Accurate and professional financial documentation forms the bedrock of sound business practices, facilitating transparency, accountability, and efficient record-keeping. In an era where every transaction can be scrutinized for compliance, reimbursement, or tax purposes, the humble receipt holds significant weight. For various service providers and their clientele, particularly within the transportation sector, a standardized and comprehensive american taxi receipt template becomes an invaluable asset. This document serves not merely as proof of payment but as a vital piece of the financial puzzle, ensuring clarity for both the service provider and the customer.

This article explores the utility and design principles behind an effective american taxi receipt template, outlining its core components, benefits, and applications. From independent drivers to large fleet operators, and from individual passengers to corporate clients seeking expense reimbursements, a well-structured receipt streamlines administrative processes. It supports effective financial management, helps mitigate potential disputes, and contributes to an overall perception of professionalism and reliability. Understanding its essential elements and how to implement them effectively is crucial for maintaining robust financial integrity.

The Importance of Clear and Professional Documentation

In any business environment, the meticulous maintenance of financial records is not merely a best practice; it is often a regulatory imperative. Clear and professional documentation, such as a payment receipt, serves as a tangible proof of transaction, providing a verifiable record for all parties involved. This level of detail is critical for internal accounting, external audits, and tax compliance, ensuring that every financial interaction is transparent and traceable. Such documentation prevents misunderstandings, supports accurate budgeting, and reinforces a business’s credibility.

Beyond compliance, well-organized business documentation fosters efficiency. It allows for quick retrieval of information, simplifies reconciliation processes, and reduces the time spent resolving discrepancies. A standardized approach to generating receipts reflects an organization’s commitment to detail and customer service. It minimizes potential financial ambiguities, contributing to a smoother operational workflow and a more trustworthy reputation in the market.

Key Benefits of Using Structured Templates for American Taxi Receipt Template

Adopting a structured american taxi receipt template offers a multitude of advantages that extend beyond basic record-keeping. The primary benefit lies in ensuring consistency and accuracy across all transactions. A template pre-defines the essential fields, prompting the user to capture all necessary information, thereby reducing errors and omissions that often occur with hastily handwritten or unstructured records. This standardization ensures that every receipt issued contains the same critical data points, facilitating easier aggregation and analysis of financial data.

Furthermore, leveraging a consistent layout significantly enhances transparency. Customers receive a clear, easily understandable document that itemizes their payment, which can be crucial for expense reporting or personal budgeting. For the service provider, the template streamlines the process of generating receipts, saving valuable time and reducing administrative overhead. This structured approach to the receipt of payment supports robust internal controls, minimizes discrepancies during reconciliation, and reinforces a professional brand image through uniform presentation. The integrity of financial records is undeniably strengthened by such systematic documentation.

How This Template Can Be Customized for Different Purposes

While the core functionality of a receipt remains constant—proof of transaction—the american taxi receipt template is remarkably adaptable and can be customized to serve various financial documentation needs. Its inherent structure, designed for clear data presentation, makes it a versatile tool for different types of transactions beyond just taxi services. The layout can be modified to suit specific industry requirements or unique business models, retaining its fundamental purpose while accommodating diverse information requirements.

For sales transactions, the template can include fields for product codes, quantities, unit prices, and total amounts, effectively transforming it into a detailed sales record or simplified invoice form. When used for service receipts, it can enumerate specific services rendered, hourly rates, and labor costs. In the context of rent payments, fields for property address, rental period, and tenant details can be incorporated. For donations, the template can be adapted into a formal donation acknowledgment, including the organization’s tax ID and a statement about the tax-deductible nature of the contribution. Finally, for business reimbursements, it provides a consistent format for employees to submit their expenditures, ensuring all required information for accounting and compliance is present. The flexibility of this basic financial template allows it to become a foundational element for comprehensive business documentation across numerous applications.

Examples of When Using the American Taxi Receipt Template is Most Effective

The application of a standardized receipt template extends across numerous scenarios where clear, verifiable proof of payment is essential. Its structured nature makes it particularly effective in situations requiring detailed expense tracking, formal acknowledgment, or regulatory compliance.

- For Business Travelers Seeking Reimbursement: Employees frequently use taxi services for client meetings, airport transfers, or travel between business locations. A comprehensive receipt is mandatory for submitting expense reports, ensuring they receive accurate and timely reimbursement from their employers.

- For Independent Contractors and Freelancers: When billing clients for services that include transportation, a clear taxi receipt allows for transparent invoicing and proof of legitimate business expenses. This helps in managing their own finances and tax obligations.

- For Ride-Sharing Drivers and Operators: Beyond traditional taxis, ride-sharing platforms can leverage a similar template to provide passengers with detailed digital or print receipts, enhancing trust and providing necessary records for both the driver’s income tracking and the passenger’s expense management.

- For Corporate Fleet Management: Companies operating their own vehicle fleets or contracting taxi services for their staff require meticulous records. Utilizing a consistent receipt form simplifies auditing, cost analysis, and ensures compliance with internal financial policies.

- For Tax Reporting and Audits: Both individuals and businesses must maintain accurate records for tax purposes. A well-organized collection of these receipts serves as undeniable proof of expenses, which can be critical during tax filing or in the event of an audit.

- For Resolving Payment Disputes: In cases where a customer disputes a charge or payment, a detailed receipt serves as concrete evidence of the transaction, including the date, time, amount, and services rendered, helping to quickly resolve conflicts.

- For Budgeting and Financial Planning: Individuals and businesses can use these standardized records to track transportation spending over time, aiding in budget allocation and financial forecasting.

Tips for Design, Formatting, and Usability

Creating a highly effective receipt form involves more than just listing required fields; it demands thoughtful design and formatting to optimize usability for both the issuer and the recipient. Whether the document is intended for print or digital distribution, clarity, conciseness, and organization are paramount. Adhering to professional standards in its presentation elevates its perceived value and ensures its practical utility.

Essential Design Elements

The layout of the document should be intuitive and easy to read. Key information should be prominently displayed, often near the top. Utilize clear, legible fonts and appropriate font sizes to ensure readability. Consistency in branding, including logos and color schemes, helps to reinforce professional identity and makes the receipt instantly recognizable. Consider adding a unique receipt number for tracking purposes, as this simplifies referencing and reconciliation.

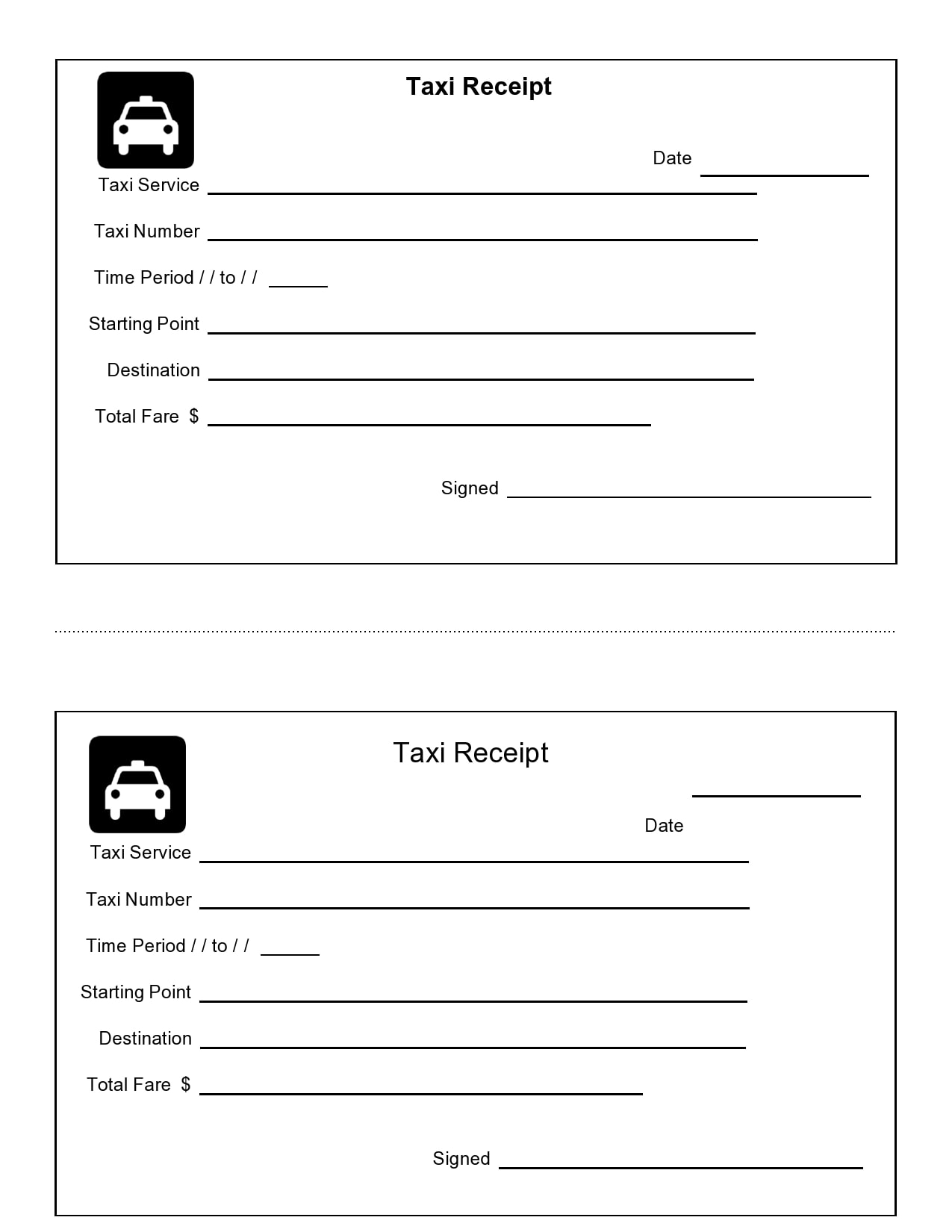

Critical Information Fields

At a minimum, the template must include the service provider’s name and contact information (company name, address, phone number, email). The date and time of the transaction are crucial for accurate record-keeping. A clear description of services rendered (e.g., "Taxi Service"), the total amount paid, and the method of payment (cash, credit card, mobile payment) are also indispensable. For credit card transactions, often the last four digits of the card number are included for verification. Space for the driver’s name or ID number, pickup, and drop-off locations, and possibly mileage or duration of the trip, adds further detail and can be invaluable for specific use cases.

Formatting for Clarity and Organization

Employ clear headings and subheadings to segment information logically. Use bullet points or tables for itemized breakdowns if multiple charges are involved, enhancing readability. Align text consistently, and use sufficient white space to prevent the document from appearing cluttered. Group related information together; for instance, all contact details in one section, and all transaction details in another.

Usability for Print Versions

For physical copies, ensure the template fits standard paper sizes (e.g., Letter or A4) and is optimized for efficient printing. A compact yet comprehensive design is ideal for portable printers often used in vehicles. Consider the quality of the paper stock if it’s meant to endure handling or storage. Providing a clear tear-off section for the customer copy can also be a thoughtful touch.

Optimization for Digital Versions

When designing for digital distribution (e.g., email or mobile app receipts), prioritize responsive design. The document should render correctly and be easily navigable on various screen sizes, from smartphones to desktop monitors. PDF format is often preferred for digital receipts due to its universal compatibility and ability to maintain formatting integrity. Ensure all embedded links (e.g., to customer support or company website) are active and functional. Digital versions also allow for easy searchability and archival, making them highly efficient for long-term record-keeping. Including a QR code for quick access to detailed trip information or customer feedback can also enhance the digital experience.

By focusing on these design and usability principles, the basic receipt can be transformed into a powerful and professional financial tool that serves its purpose effectively in both physical and digital formats.

Conclusion

In the dynamic landscape of modern business, the reliance on precise and verifiable financial documentation cannot be overstated. The thoughtful implementation of a structured template, whether for taxi services or other transactions, stands as a testament to an organization’s commitment to professionalism and operational excellence. This foundational document facilitates meticulous record-keeping, streamlines expense management, and reinforces a transparent relationship between service providers and their clientele. Its consistent application mitigates potential disputes, simplifies accounting processes, and ensures adherence to crucial financial regulations.

Ultimately, a well-designed receipt transcends its simple function as a proof of payment; it evolves into a critical component of a robust financial ecosystem. It empowers individuals with the necessary documentation for reimbursements and budgeting, while providing businesses with the data required for accurate reporting, audits, and strategic financial planning. By embracing such a reliable, accurate, and efficient financial template, businesses not only safeguard their fiscal integrity but also project an image of dependable and trustworthy service.