In the intricate world of financial transactions, precision and transparency are not merely ideals but necessities. Businesses, landlords, service providers, and individuals frequently encounter scenarios where a deposit is required to reserve an item, service, or property. This initial financial commitment, often termed a holding deposit, necessitates a formal acknowledgment to safeguard the interests of all parties involved. A meticulously crafted holding deposit receipt template serves as this crucial proof of transaction, acting as a foundational document that validates the exchange and outlines the terms under which the deposit is held. Its purpose extends beyond a simple acknowledgment of payment, providing a clear and undisputed record that can prevent future misunderstandings or disputes.

The utility of such a template spans across various sectors, benefiting anyone who collects or pays a holding deposit. For the recipient, it offers a standardized method for recording incoming funds, ensuring consistency in record-keeping and facilitating easier reconciliation. For the payer, it provides tangible evidence of their financial commitment, offering peace of mind and clarity on their contractual position. This form essentially formalizes an agreement, making it a critical component of effective business communication and robust financial management.

The Indispensable Role of Professional Documentation in Financial Transactions

Clear and professional documentation stands as a cornerstone of ethical and efficient business operations. Every financial exchange, regardless of its size or complexity, carries the potential for misunderstanding if not properly recorded. Standardized documentation minimizes ambiguity, fosters trust between transacting parties, and provides a reliable reference point should questions arise. It translates verbal agreements into concrete, verifiable records, which is essential for maintaining strong client relationships and operational integrity.

Specifically, in financial transactions, precise documentation serves multiple critical functions. It acts as an official payment receipt, confirming that funds have changed hands and specifying the amount and purpose. This level of detail is paramount for accurate accounting, internal audits, and external financial reviews. Without such records, businesses risk discrepancies in their books, potential legal challenges, and a significant erosion of credibility.

Furthermore, comprehensive business documentation ensures compliance with legal and regulatory requirements. Many jurisdictions mandate specific record-keeping practices for financial transactions, especially those involving deposits or advance payments. A well-structured document not only fulfills these obligations but also provides a robust defense against potential legal claims, offering irrefutable evidence of the transaction’s terms and execution. This makes the creation and maintenance of a clear financial template not just good practice, but a legal and operational imperative.

Key Benefits of Using a Structured Holding Deposit Receipt Template

Adopting a structured holding deposit receipt template offers a multitude of advantages that enhance accuracy, transparency, and consistency in financial record-keeping. Firstly, it ensures uniformity across all deposit transactions. Every receipt issued will contain the same critical fields, presented in a consistent format, which significantly reduces the likelihood of errors or omissions that often occur with ad-hoc documentation.

Secondly, such a template dramatically improves the accuracy of collected data. By providing pre-defined fields for essential information like dates, amounts, names, and the specific purpose of the deposit, it guides the user to capture all necessary details comprehensively. This precision is vital for accurate financial reporting and for maintaining an unimpeachable audit trail. An accurate receipt also serves as definitive proof of transaction, protecting both parties.

Thirdly, the template fosters transparency by clearly articulating the terms under which the deposit is held. This includes defining whether the deposit is refundable, non-refundable, or applicable towards a final purchase, along with any conditions for its return or forfeiture. Such clarity prevents disputes by ensuring both parties have a shared understanding of the financial commitment from the outset. It effectively acts as a mini-contract, outlining expectations.

Finally, integrating a standardized receipt into daily operations streamlines administrative processes. It reduces the time and effort required to generate individual receipts, allowing staff to focus on more value-added activities. This efficiency contributes to a more organized and professional business environment, enhancing overall operational effectiveness and bolstering the business documentation system.

Customizing the Document for Diverse Business and Personal Needs

The inherent flexibility of a well-designed holding deposit receipt template makes it highly adaptable to a wide array of business and personal applications. While the core function remains consistent—to acknowledge a financial commitment—the specific details and clauses within the document can be tailored to suit varied circumstances. This versatility ensures that the form can serve distinct purposes without requiring an entirely new design for each scenario.

For sales transactions, this form can be customized to function as a preliminary sales record. It would detail the item being reserved, its full purchase price, and how the holding deposit contributes to the final amount. This is particularly useful for high-value items, custom orders, or vehicles, where a buyer wishes to secure a specific product before full payment is made. It clearly outlines the terms of the reservation and subsequent purchase.

In the realm of service agreements, the layout can be modified to acknowledge retainers or advance payments for future services. A service receipt for a large project, for instance, might specify milestones, hourly rates, or project phases that the deposit covers. This ensures transparency for both the service provider and the client regarding the scope of work tied to the initial payment, acting as a partial billing statement.

Rental property applications also benefit significantly from a tailored template. Here, the receipt would confirm a deposit for a rental unit, specifying the address, the duration for which the unit is held, and the conditions under which the deposit might be refunded or applied to the first month’s rent or security deposit. It provides a formal acknowledgment of the tenant’s serious interest and the landlord’s commitment to hold the property.

Beyond commercial applications, the document can even serve in non-profit contexts as a donation acknowledgment for pledges or specific funding commitments. Similarly, for business reimbursements, it could detail an advance given for specific expenses, serving as an initial expense record that will later be balanced against actual expenditures. The ability to modify fields, add specific disclaimers, or incorporate unique terms makes the document an invaluable financial template across numerous domains.

When and Where This Template is Most Effective

The application of this template is broad, proving most effective in situations requiring a formal, undeniable record of a conditional payment. Its structured nature is particularly beneficial in transactions where a commitment needs to be secured without immediate full payment, or where specific terms for a future transaction must be established.

Here are examples of when using this template is most effective:

- Real Estate Transactions: When a prospective tenant or buyer places a deposit to reserve a rental property or purchase a home while background checks or financing are finalized. This ensures the property is taken off the market for a specified period.

- Vehicle Sales: When a customer puts down a deposit to hold a specific car, truck, or motorcycle, pending a loan approval or the sale of their current vehicle.

- Special Order or Custom Manufacturing: For unique items that require production or sourcing, such as bespoke furniture, custom jewelry, or specialized machinery, where a deposit secures the order and covers initial material or labor costs.

- Event Bookings and Venue Reservations: When securing a venue for a wedding, conference, or party, or booking a caterer, photographer, or entertainer, a deposit locks in the date and services.

- High-Value Service Contracts: For large projects where a retainer is required upfront, such as extensive consulting engagements, major construction work, or complex software development.

- Pet Adoptions/Purchases: When reserving a specific animal from a breeder or shelter, particularly before it is old enough to leave its mother or has completed necessary veterinary procedures.

- Business-to-Business Agreements: For pre-payments on bulk orders, professional services, or specialized equipment, where the deposit signifies a firm commitment from the purchasing entity.

In each of these scenarios, the template serves as an indisputable financial record, safeguarding the interests of both the payer and the recipient by explicitly detailing the transaction’s parameters.

Essential Elements of the Receipt Layout for Optimal Usability

Designing the layout of the receipt for optimal usability is crucial for ensuring clarity, efficiency, and legal defensibility. A well-structured file guides the user through the necessary information and presents it logically, minimizing confusion and potential errors. Every element of the form, from the heading to the footer, should contribute to its overall effectiveness as a robust financial document.

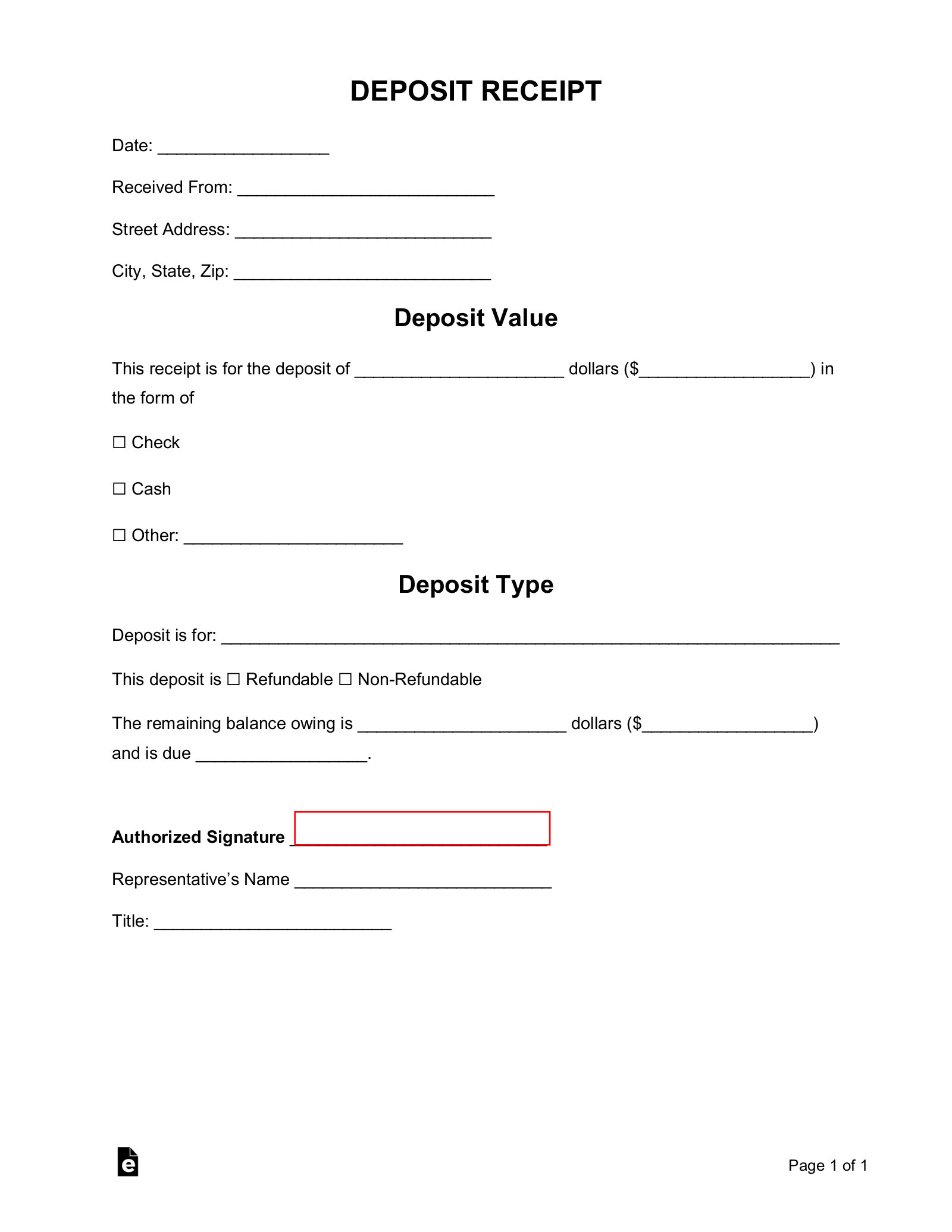

Key data fields form the core of the document. These typically include the full names and contact information of both the payer and the recipient (e.g., business name, address, phone number). The date of the transaction is indispensable, along with the precise amount of the holding deposit in both numerical and written form to prevent discrepancies. A clear, concise purpose of the deposit must be stated, detailing what the funds are reserving (e.g., "holding deposit for 123 Main St. rental application," "deposit for 2023 Honda Civic VIN#…").

Furthermore, the layout must include a section for the terms and conditions related to the deposit. This is where clarity on refund policies, forfeiture conditions, and how the deposit will be applied (e.g., towards purchase price, security deposit) is paramount. Dates for these conditions to be met should also be included. Signatures from both parties are essential for legal validity, along with the date of signing. A unique receipt number is critical for internal tracking and serves as a reliable reference point for future inquiries, enhancing its function as a robust invoice form.

For both print and digital versions, the importance of clear formatting and readability cannot be overstated. Sufficient white space, legible fonts, and a logical flow of information ensure that the form is easy to complete and understand. Branding elements, such as a company logo, can enhance professionalism and credibility. For digital versions, features like digital signatures, secure distribution methods (e.g., encrypted PDFs), and integration with existing billing statement or accounting systems can significantly improve efficiency and security. Considering accessibility, ensuring the file can be easily read by screen readers for visually impaired users, is also a professional standard.

Tips for Designing and Formatting Your Financial Template

Crafting a professional and functional financial template involves careful attention to design and formatting. The goal is to create a document that is not only informative but also intuitive and visually appealing, reflecting the professionalism of your organization. This approach ensures the template serves its purpose effectively as a critical piece of business documentation.

Firstly, prioritize a clean and uncluttered design. Use ample white space to separate sections and improve readability. Overly dense text or a chaotic layout can deter users and lead to missed information. Choose professional, easy-to-read fonts (e.g., Arial, Calibri, Times New Roman) and maintain consistent font sizes throughout the document. Headings and subheadings should be clearly distinguishable to guide the user’s eye through the form logically.

For print versions, consider the practicalities of physical use. Ensure fields are appropriately sized for manual entry, and provide clear lines for signatures. If the form will be carbon-copied, ensure the paper and layout support this. For digital versions, designing for screen legibility is key. Use fillable PDF formats to enable easy digital completion and submission, reducing paper waste and enhancing efficiency. Ensure that the template is responsive or well-formatted for various screen sizes if it is to be accessed on mobile devices.

Implement clear version control if you anticipate making updates to the template over time. A small version number in the footer can prevent the accidental use of outdated forms. Furthermore, consider how the receipt will integrate with your existing financial systems. Can it be easily exported for accounting software? Does it align with your invoicing procedures? This foresight will save significant administrative time and effort. Finally, always include contact information for inquiries, reinforcing the template’s role as a reliable financial record and an extension of your customer service.

The Indispensable Value of a Structured Financial Tool

In conclusion, the holding deposit receipt template is far more than a simple slip of paper; it is a vital instrument for maintaining financial integrity and operational efficiency across diverse transactions. Its structured nature serves as a robust defense against ambiguity, providing a consistent, accurate, and transparent record of conditional payments. By clearly documenting the terms of a deposit, this template prevents disputes, fosters trust between parties, and ensures adherence to legal and regulatory standards. It embodies effective business documentation, acting as a reliable invoice form, a precise sales record, or a clear service receipt as needed.

The strategic deployment of a well-designed template elevates the professionalism of any entity handling deposits. It streamlines administrative processes, allowing for easier tracking, reconciliation, and auditing, while providing immediate proof of transaction. Whether for real estate, vehicle sales, service agreements, or bespoke orders, its adaptability makes it an indispensable component of sound financial management. Its dual function as both an acknowledgment of payment and an outline of crucial terms underscores its comprehensive utility.

Ultimately, embracing a standardized holding deposit receipt template is a testament to an organization’s commitment to clarity, accountability, and customer satisfaction. It simplifies complex financial interactions, reinforces contractual agreements, and builds a solid foundation for trustworthy business relationships. For any business or individual engaged in transactions requiring a deposit, this reliable, accurate, and efficient financial record tool is not merely an option, but an essential asset.