In the intricate world of financial transactions, the meticulous documentation of every exchange is not merely a best practice but a fundamental necessity. A personal loan payment receipt template serves as a critical instrument in this regard, offering a standardized, professional, and undeniable record of funds exchanged between parties. Its primary purpose is to acknowledge the receipt of payment for a personal loan, providing both the payer and the recipient with a clear, verifiable proof of transaction.

This essential document is invaluable for individuals managing personal loans, whether they are borrowers making payments or lenders receiving them. It brings clarity and structure to what can sometimes be informal arrangements, ensuring that all financial obligations are properly tracked and accounted for. Furthermore, it benefits small businesses, freelancers, or even individuals who occasionally extend personal loans, establishing a professional standard for financial record-keeping.

The Importance of Clear and Professional Documentation in Financial and Business Transactions

The backbone of any sound financial operation, whether personal or corporate, rests upon precise and comprehensive documentation. Clear and professional documentation, such as a robust payment receipt, minimizes ambiguities, prevents disputes, and establishes an auditable trail for all financial movements. In the absence of such records, misunderstandings can easily arise, leading to potential legal complications, strained relationships, and significant financial inaccuracies.

Professional documentation extends beyond mere record-keeping; it reflects an organization’s or individual’s commitment to transparency and accountability. It provides a formal acknowledgment that a transaction has occurred, detailing critical specifics like the amount, date, purpose, and parties involved. This level of detail is indispensable for tax purposes, internal audits, and external regulatory compliance, safeguarding all parties against potential discrepancies or challenges.

Key Benefits of Utilizing a Structured Personal Loan Payment Receipt Template

Adopting a structured personal loan payment receipt template offers a multitude of advantages, significantly enhancing the efficiency and integrity of financial record-keeping. These templates are meticulously designed to ensure accuracy, foster transparency, and maintain consistency across all transactions, thereby mitigating risks associated with manual or informal documentation.

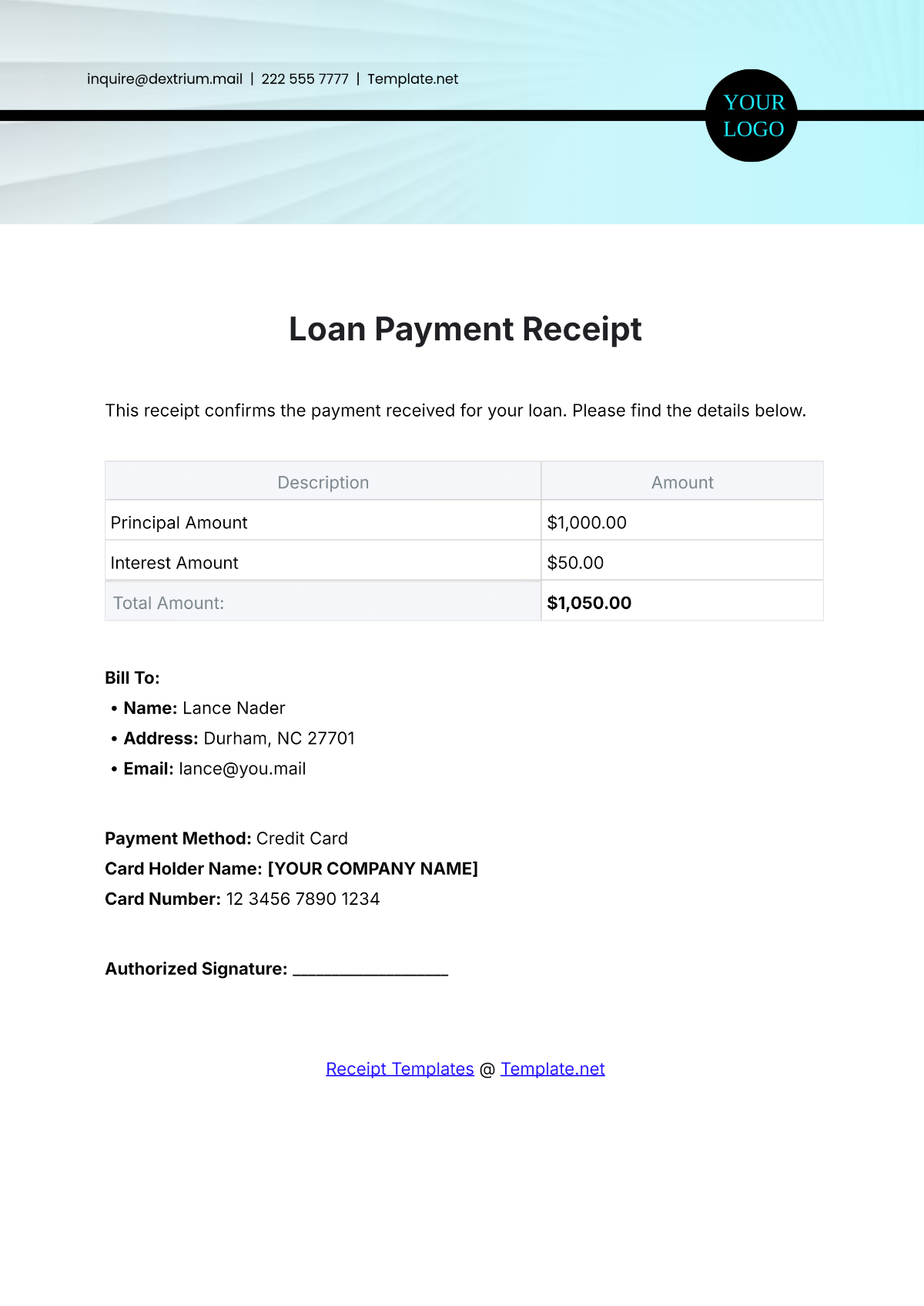

Firstly, such a template guarantees accuracy by prompting for all necessary data fields, reducing the likelihood of critical information being omitted or misrecorded. This structured approach helps prevent human error, which is crucial when dealing with financial figures and dates. Secondly, it champions transparency by providing a clear, itemized breakdown of the payment, including the principal amount, interest, and any applicable fees, making the financial interaction unequivocal for both the payer and the payee. Lastly, consistency is paramount; using the same layout for every transaction creates a uniform record-keeping system. This uniformity simplifies the retrieval of information, streamlines auditing processes, and reinforces a professional image for all financial communications. The systematic nature of the document ensures that all relevant details are captured every time, solidifying its value as a reliable financial tool.

Customization and Versatility Across Financial Transactions

While specifically titled for personal loans, the underlying structure of a payment receipt template is remarkably adaptable, making it a versatile tool across a broad spectrum of financial transactions. Its core components—payer details, recipient details, date, amount, purpose, and acknowledgment—are universal requirements for documenting financial exchanges. This inherent flexibility allows for easy customization to suit various operational needs beyond just personal loan repayments.

For instance, this form can be modified to function as a sales record for goods, a service receipt for professional engagements, or an invoice form for tracking billable hours. It can effectively serve as a rent payment acknowledgment for landlords and tenants, providing irrefutable proof of monthly housing payments. Non-profit organizations frequently adapt this layout to acknowledge donations, fulfilling legal requirements for charitable contributions. Businesses can also leverage this template for internal purposes, such as processing employee expense reimbursements, ensuring proper documentation for all outgoing funds. The ability to tailor the fields and branding makes the template an indispensable component of comprehensive business documentation and financial oversight.

Practical Applications: When to Employ This Payment Receipt Template

The effective use of a payment receipt template extends across numerous scenarios where formal acknowledgment of payment is essential. Employing a standardized form not only ensures compliance and accuracy but also fosters trust between transacting parties.

Here are specific examples of when using this financial template is most effective:

- Personal Loan Repayments: Directly, for the primary purpose of recording each installment payment made on a personal loan, providing clear proof of transaction for both borrower and lender.

- Rent Payments: Landlords can issue this document to tenants upon receiving rent, serving as a reliable record for both parties.

- Service Payments: Freelancers, consultants, and service providers can utilize the receipt to acknowledge payment for services rendered, detailing the work performed and the amount received.

- Product Sales: Small businesses or individual sellers can provide this form to customers as a sales record, confirming the purchase and payment for goods.

- Donations and Contributions: Non-profit organizations can adapt this layout to acknowledge monetary donations, which is often required for tax-deductible contributions.

- Business Expense Reimbursements: Companies can use the template internally to document the reimbursement of employee expenses, ensuring clear financial tracking.

- Advance Payments or Deposits: When a deposit or advance payment is made for a future service or product, this form provides a formal record of the initial financial exchange.

- Informal Financial Agreements: For lending or borrowing money between individuals where a formal bank statement might not be generated, this receipt offers crucial documentation.

Design, Formatting, and Usability Considerations

The effectiveness of any financial document, including a payment receipt, is significantly influenced by its design, formatting, and overall usability. A well-designed receipt is not only clear and professional but also easy to complete, read, and retain, whether in print or digital format. Strategic attention to these elements enhances user experience and reinforces the document’s reliability.

For Print Versions

When designing for print, clarity and conciseness are paramount. The layout should be clean, with ample white space to prevent visual clutter. Key fields such as "Date," "Payer Name," "Recipient Name," "Amount Received," "Purpose of Payment," and "Balance Due" should be prominently labeled and easy to fill. Use a legible font size (e.g., 10-12pt) and a professional typeface. Including a dedicated space for signatures from both parties adds an essential layer of authentication. Furthermore, ensuring that the document fits standard paper sizes (e.g., Letter or A4) and is ink-efficient will facilitate practical use and printing. A section for unique receipt numbers also helps in sequential record-keeping, making retrieval and referencing simpler.

For Digital Versions

Digital versions of the template offer enhanced functionality and accessibility. These should ideally be created using editable formats such as PDF forms or spreadsheet applications (e.g., Excel, Google Sheets) that allow for direct data entry. Interactive fields can incorporate dropdown menus for common entries, automatic date stamping, and even basic calculations (e.g., remaining balance). The digital receipt should be easily shareable via email or cloud services and be designed for optimal viewing across various devices, including desktops, tablets, and smartphones. Implementing secure digital signatures can replace physical signatures, maintaining the document’s legal integrity. Additionally, ensuring the file is easily searchable and can be integrated with accounting software systems adds significant value for digital record management. Consider file naming conventions that include date and transaction details for quick identification.

In conclusion, the utility of a well-crafted payment receipt template cannot be overstated in modern financial practice. It serves as a foundational component for ensuring accuracy, fostering transparency, and maintaining consistency in all monetary exchanges. From personal loan repayments to various business transactions, this reliable financial record empowers individuals and organizations with the definitive proof of transaction necessary for sound financial management and dispute resolution.

By systematically documenting each payment, this template significantly reduces the potential for misunderstandings or discrepancies, thereby strengthening trust between transacting parties. Its adaptability across different financial contexts—whether it’s a sales record, a service receipt, or a donation acknowledgment—underscores its versatility and essential role in comprehensive financial documentation. The professional layout and clear information presented in this form contribute to an organized and efficient approach to financial record-keeping.

Ultimately, embracing a robust payment receipt system, grounded in a meticulously designed template, is a testament to an individual’s or entity’s commitment to financial integrity and professional communication. It transforms what could be a complex and error-prone process into a streamlined, accurate, and verifiable workflow, offering peace of mind and an indisputable record for every payment made or received. This commitment to clear documentation is an investment in long-term financial stability and accountability.