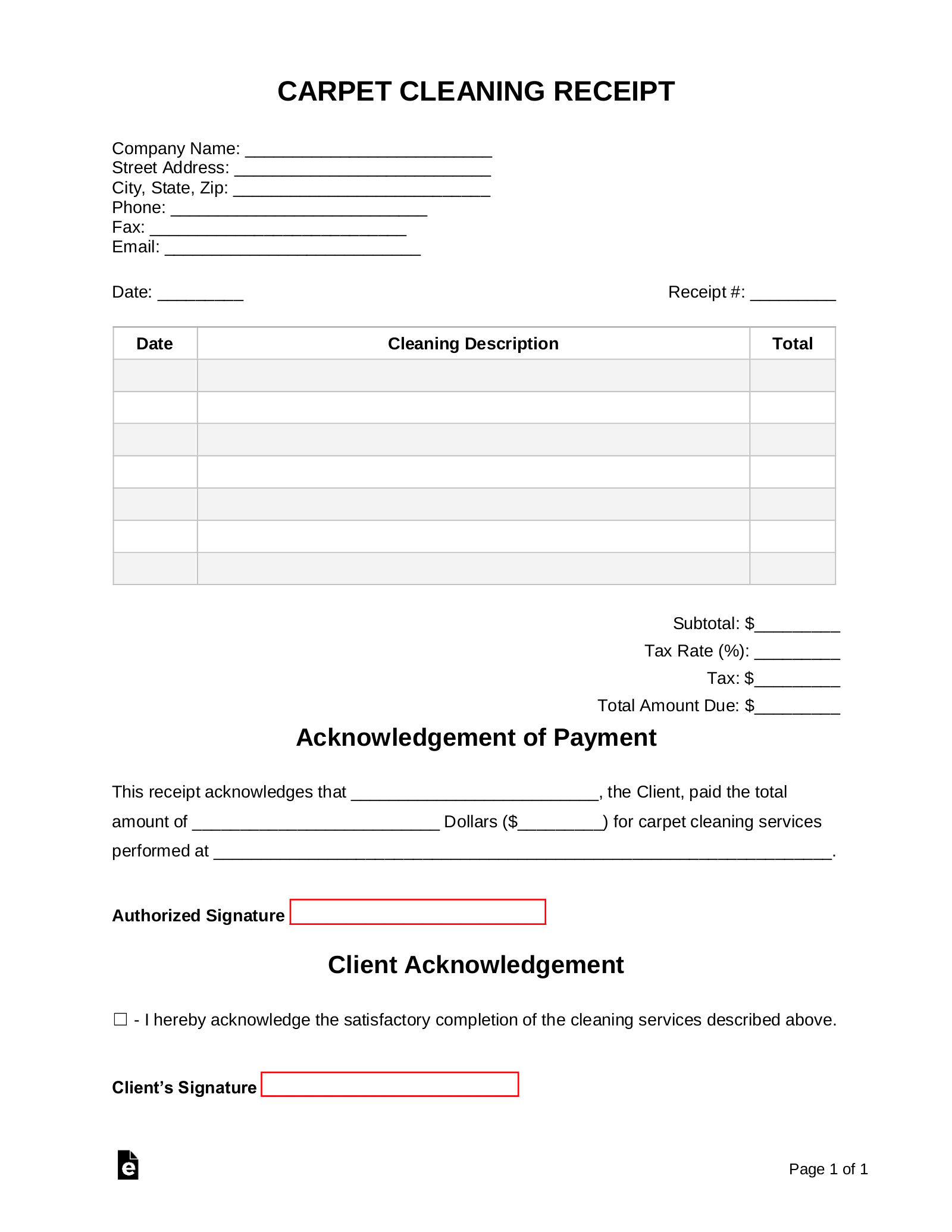

In the intricate landscape of modern business, particularly within service-oriented sectors such as professional carpet cleaning, the significance of meticulously maintained records cannot be overstated. A well-structured carpet cleaning receipt template serves as a foundational element for financial transparency, legal compliance, and superior customer service. This essential document provides clear proof of transaction for both the service provider and the client, establishing a professional standard for every engagement.

The primary purpose of such a template extends beyond mere acknowledgment of payment; it functions as a comprehensive record of services rendered, costs incurred, and payment received. For businesses, it streamlines accounting processes, simplifies tax preparation, and offers a clear audit trail. For customers, it provides assurance regarding the services they’ve paid for, enables expense tracking, and can be vital for warranty claims or insurance purposes.

The Importance of Clear and Professional Business Documentation

Professional documentation forms the backbone of credible business operations, fostering trust and accountability with every transaction. A well-drafted receipt, invoice form, or service record speaks volumes about a company’s commitment to clarity and professional conduct. It mitigates potential disputes by providing an irrefutable paper or digital trail of agreements and financial exchanges.

Such documentation is indispensable for internal financial management, external audits, and legal compliance. It ensures that all revenue and expense records are accurately categorized and readily accessible. Furthermore, consistent and professional billing statements enhance a company’s brand image, projecting an organized and trustworthy business entity to its clientele.

Key Benefits of Using Structured Templates for Financial Records

Adopting structured templates for financial records, including a robust carpet cleaning receipt template, offers a multitude of advantages. These templates are designed to capture all critical information systematically, significantly reducing the risk of errors and omissions. This standardization ensures that every receipt issued maintains a consistent level of detail and professionalism.

The inherent structure of these templates promotes accuracy, as predefined fields guide users to input necessary data, from service descriptions to payment methods. This fosters transparency for both parties, as all details are explicitly laid out. Consistency in record-keeping simplifies financial reconciliation, making it easier to track income, manage expenses, and prepare financial reports efficiently.

Customization for Diverse Business Applications

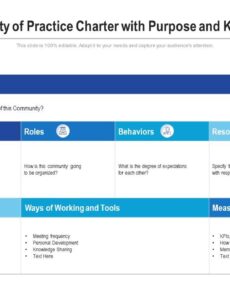

While specifically tailored for carpet cleaning, the underlying principles of a well-designed financial template are remarkably versatile. The core layout and logical flow can be adapted for a wide array of business transactions, making it an invaluable tool across various industries. This adaptability allows businesses to maintain a uniform documentation standard regardless of the specific service or product being offered.

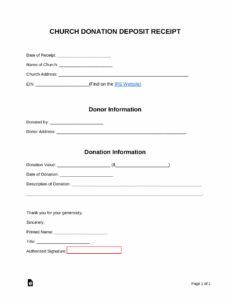

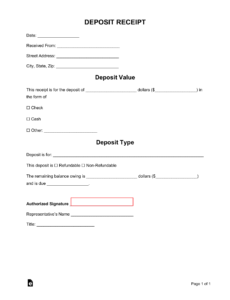

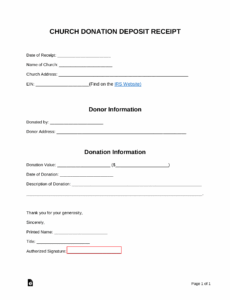

This adaptable template structure can readily be customized for various purposes, extending its utility far beyond its original intent. It can serve as a robust framework for general sales records, comprehensive service receipts for any trade, or formal rent payment acknowledgments. Furthermore, nonprofit organizations can modify this form into a clear donation acknowledgment, ensuring compliance and donor trust. Businesses can also utilize it for internal purposes, streamlining the process for employee expense records or business reimbursements, ensuring every financial outlay is properly documented and approved.

Examples of When Using a Financial Template is Most Effective

Employing a standardized financial template is effective across numerous scenarios where clear documentation of a transaction is paramount. Its utility shines brightest in situations demanding precision, transparency, and a verifiable record for all parties involved. Whether dealing with routine payments or more complex financial exchanges, the use of such a document significantly enhances operational efficiency and client confidence.

Here are specific examples of when using this template is most effective:

- Upon Completion of Services: Issuing a detailed receipt immediately after carpet cleaning services have been rendered and payment received. This provides the customer with instant proof of transaction and an itemized breakdown of costs.

- For Recurring Maintenance Contracts: When clients subscribe to regular carpet cleaning or other maintenance services, the receipt can clearly list the period covered and the specific services performed, ensuring ongoing transparency.

- As Proof of Warranty-Related Work: If a service involves warranty work or re-cleaning, the receipt serves as an official record of the date and nature of the service, crucial for tracking compliance.

- For Business Expense Reporting: Companies can use this form to track expenses incurred for various business operations, such as purchasing supplies or contractor payments, simplifying internal accounting.

- When Accepting Partial Payments: For larger projects, the document can be adapted to acknowledge partial payments, clearly stating the amount received, the outstanding balance, and the terms for subsequent payments.

- For Insurance Claims: In situations where carpet cleaning is necessitated by damage covered by insurance, a professional service receipt can be a vital piece of evidence for filing and processing claims.

- During Annual Financial Audits: For both businesses and individuals, organized receipts are crucial during tax season or financial audits to substantiate income and expenses.

- As a Sales Record for Products: While primarily service-oriented, the template can be easily adjusted to function as a sales record for related products, such as stain removers or protective treatments sold alongside the cleaning service.

- Acknowledging Rent or Lease Payments: Property managers can adapt the form to issue formal acknowledgments for rent or lease payments, ensuring tenants have a clear record.

- Documenting Donations: Charitable organizations can modify the layout to create official donation acknowledgments for tax purposes, verifying contributions received.

Tips for Design, Formatting, and Usability

The effectiveness of any financial template hinges significantly on its design, formatting, and overall usability, whether in print or digital format. A well-designed document is intuitive, easy to read, and accurately reflects the professionalism of the issuing entity. Attention to these details ensures that the receipt is not only functional but also enhances the client’s experience.

Design and Layout:

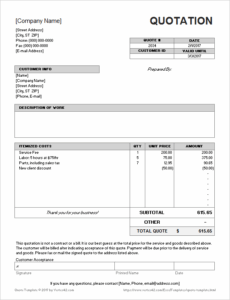

- Clear Headings and Fields: Utilize bold headings for sections like "Client Information," "Service Details," and "Payment Summary" to guide the eye. Ensure input fields are clearly labeled and spacious enough for legible entries.

- Branding Elements: Incorporate your company logo, name, address, and contact information prominently at the top. Consistent branding reinforces your professional identity and makes the document easily recognizable.

- Logical Flow: Organize information in a sequential and logical manner, typically starting with client details, then service specifics, followed by pricing, payment information, and any disclaimers.

- White Space: Employ adequate white space around text and fields to prevent the layout from appearing cluttered. This enhances readability and reduces visual fatigue.

- Professional Font Choices: Select clean, professional, and easily readable fonts (e.g., Arial, Calibri, Times New Roman) in appropriate sizes (typically 10-12 points for body text).

Formatting:

- Itemized Services: Clearly list each service performed, its quantity, unit price, and total cost. This transparency helps clients understand the breakdown of charges.

- Tax Information: Include a dedicated section for applicable taxes (e.g., sales tax), detailing the tax rate and the calculated amount.

- Payment Details: Specify the payment method (cash, credit card, check), the amount paid, and any remaining balance. A clear "Paid in Full" stamp or notation is crucial.

- Terms and Conditions/Disclaimers: Include a concise section for important terms, warranty information, or disclaimers, ensuring clients are fully informed. This might include re-cleaning policies or specific care instructions.

- Signature Lines: Provide dedicated spaces for both the service provider’s and the client’s signatures, if applicable, to acknowledge completion and satisfaction.

Usability (Print and Digital):

- Print-Friendly: Ensure the document is designed to print cleanly on standard paper sizes (e.g., 8.5" x 11"). Avoid excessive colors or complex graphics that may not reproduce well.

- Digital Compatibility: For digital versions, ensure the file is saved in a widely accessible format like PDF. Editable PDF forms or web-based invoice forms are highly convenient for digital record-keeping and instant sharing.

- Editable Fields: If distributing as an editable document, use form fields that allow for easy data entry, autofill capabilities, and potentially automated calculations for totals and taxes.

- Accessibility: Consider accessibility for all users, including clear contrast between text and background, and structured headings for screen readers if the document is to be widely distributed digitally.

- Archiving: Encourage digital archiving of all completed receipts for easy retrieval and secure backup. Cloud storage solutions offer reliable methods for maintaining financial records.

By adhering to these design, formatting, and usability principles, the utility of this foundational financial template is maximized. It transforms a simple acknowledgment of payment into a robust piece of business documentation that serves multiple critical functions, reinforcing professionalism and efficiency for both service providers and their clients.

The Enduring Value of a Reliable Financial Record

In conclusion, the strategic implementation of a well-crafted financial template, whether for carpet cleaning services or other business transactions, stands as a testament to organizational excellence. It transcends its basic function as a payment receipt, evolving into an indispensable tool for maintaining rigorous financial hygiene, ensuring legal compliance, and fostering unwavering client trust. This professional documentation is a core component of effective business communication, providing clarity and confidence in every financial interaction.

By standardizing the process of documenting transactions, businesses gain a significant advantage in accuracy, transparency, and operational efficiency. The consistent application of a structured service receipt not only streamlines accounting and simplifies tax preparation but also reinforces a company’s commitment to professionalism and accountability. Ultimately, such a reliable financial template is not merely a record; it is a fundamental asset that contributes significantly to the long-term success and reputable standing of any enterprise.