In the intricate landscape of modern commerce and financial administration, the diligent recording of every transaction stands as a cornerstone of operational integrity and fiscal responsibility. A merchandise receipt template serves as an indispensable tool in this regard, providing a standardized, clear, and incontrovertible record of goods exchanged or services rendered. Its primary purpose extends beyond mere acknowledgment of payment; it functions as a critical document for accountability, legal compliance, and transparent communication between transacting parties.

This foundational document is pivotal for a broad spectrum of users, from small business owners meticulously tracking sales to large corporations managing complex inventory flows, and even individuals requiring documentation for personal financial records or reimbursements. By codifying transaction details in an organized format, the merchandise receipt template facilitates accurate bookkeeping, simplifies tax preparation, and offers a reliable reference point should any discrepancies arise. Its utility underpins efficient financial management, ensuring clarity and precision in every commercial interaction.

The Imperative of Meticulous Documentation in Financial Transactions

The meticulous documentation of financial transactions is not merely a bureaucratic formality; it is an absolute necessity for any entity engaged in commercial activity. In a business environment characterized by stringent regulatory oversight and high expectations for transparency, comprehensive records provide an essential safeguard. Such documentation offers verifiable proof of every exchange, protecting both the seller and the buyer from potential disputes or misunderstandings.

Beyond dispute resolution, robust documentation is fundamental for legal and tax compliance. Businesses are typically required to maintain detailed records for audit purposes, proving income, expenses, and tax liabilities. Accurate payment receipts and sales records are crucial for satisfying these obligations, mitigating risks of penalties, and ensuring smooth financial operations. Furthermore, well-maintained documentation supports sound internal controls, enabling businesses to monitor performance, identify trends, and make informed strategic decisions.

Core Advantages of a Structured Merchandise Receipt Template

Adopting a structured merchandise receipt template offers a multitude of benefits that extend far beyond simply recording a sale. This standardized approach significantly enhances accuracy, promotes transparency, and ensures consistency across all transactional records, thereby bolstering overall financial management and operational efficiency. It transforms what could be a chaotic process into a streamlined and reliable system.

One of the primary advantages of utilizing a professional merchandise receipt template is the assurance of accuracy. Pre-defined fields guide the user to input all necessary details, minimizing the risk of omission or error that can occur with ad-hoc documentation. This structured input ensures that key information such as item descriptions, quantities, unit prices, taxes, and total amounts are consistently captured correctly, preventing future accounting discrepancies. Moreover, the template fosters transparency by providing both parties with a clear and identical record of the transaction, building trust and clarity in commercial relationships. It clearly delineates what was purchased, for how much, and when, leaving little room for misinterpretation.

Versatility: Customizing the Template for Diverse Applications

The inherent flexibility of a well-designed merchandise receipt template allows for its adaptation across a remarkably diverse range of financial scenarios. While its name suggests a focus on physical goods, the underlying structure and purpose – to document a financial exchange – make it highly customizable for various payment receipts and acknowledgment needs. This adaptability makes the template an invaluable asset for numerous business functions and industries.

For instance, while primarily known as a sales record, the layout can be easily modified to function as a service receipt, detailing hours worked, specific tasks performed, and corresponding fees. It can also be repurposed as a robust invoice form or billing statement for services rendered over a period, providing an itemized breakdown. Landlords frequently adapt the document to serve as a rent payment receipt, clearly stating the period covered, the amount received, and any outstanding balances. Non-profit organizations utilize a tailored version as a donation acknowledgment, providing donors with official proof for tax deduction purposes. Furthermore, corporate finance departments frequently rely on customized versions of this form to process business reimbursements, documenting employee expenses for travel, supplies, or client entertainment. The core elements of sender, recipient, date, description, and amount remain, but the specific details can be adjusted to suit the particular nature of the transaction.

Practical Applications: When to Leverage a Merchandise Receipt Template

Leveraging a merchandise receipt template is most effective in scenarios where a clear, verifiable, and official record of a financial transaction is paramount. The consistent use of such a template ensures that all parties have access to identical information, simplifying record-keeping and minimizing potential points of contention. This structured approach is beneficial in a wide array of commercial and administrative contexts.

Consider the following examples where employing this template is highly advantageous:

- Point-of-Sale Transactions: For any retail or e-commerce business, providing a detailed receipt at the time of purchase is standard practice, confirming the sale and providing proof of transaction for the customer.

- Delivery of Goods or Services: When goods are delivered or a service is completed, a receipt can confirm the successful exchange and payment, serving as an acceptance of delivery and an official service receipt.

- Proof for Warranty Claims and Returns: Customers rely on the receipt to establish proof of purchase date and price when making warranty claims or returning merchandise, streamlining these processes for businesses.

- Tax Deductions and Expense Records: Both businesses and individuals use these documents as critical expense records for tax filings, deductions, and financial audits, validating expenditures.

- Internal Accounting and Reconciliation: Finance departments use the file to reconcile daily sales, track revenue streams, and verify cash flow, ensuring internal accounting accuracy.

- Customer Service Inquiries: In cases of customer queries or disputes regarding purchases, the receipt provides an immediate and definitive reference point to resolve issues efficiently.

- Subscription or Membership Fee Payments: For recurring payments, a clear receipt confirms that a payment has been made for a specific period, preventing misunderstandings about active memberships or subscriptions.

- Contractor and Freelancer Payments: When paying independent contractors or freelancers, this form can serve as an official record of payment for services rendered, aiding both parties in tax preparation.

Design and Usability: Optimizing Your Receipt Template

The efficacy of any financial template is significantly influenced by its design and usability. An optimized receipt template should be intuitive, comprehensive, and adaptable to both digital and print formats, ensuring it serves its purpose efficiently for all users. Careful consideration of layout, content, and accessibility contributes to its overall utility and professionalism.

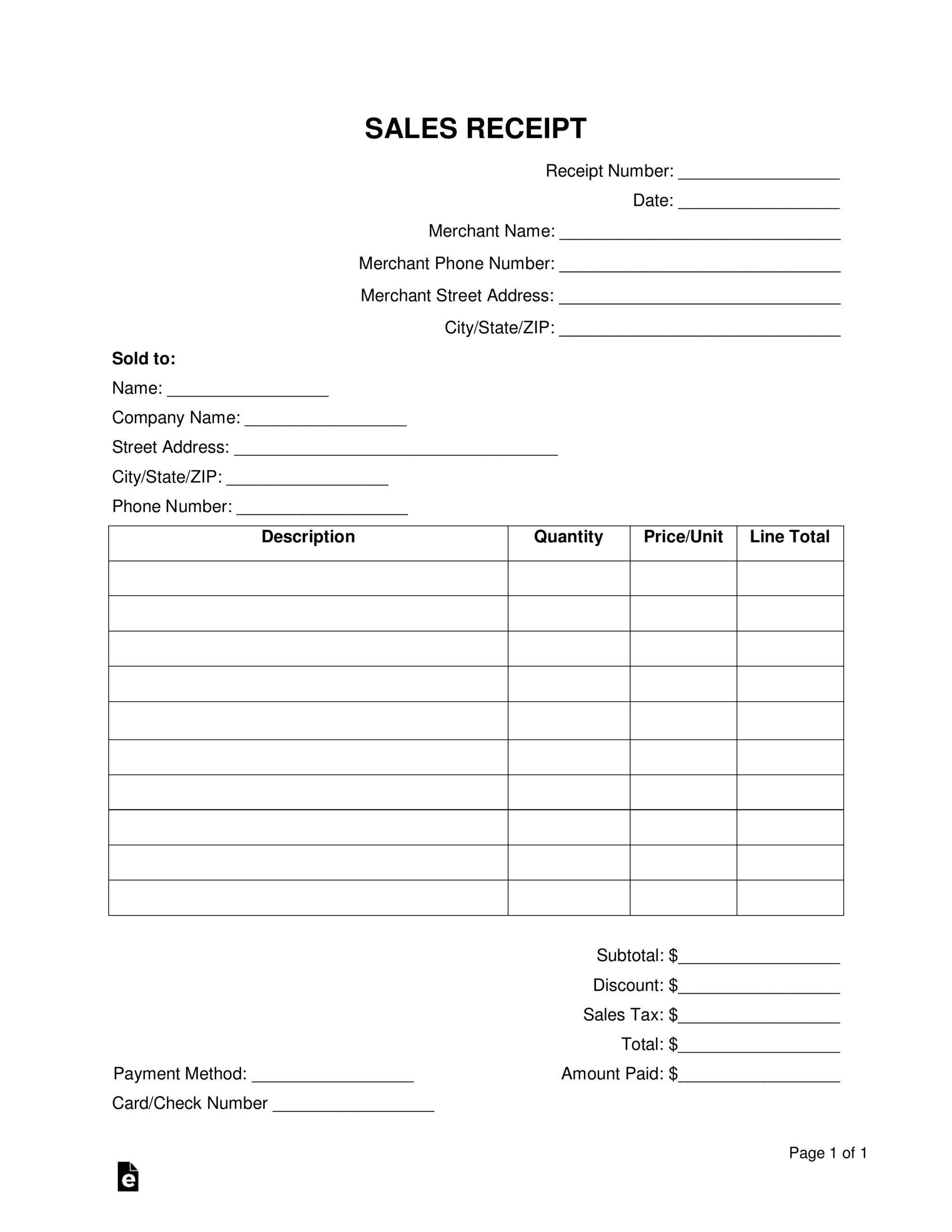

A well-designed template typically includes several key elements to ensure completeness. These include the vendor’s full legal name, address, and contact information, prominently displayed for easy identification. Similarly, the recipient’s name and contact details should be captured accurately. The date and time of the transaction are crucial, along with a unique receipt number for tracking and reference. The core of the document is an itemized list of goods or services, detailing quantity, unit price, and extended price for each item. Subtotals, applicable taxes (e.g., sales tax), discounts, and the final total amount due or paid must be clearly presented. Crucially, the payment method used (cash, credit card, check) should be noted, and space for signatures or official stamps adds an extra layer of authentication. Optional fields for return policies, warranty information, or a personalized message can enhance customer service.

For digital versions, the template should ideally be available in easily shareable and readable formats such as PDF. Digital signatures can enhance security and authenticity. Consideration should be given to responsive design if accessed via mobile devices, ensuring readability and ease of use. For print versions, choosing a durable paper stock and a clear, legible font is essential. Adequate spacing for handwritten notes or additional details, if required, should also be factored into the layout. Branding elements such as a company logo and specific color schemes should be consistently applied to reinforce corporate identity and professionalism. Ultimately, the goal is to create a financial template that is not only robust in its record-keeping capabilities but also user-friendly and visually appealing.

The Future of Transactional Documentation

As technology continues to advance, the landscape of transactional documentation is evolving, with increasing integration of digital solutions. Cloud-based accounting software, mobile payment systems, and blockchain technologies are redefining how financial templates are generated, stored, and verified. However, regardless of the technological medium, the fundamental principles of clarity, accuracy, and immutability remain paramount for any payment receipt or financial template. The shift towards digital documentation emphasizes features such as automated data entry, secure electronic storage, and instant accessibility, further streamlining the process.

The enduring value of a well-structured template lies in its capacity to adapt to these changes while retaining its core function. It serves as the logical blueprint for electronic records, just as it does for paper ones, ensuring that the essential data points for a proof of transaction are never overlooked. This continuous evolution means that the template will remain a vital component in business documentation, regardless of how transactions are physically processed or digitally recorded in the years to come.

In conclusion, the strategic implementation of a robust receipt template is an indispensable practice for sound financial management and effective business communication. This critical financial template provides a standardized, accurate, and transparent record of transactions, serving as irrefutable proof of payment and a cornerstone for reliable accounting. Its versatility allows it to be meticulously customized for various applications, from retail sales and service acknowledgments to rent payments and donation records, proving its adaptability across diverse commercial and organizational contexts.

By ensuring consistency, reducing errors, and facilitating compliance with regulatory requirements, the template fortifies the integrity of financial operations. It not only streamlines record-keeping and simplifies audit processes but also fosters trust and clarity between transacting parties. In a world where precision and accountability are non-negotiable, the template stands as a vital tool, empowering businesses and individuals alike to manage their financial records with confidence and efficiency, solidifying its role as an enduring asset in effective financial documentation.