In the intricate landscape of modern business operations, meticulous record-keeping stands as a cornerstone of financial integrity and operational efficiency. For businesses of all sizes, accurately documenting sales transactions is not merely a procedural requirement but a fundamental practice that underpins fiscal health, compliance, and customer satisfaction. A sales receipt serves as tangible proof of a transaction, providing essential details for both the seller and the buyer.

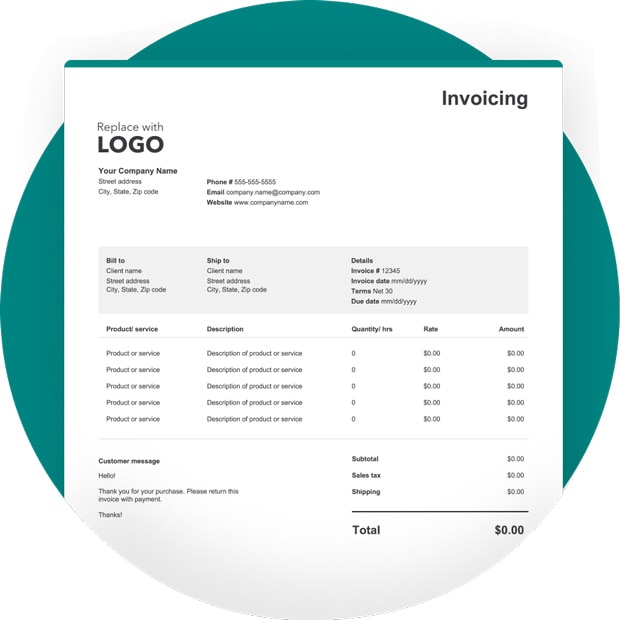

For entities leveraging QuickBooks, the widely adopted accounting software, utilizing a quickbooks sales receipt template is paramount for streamlining this critical process. This article delves into the significance of a well-structured sales receipt, exploring its benefits, customization options, and best practices for implementation within the QuickBooks ecosystem. It is designed for business owners, accountants, and administrative staff seeking to enhance their financial documentation processes through clarity, consistency, and professional presentation.

The Importance of Clear and Professional Financial Documentation

Professional financial documentation is not merely a formality; it is a vital component of robust business management. Clear and accurate records provide an irrefutable trail of financial activities, essential for internal auditing, tax compliance, and dispute resolution. Without well-maintained documentation, businesses risk operational inefficiencies, potential legal challenges, and a compromised ability to track their financial performance accurately.

A professionally crafted receipt or invoice form reflects positively on a business’s credibility and reliability. It assures customers of transparency and accountability, fostering trust and repeat business. Conversely, poorly organized or incomplete documentation can lead to confusion, errors, and a perception of unprofessionalism, potentially damaging client relationships and undermining a company’s reputation. Establishing a standardized approach to sales records is therefore indispensable for maintaining long-term business success and financial health.

Key Benefits of Structured Templates for Financial Records

Implementing structured templates for financial records, particularly for sales transactions, offers a multitude of benefits that extend beyond mere record-keeping. A well-utilized quickbooks sales receipt template ensures uniformity across all transactions, reducing the likelihood of human error and enhancing the overall accuracy of financial data. This consistency is crucial for generating reliable financial reports, which are vital for strategic decision-making and performance analysis.

Moreover, these templates significantly contribute to transparency in business dealings. Every transaction is clearly itemized, detailing goods or services provided, quantities, prices, taxes, and total amounts. This level of detail provides a clear proof of transaction for both parties. Furthermore, employing a consistent layout aids in quicker processing times for administrative tasks, as staff become familiar with the format and location of key information. This efficiency translates into cost savings and allows resources to be allocated to more strategic initiatives, ultimately bolstering the business’s operational agility and financial integrity.

Customizing the Template for Diverse Business Applications

The utility of a standardized template extends significantly through its capacity for customization, adapting to the unique requirements of various business transactions. The quickbooks sales receipt template offers unparalleled flexibility, allowing businesses to tailor the document to accurately reflect the nature of their sales, services, or other financial acknowledgments. This adaptability ensures that while the underlying structure remains consistent, the specific details pertinent to each transaction type are prominently featured.

For instance, a retail business might emphasize product SKUs and quantities, while a service provider would prioritize service descriptions and hourly rates. Rental businesses can configure the layout to include property details and lease terms, and non-profit organizations can adapt it into a donation acknowledgment, clearly stating the charitable contribution and tax-deductible amount. This customization capability ensures that each financial template serves its specific purpose effectively, maintaining clarity and relevance across all business documentation.

Examples of When Using a Sales Receipt Template Is Most Effective

Utilizing a dedicated sales receipt template is particularly effective in scenarios requiring immediate proof of purchase or payment acknowledgment, where a full invoice with payment terms isn’t necessary. This concise financial template is ideal for transactions completed at the point of sale or when payment is received upfront.

- Retail Product Sales: For physical or digital goods sold directly to consumers, providing a detailed breakdown of items purchased, prices, and total amount paid. This serves as a vital sales record for both customer and business.

- Service Payments: When clients pay for services rendered immediately upon completion, such as consulting fees, repairs, or professional appointments. This confirms the service receipt and amount received.

- Rental Income: Acknowledging the receipt of rent payments from tenants, clearly stating the period covered and the amount received. This acts as an official payment receipt for landlords and tenants.

- Donations and Contributions: For non-profit organizations, generating a donation acknowledgment for charitable contributions received, which is crucial for donor records and tax purposes.

- Business Reimbursements: Documenting internal reimbursements for employee expenses, ensuring clear expense records and audit trails within the company’s financial template.

- Small Cash Transactions: For any instance where a quick, formal record of a cash payment is needed without the complexity of a full billing statement or an invoice form.

These examples highlight the versatility of the document, demonstrating its critical role in maintaining accurate and transparent business documentation across diverse operational contexts.

Tips for Design, Formatting, and Usability

The effectiveness of any financial document is significantly influenced by its design, formatting, and overall usability, whether in print or digital form. A well-designed receipt enhances the professional image of a business and ensures that critical information is easily digestible for all parties involved.

Clarity and Readability

Prioritize a clean, uncluttered layout. Use legible fonts (e.g., Arial, Calibri, Times New Roman) in appropriate sizes to ensure easy readability. Headings and subheadings should clearly differentiate sections, guiding the eye through the document. Essential details such as transaction date, unique receipt number, customer information, itemized list of goods/services, quantities, unit prices, taxes, and the total amount paid should be immediately apparent.

Branding and Professionalism

Incorporate your company’s logo, branding colors, and contact information prominently at the top of the receipt. Consistent branding across all business documentation reinforces your professional identity and makes the receipt instantly recognizable. Ensure the contact details are current, including phone number, email, and physical address, for any follow-up inquiries.

Essential Fields and Customization

Identify and include all necessary fields for your specific business operations. QuickBooks allows for significant customization of fields. Consider adding a section for payment method (e.g., cash, credit card, check), transaction ID, and any special notes or terms of sale. For digital versions, ensure all fields are fillable and data entry is intuitive.

Digital vs. Print Considerations

For digital versions, optimize the file format for easy sharing and archival. PDF is generally preferred for its universal compatibility and secure rendering. Ensure the document is responsive if viewed on various devices. For print, design the layout to be economical with paper while retaining all necessary information. Consider the possibility of printing multiple copies for internal records and customer copies. Ensure adequate margins for stapling or filing.

Accessibility and Archival

Design the receipt with accessibility in mind, using high contrast for text and background. For long-term usability, ensure that the file naming convention for digital receipts is consistent and logical, facilitating easy retrieval. Implement a robust archival system, whether cloud-based or local, to ensure that all financial templates and records are securely stored and readily accessible for future reference, audits, or customer inquiries. This proactive approach to business documentation safeguards against data loss and ensures continuity.

Concluding Thoughts on Financial Record Management

The diligent management of financial records stands as an indispensable pillar of a thriving business. A precisely utilized and thoughtfully customized sales record, such as the one offered by QuickBooks, transcends its basic function as a mere acknowledgment of payment. It evolves into a powerful tool that upholds accountability, enhances transparency, and fortifies the operational backbone of any enterprise. By systematizing the creation of every payment receipt, businesses not only comply with regulatory requirements but also cultivate an environment of trust with their clientele.

Ultimately, investing in the careful implementation and consistent application of a reliable financial template like this ensures that every transaction is impeccably documented. This commitment to accuracy and professionalism minimizes discrepancies, streamlines accounting processes, and provides a clear, defensible record for all stakeholders. The result is a more organized, efficient, and credible business operation, poised for sustained growth and financial stability in an ever-evolving market.