Effective financial record-keeping is a cornerstone of sound business practice and personal fiscal management. In an environment where transparency and accountability are paramount, the accurate documentation of every monetary exchange becomes indispensable. A cash transaction receipt template serves as a standardized, professional tool designed to meticulously record the details of funds received or disbursed in cash, providing an undeniable record for both parties involved. This foundational document ensures clarity, mitigates disputes, and facilitates streamlined accounting processes for individuals, small businesses, non-profit organizations, and large corporations alike.

The primary purpose of such a template extends beyond mere acknowledgment of payment; it functions as a crucial piece of financial evidence. By providing a clear, structured format for essential transaction information, it empowers users to maintain precise records, adhere to regulatory compliance, and build trust with clients and stakeholders. Whether for simple retail sales, complex service agreements, or internal business reimbursements, the consistent application of a well-designed cash transaction receipt template is an act of due diligence that benefits all parties by establishing a robust audit trail and fostering an environment of financial integrity.

The Importance of Clear and Professional Documentation in Financial and Business Transactions

In the dynamic world of finance and commerce, the integrity of a transaction often hinges on the quality of its accompanying documentation. Professional and unambiguous records are not just a best practice; they are a fundamental requirement for legal, accounting, and operational continuity. Comprehensive business documentation acts as a verifiable narrative, detailing every exchange and ensuring that financial activities are transparent and defensible. This level of clarity is vital for internal management, external audits, and potential legal proceedings, offering an irrefutable proof of transaction.

Without standardized documentation, businesses risk inconsistencies in their financial statements, which can lead to significant discrepancies during reconciliation or audit. Ambiguous records can result in miscommunication, potential fraud, and a general erosion of trust among customers, suppliers, and employees. Clear and professional documentation, such as a meticulously completed payment receipt, provides an accurate expense record for tax purposes and a reliable reference for future business decisions. It solidifies the understanding between parties and serves as a formal acknowledgment of obligations met, reducing the likelihood of disputes and enhancing overall business efficiency.

Key Benefits of Using Structured Templates for Cash Transactions

The strategic adoption of structured templates for recording cash transactions offers a multitude of benefits, primarily centered on accuracy, transparency, and consistency in record-keeping. A well-designed template provides a standardized framework, compelling users to capture all necessary details for each transaction, thereby minimizing oversight and data entry errors. This systematic approach ensures that every payment receipt contains uniform information, regardless of who processes it, greatly enhancing the reliability of financial data.

Accuracy is paramount in financial management, and a robust financial template helps achieve this by guiding the user through essential data fields, such as transaction date, amount, purpose, and parties involved. This reduces the subjective interpretation of what information to record and ensures completeness. Furthermore, the inherent structure of the template fosters transparency by clearly delineating the terms and specifics of the exchange, making the record easily understandable and auditable. Consistency, another critical advantage, is maintained across all cash transactions, simplifying reconciliation processes and providing a cohesive sales record or service receipt database that is easy to navigate and analyze. By integrating such a formal structure, businesses can proactively manage their financial health, streamline operational workflows, and significantly reduce administrative burdens. The consistent use of the template also creates a predictable audit trail, which is invaluable for internal controls and external regulatory compliance.

How This Template Can Be Customized for Different Purposes

The inherent flexibility of a well-designed financial template allows for extensive customization, making it suitable for a diverse range of transactional contexts beyond basic sales. Its core structure can be adapted to meet specific industry requirements or unique organizational needs, transforming it into a versatile business documentation tool. Whether a business specializes in products, services, or manages various financial flows, the underlying layout can be modified to capture relevant details for each scenario.

For example, when used as an invoice form for sales, the receipt can include fields for product codes, quantities, unit prices, and total amounts, along with sales tax details. In a service-oriented business, the template might feature sections for hours worked, service descriptions, and any associated labor rates, functioning as a detailed service receipt. Non-profit organizations often require specific fields for donor information and donation types, effectively transforming the document into a donation acknowledgment form that meets tax exemption requirements. Similarly, for rent payments, specific fields for property address, rental period, and tenant names can be incorporated. For business reimbursements, the form can be tailored to include expense categories, employee details, and approval signatures, ensuring accountability and compliance with company policies. This adaptability ensures that the document remains relevant and effective across various financial activities, making it an indispensable asset for comprehensive record-keeping.

Examples of When Using a Cash Transaction Receipt Template is Most Effective

Utilizing a cash transaction receipt template proves most effective in numerous scenarios where tangible proof of transaction is essential for accountability, legal compliance, or accurate financial reconciliation. These instances often involve direct cash exchanges where other forms of electronic tracking might be absent.

- Retail Sales: For small retail businesses, kiosks, or street vendors handling cash payments directly, the template provides an immediate, verifiable record for both the seller and the customer. It documents the purchase, aiding in inventory management and sales tracking.

- Service Provision: When individual contractors, freelancers, or service providers receive cash for their work (e.g., plumbing, tutoring, landscaping), this

receiptoffers concrete evidence of payment received, outlining the services rendered and the amount exchanged. This functions as a clearservice receipt. - Rent Payments: Landlords and property managers can issue this

formto tenants making rent payments in cash, ensuring a formal record of payment, date, and period covered, which is critical for lease agreements and financial tracking. - Donations to Non-Profits: Non-profit organizations often accept cash donations. A specialized

donation acknowledgmentgenerated from the template provides donors with a record for tax purposes and helps the organization accurately track contributions. - Employee Reimbursements: Businesses reimbursing employees for out-of-pocket cash expenses, such as travel meals or minor supplies, can use the

templateto document the reimbursement, categorizing theexpense recordand ensuring proper accounting. - Garage Sales or Private Sales: Individuals selling items in a private capacity, like vehicles or furniture, can use the

documentto formalize the cash transaction, protecting both buyer and seller from future disputes by detailing the item, price, and date of sale. - Small Business Purchases from Suppliers: When a small business makes a cash purchase from a supplier who does not provide a formal

invoice form, creating its ownpayment receiptusing the template ensures an accurateexpense recordfor tax and accounting purposes. - Petty Cash Disbursements: Managing a petty cash fund requires diligent tracking. The

templatecan be used to record every cash withdrawal and its purpose, maintaining a transparentfinancial templatefor internal audits.

In each of these situations, the document serves as a reliable, tangible record, reinforcing transparency and accountability in cash-based financial interactions.

Tips for Design, Formatting, and Usability

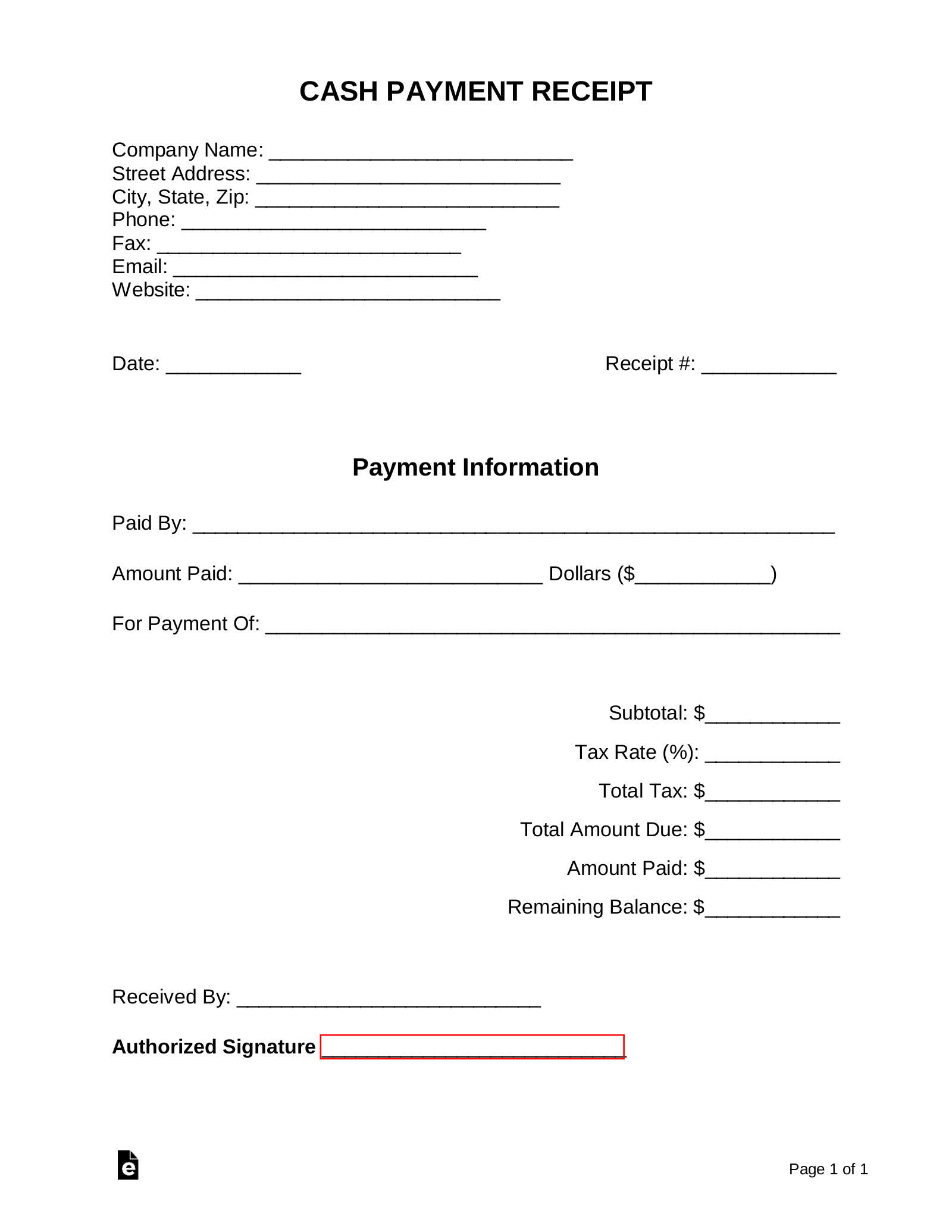

The effectiveness of a cash transaction receipt template is significantly enhanced by thoughtful design, clear formatting, and intuitive usability, catering to both print and digital applications. A well-structured layout not only looks professional but also facilitates quick and accurate data entry and retrieval. Consistency in design across all receipts reinforces brand identity and simplifies record management.

For design, prioritize simplicity and clarity. Essential fields should be prominently displayed, typically including:

- Company Logo and Contact Information: For professional branding and easy identification.

- Receipt Number: Unique identifier for tracking and reference.

- Date and Time of Transaction: Crucial for chronological record-keeping.

- Payer Information: Name, address, or contact details of the person or entity making the payment.

- Recipient Information: Name, address, or contact details of the person or entity receiving the payment.

- Itemized List of Goods/Services: Description, quantity, unit price, and total for each item.

- Subtotal, Tax, Discounts, and Grand Total: Clear breakdown of costs.

- Payment Method: Specifically "Cash" for this

template. - Purpose of Transaction: A brief description for clarity.

- Authorized Signature Line: For the recipient, confirming the transaction.

- Optional Fields: Such as customer ID, project code, or specific notes.

Formatting should emphasize readability. Use clear, legible fonts and adequate spacing between fields. Bold headings and clear labels help users quickly identify where to input or find information. Consider using distinct sections for different categories of information, such as payer details, transaction items, and summary totals. For digital versions, ensure fields are interactive and allow for auto-population where possible, reducing manual entry. Using a grid-based layout can help align elements and maintain a clean appearance.

Regarding usability, the template should be straightforward to complete and understand for anyone, regardless of their financial expertise. For print versions, ensure there is sufficient space for handwritten entries and signatures. The file should be easily printable on standard paper sizes. For digital versions, ensure compatibility with common software (e.g., Microsoft Word, Google Docs, PDF editors) and mobile devices. Implement features like dropdown menus for common items or pre-calculated fields to minimize errors and speed up the process. Providing clear instructions or tooltip hints for complex fields can further improve user experience. A user-friendly document encourages consistent adoption and minimizes errors, ensuring the receipt serves its intended purpose effectively as a reliable financial template.

The Value of a Reliable Financial Record Tool

In conclusion, the strategic implementation of a high-quality cash transaction receipt template transcends the simple act of acknowledging a payment; it embodies a commitment to financial integrity and operational excellence. This foundational document provides an unparalleled level of transparency and accountability, serving as an indispensable proof of transaction for both the payer and the recipient. By standardizing the recording process, it mitigates potential disputes, simplifies audits, and strengthens the overall financial health of any organization or individual.

The enduring value of such a robust financial template lies in its capacity to foster accuracy and consistency in record-keeping, transforming sporadic cash movements into a structured, auditable trail. Whether customized as an invoice form for sales, a donation acknowledgment, or an expense record for reimbursements, this layout is a cornerstone of effective financial management. Embracing this reliable tool ensures that every cash transaction is not just completed, but meticulously documented, contributing significantly to clarity, compliance, and confidence in all financial dealings.