In the intricate landscape of financial transactions and philanthropic endeavors, the importance of precise and professionally presented documentation cannot be overstated. For individuals and organizations alike, clear record-keeping is not merely a formality; it is a fundamental pillar of accountability, transparency, and legal compliance. When it comes to charitable giving, this principle takes on particular significance, as both donors and recipient non-profits rely heavily on accurate records for tax purposes and internal auditing.

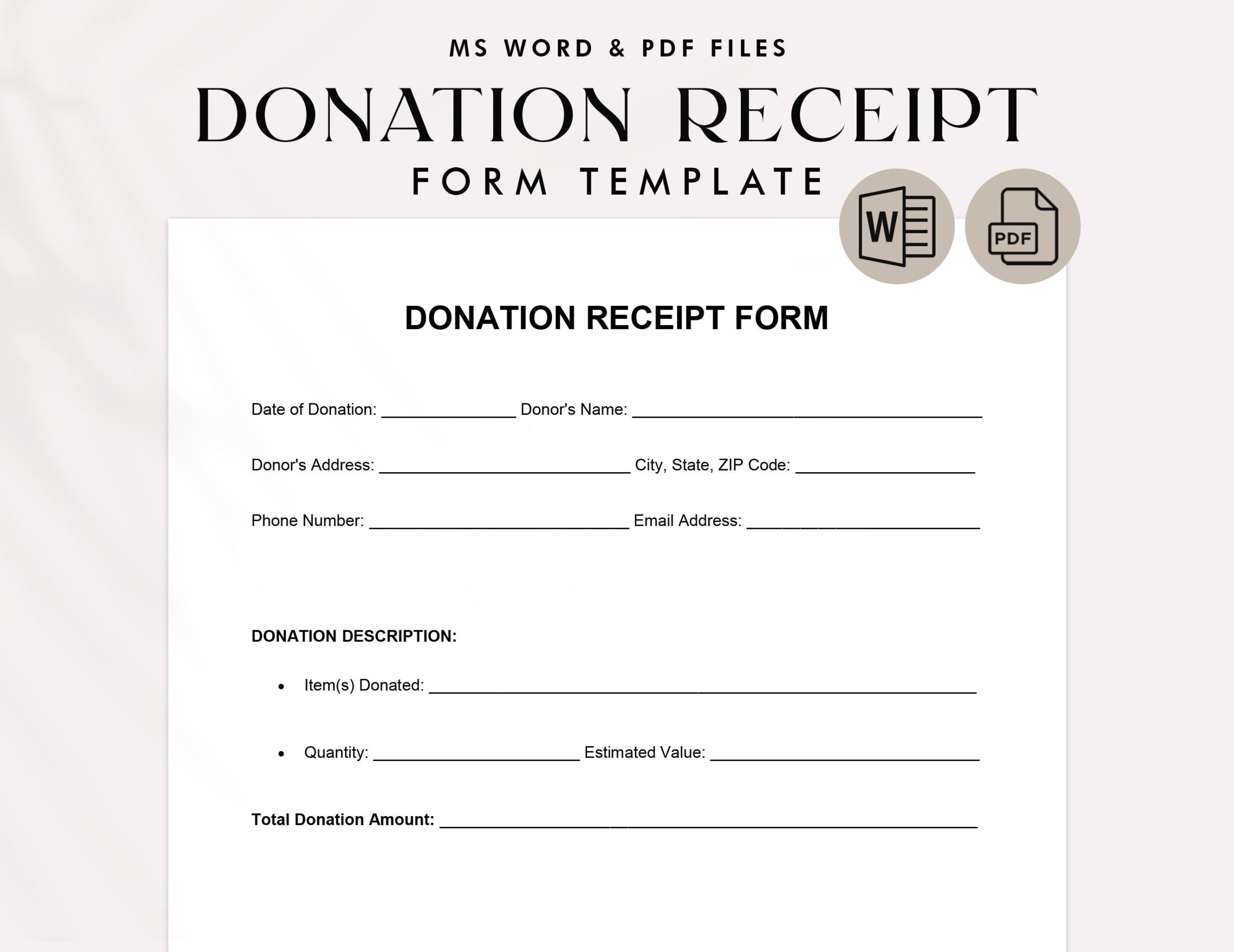

A meticulously crafted charitable contribution receipt template serves as an indispensable tool in this regard. It provides a standardized, authoritative acknowledgment of a donation, detailing critical information required by tax authorities and ensuring that both parties have a clear, undisputed record of the transaction. This foundational document benefits donors by providing the necessary proof for tax deductions and assists non-profit organizations in maintaining impeccable financial records, fostering trust, and demonstrating sound stewardship of funds.

The Imperative of Meticulous Financial Documentation

Effective financial and business communication hinges upon the clarity and professionalism of its underlying documentation. Every transaction, whether large or small, requires a reliable paper or digital trail to validate its occurrence, quantify its value, and attribute it correctly. Such robust documentation is critical for internal accounting, external audits, regulatory compliance, and dispute resolution. Without it, organizations risk financial discrepancies, legal challenges, and a significant erosion of stakeholder trust.

Professional documentation also reflects positively on an organization’s operational standards. It communicates an attention to detail and a commitment to transparency that resonates with donors, clients, and partners. A well-structured payment receipt or proof of transaction not only fulfills a legal requirement but also reinforces an entity’s credibility and ethical posture in the marketplace. This professional approach underpins all successful financial interactions, from simple sales records to complex billing statements.

Core Advantages of a Structured Receipt Template

Utilizing a structured template for a charitable contribution receipt template offers a multitude of key benefits that extend beyond simple record-keeping. Foremost among these is the assurance of accuracy. A predefined layout guides the user to input all necessary data fields, significantly reducing the likelihood of omissions or errors that could invalidate the document for tax purposes or create accounting headaches.

Furthermore, a standardized layout promotes transparency and consistency. Every donation acknowledgment issued by an organization will bear a consistent look and include identical categories of information, fostering clarity for both internal financial management and external stakeholders. This consistency builds donor confidence and streamlines the auditing process. Ultimately, employing such a financial template enhances the overall integrity of an organization’s financial operations, making it an invaluable asset for any entity regularly receiving contributions.

Versatility and Customization Across Various Transactions

While the primary focus of this discussion centers on charitable contributions, the underlying principles of a well-designed receipt template are universally applicable across a broad spectrum of financial transactions. The adaptable nature of such a document allows it to be readily customized for diverse purposes, transforming it from a mere donation acknowledgment into a versatile business documentation tool. The fundamental layout and data fields can be adjusted to suit distinct operational needs.

For instance, this form can be adapted to function as a payment receipt for services rendered, a sales record for goods sold, or even an expense record for business reimbursements. Essential elements like transaction date, amount, recipient, and description of goods or services can be modified to reflect specific transaction types. The strategic use of the template ensures that every financial exchange is documented with the same level of precision and professionalism, regardless of its specific context, making it a powerful and flexible financial template.

Optimal Scenarios for Employing a Receipt Template

The strategic deployment of a well-designed receipt template is crucial for maintaining financial integrity and operational efficiency across numerous contexts. Its structured format ensures that all necessary information is captured, providing clear proof of transaction for various stakeholders.

Here are examples of when using this template is most effective:

- Charitable Donations: Providing official documentation for cash or in-kind donations, crucial for donor tax deductions and non-profit compliance. This is where the charitable contribution receipt template excels, ensuring all IRS-mandated information is present.

- Sales of Goods: Issuing clear sales records for products purchased, detailing items, quantities, prices, and total amounts, serving as a payment receipt for customers and internal inventory management.

- Provision of Services: Documenting the completion and payment for services, outlining the service provided, date, cost, and any specific terms, acting as a service receipt for client and provider.

- Rent Payments: Acknowledging rent received for properties, ensuring both landlord and tenant have a record of the payment date, amount, and period covered, critical for lease agreements.

- Business Reimbursements: Recording payments made to employees or contractors for approved expenses, detailing the expense type, amount, and date, vital for expense record keeping and auditing.

- Event Ticket Sales: Providing proof of purchase for event admissions, detailing ticket type, price, and event information.

- Membership Dues: Confirming the payment of membership fees for clubs, associations, or subscriptions, including the membership period.

- Consulting Fees: Formalizing the receipt of payments for professional consulting services, outlining the scope of work and payment terms.

- Loan Repayments: Documenting installments made on a loan, including the principal and interest breakdown, for both borrower and lender records.

- Subscription Renewals: Acknowledging recurring payments for software, magazines, or other subscription-based services.

Each of these scenarios benefits immensely from the consistency and reliability that a standardized receipt template provides, reinforcing trust and streamlining financial processes.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template is significantly influenced by its design, formatting, and overall usability, whether in print or digital form. A well-designed layout should prioritize clarity and ease of comprehension, ensuring that critical information is immediately identifiable. This requires thoughtful consideration of typography, spacing, and the logical arrangement of data fields.

For both print and digital versions, consistency in branding is essential. Integrating an organization’s logo, color scheme, and contact information not only professionalizes the document but also reinforces brand identity. When designing the template, ensure that all fields are clearly labeled, ideally with examples or guidance where complex information is required. For digital versions, features like auto-fill capabilities, dropdown menus for standardized entries (e.g., payment methods), and date pickers can dramatically improve efficiency and reduce input errors.

Usability also extends to accessibility. The template should be easily printable, with adequate margins and a legible font size. For digital distribution, ensure the file format is widely compatible (e.g., PDF) and that the document is accessible for users with disabilities, adhering to web content accessibility guidelines where applicable. The goal is to create a receipt that is not just legally compliant, but also user-friendly and aesthetically pleasing, reinforcing the professional image of the issuing entity. Simplicity in design, coupled with comprehensive data fields, ensures that the document serves its purpose effectively without overwhelming the user or recipient.

The Enduring Value of Structured Financial Records

In conclusion, the strategic implementation of a specialized template for financial records stands as a testament to an organization’s commitment to precision, transparency, and accountability. Far more than a mere formality, this foundational document acts as a reliable, accurate, and efficient tool in the complex world of financial management. It not only safeguards an organization against potential discrepancies but also builds a strong foundation of trust with all stakeholders, from donors and clients to auditors and regulatory bodies.

By standardizing the process of documenting transactions, from a simple payment receipt to a detailed expense record, organizations can significantly streamline their administrative tasks and enhance operational efficiency. The consistent format ensures that all vital information is captured accurately, providing undeniable proof of transaction and simplifying financial reconciliation. This proactive approach to record-keeping is an investment in an organization’s financial health and reputation.

Ultimately, the comprehensive benefits derived from adopting a professional financial template extend across an organization’s entire operational spectrum. It facilitates impeccable internal accounting, simplifies external audits, ensures adherence to tax regulations, and strengthens relationships through clear communication. In an environment where financial scrutiny is ever-increasing, leveraging such a robust system is not just good practice—it is an indispensable component of effective and ethical business conduct.