In the intricate landscape of modern business operations, the integrity and accuracy of financial documentation are paramount. A purchase order receipt template serves as a foundational tool in this regard, providing a standardized, verifiable record of transactions. This essential document bridges the gap between a confirmed purchase order and the actual delivery or completion of goods and services, ensuring that all parties possess clear proof of the transaction’s fulfillment.

The utility of a robust purchase order receipt template extends across various organizational structures, from bustling enterprises managing complex supply chains to small businesses meticulously tracking expenses and revenue. It is an indispensable asset for financial controllers, procurement managers, accounting departments, and even individual entrepreneurs who rely on precise record-keeping for fiscal health and operational transparency. By standardizing the acknowledgment process, it significantly streamlines financial reconciliation, audit preparations, and dispute resolution, fostering an environment of trust and accountability.

The Indispensable Value of Clear Financial Documentation

The bedrock of sound financial management rests upon the clarity and accuracy of its documentation. In business, every transaction, no matter how minor, contributes to a larger financial narrative that must be meticulously recorded and easily auditable. Professional and unambiguous documentation, such as a comprehensive payment receipt or an official sales record, mitigates risks associated with discrepancies, errors, and potential fraud. It provides an undeniable proof of transaction, crucial for legal and financial compliance.

Beyond mere compliance, well-structured business documentation enhances operational efficiency. It enables rapid retrieval of information, supports informed decision-making, and strengthens internal controls. For external stakeholders, including auditors, investors, and regulatory bodies, precise financial records signify a well-managed and transparent organization. Such documentation is not just a formality; it is a strategic asset that underpins trust, reliability, and long-term financial stability.

Key Benefits of Structured Templates for Financial Records

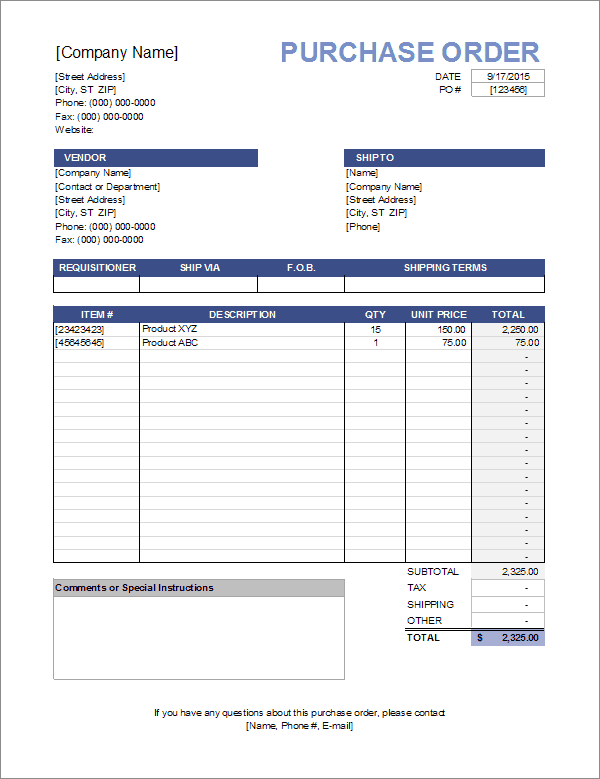

Adopting structured templates for critical financial records, particularly for acknowledging purchase order fulfillment, offers a multitude of strategic advantages. Foremost among these is the assurance of accuracy and completeness. A well-designed template incorporates all necessary fields, prompting users to capture every detail, from vendor information and item specifics to quantities, prices, and delivery dates. This systematic approach drastically reduces the likelihood of missing crucial data points, thereby preventing errors that could lead to financial discrepancies or operational delays.

Furthermore, using a well-designed purchase order receipt template significantly enhances transparency and consistency in record-keeping. When every receipt adheres to a uniform format, it creates a predictable and easily decipherable paper trail. This consistency simplifies the reconciliation process, allowing accounting departments to quickly match receipts against purchase orders and invoices. Such standardization also reinforces internal controls, as deviations from the established format become readily apparent, flagging potential issues for immediate review. The clear structure provided by this type of document cultivates a culture of meticulous record-keeping, essential for maintaining financial integrity and supporting efficient business processes.

Customizing the Template for Diverse Business Applications

The inherent flexibility of a well-designed receipt template allows it to be adapted for a wide array of specific business applications, extending its utility far beyond typical procurement acknowledgments. Its core structure, which typically includes fields for date, recipient, issuer, and transaction details, can be readily customized to suit distinct operational needs. This adaptability makes it an invaluable financial template for various sectors and transactional types.

For instance, in a sales context, the form can transform into a detailed sales record, incorporating fields for product SKUs, unit prices, sales tax, and total amounts, serving as an official invoice form. For service providers, it becomes a service receipt, detailing the type of service rendered, hours worked, hourly rates, and specific deliverables. Non-profit organizations can customize it into a donation acknowledgment, clearly stating the date, donor’s name, amount contributed, and any relevant tax-deductible information, fulfilling IRS requirements for charitable contributions. Similarly, businesses can tailor it for expense record purposes, facilitating employee reimbursements by outlining itemized expenses, dates incurred, and proof of payment, streamlining the process of tracking business documentation. The ability to modify fields, add logos, and adjust the layout ensures that the template remains relevant and effective across a diverse range of financial transactions.

When to Utilize a Purchase Order Receipt Template

Effectively employing a purchase order receipt template is critical for organizations striving for robust financial accountability and seamless operational flow. It serves as a definitive confirmation that goods or services ordered via a purchase order have been received or completed according to specifications. Below are specific scenarios where leveraging this template is most effective:

- Upon Delivery of Goods: When a shipment of raw materials, components, or finished products arrives from a supplier, this form is used to confirm the receipt of items against the original purchase order. It details quantities, item descriptions, and any discrepancies, serving as a critical proof of transaction.

- Completion of Services: After a vendor or contractor has completed a service, such as IT support, consulting, or maintenance work, the template acknowledges the successful delivery of that service. It outlines the scope of work, dates performed, and confirmation of satisfaction, functioning as a comprehensive service receipt.

- Rent or Lease Payments: For businesses managing properties or equipment leases, the document can serve as a payment receipt for rent or lease installments. It clearly states the period covered, the amount paid, and the property or asset involved, providing vital business documentation.

- Charitable Contributions: Non-profit organizations utilize a customized version as a donation acknowledgment for contributions received. This helps donors with tax filings and provides the organization with an accurate record of incoming funds, aligning with requirements for a donation acknowledgment.

- Business Expense Reimbursements: When employees submit expenses for reimbursement, this form can be adapted as an expense record, detailing the nature of the expense, amount, and date incurred. It ensures transparency and proper classification of company expenditures.

- Internal Transfers of Goods: Even for internal transfers between departments or warehouses within a large organization, using the template ensures accountability and an accurate inventory record of items moved, preventing losses and facilitating stock management.

- Advance Payments or Deposits: For situations requiring an initial payment or deposit, the receipt provides formal acknowledgment of the funds received. This is crucial for project initiation or securing services, acting as an upfront payment receipt.

In each of these instances, the systematic capture of information provided by the template helps to validate transactions, supports financial audits, and reduces the potential for disputes, making it an indispensable component of financial operations.

Tips for Design, Formatting, and Usability

Creating a purchase order receipt template that is both functional and aesthetically pleasing requires attention to design, formatting, and overall usability. The goal is to produce a document that is clear, easy to complete, and simple to understand for all stakeholders, whether in print or digital format. A well-designed layout contributes significantly to professional communication and efficient record-keeping.

Clarity and Organization:

- Logical Flow: Arrange fields in a logical sequence, typically starting with general information (date, receipt number) and progressing to specific transaction details (item descriptions, quantities, prices).

- Clear Headings and Labels: Use concise and unambiguous headings for sections and labels for individual fields. This prevents confusion and ensures accurate data entry.

- Ample White Space: Incorporate sufficient white space around text and fields to improve readability and reduce visual clutter. This makes the document less intimidating and easier to process.

Formatting for Professionalism:

- Consistent Branding: Include your company’s logo, contact information, and branding colors. This reinforces your professional image and ensures immediate recognition.

- Legible Fonts: Choose professional, easy-to-read fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size. Avoid overly decorative or small fonts that hinder readability.

- Structured Sections: Use clear lines, boxes, or subtle shading to delineate different sections, such as "Sender Information," "Recipient Information," "Transaction Details," and "Authorization."

Usability for Print and Digital:

- Print-Friendly Design: Ensure the template is designed to print cleanly on standard paper sizes without cutting off information or appearing distorted. Consider ink usage if printing in bulk.

- Digital Form Fields: For digital versions (e.g., PDF forms), incorporate interactive form fields that allow users to type directly into the document. This improves efficiency and reduces errors.

- Date Pickers and Dropdowns: Utilize features like date pickers and dropdown menus for standardized entries where applicable (e.g., payment methods, item categories). This minimizes manual input errors and ensures consistency.

- Signatures: Include dedicated spaces for authorized signatures (digital or physical) to signify approval and acknowledgment of receipt. This adds a layer of authenticity and accountability.

- File Naming Conventions: Encourage consistent file naming conventions for digital versions to facilitate easy retrieval and organization within an electronic filing system.

By adhering to these design and formatting principles, organizations can create a receipt template that not only fulfills its functional purpose but also elevates their commitment to professional and efficient business communication.

The Enduring Value of a Reliable Financial Record Tool

In conclusion, the purchase order receipt template stands as a testament to the power of structured documentation in fostering financial integrity and operational efficiency. It transcends the basic function of a simple acknowledgment, evolving into a multifaceted tool that underpins accuracy, transparency, and consistency across diverse business transactions. From verifying the delivery of goods to formalizing service completion or acknowledging charitable donations, this template ensures that every financial interaction is meticulously recorded and readily auditable.

Embracing this robust financial template enables organizations to streamline their accounting practices, mitigate risks associated with discrepancies, and build a resilient framework for compliance and reporting. Its adaptability across various scenarios — as a payment receipt, an expense record, or a sales record — underscores its versatility and indispensable role in modern financial management. Ultimately, leveraging a well-designed purchase order receipt template is not merely about creating a document; it’s about investing in a reliable, accurate, and efficient system that empowers businesses to maintain impeccable financial health and navigate the complexities of commerce with confidence.