail for all monetary exchanges, critical for internal accounting, external audits, and regulatory compliance. Without clear and consistent records, businesses risk encountering significant challenges, including mismanaged finances, disputes with clients or vendors, and potential legal or tax penalties. A properly issued payment receipt or invoice form ensures that every transaction is accounted for, providing an undeniable proof of transaction.

Beyond mere compliance, high-quality documentation fosters trust and transparency with stakeholders, including customers, suppliers, investors, and regulatory bodies. It demonstrates an organization’s commitment to ethical practices and operational integrity. Standardized business documentation facilitates smoother financial reconciliation, accurate forecasting, and informed decision-making. In essence, robust record-keeping is not just about meeting obligations; it is about building a stable, credible, and efficient financial infrastructure.

Strategic Benefits of a Structured Tax Deductible Receipt Template

Implementing a standardized tax deductible receipt template significantly enhances the efficiency and accuracy of financial record-keeping, yielding a multitude of strategic benefits. Foremost among these is the assurance of consistency. Every transaction is documented with the same critical details, presented in a uniform format, which drastically reduces errors and omissions that often plague manual or ad-hoc systems. This consistency is vital for maintaining a clear and comprehensive expense record or donation acknowledgment.

Moreover, utilizing a structured template boosts transparency for all parties involved. Recipients receive a professional, easily understandable record that clearly outlines the nature of the transaction, the amount, and the date, alongside any other pertinent information for their tax filings. For the issuing entity, this organized approach simplifies internal auditing processes, allowing for quick retrieval of specific records when needed. It effectively streamlines year-end accounting procedures, reducing the time and resources typically expended on data compilation and verification, ensuring that all financial templates are adhered to.

Customization for Diverse Transaction Types

The inherent flexibility of a well-designed receipt template allows it to be extensively customized to suit a myriad of transaction types, ensuring its applicability across different financial scenarios. Whether it’s for a retail sale, a professional service, a rent payment, a charitable donation, or an employee reimbursement, the core structure remains adaptable. This versatility is crucial for maintaining a single, coherent system for all outgoing and incoming funds that might be tax-relevant.

For sales records, the document can be tailored to include product descriptions, quantities, unit prices, and sales tax details. Service receipts might focus on hours billed, service descriptions, and specific project codes. When used as a donation acknowledgment, the layout must clearly state the non-profit’s information, the donor’s details, the date of contribution, and the donation amount, explicitly mentioning whether goods or services were provided in exchange. For rent payments or business reimbursements, the form can accommodate tenant names, property addresses, specific expense categories, and approval signatures, making it a powerful financial template for various uses. The ability to modify fields, add logos, and adjust branding elements ensures that this form remains professional and relevant across all its applications.

Optimal Scenarios for Utilizing a Tax Deductible Receipt Template

The effective use of a standardized receipt is paramount in various situations where financial clarity and tax compliance are critical. Adopting such a form prevents ambiguities and reinforces the legitimacy of transactions for both the payer and the payee.

Examples of when using this form is most effective include:

- Charitable Contributions: When individuals or organizations donate money, goods, or services to qualified non-profit entities. A clear donation acknowledgment is crucial for the donor to claim deductions and for the charity to maintain accurate records.

- Business Expenses: For entrepreneurs and businesses, documenting operational costs like office supplies, travel, meals, and professional development is vital. An organized expense record supports deductions and facilitates internal financial review.

- Professional Services Rendered: When independent contractors, freelancers, or service providers issue bills for their work (e.g., consulting, legal, design services). A detailed service receipt acts as proof of payment for the client and income record for the provider.

- Property-Related Payments: For landlords collecting rent or tenants paying for specific property-related services. A clear payment receipt can document monthly rent, security deposits, or maintenance fees, which can be relevant for tax purposes.

- Medical Expenses: In cases where individuals pay for medical services, prescriptions, or equipment that may be eligible for tax deductions. This documentation serves as a critical proof of transaction.

- Educational Expenses: For payments related to qualified tuition, fees, or course materials, especially for higher education, where certain credits or deductions might apply.

- Purchases of Business Assets: When a business acquires assets that can be depreciated or expensed. A detailed sales record or billing statement ensures proper asset tracking and depreciation calculations.

- Employee Reimbursements: When employees incur out-of-pocket expenses on behalf of the company. A formal reimbursement record provides necessary documentation for both the employee and the employer for tax reporting and expense reconciliation.

Design, Formatting, and Usability Best Practices

The efficacy of any financial document, including a payment receipt or expense record, hinges significantly on its design, formatting, and overall usability. A well-structured layout ensures that critical information is easily identifiable, reducing the time spent on data entry and review. For both print and digital versions, clarity and professionalism should be paramount.

For Design and Formatting:

- Clean Layout: Utilize clear headings, adequate white space, and logical grouping of information. Avoid clutter to enhance readability.

- Essential Fields: Include mandatory fields such as issuer’s name/logo, recipient’s name, unique receipt number, date of transaction, detailed description of goods/services, total amount paid, method of payment, and any applicable tax identification numbers (e.g., EIN for charities).

- Branding Consistency: Incorporate company logos, fonts, and color schemes to maintain a consistent brand image and professional appearance.

- Legible Fonts: Choose professional, easy-to-read fonts in an appropriate size (e.g., 10-12pt for body text).

- Clear Denominations: Ensure currency symbols and decimal places are consistently applied for all monetary values.

- Disclaimer/Notes Section: Include a dedicated area for any necessary disclaimers, special instructions, or notes regarding the tax deductibility status of the transaction. For donations, this might include IRS-required language.

For Usability (Print and Digital):

- Digital Accessibility: Ensure the digital file is accessible across various devices and operating systems. PDF is often preferred for its universal compatibility and preservation of formatting.

- Fillable Fields: For digital templates, integrate fillable fields that allow for easy data entry, reducing manual errors and improving efficiency.

- Print-Friendly: Design should be optimized for printing, ensuring no data is cut off and that the document looks professional when physical copies are required.

- Searchability: If stored digitally, use a naming convention that allows for easy searching and retrieval (e.g.,

YYYYMMDD_RecipientName_ReceiptNumber). - Language Clarity: Use unambiguous language, especially when describing goods or services, to avoid misinterpretations.

- Automated Calculations: For complex forms, consider incorporating basic automated calculations (e.g., totals, tax) in digital versions to minimize human error.

By adhering to these best practices, the payment receipt or billing statement becomes not just a record but an effective communication tool, enhancing both operational efficiency and stakeholder confidence.

The implementation of a robust, well-designed financial template, such as the described form, fundamentally strengthens an organization’s financial backbone. It serves as an authoritative proof of transaction, indispensable for both internal accounting rigor and external compliance requirements. By standardizing the documentation process, businesses and individuals alike can approach tax season with greater confidence, knowing that their records are complete, accurate, and readily verifiable.

Ultimately, this document transcends its basic function as a mere record of payment. It embodies a commitment to transparency, precision, and operational excellence, acting as a pivotal component in effective financial governance. Investing in such a reliable and efficient financial template is not just about fulfilling an obligation; it is about fortifying financial integrity and fostering trust in every transaction.