In the intricate world of finance and commerce, the meticulous documentation of every transaction is not merely a best practice; it is a fundamental requirement for operational integrity and legal compliance. Among the myriad of essential business documents, the cash deposit receipt template stands out as a critical tool, providing indisputable proof of cash received for goods, services, or other financial obligations. This structured document serves as a cornerstone for both parties involved, ensuring that every cash-based exchange is accurately recorded, acknowledged, and accounted for, thereby minimizing disputes and fostering trust.

The utility of a robust cash deposit receipt template extends across various sectors, from small businesses and large corporations to non-profit organizations and individual contractors. Its primary purpose is to offer a standardized format for documenting the reception of cash, creating a clear and immutable record that benefits both the payer and the payee. For payers, it acts as a vital proof of transaction, safeguarding against future claims of non-payment. For payees, it forms an essential component of their financial records, facilitating accurate bookkeeping, reconciliation, and audit preparedness. This foundational document streamlines administrative processes and enhances financial transparency for all stakeholders.

The Importance of Clear and Professional Documentation in Financial and Business Transactions

Professionalism in business is often reflected in the clarity and precision of its documentation. In financial transactions, this principle is amplified, as every exchange of value carries implications for accounting, tax obligations, and legal recourse. Clear and professional documentation, such as a well-designed payment receipt, provides an unequivocal record of an agreement or transaction, leaving no room for ambiguity or misinterpretation. It solidifies the understanding between parties and forms the backbone of reliable financial reporting.

Beyond mere record-keeping, comprehensive documentation underpins legal and regulatory compliance. Businesses are often subject to stringent auditing requirements, where every financial movement must be traceable and verifiable. A professionally structured form, acting as a proof of transaction, ensures that businesses can readily provide evidence of income and expenses, thereby protecting against potential discrepancies, penalties, or disputes. This rigorous approach to documentation not only mitigates risks but also enhances a company’s reputation for trustworthiness and operational excellence.

Key Benefits of Using Structured Templates for Cash Deposit Receipts

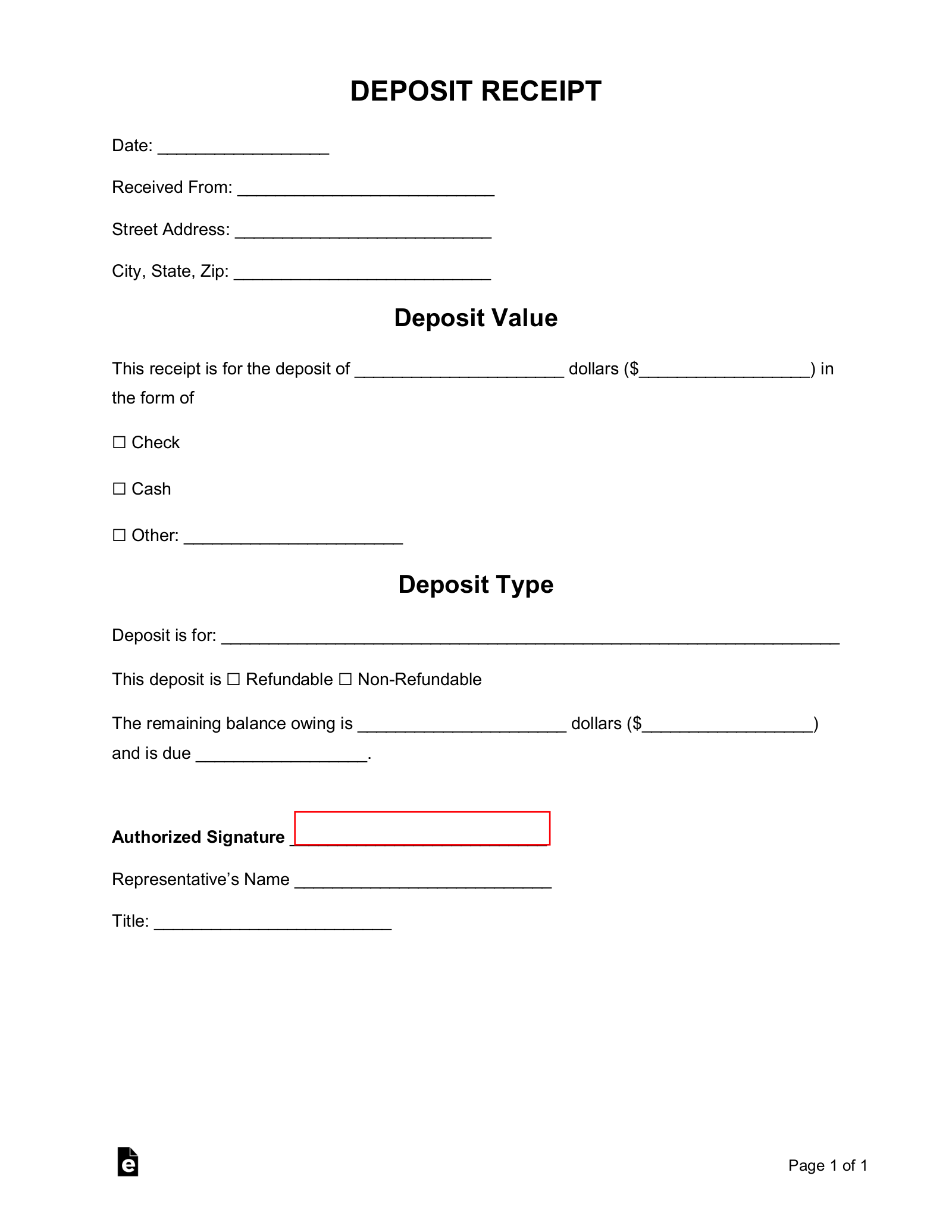

The adoption of structured templates for financial records, particularly for a cash deposit receipt template, offers a multitude of advantages that transcend simple record-keeping. These templates are meticulously designed to capture all necessary information consistently, ensuring that no critical detail is overlooked during a transaction. This standardization is paramount for maintaining data integrity and facilitating efficient retrieval of information when needed.

One of the foremost benefits is the enhancement of accuracy. By providing predefined fields for essential information—such as date, amount, purpose, and parties involved—a template guides the user to input all relevant details systematically. This structured approach significantly reduces the likelihood of errors or omissions that can occur with ad-hoc documentation. Furthermore, it fosters transparency, as both the payer and payee receive an identical, clear record of the transaction, building confidence and accountability. The consistent layout provided by a dedicated financial template also dramatically improves the efficiency of record-keeping. Instead of creating a new form for each transaction, businesses can quickly complete and issue the existing layout, saving valuable time and resources while maintaining a high level of professionalism.

Customizing the Cash Deposit Receipt Template for Diverse Applications

The inherent flexibility of a well-designed financial template allows for its adaptation across an extensive array of business and personal scenarios. While the core elements of a payment receipt remain constant—date, amount, and parties—the specific details and branding can be tailored to suit various operational contexts. This adaptability makes the document invaluable for businesses ranging from retail and services to non-profit organizations and property management.

For instance, a sales record in a retail environment might include fields for product codes and quantities, whereas a service receipt for a consulting firm would list hours billed and project specifics. Landlords utilize this form for rent payments, often adding fields for lease periods and property addresses. Non-profit organizations transform this basic form into a donation acknowledgment, incorporating donor information and tax-exempt status details. Even for business reimbursements, a customized template ensures all necessary expense categories and approvals are documented. The ability to modify logos, colors, and specific data fields ensures that the document not only functions effectively but also aligns with the brand identity and unique operational requirements of the user, making this form a versatile tool for financial management.

Practical Applications: When to Utilize a Cash Deposit Receipt Template

The utility of a standardized payment receipt extends across numerous scenarios where cash changes hands, necessitating a clear and verifiable record. Implementing a dedicated template ensures that every transaction is documented professionally and consistently, providing peace of mind for both parties involved.

Here are examples of when using this template is most effective:

- Retail Sales: When customers make cash purchases for goods in a store, a receipt confirms payment and details the items bought.

- Service Industries: For businesses like salons, repair shops, or consultants receiving cash payments for services rendered, this form serves as a crucial service receipt.

- Rent Payments: Landlords can issue this document to tenants as proof of rent payment, specifying the rental period and property address.

- Donations: Non-profit organizations use it as a donation acknowledgment for cash contributions, essential for donor records and tax purposes.

- Business Reimbursements: When employees receive cash for expenses, this form acts as an expense record, documenting the reimbursement.

- Freelance Work: Independent contractors can provide this form upon receiving cash payment for their work, ensuring transparency.

- Down Payments/Deposits: For any initial cash deposit for a larger purchase or service, this document serves as an official record of the partial payment.

- Event Ticket Sales: Organizers selling tickets for events for cash can issue this form as a record of purchase.

- Personal Loans: When repaying a personal loan in cash, this document provides mutual protection for both lender and borrower.

- Tutoring Services: Tutors receiving cash payments can use this form to confirm payment for sessions.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial document is not solely dependent on its content but also significantly on its design, formatting, and overall usability. A well-structured template should be intuitive, clear, and professional, facilitating quick completion and easy comprehension for both the issuer and the recipient. Attention to these details ensures that the document serves its purpose efficiently and reflects positively on the entity issuing it.

For optimal design, prioritize readability. Use clear, legible fonts and maintain an uncluttered layout with sufficient white space between elements. Key information, such as the amount, date, and purpose, should be prominently displayed. Formatting should include distinct sections for payer details, payee details, transaction specifics, and an optional signature line. Incorporating a unique receipt number or transaction ID is crucial for tracking and reconciliation.

In terms of usability, consider both print and digital versions. For printed forms, ensure they are easy to fill out manually if needed, with adequate space for handwritten entries. For digital versions, creating fillable PDF forms or integrating them into a digital invoicing system enhances efficiency. Digital templates should be easily downloadable, shareable, and compatible with various devices. Elements such as company logos and contact information should be strategically placed to reinforce brand identity without overshadowing critical transaction details. Ensuring the form is accessible and understandable to all users, regardless of their technical proficiency, is paramount for its widespread adoption and utility as a reliable financial template.

The Enduring Value of a Structured Financial Record

In today’s fast-paced business environment, the significance of reliable and efficient financial documentation cannot be overstated. A well-implemented cash deposit receipt template transforms a simple exchange of cash into a formalized, transparent, and verifiable transaction. It serves as a powerful instrument for ensuring accuracy in bookkeeping, fostering mutual trust between parties, and establishing an undeniable audit trail. This foundational document plays a pivotal role in mitigating financial risks, resolving potential disputes, and upholding a business’s commitment to professionalism and integrity.

Ultimately, the consistent use of a structured form for cash receipts is an investment in operational excellence and sound financial management. It simplifies reconciliation processes, streamlines administrative tasks, and provides invaluable support during tax preparations and audits. By standardizing the recording of cash transactions, businesses and individuals alike equip themselves with a reliable, accurate, and efficient tool that underpins financial accountability. This commitment to clear documentation ensures that every cash deposit is not just an exchange, but a meticulously recorded event, contributing to a robust and transparent financial ecosystem.