In the intricate landscape of modern business and financial interactions, the formal acknowledgment of receipt serves as a cornerstone for maintaining clarity, accountability, and trust. This vital document confirms that a specific item, payment, or communication has been received by the intended party, effectively eliminating ambiguity and providing a verifiable record. Utilizing a well-structured acknowledgment of receipt template is not merely a courtesy; it is a strategic imperative for organizations and individuals committed to professional excellence and robust record-keeping.

This article delves into the critical role of a standardized acknowledgment of receipt template, exploring its purpose, myriad benefits, and how it can be effectively customized across various operational contexts. From financial transactions to document handovers, this foundational tool underpins transparent communication and strengthens operational integrity for all involved parties, ensuring both senders and recipients possess clear documentation of key interactions. Businesses, non-profits, government agencies, and even individuals engaged in significant exchanges stand to benefit immensely from incorporating such a template into their standard operating procedures.

The Importance of Clear and Professional Documentation

Precision and clarity in business documentation are paramount, forming the bedrock of sound financial management and ethical business practices. Every transaction, interaction, and agreement carries implications that necessitate meticulous record-keeping, safeguarding against potential disputes and ensuring regulatory compliance. Professional documentation provides an irrefutable audit trail, offering transparency and accountability that are indispensable in today’s complex economic environment.

Well-crafted business documentation minimizes misunderstandings, clarifies expectations, and substantiates claims when required. It is an essential component for internal operations, external audits, and legal protections. Standardized forms, such as an invoice form or a detailed billing statement, contribute significantly to this overall objective, ensuring that all aspects of a financial transaction are thoroughly recorded and understood by all stakeholders.

Key Benefits of Using Structured Templates

The adoption of a structured acknowledgment of receipt template offers a multitude of advantages that transcend simple confirmation. Such a template is instrumental in ensuring accuracy, fostering transparency, and maintaining consistency in record-keeping across an organization. It transforms what could be an informal verbal exchange into a formal, verifiable event.

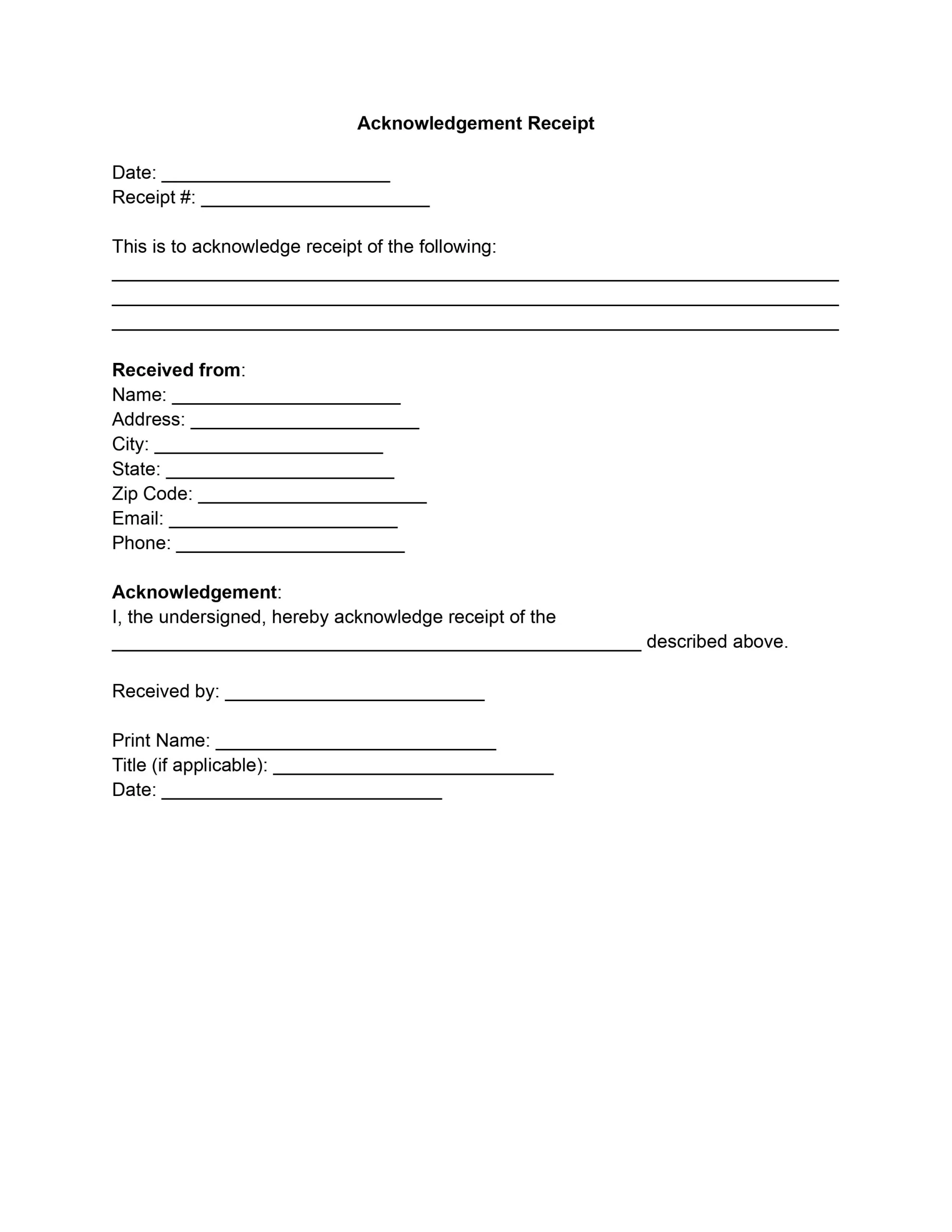

Firstly, a standardized template significantly enhances accuracy by prompting the inclusion of all necessary details, thereby minimizing errors and omissions. It guides users to input critical information such as dates, amounts, sender and recipient details, and a clear description of what was received. This structured approach ensures that every payment receipt or proof of transaction contains a complete and reliable dataset.

Secondly, transparency is inherently built into the use of a formal template. Both parties involved receive a clear, identical record of the exchange, fostering mutual understanding and reducing the likelihood of future disputes. This clear documentation cultivates trust and establishes a professional precedent for all interactions.

Finally, consistency in record-keeping is achieved by mandating a uniform format for all acknowledgments. This streamlines data management, simplifies auditing processes, and ensures that all financial templates and sales records adhere to the same high standards. The predictable structure makes it easier to track, categorize, and retrieve information efficiently, contributing to robust business documentation.

Customization for Diverse Applications

The inherent flexibility of an acknowledgment of receipt template makes it adaptable to a vast array of scenarios, serving different purposes across various sectors. While the core function remains consistent—confirming receipt—the specific fields and details can be tailored to meet the unique requirements of each application. This adaptability ensures that the document remains relevant and effective, regardless of the context.

For sales transactions, the template can be customized to function as a proof of purchase, detailing product names, quantities, unit prices, and total amounts. In the realm of services, it transforms into a service receipt, confirming the completion of work or the receipt of payment for services rendered, often including service dates and descriptions of work performed. Rent payments require specific fields for tenant names, property addresses, payment periods, and methods, making it an indispensable tool for landlords and property managers.

Non-profit organizations frequently use customized templates for donation acknowledgment, providing donors with the necessary documentation for tax purposes while confirming their contributions. For internal business operations, the template can be adapted for employee expense records or business reimbursements, ensuring clear tracking of funds distributed and received. The ability to modify fields, add logos, and incorporate specific disclaimers ensures that the template effectively serves its intended purpose in any given scenario, from a simple payment receipt to a complex financial transaction record.

When an Acknowledgment of Receipt Template is Most Effective

The strategic deployment of an acknowledgment of receipt template is most effective in situations where proof of delivery or payment is critical for accountability, legal protection, or clear record-keeping. Its utility shines brightest in scenarios where there is a potential for dispute, a need for an audit trail, or a requirement for formal confirmation.

Employing this document is particularly beneficial in the following circumstances:

- Cash Transactions: When cash changes hands, a physical or digital acknowledgment provides irrefutable proof of the exchange, protecting both the payer and the recipient.

- Delivery of Sensitive Documents: For legal papers, contracts, or confidential information, an acknowledgment confirms that the documents reached their intended recipient, vital for compliance and liability.

- High-Value Goods Transfer: When items of significant value are exchanged or delivered, this form serves as a crucial sales record, protecting against claims of non-delivery or non-payment.

- Services Rendered and Paid: Confirming that services were completed to satisfaction and payment was received, offering clarity for both service providers and clients, and acting as a clear service receipt.

- Donations and Contributions: Non-profit organizations issue donation acknowledgments to confirm receipt of funds or in-kind donations, essential for donor records and tax compliance.

- Rent or Lease Payments: Landlords use these documents to provide tenants with a record of their rent payment, preventing future misunderstandings and aiding in financial tracking.

- Expense Reimbursements: Businesses provide employees with these receipts for expense claims, confirming the payout and establishing a clear expense record for both parties.

- Inter-departmental Material Transfer: Within large organizations, the layout can track the movement of equipment, inventory, or important internal files between departments.

- Final Settlement Payments: For agreements resolving disputes or completing projects, the template provides definitive proof that the agreed-upon funds have been transferred.

Design, Formatting, and Usability Tips

Creating an effective acknowledgment template extends beyond mere content; its design, formatting, and overall usability significantly impact its functionality and adoption. A well-designed document is clear, professional, and easy to complete and understand, whether in print or digital format. Strategic considerations in these areas ensure that the file serves as a reliable and efficient financial template.

Firstly, prioritize clarity and conciseness in the layout. Use clear headings, legible fonts, and ample white space to prevent the document from appearing cluttered. The most critical information—such as the date, recipient, sender, and a precise description of what was received—should be prominently displayed and easily identifiable. Every field should have a clear label, making it intuitive for users to fill in the required data.

For digital versions, consider using fillable PDF forms or web-based interfaces that auto-populate standard information where possible. This not only enhances efficiency but also reduces the potential for manual errors. Ensure the digital layout is mobile-responsive if it will be accessed on various devices. Integrate features for digital signatures to streamline the confirmation process, further solidifying the proof of transaction.

When designing the form, incorporate your organization’s branding elements, such as logos and brand colors, to maintain a professional and consistent corporate identity. This reinforces credibility and establishes the document as an official business communication. Always include a unique transaction ID or reference number on the receipt to facilitate easy tracking and retrieval in future record-keeping. Finally, ensure that the form is accessible to all users, considering factors like screen reader compatibility for digital formats and clear print contrast for physical copies.

The Enduring Value of Acknowledgment Records

In conclusion, the strategic implementation of a well-designed acknowledgment template is far more than a bureaucratic formality; it is an indispensable tool for fostering clarity, accountability, and professionalism in all forms of exchange. This robust document serves as a reliable, accurate, and efficient financial record, solidifying transactions and communications with undeniable proof of receipt. Its consistent use builds a foundation of trust and transparency, essential for enduring business relationships and operational integrity.

By providing a clear and verifiable audit trail, this document significantly mitigates risks associated with misunderstandings, disputes, and compliance issues. It ensures that every payment, delivery, or transfer is officially documented, safeguarding the interests of all parties involved. Embracing this fundamental business documentation is a proactive step towards cultivating precision, securing financial operations, and upholding the highest standards of professional conduct in every interaction.