In the contemporary business landscape, the meticulous documentation of financial transactions is not merely a formality but a fundamental requirement for operational integrity and legal compliance. Among the myriad tools available for this purpose, the structured design inherent in a well-conceived receipt template stands out as indispensable. This article delves into the utility and strategic importance of adopting a robust grocery store receipt template—a term used here to encapsulate any standardized, detailed proof of purchase or payment, regardless of the specific goods or services exchanged.

The primary purpose of such a template extends far beyond a simple record of sale; it serves as a critical conduit for transparency, accountability, and efficient record-keeping. For both sellers and purchasers, it provides undeniable proof of transaction, facilitates financial reconciliation, and supports various administrative functions from tax preparation to expense reporting. Beneficiaries range from small businesses needing to formalize their sales processes to large corporations requiring consistent documentation across departments, and even individuals seeking organized personal financial management.

The Importance of Clear and Professional Documentation

Clear and professional documentation is the bedrock of sound financial management and ethical business practices. In an increasingly regulated environment, ambiguous or incomplete records can lead to significant discrepancies, audit complications, and potential legal challenges. A well-designed receipt, acting as a definitive payment receipt, mitigates these risks by providing a precise, unalterable account of each transaction. It acts as an official record, validating the exchange of funds for goods or services.

Beyond compliance, professional documentation fosters trust with clients and partners. When a business consistently provides clear, detailed, and uniformly presented receipts, it projects an image of reliability and professionalism. This contributes positively to brand perception and customer satisfaction, reinforcing the importance of every interaction, no matter how small. It also simplifies internal processes, allowing for easier tracking of inventory, sales performance, and cash flow.

Key Benefits of Structured Templates for Financial Records

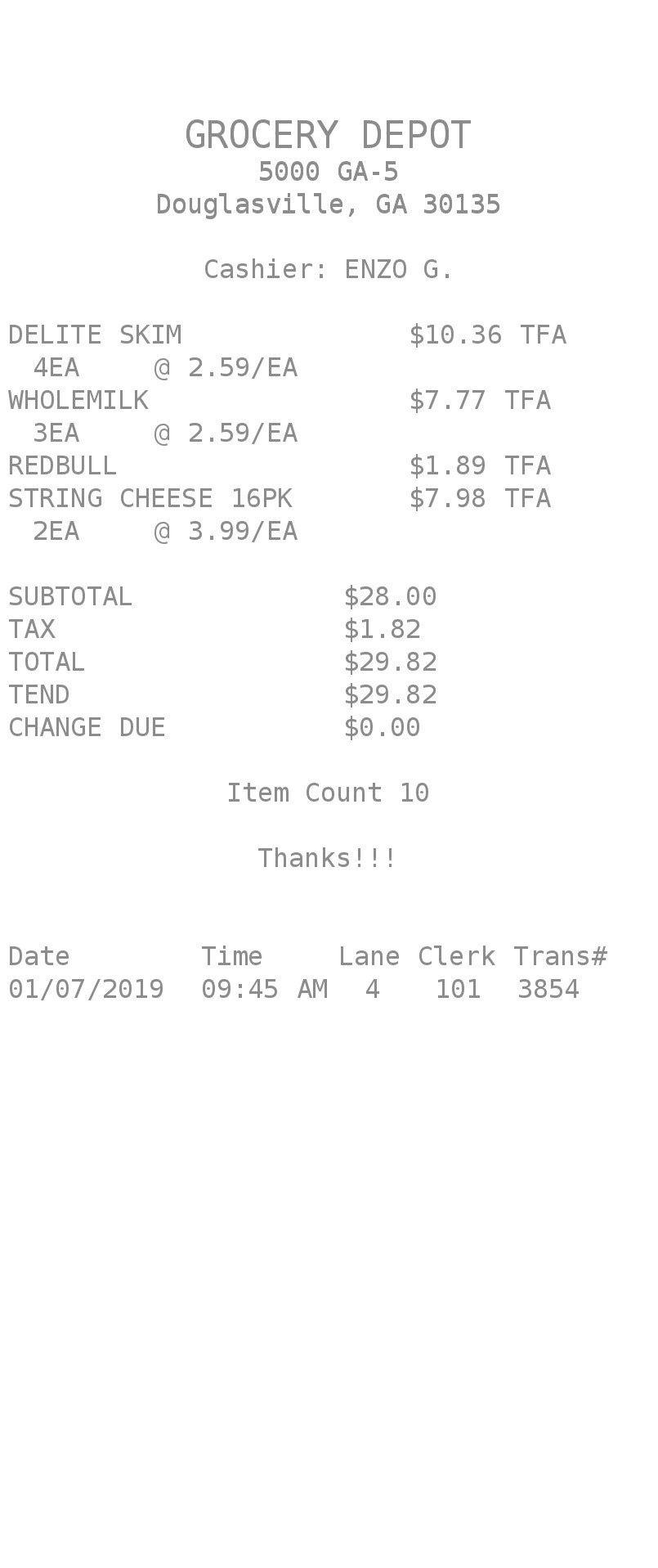

Adopting structured templates for financial records offers a multitude of advantages, significantly streamlining administrative tasks and enhancing data integrity. The underlying structure of a grocery store receipt template, for instance, is designed to capture all essential details in a standardized format, which is paramount for accuracy, transparency, and consistency in record-keeping. This standardization eliminates the variability that often arises from manual or ad-hoc documentation methods.

Accuracy is vastly improved as templates prompt users to fill in all necessary fields, reducing omissions and errors. This systematic approach ensures that critical data points, such as date, time, transaction ID, itemized lists, and total amounts, are consistently recorded. Transparency is enhanced because all parties involved can clearly see the breakdown of costs, taxes, and any discounts applied, fostering a sense of fairness and clarity. Consistency, perhaps the most undervalued benefit, ensures that every payment receipt across an organization adheres to the same format, simplifying data aggregation, analysis, and auditing processes. This uniform approach is invaluable for maintaining a coherent sales record over time.

Customization for Diverse Transactional Purposes

The inherent flexibility of a well-designed template allows for extensive customization, making it suitable for a broad spectrum of transactional purposes beyond typical retail sales. While initially conceived for itemized product sales, such a robust grocery store receipt template can be readily adapted to generate proof of transaction for services rendered, formal rent payments, philanthropic donations, or even business reimbursements. This adaptability underscores its utility as a foundational financial template.

For service-based businesses, the itemized section can be modified to detail the type of service, hourly rates, and labor costs. A rental property owner can customize the layout to include property address, rental period, and tenant information. Non-profit organizations can adapt the form into a donation acknowledgment, incorporating tax-exempt identification numbers and specific fund allocations. In corporate settings, it can serve as an expense record, itemizing reimbursable expenditures. The core structure remains, but specific fields are tailored to meet unique industry or organizational requirements, transforming it into a versatile invoice form or billing statement.

Examples of When Using This Template Is Most Effective

The application of a standardized receipt template is most effective in scenarios demanding clear, auditable proof of transaction and comprehensive financial tracking. Its utility spans various sectors and individual needs.

- Retail Sales: For any business selling goods, from boutique shops to electronics stores, a detailed sales record ensures accuracy, facilitates returns, and supports inventory management.

- Service Providers: Freelancers, consultants, and contractors benefit from providing clients with a service receipt detailing work performed, hours logged, and charges incurred.

- Landlords and Property Managers: Issuing a formal rent payment receipt provides clear documentation for both tenant and landlord, essential for financial reconciliation and dispute resolution.

- Non-Profit Organizations: A donation acknowledgment serves as crucial business documentation for donors seeking tax deductions and for the organization’s compliance records.

- Business Reimbursements: Employees submitting expense reports require precise expense records, and a template helps standardize these submissions for quicker processing and auditing.

- Online Transactions: Digital versions of the template can be integrated into e-commerce platforms, automatically generating a proof of transaction upon purchase completion.

- Small Businesses and Startups: Establishing professional documentation early helps build credibility and streamline financial operations from inception.

- Event Organizers: For ticket sales or vendor fees, issuing a consistent payment receipt provides clear financial tracking for all parties.

Tips for Design, Formatting, and Usability

Optimizing the design, formatting, and usability of any financial template is crucial for its effectiveness, regardless of whether it’s a print or digital version. A well-crafted receipt should be intuitive, comprehensive, and visually professional.

Design and Content Elements

Firstly, critical information must be prominently displayed. This includes the issuer’s business name, logo, contact information, and the transaction date. The receipt number, a unique identifier, is paramount for tracking and referencing. Key transactional data should follow: a clear itemized list of products or services, quantities, unit prices, and subtotal. Tax information (e.g., sales tax, VAT), discounts, and the final total amount paid should be explicitly detailed. Crucially, the payment method used (cash, credit card, check) should be noted, along with any relevant payment gateway transaction IDs. A dedicated field for customer information, though optional, can be beneficial for loyalty programs or targeted marketing.

Formatting for Clarity and Professionalism

The layout of the document should prioritize readability. Utilize a clean, uncluttered design with ample white space between sections. Employ consistent font styles and sizes, reserving bolding for headings and key figures like the total amount. Organize information logically, perhaps using distinct sections for issuer details, transaction specifics, and payment summary. For digital versions, ensure the file is easily shareable and viewable across various devices without distortion, often accomplished with PDF formats. For print, design the form to fit standard paper sizes and minimize excessive ink usage if high-volume printing is anticipated.

Usability for Both Print and Digital Versions

Usability extends to both how easily the receipt can be filled out and how readily its information can be processed. For print versions, provide clear lines or boxes for handwritten entries, if applicable. Digital templates should be designed with user-friendly input fields, potentially featuring dropdown menus for common items or services to enhance speed and accuracy. Integration with existing point-of-sale (POS) systems or accounting software is a significant advantage, automating data entry and minimizing manual effort. The template should also be accessible, meaning it should be easy to locate, retrieve, and understand for all stakeholders, including those with visual impairments if applicable, through proper tagging and structure in digital formats. This ensures the template serves as an efficient tool for business documentation.

A well-designed template also considers future needs, such as space for return policies, warranty information, or customer service contact details, enhancing the overall customer experience and reducing post-purchase inquiries. The objective is to create a functional, informative, and professional financial template that meets the practical needs of both the issuer and the recipient.

Conclusion: The Enduring Value of a Reliable Financial Template

In conclusion, the strategic adoption of a standardized financial template, exemplified by the detailed structure of a effective grocery store receipt template, represents a cornerstone of robust business administration. It transcends its literal interpretation to embody a comprehensive solution for managing any financial exchange with precision and professionalism. By providing a clear, consistent, and accurate proof of transaction, this form not only fulfills basic accounting necessities but also significantly enhances operational efficiency and stakeholder confidence.

A meticulously crafted template serves as more than just a piece of paper or a digital file; it is a vital instrument for maintaining transparency, fostering accountability, and ensuring legal compliance across all transactional facets. Its adaptability to various purposes—from sales and services to rent and donations—underscores its universal value as an indispensable tool for meticulous record-keeping. Embracing such a reliable, accurate, and efficient financial record tool is not merely an option but a strategic imperative for any entity committed to excellence in financial management.