In the intricate landscape of modern business and personal finance, clear and verifiable documentation stands as a cornerstone of responsible management. For transactions involving vehicle maintenance and repair, a robust and well-structured auto service receipt template is not merely a courtesy but a fundamental necessity. This crucial document serves as official proof of payment and details the services rendered, components used, and associated costs. Its primary purpose is to provide an undeniable record for both the service provider and the customer, fostering transparency and accountability.

Such a template benefits a wide array of stakeholders. For auto service businesses, it streamlines record-keeping, facilitates accurate accounting, and aids in resolving potential disputes by providing an indisputable transaction history. Customers, in turn, rely on this receipt for budgeting, warranty claims, tax documentation, and maintaining a service history for their vehicles. Essentially, it transforms a verbal agreement into a tangible, legally sound record, ensuring clarity and peace of mind for all parties involved in vehicle servicing transactions.

The Imperative of Meticulous Documentation in Business Transactions

Professionalism in any business enterprise is intrinsically linked to the quality of its documentation. In the realm of financial and service transactions, clear and precise records are not just a best practice; they are a critical operational requirement. Meticulous documentation, particularly through standardized forms, ensures that every financial exchange is accurately recorded, leaving no room for ambiguity or misunderstanding. This commitment to detail establishes credibility, builds trust with clients, and safeguards against legal and financial complications.

Well-maintained records provide an essential audit trail, crucial for internal review, external audits, and tax compliance. They serve as definitive proof of transaction, vital for dispute resolution, warranty claims, and historical analysis of business performance. Without such clarity, businesses risk operational inefficiencies, potential revenue loss, and damage to their professional reputation. Therefore, investing in professional business documentation practices is an investment in the stability and longevity of an organization.

Core Advantages of a Structured Auto Service Receipt Template

Adopting a structured Auto Service Receipt Template offers a multitude of benefits that extend far beyond simply confirming a payment. Primarily, it champions accuracy by providing predefined fields for all essential information, minimizing human error and ensuring that no critical detail is overlooked. This standardization guarantees that every transaction is recorded comprehensively, from the date and time of service to the specifics of parts and labor.

Furthermore, this form significantly enhances transparency. By itemizing costs and clearly describing services performed, customers gain a complete understanding of what they are paying for, fostering trust and reducing inquiries. The consistency derived from using a single layout across all transactions also simplifies record-keeping and financial reconciliation for the business. This leads to greater operational efficiency, quicker processing times, and a reliable historical archive, making it an invaluable financial template for any service-oriented operation.

Versatile Customization for Diverse Transaction Types

While the core functionality of a receipt remains consistent across various sectors, the beauty of a well-designed financial template lies in its adaptability. A robust receipt template, like the one for auto service, can be readily customized to suit an array of different transaction types, extending its utility far beyond its initial specific purpose. This flexibility allows businesses and individuals to maintain a uniform, professional standard for all their financial documentation.

For instance, by modifying fields and descriptions, the document can serve as a payment receipt for retail sales records, detailing product names, quantities, and unit prices. It can be adapted into a service receipt for professional consultations, specifying hours worked and hourly rates. With minor adjustments, it can become a rent payment acknowledgment, clearly stating the period covered and method of payment. Non-profit organizations can customize it into a donation acknowledgment, providing essential information for tax deductions. Similarly, businesses can tailor it for internal business reimbursements, ensuring clarity for expense tracking. This inherent versatility underscores the power of a standardized invoice form as a foundational tool in financial communication.

Optimal Applications for Service Receipts

The utility of a well-crafted service receipt is extensive, serving critical functions in various scenarios for both individuals and businesses. This crucial document ensures transparency, accountability, and a clear historical record for all parties involved in service transactions.

- Individual Vehicle Maintenance: When a customer pays for routine oil changes, tire rotations, or more complex repairs, the receipt provides a detailed breakdown of services, parts, and labor costs. This acts as their personal

proof of transactionand a record of their vehicle’s service history. - Business Fleet Management: Companies operating fleets of vehicles rely on these receipts to track maintenance expenses, monitor vehicle performance, and project future operational costs. Each

expense recordcontributes to a comprehensive overview of fleet health and expenditure. - Warranty Claims Documentation: If a part fails prematurely or a service issue arises under warranty, the original service receipt is often the primary document required to substantiate a claim, verifying the date of service and the specific work performed.

- Insurance Claims Processing: Following an accident or damage, an itemized service receipt for repairs is essential evidence for insurance companies, detailing the work completed and costs incurred to facilitate claim processing.

- Tax Documentation: For businesses and individuals who use their vehicles for work, the service receipt serves as a vital

financial templatefor tax deductions related to vehicle maintenance expenses, ensuring compliance and accurate reporting. - Resale Value Enhancement: A complete service history, documented through consistent and detailed receipts, can significantly increase a vehicle’s resale value, assuring prospective buyers of its proper care and maintenance.

- Dispute Resolution: In the event of a disagreement between the customer and the service provider regarding the scope of work or charges, the precise details on the receipt provide an impartial basis for resolution.

Each of these applications highlights how the consistent use of a detailed service receipt strengthens accountability and provides valuable historical data, reinforcing its role as an indispensable piece of business documentation.

Best Practices for Design, Formatting, and Usability

The effectiveness of any receipt hinges significantly on its design, formatting, and overall usability. A well-designed receipt is not only functional but also reflects professionalism and attention to detail. Key elements must be presented clearly and logically, ensuring that both print and digital versions are easy to read and understand.

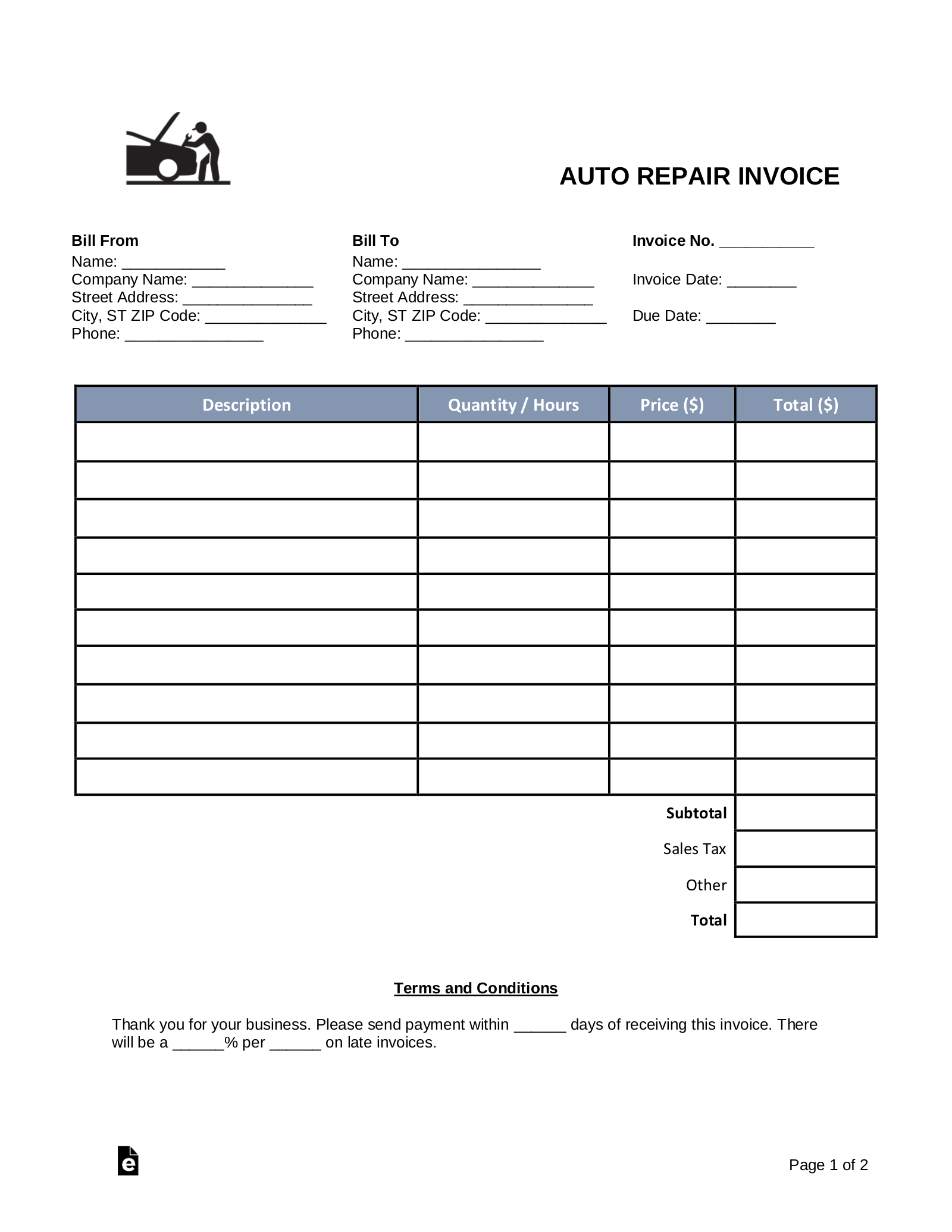

For design, prioritize a clean, uncluttered layout. Utilize clear headings (invoice form, payment receipt) and distinct sections to categorize information such as customer details, vehicle information, service description, parts used, labor charges, and total amount due. Incorporate ample white space to improve readability and prevent information overload. Branding elements, such as a company logo and contact information, should be prominently featured, reinforcing the business’s identity.

In terms of formatting, consistency is paramount. Use a legible font style and size, ensuring that all text is easily discernible. Bold important figures like the total amount and taxes. Itemize services and parts in a clear, columned format, including quantities, unit prices, and extended totals. Ensure that the date of service, payment date, and unique receipt number are clearly visible. For digital versions, consider using fillable PDF formats that allow for easy data entry and digital archiving. If the receipt will be printed, ensure it is optimized for standard paper sizes and that all information fits without truncation.

Usability considerations encompass both the preparer and the recipient. The layout should be intuitive for those filling out the form, whether manually or through software, minimizing errors and speeding up the process. For recipients, the information should be immediately understandable, allowing them to quickly identify the crucial details they need for expense record keeping or proof of transaction. Providing a clear method for payment (e.g., "Paid by Credit Card," "Cash") and any relevant warranty information further enhances the practical value of the document. Adhering to these best practices ensures that the template serves as an exemplary financial template, delivering both efficiency and clarity.

The Enduring Value of a Reliable Financial Record

In conclusion, the judicious adoption and consistent application of a well-structured receipt template transcend mere administrative formality; it represents a foundational pillar of sound financial practice. This versatile document ensures that every transaction, particularly those as detailed as vehicle service and repair, is meticulously recorded, providing an unassailable proof of transaction for all involved parties. Its inherent structure guarantees accuracy, fosters unwavering transparency, and instills a critical level of consistency in all business documentation.

Ultimately, the power of this form lies in its ability to simplify complex financial interactions, transforming potential areas of dispute into clear, documented agreements. It is an indispensable tool for expense record keeping, a crucial aid in financial audits, and a robust defense in the event of discrepancies. By providing a reliable, accurate, and efficient financial template, it not only streamlines operations but also cultivates trust and professionalism, thereby securing its place as an essential asset in both personal and commercial financial management.