In any financial transaction, precision and clarity are paramount. This holds especially true in the realm of automotive sales, where significant investments are made, and ownership changes hands. A robust and meticulously structured used car sales receipt template serves as the foundational pillar for transparent and legally sound transactions, protecting both the buyer and the seller. It acts as an official record, detailing the specifics of the exchange and providing tangible proof of purchase.

The primary purpose of such a comprehensive used car sales receipt template is to formalize the agreement made between parties, ensuring all critical information related to the vehicle, payment, and participants is accurately captured. This document is not merely a formality; it is an indispensable tool that benefits individuals engaging in private sales, independent dealerships, and even larger enterprises managing trade-ins or disposals. By standardizing the information captured, it significantly reduces the potential for misunderstandings or disputes arising post-transaction.

The Importance of Clear and Professional Documentation in Financial and Business Transactions

Clear and professional documentation is a cornerstone of effective business communication and sound financial practice. In the absence of well-structured records, even straightforward transactions can become sources of confusion, legal challenges, or financial discrepancies. A professional payment receipt or invoice form establishes credibility, demonstrating a commitment to ethical and organized business operations. This level of detail helps build trust between transacting parties.

Beyond fostering trust, comprehensive business documentation serves critical legal and regulatory functions. It provides an undeniable proof of transaction, essential for resolving disputes, substantiating tax filings, and complying with various industry regulations. Accurate sales records, service receipts, and billing statements are indispensable for internal financial tracking, auditing processes, and strategic business analysis. They transform abstract agreements into concrete, verifiable data points that underpin operational stability and growth.

Key Benefits of Using Structured Templates for Used Car Sales Receipt Template

Adopting structured templates for a used car sales receipt template offers numerous advantages that extend far beyond simply recording a sale. These forms are designed to streamline the documentation process, ensuring that every essential detail is consistently captured across all transactions. This standardization is crucial for maintaining professional integrity and operational efficiency within any sales environment.

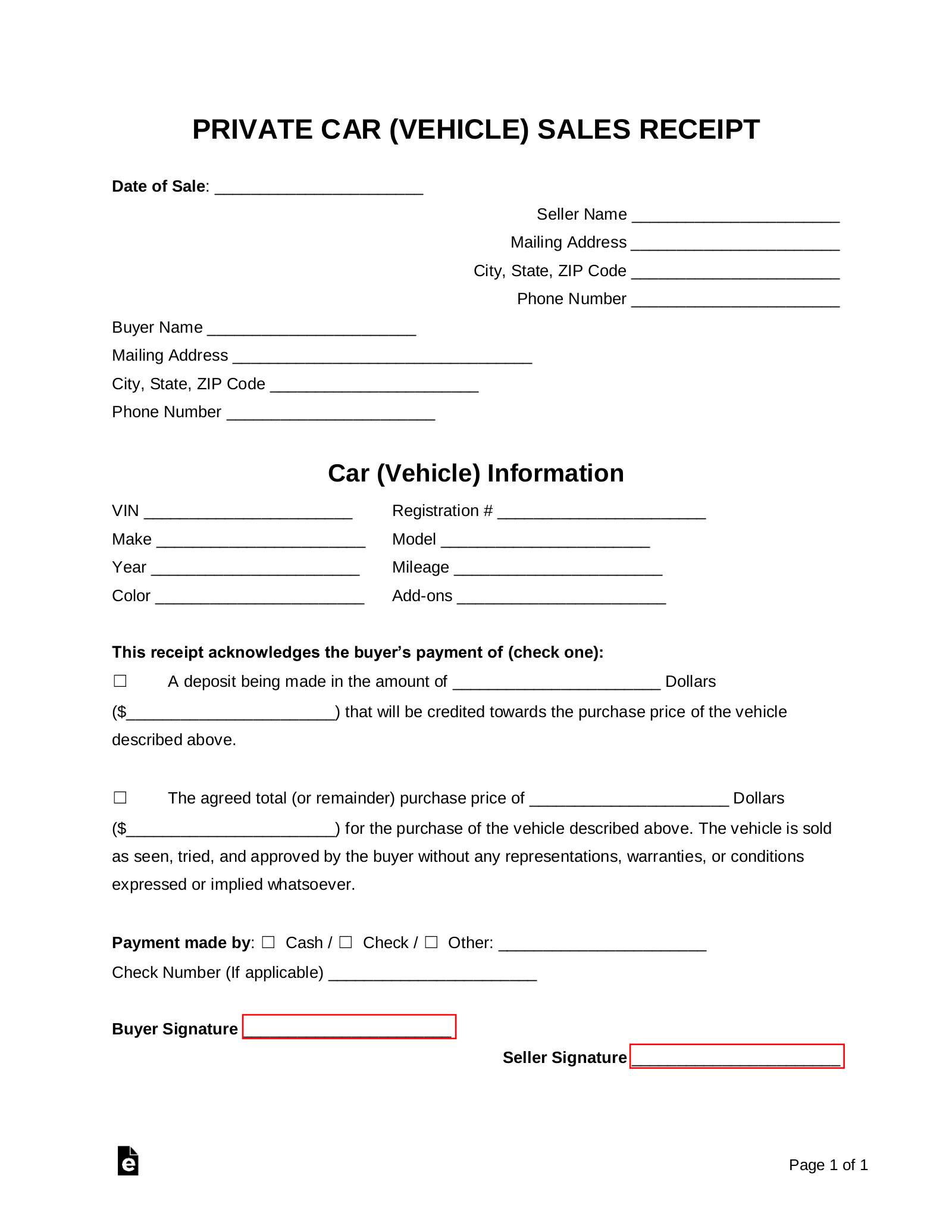

Firstly, such a template significantly enhances accuracy. By providing predefined fields for critical information—such as vehicle identification numbers (VIN), mileage, purchase price, and buyer/seller details—it minimizes the risk of omission or error that might occur with less structured methods. This consistency in record-keeping is vital for reliable financial reporting and inventory management. Secondly, it promotes transparency. A well-designed template clearly itemizes all components of the transaction, including any taxes, fees, or additional agreements, leaving no room for ambiguity. This clarity builds confidence among buyers and provides sellers with a verifiable account of the sale. Finally, consistency is a major benefit. When every transaction follows the same documentation protocol, it simplifies record retrieval, facilitates internal audits, and ensures compliance with legal requirements across the board.

Customizing the Template for Diverse Applications

While the core functionality of a sales receipt is to document a transaction, the underlying structure of a robust financial template is remarkably adaptable. The principles guiding the design of a used car sales receipt can be readily applied and customized for a wide array of other financial and business purposes. This versatility makes the initial investment in a quality layout highly cost-effective, as it can serve multiple departments or business needs.

For instance, the fundamental layout can be easily modified to serve as a general sales receipt for various goods, a detailed service receipt for repair work or consultations, or even a specialized donation acknowledgment for non-profit organizations. By simply adjusting the field labels and specific sections, the document can effectively track rent payments, document business reimbursements for employees, or act as an official expense record. This adaptability streamlines documentation processes across an organization, ensuring that all financial records maintain a consistent level of professionalism and detail, irrespective of their specific application. The robust framework of a well-designed financial template supports numerous transactional requirements.

Examples of When Using a Used Car Sales Receipt Template is Most Effective

The application of a comprehensive used car sales receipt template is particularly impactful in scenarios where clear, verifiable proof of transaction and ownership transfer is paramount. Its structured nature ensures that all necessary information is collected, significantly reducing potential disputes and simplifying record-keeping. Utilizing such a specific document is invaluable in several key situations:

- Private Party Car Sales: When an individual sells a vehicle directly to another, this form provides a formal record of the sale, detailing the vehicle’s condition, agreed-upon price, and transfer of ownership. It protects both parties by documenting the precise terms of the transaction.

- Dealership Used Vehicle Transactions: Even established dealerships benefit from a standardized format for their sales records, ensuring consistency across their inventory and sales teams. This promotes compliance and provides a uniform customer experience.

- High-Value Asset Transfers: While specifically for cars, the template’s structure is also effective for other high-value personal property sales, adapting to require specific identification details for those items.

- Proof for Tax Purposes: Accurate documentation of vehicle sales is often required for tax filings, particularly concerning capital gains or sales tax calculations, making the receipt an essential financial record.

- Insurance and Registration: New owners require a robust payment receipt to register the vehicle with the Department of Motor Vehicles (DMV) and obtain insurance, confirming their legal ownership.

- Fleet Management and Disposals: Businesses managing vehicle fleets use this document to formalize the sale or disposal of company vehicles, maintaining clear audit trails for asset management.

Tips for Design, Formatting, and Usability

The effectiveness of any financial template hinges not just on its content but also on its design, formatting, and overall usability. A well-designed receipt should be intuitive, professional, and functional, whether it’s a print or digital version. Attention to these details enhances clarity and minimizes errors during completion.

For print versions, legibility is paramount. Use clear, professional fonts that are easily readable, and ensure adequate spacing between fields to prevent a cluttered appearance. Quality paper stock can elevate the perceived professionalism and durability of the document. Consider incorporating features like carbon copies or duplicate sheets, allowing both parties to receive an original signed copy instantly. Branding elements, such as a company logo and contact information, should be subtly integrated to reinforce professional identity without distracting from the transaction details.

For digital versions, the focus shifts to interactivity and accessibility. Design the form with fillable fields using common software like Adobe PDF or Microsoft Word, making it easy to complete electronically. Implement digital signature capabilities, ensuring legal validity and convenience. Cloud-based storage and sharing options enhance accessibility and provide secure backups, while access controls can protect sensitive information. Ensure the template is compatible with various devices and offers options to export data to different formats, such as PDF for archiving or CSV for integration with accounting software. Emphasizing logical flow and clear instructions within the digital template will significantly improve user experience and data accuracy.

A professional layout, whether printed or digital, serves as a testament to the meticulousness of the parties involved. It reinforces the integrity of the business documentation and ensures that the proof of transaction is clear, unambiguous, and easily retrievable when needed. Adherence to these design principles transforms a simple form into a powerful tool for effective business communication.

Conclusion

In an environment where clarity and accountability are non-negotiable, the value of a meticulously crafted financial template cannot be overstated. From private sales to commercial transactions, this document stands as a testament to transparency and precision, establishing a clear and undisputed record of the exchange. It effectively mitigates potential disputes, simplifies tax obligations, and provides an unassailable proof of transaction for all parties involved, solidifying the agreement made.

Ultimately, embracing a standardized and professional layout for sales records is an investment in operational efficiency, legal compliance, and customer confidence. It streamlines the documentation process, ensuring that every financial detail is accurately captured and readily accessible. This dedication to robust business documentation ensures that every sale is not just a transaction, but a clearly defined and securely recorded agreement, reflecting the highest standards of financial integrity.