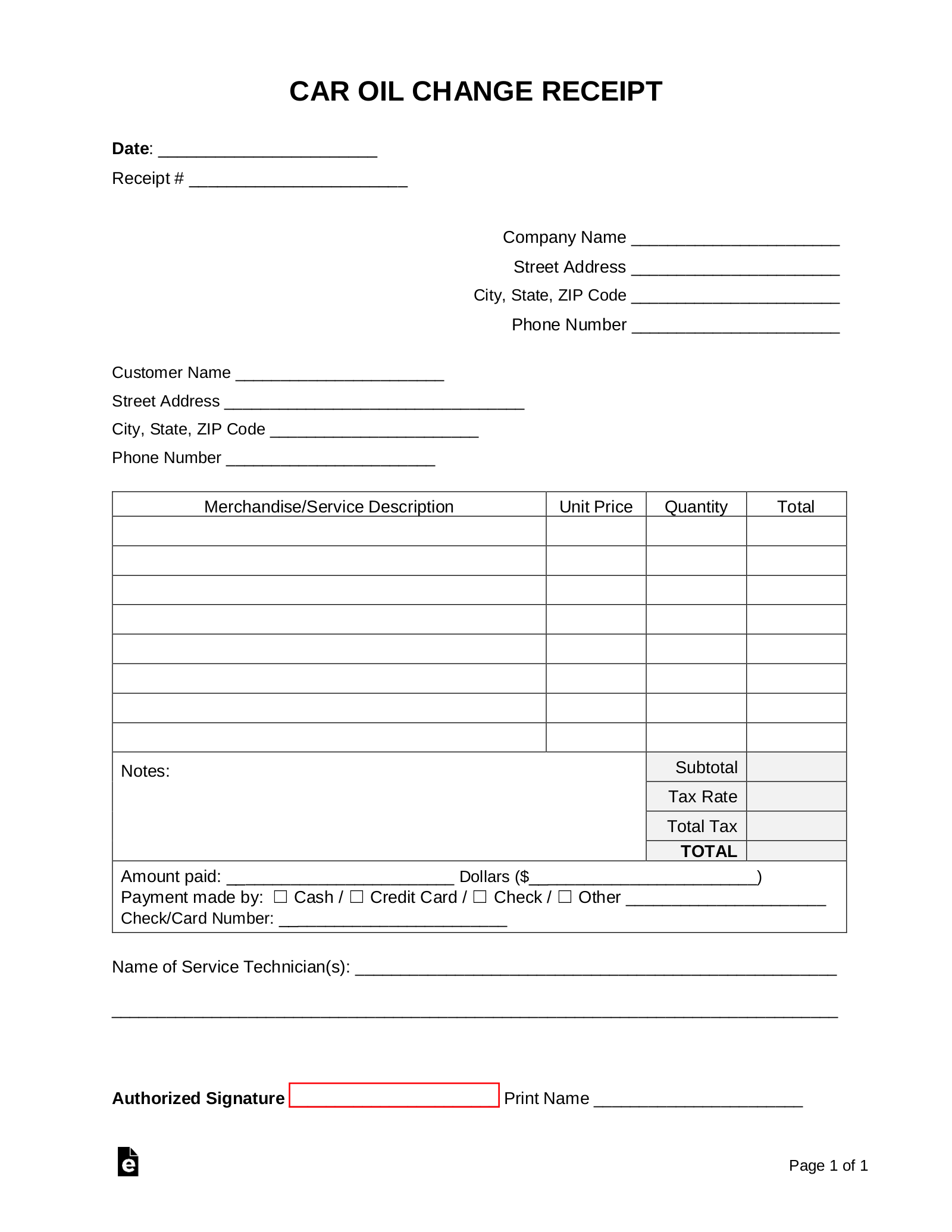

In the intricate landscape of modern business operations, meticulous record-keeping stands as a cornerstone of financial integrity and operational transparency. Among the myriad documents essential for this purpose, a well-structured receipt holds a pivotal position. While the phrase "oil change receipt template" might initially suggest a narrow application, its underlying principles of clear documentation and accurate transaction logging are universally applicable across an expansive range of financial exchanges. This foundational tool provides irrefutable proof of payment and service, establishing a verifiable record for both the service provider and the customer.

The primary purpose of such a standardized document is to simplify, organize, and authenticate financial interactions. For businesses, it serves as a critical component of accounting and inventory management, aiding in revenue tracking and compliance. For individuals, it offers a tangible record for expense tracking, warranty claims, and potential tax deductions. From a bustling automotive service center issuing a detailed oil change receipt template to a non-profit organization acknowledging a generous contribution, the benefits of a uniform and comprehensive receipt format resonate across diverse sectors, ensuring clarity and mitigating potential disputes by providing unambiguous proof of transaction.

The Imperative of Clear and Professional Documentation

In an environment increasingly focused on accountability and regulatory compliance, the importance of clear and professional business documentation cannot be overstated. Every financial transaction, regardless of its size or nature, contributes to a company’s fiscal narrative. A precisely documented record not only validates the exchange but also underpins financial reporting, audit readiness, and legal defense. Professional documentation instills confidence in clients and partners, signaling reliability and attention to detail, which are invaluable assets in fostering enduring business relationships.

Beyond mere proof of purchase, a comprehensive payment receipt acts as a critical piece of business documentation that supports a multitude of operational functions. It streamlines processes such as inventory reconciliation, ensures accurate tax reporting, and provides vital data for strategic financial analysis. In the event of a discrepancy or dispute, a meticulously prepared service receipt or sales record offers immediate and unambiguous evidence, protecting the interests of both parties involved. This commitment to detailed record-keeping is not merely an administrative chore but a strategic imperative that strengthens an organization’s financial health and legal standing.

Key Benefits of Using a Structured Oil Change Receipt Template

Adopting a structured template for financial records, such as an oil change receipt template, yields substantial advantages for any entity processing transactions. These pre-designed layouts are engineered to capture all essential information consistently, translating into enhanced accuracy, transparency, and operational efficiency. The uniformity provided by such a system significantly reduces the likelihood of human error, which is often prevalent in manual or ad-hoc documentation processes.

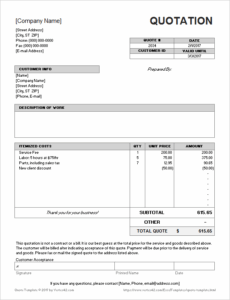

Firstly, a standardized format ensures accuracy by guiding the user to input all necessary data fields, from itemized services and costs to payment methods and dates. This systematic approach minimizes omissions and transcription errors, establishing a reliable record from the outset. Secondly, it champions transparency by presenting a clear, itemized breakdown of services rendered and charges incurred. This clarity fosters trust with clients and allows for easy verification of expenses, promoting open and honest financial interactions. Finally, consistency across all documents simplifies record-keeping and auditing. When every receipt adheres to the same structure, archiving, retrieving, and analyzing financial data becomes significantly more efficient, saving invaluable time and resources during tax season or internal reviews. The benefits extend to enhancing the professional image of the issuing entity, reinforcing its commitment to organized and client-focused service delivery.

Customizing Your Template for Diverse Financial Needs

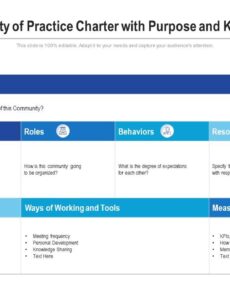

While the initial framing might be around a service-specific document, the fundamental structure of this type of template is remarkably versatile, making it adaptable for a wide array of financial transactions beyond automotive services. The core components—issuer details, recipient information, itemized services or goods, pricing, taxes, and total amount—are universal to nearly all financial exchanges. This inherent flexibility allows businesses and organizations to customize the layout to suit their unique operational requirements, transforming it from a simple service receipt into a robust multi-purpose financial tool.

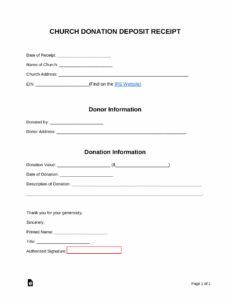

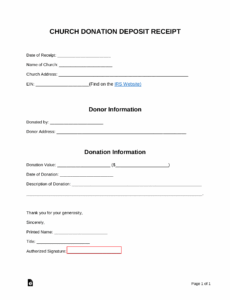

For instance, when applied to sales records, the document can be tailored to list specific products, quantities, and unit prices, functioning as a detailed invoice form. In the context of service receipts, it can detail labor hours, specific tasks completed, and any parts used. Non-profit organizations frequently adapt this form into a donation acknowledgment, ensuring they capture donor information, the amount contributed, and any specific designations, which is crucial for tax purposes and donor relations. Similarly, landlords can use it as a rent payment receipt, providing tenants with proof of their monthly housing expense. Businesses also leverage it for reimbursements, creating an expense record that clearly outlines the nature of the expenditure, the amount, and the purpose, facilitating internal accounting and employee payouts. The ability to modify fields, add specific sections, and incorporate branding elements makes this financial template an indispensable asset for comprehensive business documentation, regardless of the transaction type.

Scenarios Where a Structured Receipt Is Most Effective

A well-designed and structured receipt, serving as tangible proof of transaction, proves invaluable in numerous operational contexts, providing clarity and accountability. Its utility extends across various industries and personal financial situations, making it a cornerstone of effective financial management.

Here are several examples of when using such a template is most effective:

- Automotive Services: Beyond basic oil changes, for comprehensive vehicle repairs, detailing parts, labor hours, diagnostic fees, and specific maintenance tasks performed. This ensures customers understand the full scope of work and costs.

- Retail Sales: For itemizing multiple products purchased, applying discounts, calculating sales tax, and noting payment methods. This serves as a clear sales record for both customer and retailer.

- Consulting and Professional Services: Documenting hours billed, specific deliverables, project milestones, and agreed-upon rates. This clarity prevents misunderstandings regarding service delivery and payment.

- Home Improvement and Maintenance: For contractors detailing materials used, labor costs for tasks like plumbing, electrical work, landscaping, or carpentry. This provides a detailed service receipt for homeowners.

- Educational Institutions and Workshops: Confirming enrollment fees, material costs, and program dates for courses, seminars, or workshops. This acts as a billing statement and proof of payment for participants.

- Charitable Giving and Fundraising: As a formal donation acknowledgment, detailing the amount, date, and sometimes the specific campaign the contribution supported. This is vital for tax-deductible purposes for donors and for the organization’s financial records.

- Business Travel and Expense Reimbursements: For employees submitting expenses, itemizing travel costs, meals, and other business-related expenditures. This functions as an expense record that streamlines the reimbursement process.

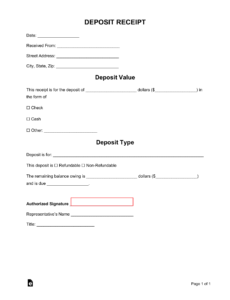

- Rental Properties: For landlords providing tenants with a payment receipt for monthly rent, security deposits, or other charges. This protects both parties by documenting financial transfers.

In each of these scenarios, the consistent application of a predefined layout ensures that all pertinent information is captured, providing a reliable and easily verifiable record for all parties involved.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial document, including a comprehensive payment receipt, is heavily influenced by its design, formatting, and overall usability. A well-designed layout not only looks professional but also enhances readability and ensures that critical information is easily accessible. Whether intended for print or digital distribution, adhering to specific best practices can significantly elevate the functionality and reliability of the template.

Clarity and Readability:

The paramount consideration is that the document must be easy to read and understand. This involves:

- Font Choice: Opt for professional, legible fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12pt for body text).

- Whitespace: Utilize ample whitespace around text and sections to prevent a cluttered appearance and improve visual flow.

- Logical Grouping: Group related information together (e.g., customer details, service details, payment summary) using clear headings or distinct sections.

Essential Fields:

Every comprehensive receipt should include:

- Issuer Information: Company name, logo, address, phone number, and perhaps a website.

- Recipient Information: Customer name, address, and contact details.

- Transaction Details: Unique receipt number, date and time of transaction.

- Itemized List: A clear breakdown of goods or services provided, including descriptions, quantities, unit prices, and extended totals.

- Financial Summary: Subtotal, applicable taxes (with rates), discounts, and the grand total amount due.

- Payment Information: Method of payment (cash, credit card, check), amount paid, and any remaining balance.

- Terms and Conditions: Brief notes on returns, warranties, or specific service guarantees.

- Authorized Signature/Disclaimer: Space for a signature or a statement confirming the transaction.

Branding:

Incorporate company branding elements, such as logos and brand colors, consistently. This reinforces brand identity and lends a professional appearance to every proof of transaction.

Digital vs. Print Considerations:

- For Digital Versions:

- File Format: PDF is ideal for digital distribution due to its universal compatibility and security features, ensuring the layout remains consistent across different devices.

- Email Integration: Ensure the template can be easily attached to emails or integrated into invoicing software.

- Accessibility: Consider if the file is screen-reader friendly for users with visual impairments.

- Digital Signatures: Incorporate fields for digital signatures if applicable, enhancing security and authenticity.

- Cloud Storage: Design for compatibility with cloud-based record-keeping systems.

- For Print Versions:

- Paper Size: Design for standard paper sizes (e.g., Letter or A4) to ensure easy printing.

- Ink Economy: Avoid excessive use of heavy backgrounds or complex graphics that consume a lot of ink.

- Durability: Consider using heavier paper stock for receipts that need to endure for long periods.

- Multiple Copies: Design with clear indications for "Customer Copy," "Merchant Copy," etc., if multi-part forms are used.

By adhering to these design and formatting principles, any organization can ensure that its billing statement or payment receipt is not just a record, but a clear, professional, and user-friendly piece of business documentation.

Enhancing Financial Control Through Smart Documentation

In conclusion, the strategic implementation of a well-designed receipt template transcends its basic function as a mere record of transaction. It emerges as a powerful tool for enhancing financial control, fostering transparency, and bolstering the professional image of any enterprise. From an automotive shop meticulously documenting a repair to a non-profit acknowledging a donation, the inherent value of a consistent, accurate, and clear financial template cannot be overstated. It serves as an irrefutable proof of transaction, streamlining everything from daily operations to annual audits and fostering trust with all stakeholders.

The adaptability of this document is a testament to its fundamental importance in robust financial management. Whether customized as a sales record, a service receipt, a detailed invoice form, or a specific expense record, its core utility lies in its capacity to standardize and simplify complex financial exchanges. Embracing a structured oil change receipt template or its generalized equivalent is not just a matter of compliance; it is a proactive step towards greater operational efficiency, meticulous record-keeping, and undeniable financial accountability, ensuring reliable and accurate business documentation for every transaction.