In any organization, particularly those managing public contributions, the meticulous tracking of financial transactions is not merely a best practice; it is a fundamental requirement for operational integrity and donor confidence. A well-designed church tithing receipt template serves as an indispensable tool in this regard, offering a standardized method for acknowledging contributions and maintaining accurate financial records. This document is crucial for religious institutions that rely on the generous support of their congregants to fund their operations, outreach programs, and community services.

The primary purpose of such a template is to provide a clear, unambiguous proof of transaction for every donation received, benefiting both the donor and the organization. Donors gain a verifiable record for their personal files and tax purposes, reinforcing trust and encouraging continued stewardship. For the church, this structured approach ensures transparency, simplifies auditing processes, and establishes a robust system for financial accountability, ultimately bolstering the institution’s credibility within its community and with regulatory bodies.

The Indispensable Role of Clear Financial Documentation

In an era demanding heightened transparency and accountability, the importance of clear and professional documentation in all financial and business transactions cannot be overstated. Regardless of an entity’s mission or size, robust record-keeping practices form the bedrock of fiscal responsibility. For religious organizations, which are often entrusted with significant community funds, maintaining exemplary financial records is paramount to upholding their ethical obligations and safeguarding their tax-exempt status.

Professional documentation, such as a formal payment receipt or donation acknowledgment, provides an indelible record of financial activity. It serves as irrefutable proof of transaction, crucial for internal reconciliation, external audits, and legal compliance. Without standardized forms and processes, organizations risk miscommunications, errors in reporting, and a significant loss of trust from stakeholders who expect diligence and integrity in financial management.

This commitment to detailed record-keeping extends beyond mere compliance; it fosters an environment of confidence and stability. When financial documentation is clear, consistent, and easily accessible, it simplifies operational tasks, reduces administrative burden, and frees up valuable resources that can be redirected toward the organization’s core mission. It is a proactive measure against potential discrepancies, ensuring that every financial interaction is accurately recorded and verifiable.

Key Benefits of a Structured Church Tithing Receipt Template

Utilizing a structured church tithing receipt template offers a multitude of advantages that extend far beyond simple acknowledgment, profoundly impacting accuracy, transparency, and consistency in record-keeping. The inherent design of such a form ensures that all critical information is captured uniformly for every transaction, eliminating the risks associated with manual or ad-hoc record creation. This standardization is a cornerstone of sound financial management for any institution.

One significant benefit is the enhanced accuracy it brings to financial records. By providing specific fields for essential data points—such as donor name, date, amount, and purpose of contribution—the template minimizes omissions and errors. This systematic approach ensures that every detail is correctly recorded at the point of transaction, creating an accurate historical ledger that is invaluable for financial reporting and analysis. Such precision is vital for annual tax filings and internal budget tracking.

Furthermore, the implementation of a consistent template significantly boosts transparency. When all contributions are documented using the same format, it creates a clear and auditable trail that can be easily reviewed by leadership, congregants, and external auditors. This open approach fosters trust within the community, demonstrating the organization’s commitment to honest and open financial practices. It reassures donors that their contributions are being managed responsibly and ethically.

Consistency is another paramount advantage. A standardized layout ensures that every receipt issued, whether for a small offering or a substantial gift, looks uniform and contains identical categories of information. This consistency simplifies the process of data entry, reconciliation, and archiving. It also creates a professional image for the organization, reflecting its dedication to organized and methodical financial administration, thereby reinforcing its overall credibility.

Customizing the Church Tithing Receipt Template for Diverse Applications

While the foundational concept of a receipt template is universal, its practical application can be highly versatile, making it adaptable for various financial scenarios beyond just tithes. The inherent flexibility of a well-designed form allows it to be customized to serve a broad spectrum of documentation needs, transforming it into a multi-purpose financial template for diverse organizational activities. This adaptability makes the document a valuable asset for any entity managing varied income streams.

For instance, the core structure used for acknowledging donations can be easily modified to function as an invoice form for services rendered or goods sold. By adjusting specific fields to include item descriptions, unit prices, and total costs, the template becomes suitable for acknowledging payments for educational programs, event tickets, or merchandise. This versatility minimizes the need for developing multiple unique forms, streamlining administrative tasks.

Similarly, the template can be adapted to serve as a rent payment receipt for properties owned by the organization or as a service receipt for community support programs that involve a fee. Modifying the "purpose of contribution" field to specify "rent for [property address]" or "payment for [service type]" allows the existing layout to address these distinct financial interactions effectively. The fundamental data capture elements remain relevant, requiring only minor textual adjustments.

Moreover, organizations often handle business reimbursements or expense records for staff and volunteers. By re-labeling fields to reflect "reimbursement for [expense type]" and including sections for original receipt attachments, the template can facilitate efficient tracking and documentation of outgoing funds. This comprehensive approach underscores the form’s utility as a robust piece of business documentation, capable of handling both incoming and outgoing financial movements with precision and consistency.

Effective Applications of This Financial Template

The robust design and inherent flexibility of this financial template make it suitable for a wide array of documentation needs within an organization. Its utility extends across various departments and financial transaction types, ensuring consistent record-keeping and clear communication. Here are several examples of when employing this receipt is most effective:

- Tithe and Offering Collections: The most direct application is for accurately recording individual tithes, offerings, and other monetary contributions received during worship services or through direct mail. This ensures donors receive a proper donation acknowledgment.

- Fundraising Event Payments: For special events like charity dinners, concerts, or auctions, the template can document ticket sales, silent auction bids, or direct contributions, serving as a comprehensive sales record.

- Program Fees and Registrations: When the organization charges fees for specific programs, workshops, or educational classes, this form can function as a service receipt, confirming enrollment and payment.

- Merchandise Sales: For items sold through a bookstore or gift shop (e.g., books, apparel, religious items), the template provides a clear proof of transaction, detailing items purchased and amounts paid.

- Building Fund or Capital Campaign Contributions: For larger, specific-purpose donations, the receipt clearly delineates the contribution’s intent, crucial for proper allocation and fund management.

- Rent or Facility Usage Payments: If the organization leases out space or facilities, the template can be customized to act as a payment receipt for rent, security deposits, or usage fees.

- Online Donations: While often automated, a digital version of this document can be automatically generated and emailed to donors after an online transaction, maintaining consistency with physical receipts.

- Special Projects and Missions: Contributions designated for specific mission trips, community outreach projects, or emergency relief efforts can be precisely documented, ensuring funds are tracked to their intended purpose.

Design, Formatting, and Usability Considerations

Creating an effective receipt template requires careful attention to design, formatting, and usability, ensuring it is functional for both print and digital applications. A well-designed document not only captures essential information but also reflects professionalism and ease of use. The goal is to make the process of issuing and receiving receipts as seamless and clear as possible.

Essential Elements for Effective Receipts

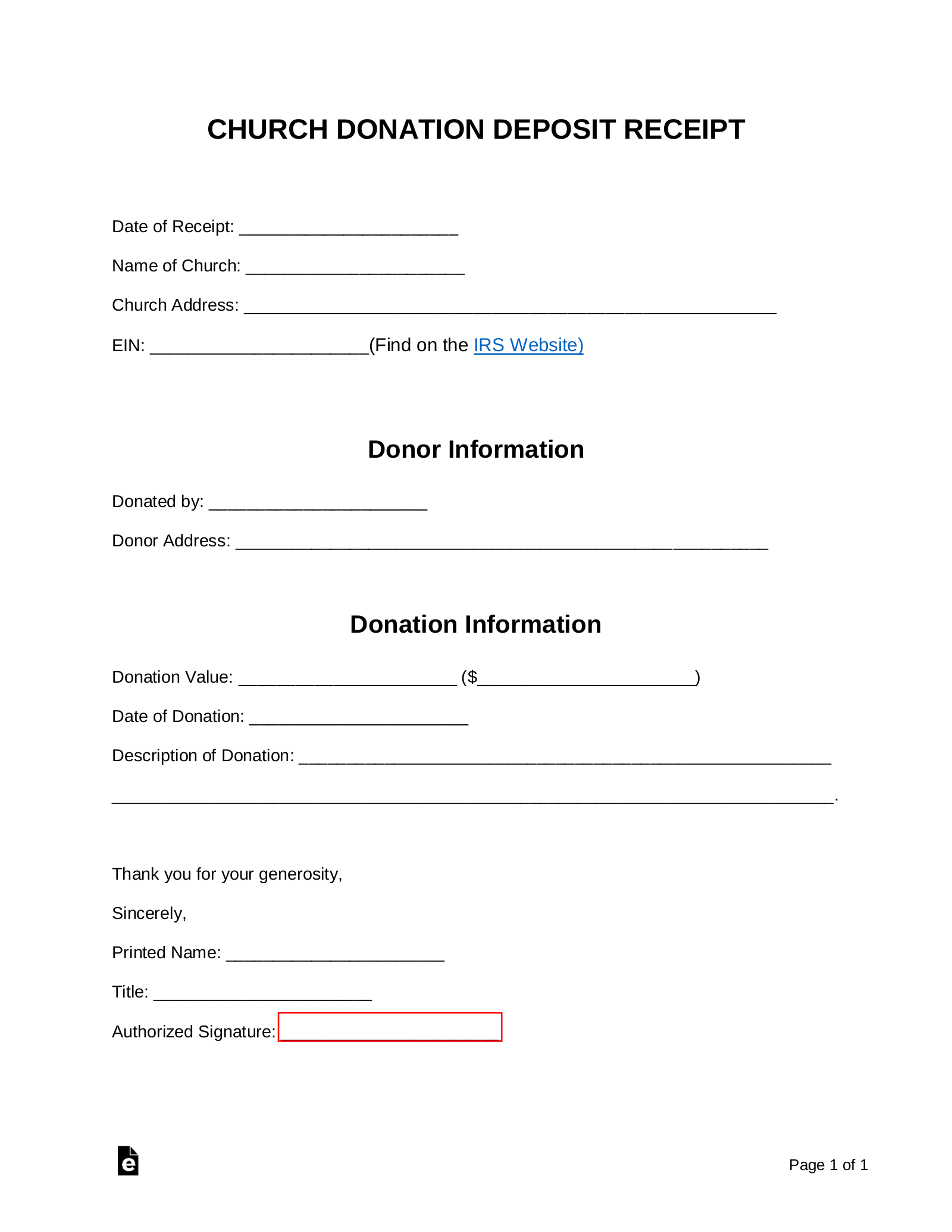

Every payment receipt should clearly display certain fundamental pieces of information to be considered complete and reliable. This includes the full name and contact information of the organization issuing the receipt, ensuring the donor knows exactly who received their contribution. A unique receipt number is critical for tracking and reconciliation, allowing for easy retrieval and referencing of specific transactions. The date of the transaction must be prominent, establishing a clear timeline for financial activities.

Furthermore, the donor’s full name and address are essential, especially for tax-deductible contributions in the US. A detailed description of the contribution, such as "Tithe," "Offering," or "Building Fund Donation," along with the specific amount received in both numerical and written form, helps prevent misunderstandings and ensures accuracy. A clear statement indicating if the donation is tax-deductible (and if goods or services were provided in exchange for the contribution, per IRS guidelines) is also vital for the donor’s record-keeping and tax preparation.

Optimizing for Print and Digital Formats

The design of the template must be optimized for both physical and electronic distribution. For print versions, a clean, uncluttered layout with sufficient white space enhances readability. Using a consistent font style and size ensures clarity, while designated signature lines (for both the issuer and, optionally, the donor) add a layer of authenticity. The template should also be designed to fit standard paper sizes to facilitate easy printing and filing.

For digital versions, accessibility and interactivity are key. The file should ideally be in a universally accessible format like PDF, ensuring it looks consistent across various devices and operating systems. Fillable PDF forms or web-based interfaces can streamline data entry and automatically generate unique receipt numbers. Incorporating digital signatures or secure authentication methods can enhance the integrity of electronic records. Additionally, ensuring the template is mobile-responsive if used via a web portal improves usability for donors and administrators on the go, facilitating instant donation acknowledgment and efficient financial tracking.

Conclusion: The Enduring Value of Precise Financial Records

In conclusion, the strategic implementation of a well-crafted financial template, whether for tithes, services, or other transactions, is an invaluable asset for any organization committed to fiscal responsibility and operational excellence. It transcends the basic function of merely acknowledging a transaction, evolving into a robust instrument for ensuring accuracy, fostering transparency, and maintaining consistency across all financial records. This commitment to meticulous documentation reinforces trust among stakeholders and solidifies the organization’s professional standing.

By providing a standardized framework for every financial interaction, this versatile document simplifies complex record-keeping tasks, reduces the potential for errors, and streamlines the auditing process. Its adaptability for diverse applications—from donation acknowledgment to billing statements and expense records—highlights its utility as a foundational piece of business documentation. Ultimately, it empowers organizations to manage their finances with greater efficiency and clarity, dedicating more resources to their core mission.

Embracing such a reliable, accurate, and efficient financial record tool is not just about compliance; it’s about building a legacy of integrity and accountability. It ensures that every contribution is respected, every transaction is traceable, and every financial report reflects an unwavering commitment to stewardship. This systematic approach is a testament to an organization’s dedication to its community and its future.