In the intricate landscape of modern commerce, the humble receipt serves as a foundational element, validating transactions and cementing agreements between buyers and sellers. For retail establishments, particularly clothing stores, these documents transcend mere proof of purchase, acting as critical records for inventory management, sales reconciliation, and customer service. A meticulously crafted clothing store receipt template is not just a convenience; it is an indispensable tool that underpins operational efficiency and professional credibility.

This article explores the comprehensive utility and strategic importance of a well-designed receipt template. It delves into the structural components, customizability options, and overarching benefits for businesses, customers, and financial stakeholders alike. By providing a clear, standardized document, a business can significantly enhance its record-keeping, streamline its financial processes, and foster greater trust with its clientele.

The Imperative of Clear Financial Documentation

Accurate and transparent documentation is paramount in all business operations, serving as the backbone for financial integrity and legal compliance. Each transaction, regardless of its size, generates data that is vital for accounting, auditing, and strategic decision-making. Professional documentation mitigates risks, prevents discrepancies, and offers indisputable proof of financial exchanges.

Beyond simple compliance, a commitment to clear documentation fosters an environment of trust and accountability. It provides a reliable historical record for both the business and its customers, crucial for resolving potential disputes or facilitating returns and exchanges. Standardized forms, such as a well-structured payment receipt, ensure that all necessary information is captured consistently, reflecting professionalism at every touchpoint.

Key Benefits of Structured Templates for Financial Records

Utilizing a structured template, particularly a robust clothing store receipt template, offers a multitude of advantages that extend across various facets of business operations. These benefits collectively contribute to enhanced accuracy, improved transparency, and greater consistency in record-keeping. The inherent design of such a form minimizes manual errors and standardizes information capture.

Accuracy is significantly bolstered as predefined fields guide data entry, ensuring all critical information—from item specifics to tax calculations—is recorded precisely. This systematic approach reduces the likelihood of omissions or misinterpretations that can lead to costly reconciliation issues or customer dissatisfaction. By automating aspects of data population, the risk associated with human error is substantially diminished.

Transparency is another cornerstone benefit. A clear receipt provides customers with a detailed breakdown of their purchase, including individual item costs, applicable discounts, sales tax, and the total amount paid. This level of detail fosters trust and helps customers understand exactly what they have purchased and for how much. For the business, it ensures clarity for internal auditing and external compliance checks.

Consistency in documentation maintains a professional brand image and simplifies internal processes. Every payment receipt issued adheres to the same layout and includes the same essential information, regardless of who processes the transaction. This uniformity aids in quicker data retrieval, easier training for new staff, and a more streamlined accounting workflow, making sales record management much more efficient.

Versatility: Customizing the Receipt Template for Diverse Transactions

While the focus here is on a clothing store receipt template, the underlying principles of a well-designed document are highly adaptable. A foundational receipt template can be customized to serve a broad spectrum of financial transactions beyond standard retail sales. Its flexibility makes it an invaluable asset for various business models and operational needs.

For sales transactions, this template can be tailored to include specific fields for product SKUs, size, color variations, and promotional discounts. It can also accommodate information relevant to loyalty programs or gift card redemptions. The detailed structure ensures that every element of a sale, from item price to final payment method, is meticulously recorded.

Beyond retail, the base layout can be modified to function as a service receipt. Service-oriented businesses can adapt the form to list hourly rates, specific service descriptions, parts used, and labor costs. This customization ensures that clients receive a clear billing statement detailing the work performed and the associated charges, acting as a comprehensive invoice form.

Furthermore, the document’s utility extends to non-commercial financial exchanges. It can be adapted for rent payments, providing a clear record of amount received, period covered, and recipient. Non-profit organizations frequently customize such a template into a donation acknowledgment, providing donors with official proof of their contribution for tax purposes. Businesses also utilize modified versions for employee expense record reimbursements, detailing the nature of the expense and the amount disbursed. This adaptability underscores the comprehensive value of a well-structured financial template.

Effective Applications of a Comprehensive Receipt

A robust clothing store receipt template is indispensable across a variety of practical scenarios, serving both immediate transactional needs and long-term record-keeping requirements. Its structured format ensures accuracy and provides crucial documentation for multiple stakeholders. Here are several key instances where using such a receipt is most effective:

- Standard Retail Sales: Provides customers with a detailed record of their apparel purchase, including itemized costs, taxes, and total amount, essential for their personal financial tracking.

- Customer Returns and Exchanges: Acts as definitive proof of purchase, detailing the original transaction, date, and items, which is critical for processing refunds or product swaps efficiently.

- Gift Card Purchases and Redemptions: Documents the sale of a gift card and, subsequently, its use, ensuring proper accounting for deferred revenue and managing gift card balances.

- Layaway Plans or Special Orders: Records initial deposits, subsequent payments, and the final collection of items, providing a clear payment receipt history for both the customer and the store.

- Proof for Warranty Claims: For items with manufacturer warranties, the receipt serves as the official date of purchase, vital for validating claims or returns due to defects.

- Personal and Business Expense Tracking: Individuals and businesses rely on this proof of transaction for budgeting, tax deductions, and reconciling corporate credit card statements.

- Internal Auditing and Reconciliation: Financial departments use these sales records to cross-reference daily sales reports, manage inventory, and ensure accurate financial statements.

- Donation Acknowledgments: For non-profit clothing drives or charity sales, a modified version acts as a formal donation acknowledgment, often required for tax deductions.

- Dispute Resolution: In the event of a discrepancy regarding a purchase, the detailed transaction information on the receipt provides an unbiased record to resolve issues quickly.

Design, Formatting, and Usability Considerations

The effectiveness of any financial template, including a clothing store receipt template, is heavily reliant on its design, formatting, and overall usability. A thoughtfully designed document not only conveys professionalism but also enhances clarity and functionality for both the issuer and the recipient. Attention to these details ensures that the receipt serves its purpose optimally in various contexts.

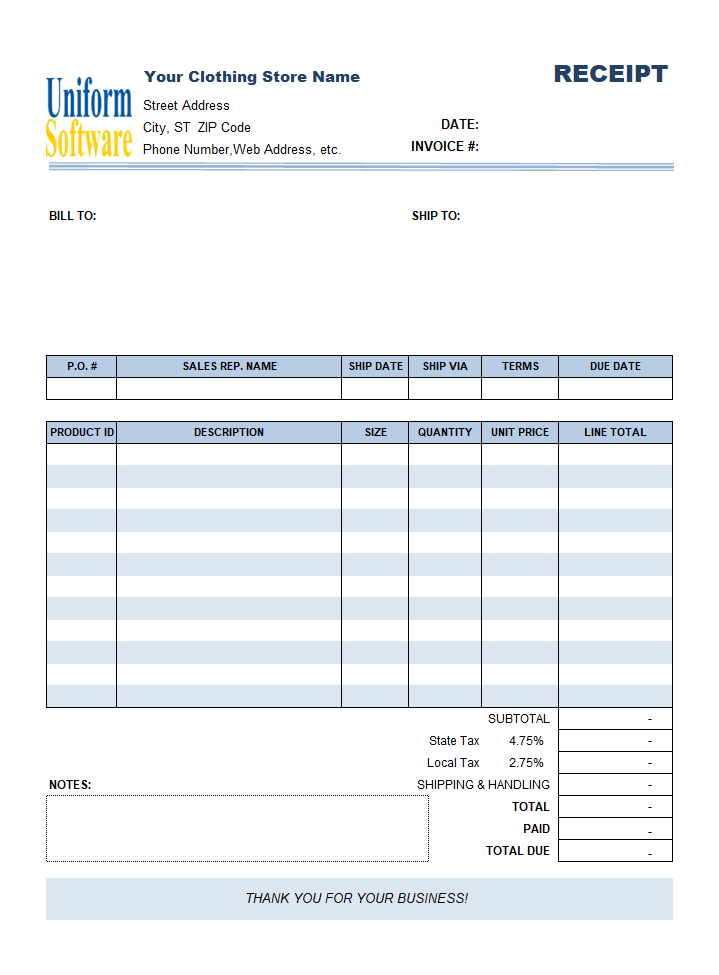

For print versions, legibility is paramount. This includes using clear fonts of an appropriate size, sufficient white space between elements, and a logical flow of information. Key details such as the business name, address, contact information, and logo should be prominently displayed to reinforce branding. The transaction date, time, and a unique transaction ID are crucial for quick referencing. Itemized lists should clearly show product descriptions, quantities, unit prices, and extended totals. Subtotals, sales tax, discounts, and the final amount due or paid must be distinctly presented. Space for a customer signature, if required for high-value purchases or policy acknowledgments, should also be allocated. Consider using carbon copies or duplicate forms for instances where both parties require a physical record.

Digital versions of the receipt offer enhanced flexibility and environmental benefits. They should be designed to be easily shareable via email, downloadable as a PDF, and viewable across various devices. Responsive design ensures readability on smartphones, tablets, and desktops. Key elements remain the same as print versions, but digital forms can also incorporate clickable links to return policies, loyalty program details, or customer support. Secure digital storage and integration with point-of-sale (POS) systems are essential for efficient data management and retrieval. Features like electronic signatures and searchable fields can further enhance the utility of the digital payment receipt.

Regardless of format, essential elements that must be included are: the business name and contact information, a unique receipt number, the date and time of the transaction, a detailed itemized list of goods or services (including product names, quantities, and prices), any applied discounts, subtotal, applicable taxes, the total amount paid, and the method of payment. Clearly stating the return or exchange policy, or a reference to where it can be found, adds value and prevents future misunderstandings.

Conclusion: The Enduring Value of Precise Financial Records

In summary, a well-implemented clothing store receipt template is far more than a mere transactional byproduct; it is an integral component of a robust business infrastructure. Its diligent use underpins operational excellence, ensuring that every financial interaction is accurately documented, transparently communicated, and consistently recorded. This structured approach to business documentation is foundational for maintaining healthy financial records and fostering positive customer relations.

The strategic investment in developing and utilizing a comprehensive financial template translates directly into increased efficiency, reduced errors, and enhanced accountability across all business functions. It empowers businesses to manage their sales records with precision, comply with regulatory requirements effortlessly, and resolve disputes confidently. For customers, it provides clear proof of transaction and peace of mind.

Ultimately, a reliable and accurate receipt template solidifies a business’s reputation for professionalism and integrity. It serves as a testament to meticulous record-keeping, ensuring seamless financial communication and contributing significantly to the long-term success and trustworthiness of any enterprise. Investing in such a template is an investment in clarity, accuracy, and the sustainable growth of an organization.