In the intricate landscape of modern business, meticulous financial documentation stands as a cornerstone of integrity, transparency, and operational efficiency. For limited companies, every transaction, whether revenue-generating or an expenditure, requires clear, auditable proof. This is precisely where a well-structured limited company receipt template becomes an indispensable asset, providing a standardized mechanism for acknowledging payments received.

This comprehensive guide delves into the essential elements, profound benefits, and practical applications of such a template. It is designed for US business owners, finance professionals, and administrative staff who seek to enhance their record-keeping practices, ensuring compliance and fostering trust with clients and stakeholders alike through effective business communication.

The Importance of Clear and Professional Documentation

The act of issuing a receipt might seem a simple administrative task, but its implications for a limited company are far-reaching. Professional financial documentation serves multiple critical functions, extending beyond mere proof of payment. It establishes an unequivocal record of a transaction, vital for both parties involved.

From a legal standpoint, accurate receipts provide undeniable evidence in the event of disputes or audits. They substantiate income and expenses, which is crucial for tax compliance and minimizing liabilities with tax authorities like the IRS. Without clear, consistent documentation, a company risks discrepancies that can lead to significant financial penalties or legal challenges.

Operationally, well-maintained records facilitate streamlined accounting processes, making financial reconciliation simpler and more efficient. They contribute to a company’s overall professional image, demonstrating an organized and trustworthy approach to business dealings. This level of clarity fosters confidence among customers, suppliers, and investors, underscoring a commitment to best practices.

Key Benefits of Structured Templates for Limited Company Receipt Template

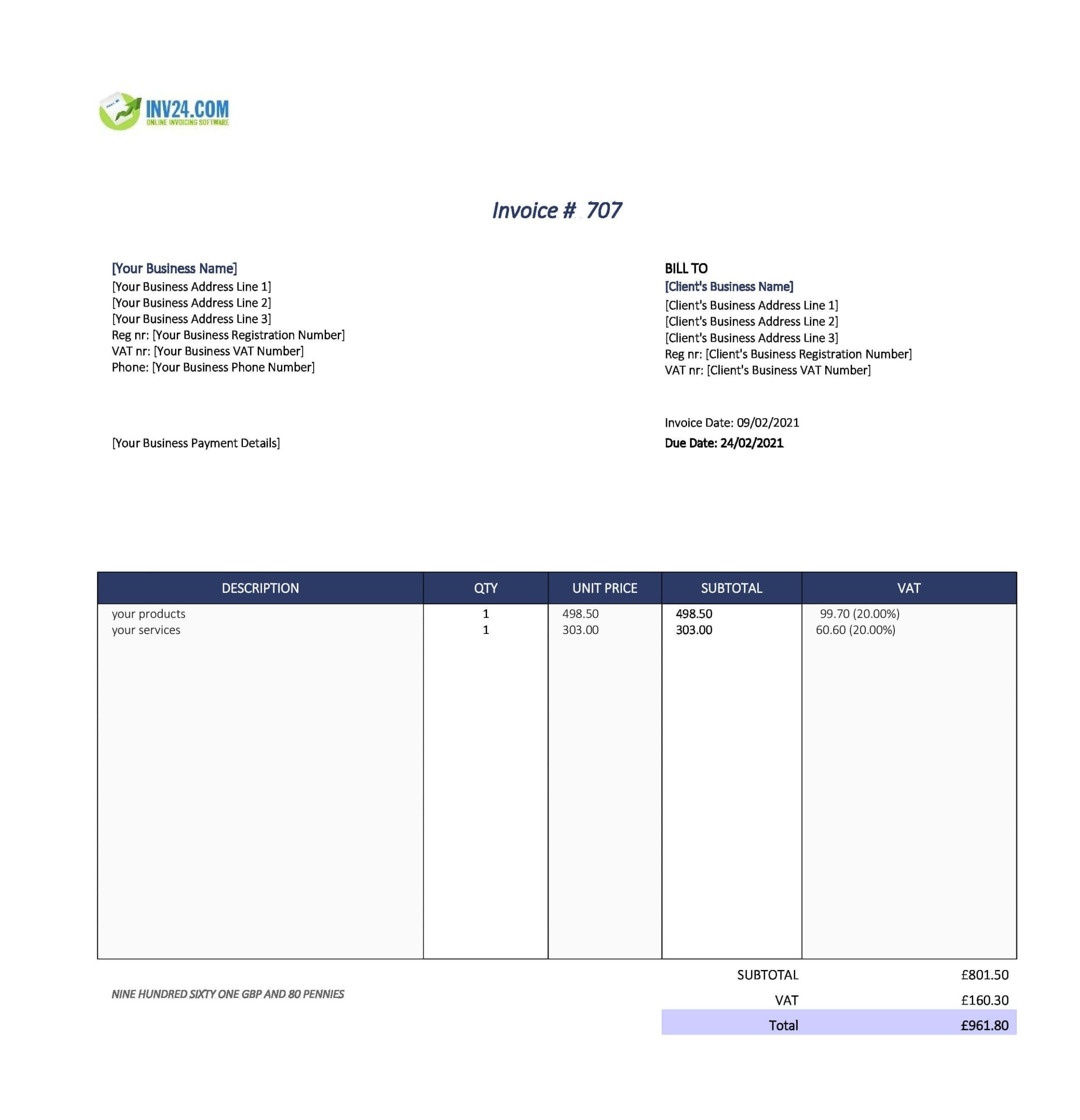

Adopting a standardized approach to issuing receipts through a structured template offers a multitude of advantages over ad-hoc methods. A well-designed limited company receipt template inherently promotes accuracy, transparency, and consistency in financial record-keeping, which are paramount for any successful enterprise.

Firstly, such a template significantly enhances accuracy by providing predefined fields for all necessary information. This minimizes errors that can arise from manual data entry or oversight, ensuring that details like payment amounts, dates, and service descriptions are correctly captured every time. This precision is invaluable for financial reporting and auditing.

Secondly, the use of a unified layout fosters transparency. All relevant parties can easily understand the nature of the transaction, the services rendered, or the products purchased, along with the payment details. This clarity reduces misunderstandings and provides a verifiable proof of transaction, beneficial for both the payer and the recipient.

Finally, consistency is a major benefit derived from employing a template. Every receipt issued will adhere to the same format, include the same core information, and often bear the company’s branding elements. This uniformity not only reinforces professional image but also simplifies data aggregation and analysis for internal financial management. Standardized billing statements make it easier to track income streams and reconcile accounts, bolstering overall financial health.

Customizing the Template for Diverse Transactions

The true power of a comprehensive receipt template lies in its adaptability to various business contexts and payment types. While the core structure remains consistent, a well-designed limited company receipt template can be easily customized to serve different purposes, ensuring that each payment acknowledgment accurately reflects the specific nature of the transaction. This flexibility is key to its utility across a limited company’s diverse operations.

For sales of goods, the template can include fields for itemized lists, product codes, quantities, and unit prices, leading to a detailed sales record. When acknowledging payments for services, it can focus on service descriptions, hourly rates, and project milestones, functioning as a thorough service receipt. For rent payments, specific property details, rental periods, and security deposit information can be incorporated, creating a clear record for landlords and tenants.

Donation acknowledgments, crucial for non-profit arms or charitable contributions received by a limited company, can be tailored to meet IRS requirements for tax-deductible contributions, specifying the non-cash value of goods or services. Business reimbursements, another common use case, would feature sections for expense categories, employee details, and supporting documentation references. The ability to modify headings, add specific notes, and adjust field labels ensures that the document remains relevant and effective for every scenario, acting as a versatile financial template for all incoming funds.

Examples of When Using a Limited Company Receipt Template Is Most Effective

Implementing a standardized receipt template streamlines operations and strengthens financial controls across numerous business scenarios. Its utility is particularly pronounced in situations requiring clear proof of payment and detailed transaction records.

- Retail Sales and E-commerce Transactions: For every product sold, whether in a physical store or online, providing a detailed payment receipt is essential for customer satisfaction, returns processing, and inventory management. This type of template ensures consistency across all sales records.

- Service-Based Businesses: Consultants, contractors, and agencies frequently receive payments for services rendered. A robust service receipt clearly outlines the services provided, hours worked, and associated costs, preventing disputes and aiding project accounting.

- Rental Income Collection: Landlords operating as limited companies benefit immensely from issuing receipts for rent payments. This provides tenants with proof of payment and creates an undeniable expense record for the company’s financial books.

- Donation Acknowledgments: For limited companies involved in charitable activities or receiving philanthropic contributions, a formalized donation acknowledgment ensures compliance with tax regulations and acknowledges donor generosity effectively.

- Subscription or Membership Fees: Businesses that rely on recurring revenue, such as software-as-a-service (SaaS) providers or gyms, use these templates to confirm receipt of monthly or annual fees, providing subscribers with a consistent record.

- Business-to-Business (B2B) Payments: When one limited company pays another for goods or services, a detailed receipt is crucial for both parties’ accounts payable and accounts receivable departments, facilitating easy reconciliation and acting as a primary business documentation tool.

- Reimbursement of Employee Expenses: While often handled internally, issuing a formal receipt to an employee confirming their reimbursement can be good practice, especially for significant sums, ensuring transparency in expense records.

Tips for Design, Formatting, and Usability

The effectiveness of any financial document, including a payment receipt, is heavily influenced by its design, formatting, and overall usability. A well-designed receipt template should be clear, professional, and easy to understand for all parties, whether in print or digital format.

Design Elements:

- Company Branding: Always include your limited company’s logo, name, address, and contact information prominently at the top. This reinforces professional identity and makes the receipt easily identifiable.

- Clear Headings: Use bold, legible headings for sections like "Payment Details," "Customer Information," and "Items/Services." This guides the eye and organizes information effectively within the file.

- Sequential Numbering: Implement a unique, sequential receipt number for every transaction. This is critical for auditing, tracking, and preventing duplicates, significantly simplifying your expense record management.

- Date and Time: Clearly state the date and, if relevant, the time of the transaction. This is a fundamental piece of information for any proof of transaction.

- Payer and Payee Information: Include the full legal name and address of both the limited company (payee) and the customer or client (payer).

- Detailed Description of Goods/Services: Provide a concise yet thorough description of what was purchased or for what services the payment was received. For itemized lists, include quantity, unit price, and total.

- Payment Details: Specify the payment method (e.g., credit card, cash, check, bank transfer), the amount received, and any applicable taxes or discounts. The total amount paid should be clearly visible.

- Authorized Signature (Optional): For certain transactions, a space for an authorized signature can add a layer of authenticity, though often not necessary for automated digital receipts.

Formatting and Usability:

- Legible Fonts: Choose clear, professional fonts that are easy to read in both print and digital versions. Avoid overly decorative or small fonts.

- Consistent Layout: Maintain a consistent layout and spacing to enhance readability and professionalism.

- White Space: Utilize adequate white space around text and sections to prevent the document from appearing cluttered.

- Digital Friendliness: Ensure the layout is suitable for digital distribution. PDFs are ideal for digital receipts as they maintain formatting across different devices and are easily archivable. Consider fillable fields for internal use or specific data entry processes.

- Print Friendliness: Design the form to be printable without excessive ink usage or requiring special paper sizes. Ensure margins are sufficient to avoid cutting off information.

- Accessibility: Consider accessibility for visually impaired users in digital versions, for example, by ensuring proper tagging in PDF files.

The Enduring Value of a Robust Receipt Template

In conclusion, for any limited company operating in today’s dynamic economic environment, a well-implemented and consistently utilized receipt template is far more than a mere administrative convenience. It is a foundational tool that underpins sound financial management, ensures legal and tax compliance, and significantly enhances a company’s professional credibility. The adoption of a structured template for acknowledging payments elevates transactional clarity from an optional extra to an operational imperative.

Such a financial template serves as an indisputable proof of transaction, protecting both the limited company and its clients, customers, or donors. It provides the structured data necessary for accurate accounting, streamlined auditing processes, and informed financial decision-making. By embracing a systematic approach to payment receipts, limited companies can solidify their operational efficiency, minimize financial risks, and foster a culture of transparency that resonates with all stakeholders. Ultimately, a robust receipt template is an investment in reliability, accuracy, and efficient financial record-keeping, crucial for sustained business success.