In the intricate landscape of modern financial and business operations, the creation and maintenance of precise documentation are not merely administrative tasks but fundamental pillars of accountability and trust. A well-designed receipt serves as a tangible record, an irrefutable proof of transaction that underpins countless exchanges daily. Understanding the utility of a well-crafted atm receipt template is paramount for any entity or individual engaged in financial dealings, from small businesses processing daily sales to large organizations managing complex reimbursements.

This comprehensive article explores the critical role that a standardized receipt template plays in ensuring accuracy, fostering transparency, and enhancing efficiency across various sectors. It is designed for US readers who appreciate meticulous financial record-keeping and seek to optimize their documentation processes. Adopting a structured approach to receipt generation benefits not only the issuer by streamlining operations but also the recipient by providing clear, understandable proof of their financial engagement, whether it’s a purchase, a payment, or a donation.

The Importance of Clear and Professional Documentation

Clear and professional documentation stands as a cornerstone of sound financial management and robust business practices. Every transaction, regardless of its scale, necessitates a verifiable record to uphold integrity and provide a reference point for all involved parties. A precisely formatted receipt eliminates ambiguity, preventing potential disputes and misinterpretations that could otherwise lead to costly errors or damaged reputations. It acts as a primary source of truth, offering a definitive account of an exchange.

Furthermore, adherence to professional documentation standards is often a regulatory requirement across many industries. Tax authorities, auditors, and legal entities frequently demand meticulous records to ensure compliance and substantiate financial claims. A receipt that is professional in appearance and content reflects positively on the issuing entity, conveying an image of reliability, meticulousness, and trustworthiness to clients, partners, and stakeholders alike. This attention to detail reinforces confidence in business operations.

Key Benefits of Using Structured Templates for Atm Receipt Template

Utilizing structured templates for an atm receipt template offers a multitude of benefits that extend far beyond simple record-keeping. These templates are meticulously designed to ensure a consistent format and capture all necessary information efficiently, acting as a crucial tool for operational excellence. They significantly contribute to accuracy, transparency, and consistency in financial documentation.

Firstly, templates drastically improve accuracy. By providing predefined fields, they guide users to input essential data points, minimizing the risk of omission or error often associated with manual or ad-hoc receipt generation. This structured approach ensures that critical details like transaction date, amount, and recipient information are consistently captured. Secondly, structured templates enhance transparency. A uniform layout makes it easier for both the issuer and the recipient to locate and understand the transaction details, fostering clear communication and reducing potential misunderstandings. This clarity is vital for building trust.

Thirdly, they promote consistency across all transactions. Every payment receipt or sales record produced will bear a similar professional appearance and informational hierarchy, regardless of who generates it. This consistency is invaluable for internal record-keeping, allowing for easier auditing and reconciliation processes. It also streamlines the customer experience by presenting predictable and easily digestible financial documentation. Finally, the use of templates drives efficiency. Automating the layout and essential fields saves considerable time that would otherwise be spent on formatting each individual receipt, allowing staff to focus on more strategic tasks.

How This Template Can Be Customized for Different Purposes

The inherent flexibility of a well-designed atm receipt template makes it incredibly adaptable, allowing it to serve a broad spectrum of financial documentation needs beyond typical ATM withdrawals. Its modular structure enables users to tailor fields and branding elements to precisely fit various transactional contexts. This versatility transforms a basic receipt into a powerful, multi-purpose financial tool.

For instance, a business can customize this document to function as a detailed sales record for product purchases, incorporating itemized lists and tax breakdowns. For service providers, the template can be adapted into a service receipt, detailing specific services rendered, hours billed, and associated rates. Non-profit organizations frequently modify the template to serve as a donation acknowledgment, ensuring compliance with charitable giving regulations and providing donors with necessary tax documentation.

Furthermore, corporations can utilize a modified layout as an internal expense record for business reimbursements, requiring specific categories or project codes. Landlords often customize it for rent payments, including property addresses and specific rental periods. The core structure can even be transformed into a simplified invoice form or a condensed billing statement for straightforward transactions. The ability to integrate company logos, specific terms and conditions, or unique reference numbers further solidifies its utility across diverse operational demands, making it an indispensable component of comprehensive business documentation.

Examples of When Using the Template Is Most Effective

The strategic deployment of a structured receipt template significantly enhances operational efficiency and legal compliance in numerous scenarios. Employing this form ensures that all pertinent details are consistently recorded, providing immediate proof of transaction. Below are several instances where utilizing such a template proves most effective:

- Retail Sales: For any direct sale of goods, providing a clear sales record with item descriptions, quantities, unit prices, and total amount. This aids inventory management and customer service for returns or exchanges.

- Service Delivery: When a professional service is completed, such as consulting, repairs, or training, issuing a service receipt that outlines the work performed, hours, and charges. This clarifies the value provided to the client.

- Rental Payments: Landlords benefit from standardized receipts for rent collection, documenting the date, amount, property address, and payment period, which is crucial for financial tracking and tenant records.

- Charitable Donations: Non-profit organizations must provide donation acknowledgment receipts that meet IRS requirements, detailing the donor’s information, donation amount, and date, for tax deduction purposes.

- Business Reimbursements: Employees submitting expenses need reliable expense records. A structured template ensures all necessary information—purpose, date, amount, vendor—is present for accurate internal accounting and audit readiness.

- Event Ticket Sales: For events, issuing a receipt confirms purchase, including event details, number of tickets, and total cost, which serves as both a payment receipt and a pre-ticket confirmation.

- Subscription Renewals: Businesses offering subscriptions can use the template to confirm renewal payments, detailing the service period, amount, and payment method, ensuring transparency for subscribers.

Tips for Design, Formatting, and Usability

The effectiveness of any financial template hinges not just on its content but equally on its design, formatting, and overall usability. A well-designed receipt template should be intuitive, professional, and easily digestible for all users, whether in print or digital format. Strategic considerations in these areas elevate the document from a mere record to a powerful communication tool.

Clarity and Readability are paramount. Utilize clear, legible fonts and ensure sufficient white space to prevent visual clutter. Key information, such as the total amount, date, and transaction type, should be immediately apparent and easy to locate. Employ bolding or slightly larger font sizes for these critical data points to draw the eye effectively.

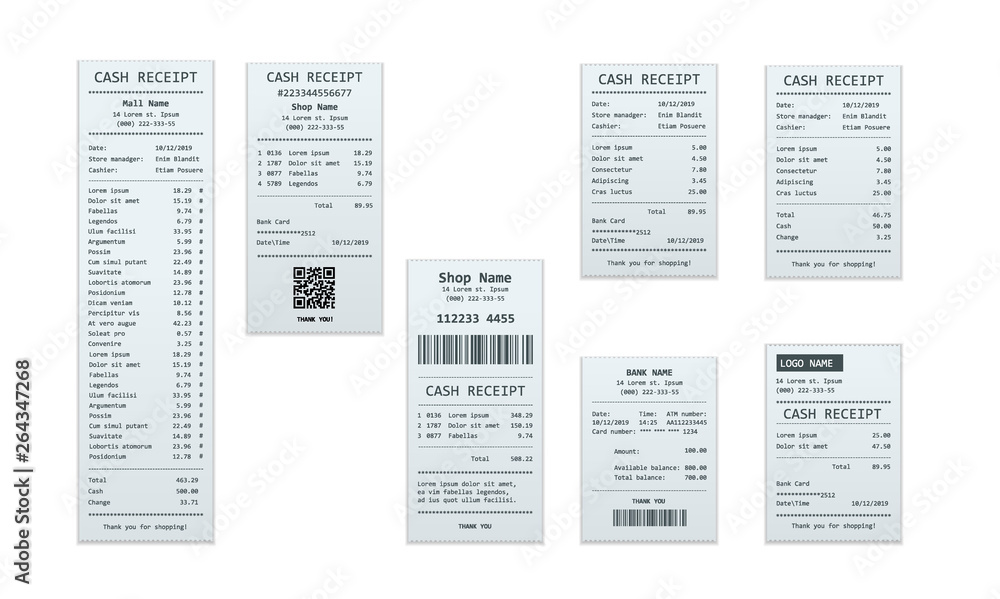

For Essential Fields, ensure that the template includes all necessary information without being overwhelming. Typical fields include: issuer’s name/logo, recipient’s name (if applicable), date and time of transaction, transaction description (itemized list for sales), amount paid, payment method, unique transaction ID, and contact information for inquiries. Consider adding a section for terms and conditions or return policies if relevant to the transaction.

Branding elements, such as a company logo, specific color schemes, and consistent typography, reinforce professionalism and brand identity. This also makes the receipt easily recognizable. However, ensure branding does not overshadow the primary financial information.

Regarding Usability, design the template to be easily filled out, whether manually or through digital input forms. For digital versions, consider responsive design to ensure optimal viewing across various devices. The template should also be easily printable, with margins and layout conducive to standard paper sizes. For digital versions, incorporate searchable text and potentially secure digital signatures. Ensure the file format is widely accessible (e.g., PDF) and can be securely transmitted and stored. Accessibility considerations for users with visual impairments, such as sufficient contrast and logical reading order, also contribute to superior usability. Finally, review and update the layout periodically to ensure it remains current with technological advancements and evolving business needs.

The Enduring Value of a Robust Receipt Template

In an era defined by rapid digital transformation and increasing scrutiny of financial accuracy, the role of a reliable receipt template has never been more critical. It transcends a simple piece of paper or a digital file; it serves as a foundational element of trust, transparency, and operational excellence for any entity conducting financial transactions. Embracing a robust atm receipt template ensures that every payment, every sale, and every donation is meticulously documented, providing indisputable proof and facilitating seamless financial reconciliation.

Ultimately, investing time in developing or adopting a high-quality template yields substantial long-term benefits. It streamlines administrative processes, minimizes errors, and supports compliance with various legal and accounting standards. A well-designed template is a testament to an organization’s commitment to professionalism and integrity, enhancing its reputation and strengthening relationships with clients, customers, and stakeholders. As a cornerstone of effective financial communication, the template stands as an invaluable tool in today’s complex economic landscape.