In the intricate world of business operations, precise and standardized documentation is not merely a formality; it is a critical pillar of accountability, transparency, and operational efficiency. The auto glass invoice template serves as a foundational component within this framework, providing a structured mechanism for auto glass service providers to meticulously detail services rendered, products supplied, and associated costs. This standardized document is essential for accurately recording transactions and facilitating clear communication between businesses and their clients.

This specialized form is indispensable for a wide array of stakeholders, including independent auto glass repair shops, large chain service centers, insurance companies, and individual vehicle owners. For businesses, it ensures consistent billing practices and simplifies financial reconciliation. For customers, it offers a transparent breakdown of charges, serving as a clear proof of transaction and often a necessary document for insurance claims or warranty purposes. Ultimately, its adoption streamlines financial workflows and reinforces professional integrity across the auto glass industry.

The Importance of Clear and Professional Business Documentation

Clear and professional business documentation forms the bedrock of credible and compliant financial and operational practices. In any sector, particularly one involving services and materials, meticulously recorded information mitigates misunderstandings, prevents disputes, and establishes a reliable audit trail. Such documentation is vital for legal compliance, tax reporting, and internal financial analysis, reflecting an organization’s commitment to precision and integrity.

Beyond compliance, robust documentation fosters trust with clients and partners. A well-prepared billing statement or service receipt communicates professionalism, ensuring that all parties have a consistent understanding of agreements and transactions. It serves as an undeniable record of commitments made and services delivered, thereby safeguarding the interests of both the service provider and the customer.

Key Benefits of Using Structured Templates for Auto Glass Invoices

Adopting structured templates for financial records offers profound advantages, particularly in specialized fields like auto glass repair. A meticulously crafted auto glass invoice template ensures consistency across all transactions, presenting information in a uniform and easily digestible format. This standardization is crucial for maintaining brand identity and professional appearance in every client interaction.

Foremost among its benefits is enhanced accuracy. By providing predefined fields for all necessary details—such as customer information, vehicle specifications, service dates, itemized costs, and payment terms—the template significantly reduces the likelihood of manual errors or omissions. This precision minimizes discrepancies in billing, which can otherwise lead to payment delays or customer dissatisfaction.

Transparency is another critical advantage. A well-designed template clearly itemizes all charges, distinguishing between parts, labor, taxes, and any other applicable fees. This detailed breakdown ensures that customers understand exactly what they are paying for, fostering trust and reducing inquiries. For internal accounting, this level of detail supports accurate revenue tracking and expense categorization, simplifying financial audits and reporting.

Furthermore, structured templates dramatically improve record-keeping efficiency. Digital or physical copies of completed forms are easily filed, searched, and retrieved, providing an accessible archive of all transactions. This systematic approach is invaluable for managing warranties, processing insurance claims, or addressing future customer service needs, transforming chaotic paperwork into an organized repository of business data.

Customization for Diverse Business and Financial Purposes

While specifically designed for the auto glass industry, the underlying structure of an auto glass invoice template offers broad applicability and can be extensively customized for various business and financial purposes. The fundamental elements of any effective financial document—clear identification of parties, itemization of goods or services, detailed pricing, and specified terms—remain constant across different contexts. This adaptability makes such templates incredibly versatile for diverse operational needs.

For instance, the core layout can be readily adapted to serve as a general sales record for retail businesses, detailing product purchases and sales tax. Service-based businesses, from plumbing to IT support, can modify the form to outline labor hours, parts used, and specific service descriptions. The template’s logical flow for itemization and costing proves invaluable in these scenarios, ensuring every aspect of a transaction is clearly documented.

Beyond commercial transactions, the adaptable nature of this form extends to more specialized financial communications. Organizations managing rent payments can customize it into a rent receipt, detailing payment dates, amounts, and periods covered. Non-profit entities can transform it into a donation acknowledgment, providing formal proof of contribution for tax purposes. Even internal business reimbursements can leverage a modified version of the document to track employee expenses against company policies.

The key to effective customization lies in recognizing the universal components of a financial transaction record and tailoring the specific fields and labels to match the particular context. This strategic flexibility ensures that businesses and organizations can maintain a consistent, professional, and accurate documentation standard, regardless of the specific transaction type.

When Using the Auto Glass Invoice Template Is Most Effective

The utility of an auto glass invoice template becomes particularly evident in scenarios such as:

- Post-Service Billing: Immediately following the completion of a windshield replacement, chip repair, or side mirror installation, providing a detailed billing statement ensures transparency and facilitates prompt payment. This serves as a formal payment receipt and proof of transaction.

- Insurance Claims: When a customer’s auto glass service is covered by insurance, a clear, itemized invoice form is indispensable. It provides all necessary business documentation for the insurance company to process the claim accurately and efficiently, outlining parts, labor, and any deductibles.

- Warranty Documentation: For services or parts that come with a warranty, the service receipt acts as the official record. It details the date of service, specific parts installed, and the scope of work, which are all crucial for validating any future warranty claims.

- Fleet Management: Businesses managing a fleet of vehicles require robust business documentation for maintenance and repair histories. Utilizing a standardized template for all auto glass work on fleet vehicles ensures consistent expense records and simplifies maintenance tracking across multiple assets.

- Mobile Service Operations: For mobile auto glass technicians, having a pre-designed template, whether digital or print, allows for on-site completion of professional service records. This enhances efficiency and ensures that all necessary information is captured before leaving the customer’s location.

- Inventory and Sales Tracking: Beyond a simple billing statement, the form can be designed to contribute to inventory management by detailing specific glass types, adhesives, and tools used, aiding in replenishment strategies and sales record analysis.

- Customer Record Keeping: Each completed document contributes to a comprehensive customer history file. This allows businesses to track past services, identify recurring issues, and offer personalized service, improving customer retention and satisfaction.

Tips for Design, Formatting, and Usability

An effective financial template, such as an invoice form, is not merely functional; it is also a reflection of an organization’s professionalism. Thoughtful design and meticulous formatting significantly enhance both its usability and the perception of the business it represents. Whether intended for print or digital distribution, several key principles should guide its creation.

Clarity and Readability

Prioritize clear, legible typography. Choose professional, sans-serif fonts (e.g., Arial, Helvetica, Calibri) that are easy to read at various sizes. Ensure adequate line spacing and sufficient white space around text blocks to prevent visual clutter. Headings and subheadings should be distinct, guiding the eye through the document logically.

Logical Flow and Organization

Arrange information in a logical sequence. Typically, this begins with sender and recipient details, followed by an invoice number, date, and service details (itemized list of parts and labor). Subtotals, taxes, and the grand total should be clearly presented at the bottom. Payment terms, methods, and contact information should be readily accessible. The overall layout should facilitate quick scanning for critical information.

Branding and Professional Aesthetics

Incorporate company branding elements, such as the business logo, official colors, and contact information, prominently at the top of the form. A consistent brand presence reinforces professionalism and trustworthiness. While aesthetics are important, avoid overly decorative elements that could distract from the primary financial information. The design should be clean, consistent, and reflective of the company’s image.

Digital and Print Adaptability

Design the template with both digital and print usage in mind. For digital versions (e.g., PDF), ensure fillable fields are easily navigable and that the document renders correctly across different devices and operating systems. For print, verify that margins are sufficient, colors print accurately, and that the layout doesn’t result in awkward page breaks. Consider options for digital signatures or secure online payment integration.

Essential Fields

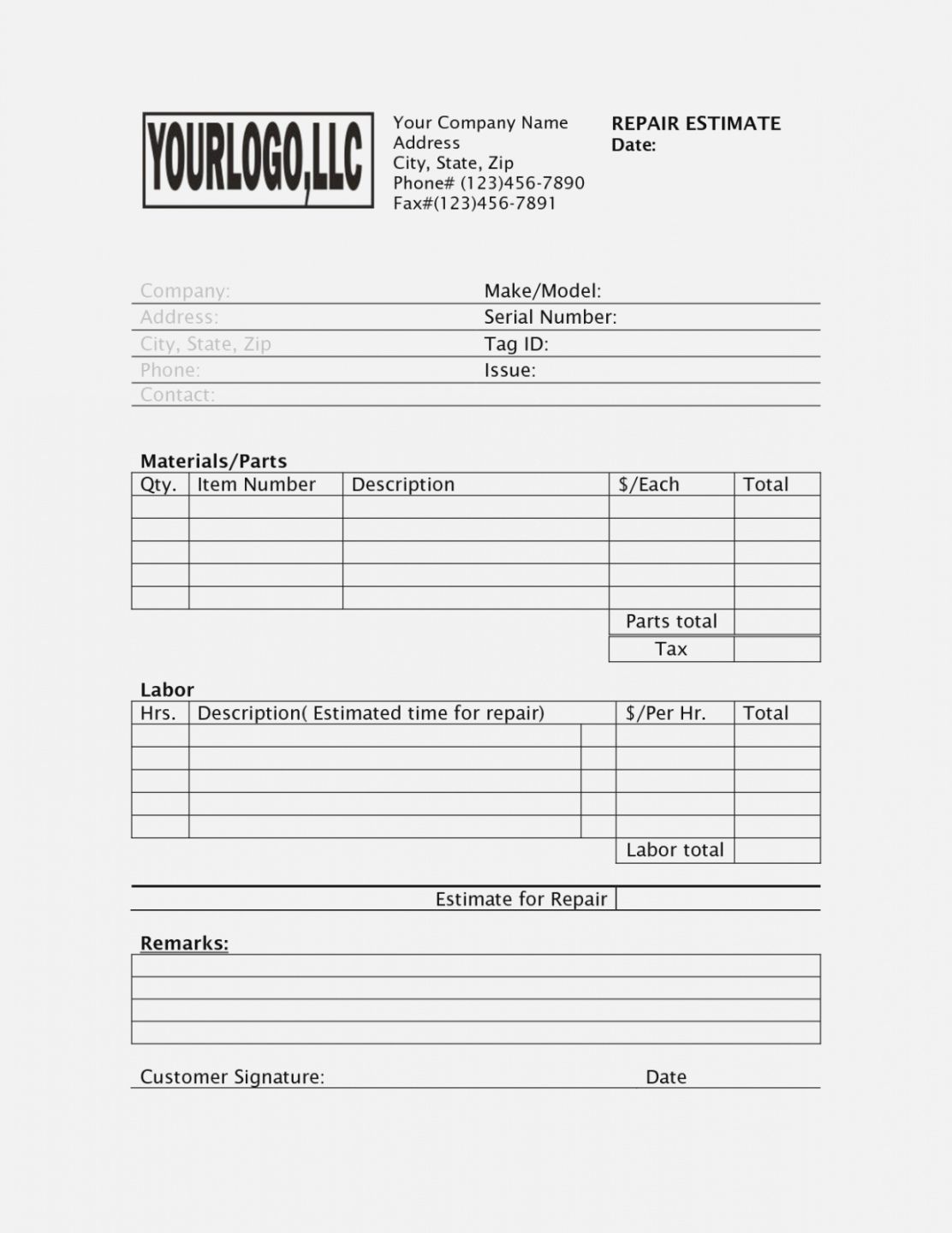

Ensure the template includes all necessary fields for a complete and legally compliant financial record:

- Company Name, Address, Contact Information, and Logo

- Client Name, Address, and Contact Information

- Invoice Number and Date of Issue

- Service Date(s)

- Vehicle Year, Make, Model, and VIN (Vehicle Identification Number)

- Detailed Description of Services Rendered and Parts Used

- Quantity, Unit Price, and Total for each item

- Subtotal, Applicable Taxes (e.g., Sales Tax), and Grand Total

- Payment Terms (e.g., Due Upon Receipt, Net 30)

- Accepted Payment Methods

- Warranty Information (if applicable)

- Space for Customer Signature and Date of Acceptance

- Any disclaimers or special notes

Usability Features

Consider features that enhance usability. For digital versions, this might include automated calculations for subtotals and totals, dropdown menus for common service items, or integration with CRM/accounting software. For printed forms, ensure sufficient space for handwritten notes or signatures. The objective is to make the process of completing and understanding the billing statement as straightforward as possible for both staff and customers.

By adhering to these design and formatting principles, businesses can transform a basic financial template into a powerful tool that not only fulfills its primary function of recording transactions but also enhances professionalism, improves communication, and contributes positively to their overall operational effectiveness.

Conclusion: The Enduring Value of a Structured Financial Record

In an era where efficiency and accountability are paramount, the judicious use of a well-designed financial template offers enduring value to any service-oriented business. This structured document transcends its basic function as a mere payment receipt; it stands as a testament to an organization’s commitment to precision, ethical practices, and exceptional customer service. It streamlines internal processes, significantly reduces administrative overhead, and minimizes the potential for financial disputes.

The benefits extend beyond operational advantages, fostering stronger relationships with clients by providing them with clear, transparent, and comprehensive proof of transaction. As a critical component of business documentation, it ensures that every service provided and every payment received is meticulously recorded, laying a robust foundation for financial accuracy and legal compliance. Its role in facilitating insurance claims, validating warranties, and maintaining thorough sales records cannot be overstated.

Ultimately, embracing a standardized and adaptable invoice form equips businesses with a reliable, accurate, and efficient financial record tool. It is an investment in professional communication, operational integrity, and long-term organizational success, ensuring that every financial interaction is handled with the utmost clarity and professionalism.