In the demanding sphere of roadside assistance and vehicle recovery, the integrity of financial transactions is paramount. A meticulously designed towing company receipt template serves as the cornerstone for ensuring transparent and legally compliant operations, offering a standardized approach to documenting every service performed. This crucial business document transcends mere financial record-keeping; it embodies a commitment to professionalism, clarity, and accountability in an industry that often operates under challenging and time-sensitive circumstances.

The primary purpose of such a template is to provide a clear, indisputable record of services rendered and payments received. It benefits not only the towing company by streamlining administrative tasks and providing vital data for accounting and tax purposes but also the customer, who receives a tangible proof of transaction for their records, insurance claims, or potential disputes. By offering a consistent format for every service interaction, this template significantly enhances operational efficiency and strengthens client trust, laying the groundwork for effective business communication.

The Indispensable Role of Clear and Professional Documentation

In any business environment, particularly those involving direct services and financial exchanges, clear and professional documentation is not merely a best practice; it is a fundamental necessity. For towing companies, which often deal with urgent situations, emotional customers, and complex legal parameters concerning vehicle recovery and storage, robust documentation can mitigate misunderstandings, prevent disputes, and ensure compliance with various state and local regulations. A well-executed payment receipt acts as a formal record, validating the exchange of services for compensation.

Such documentation forms the backbone of financial auditing, tax preparation, and internal record-keeping. It provides an incontrovertible audit trail for every transaction, detailing the services provided, the costs incurred, and the method of payment. Without this clarity, businesses expose themselves to significant operational risks, including difficulties in tracking revenue, resolving customer complaints, and demonstrating due diligence to regulatory bodies. Professional business documentation elevates a company’s standing, projecting an image of reliability and trustworthiness to both clients and partners.

Key Benefits of Structured Templates for Towing Companies

The adoption of a structured towing company receipt template offers profound operational and financial advantages. This type of standardized document ensures accuracy, transparency, and consistency in record-keeping, which are critical elements for sustainable business growth and legal compliance within the towing industry.

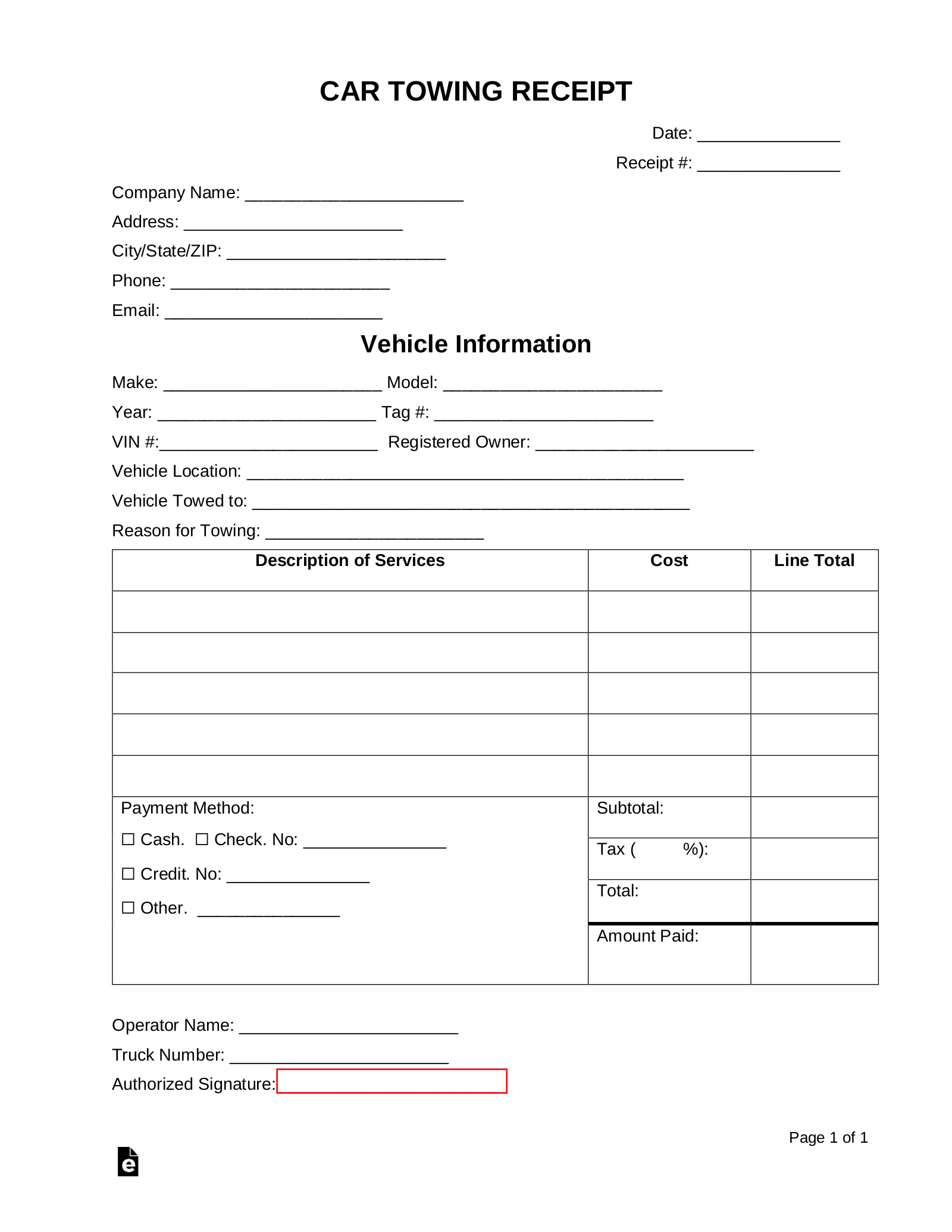

Firstly, a predefined layout significantly enhances accuracy. By mandating specific fields for essential information—such as the date and time of service, location of the incident, type of vehicle, license plate number, services rendered (e.g., standard tow, winching, lockout assistance), itemized costs, and payment details—the template minimizes the risk of human error or omissions. This ensures that all critical data points are captured consistently, providing a complete and precise record of each transaction.

Secondly, these structured forms foster unparalleled transparency. Customers receive a clear, itemized breakdown of charges, eliminating ambiguity and fostering trust. This openness is particularly vital in situations where individuals might be under stress or unfamiliar with towing procedures. For the business, transparent records support ethical billing practices and can serve as crucial evidence in resolving any billing discrepancies or customer disputes, reinforcing the company’s commitment to fair operations.

Finally, the use of a unified layout promotes remarkable consistency. Every employee uses the same format, ensuring uniformity across all transactions regardless of who processes the payment. This consistency simplifies data entry, streamlines internal processes like invoicing and accounting, and provides a standardized repository of information for analytical purposes. Over time, this consistent data collection can yield valuable insights into service patterns, pricing effectiveness, and operational bottlenecks, contributing to more informed business decisions. A dedicated service receipt template, therefore, is not just a formality but a strategic tool for operational excellence.

Customization for Diverse Business Applications

While the core principles of a receipt remain universal, the inherent flexibility of a well-designed financial template allows for extensive customization to suit various business applications beyond the towing industry. The fundamental structure—detailing parties involved, services or goods exchanged, costs, and payment confirmation—can be adapted for numerous transactional contexts. This adaptability makes the underlying layout a powerful tool for diverse financial record-keeping needs.

For instance, the same structural logic that informs a towing receipt can be repurposed to create a comprehensive sales record for a retail establishment, detailing products purchased, quantities, unit prices, and total amounts. Similarly, a service receipt for a mechanics shop or a consultancy firm would detail hours worked, specific tasks completed, and applicable rates. Even in non-commercial contexts, the file can be transformed into a donation acknowledgment, clearly stating the amount received, the date, and the recipient organization, which is crucial for tax-deductible contributions.

Furthermore, this adaptable document can function as a simplified billing statement or an invoice form for ongoing services, allowing for recurring charges to be clearly itemized and presented. Businesses can also utilize modified versions as an expense record for internal reimbursements, ensuring that all employee-incurred costs are properly documented and approved. The capacity to tailor the fields, branding elements, and specific disclaimers within the template means that its utility extends broadly across any scenario requiring robust and verifiable proof of transaction, making it a truly versatile financial template for modern business documentation.

When Using This Template Is Most Effective

The utility of a well-crafted towing company receipt template extends across a multitude of operational scenarios within the towing industry. Its structured format ensures that vital information is consistently captured, providing clear documentation for both the service provider and the customer. This consistency is particularly critical in situations where quick decisions and accurate record-keeping are paramount.

The template proves most effective in the following instances:

- Emergency Roadside Assistance: When a vehicle breaks down and requires immediate towing to a repair shop, the receipt clearly documents the call-out time, pick-up and drop-off locations, services rendered (e.g., jump-start followed by a tow), and the total cost, crucial for insurance claims or personal expense tracking.

- Accident Recovery: Following a collision, the complex nature of vehicle recovery necessitates detailed documentation. This form can itemize winching services, debris cleanup, and transport to an impound or body shop, serving as a critical piece of evidence for accident reports and insurance processing.

- Private Property Impounds: For vehicles legally towed from private property due to parking violations, the document provides the owner with an undeniable record of the impound date, time, location, reasons for the tow, and all associated fees (towing, storage, administrative), ensuring transparency in compliance with local ordinances.

- Law Enforcement Tows: When vehicles are towed at the request of police for infractions or investigations, the receipt serves as an official record of the interaction, detailing the authority’s request, destination, and any specific handling instructions, vital for chain of custody and legal proceedings.

- Vehicle Repossessions: In the sensitive context of vehicle repossessions, the template provides a formal accounting of the recovery operation, including the date, time, location of repossession, vehicle details, and confirmation of who authorized the action, which is essential for legal and financial accountability.

- Long-Distance Transport: For planned vehicle transport over significant distances, the template can be customized to include mileage, fuel surcharges, and estimated delivery times, functioning as a comprehensive billing statement for a pre-arranged service.

- Storage Fee Collections: When vehicles remain in a company’s lot for an extended period, accruing daily storage fees, the receipt can itemize these charges, along with any initial tow fees, providing a clear breakdown upon vehicle release.

In each of these scenarios, the receipt provides a tangible proof of transaction, fostering trust and clarity while protecting both the business and its clients.

Design, Formatting, and Usability Tips

An effective financial template is not only about the information it contains but also how that information is presented. Thoughtful design, formatting, and usability considerations are paramount for ensuring that the document is easy to complete, read, and understand for both the issuer and the recipient, whether in print or digital format.

For design, prioritize clarity and professionalism. The layout should incorporate the company’s branding, including its logo, contact information, and any necessary licensing numbers, ensuring instant recognition and credibility. Use clean, legible fonts and a well-organized structure with clear headings and ample white space to prevent visual clutter. Essential fields should be prominently displayed, perhaps using bold text or distinct sections. Consider including a dedicated section for "Notes" or "Special Instructions" to accommodate unique service details.

Formatting plays a crucial role in readability. Employ consistent spacing, alignment, and sizing throughout the document. Utilize tables or distinct boxes for itemized charges, ensuring that quantities, descriptions, unit prices, and totals are easily discernible. A clear breakdown of subtotal, taxes, and grand total is essential for transparency. For digital versions, ensure the form is optimized for various screen sizes and operating systems, providing a seamless user experience across devices.

Usability encompasses how easily the template can be utilized and understood. For printed versions, ensure there is sufficient space for handwritten details and signatures, and that carbon copy paper (if used) produces legible duplicates. For digital files, aim for fillable PDF forms or web-based applications that allow for easy data entry, dropdown menus for common services, and automated calculations to minimize errors. Incorporate features like digital signature capabilities and the option to email the receipt directly to the customer. Ensure the language used is straightforward and unambiguous, avoiding jargon where possible. Finally, consider accessibility for all users, making sure the document is easily readable by individuals with varying visual abilities. A well-designed receipt is an investment in both operational efficiency and customer satisfaction.

Elevating Operations with a Reliable Financial Tool

In conclusion, the strategic implementation of a robust financial template for towing operations transcends simple administrative tasks; it represents a commitment to operational excellence, financial integrity, and unparalleled customer service. By providing a consistent, clear, and comprehensive record of every transaction, the template empowers businesses to manage their finances with greater precision, mitigate potential disputes, and ensure compliance with regulatory standards. This foundational tool streamlines processes, from initial service request to final payment, fostering an environment of accountability and transparency within the demanding towing industry.

The value of this structured document extends far beyond mere transaction confirmation. It serves as a vital piece of business documentation for internal accounting, tax preparation, and performance analysis, offering invaluable data for strategic decision-making. For customers, receiving a professional and detailed proof of transaction reinforces trust and provides peace of mind, knowing that their interaction was handled with utmost professionalism. Investing in a well-designed and adaptable service receipt is, therefore, not just about issuing receipts; it is about building a reputable, efficient, and reliable business poised for sustainable growth in a competitive market.