In the realm of financial transactions, clarity and accountability are paramount. A cash payment receipt serves as a fundamental document, meticulously detailing the exchange of funds between a payer and a payee. It stands as tangible proof of a transaction, offering essential protection and reference for both parties involved. This critical piece of business documentation is not merely a formality; it is a cornerstone of transparent financial record-keeping, validating the transfer of money for goods, services, or other specified purposes.

For any entity—be it a burgeoning small business, an established corporation, an independent contractor, or even an individual engaging in personal transactions—the systematic generation of these receipts is indispensable. Utilizing a well-structured template ensures that every necessary detail is captured accurately and consistently. This proactive approach to documentation benefits both the recipient of the cash, providing a clear record for accounting and tax purposes, and the payer, offering an undeniable proof of purchase or payment, crucial for dispute resolution or future reference.

The Cornerstone of Financial Integrity: Professional Documentation

The importance of clear and professional documentation in all financial and business transactions cannot be overstated. Each monetary exchange carries with it the potential for misunderstanding or dispute, making meticulous record-keeping a non-negotiable aspect of sound financial practice. A professionally designed receipt elevates the credibility of the transaction, ensuring that all terms are unequivocally recorded and understood.

Such documentation forms an integral part of an audit trail, providing a verifiable sequence of financial events. This systematic approach is vital for regulatory compliance, internal financial reviews, and external audits, offering undeniable evidence of income and expenditure. Without clear, standardized records, businesses and individuals risk legal complications, financial discrepancies, and the erosion of trust with clients and partners. Standardized documents, like a robust payment receipt, are the first line of defense against such challenges.

Maximizing Efficiency and Accuracy with a Structured Template

Employing a structured template for your cash payment receipt template offers significant advantages in ensuring accuracy, transparency, and consistency in record-keeping. This standardized approach eliminates guesswork and ensures that every relevant data point is captured during the transaction, minimizing human error and oversight. The inherent design of such a form guides the user through the necessary fields, leaving little room for omissions.

Accuracy is fundamentally enhanced when a predefined layout is used, as it prompts for all critical information, such as the date, amount received, payer and payee details, and the specific purpose of the payment. This level of detail is crucial for precise financial tracking and reconciliation. Transparency is also greatly improved, as both parties receive an identical, clear record of the transaction, fostering trust and accountability. The uniform appearance and content of each receipt further ensure consistency across all financial interactions, simplifying internal processing and external communication. This consistency is a hallmark of professional business documentation and facilitates smoother operations.

Tailoring the Template for Diverse Financial Transactions

The inherent flexibility of a well-designed cash payment receipt template allows for extensive customization, making it suitable for a wide array of financial transactions. While the core elements remain consistent, specific fields and sections can be adapted to reflect the unique nature of various business or personal exchanges. This adaptability ensures that the document serves its purpose effectively across different contexts, functioning as a comprehensive financial template for various needs.

For instance, when used for sales transactions, the template can incorporate lines for itemized purchases, quantities, unit prices, and applicable taxes. This transforms a basic receipt into a detailed sales record. In the context of services provided, specific sections can be added to describe the service rendered, hours worked, and hourly rates, providing a clear service receipt. Landlords collecting rent payments can customize the document to include property addresses, lease periods, and tenant names, serving as a specific rent payment receipt.

Non-profit organizations can adapt the form into a donation acknowledgment, including donor information, the amount donated, and language regarding the tax-deductible nature of the contribution. Similarly, for internal business reimbursements, the layout can be modified to detail expense types, employee names, and departmental coding, creating an effective expense record. This versatility underscores the value of a flexible design, allowing the document to function effectively as a payment receipt, proof of transaction, or even a simplified invoice form depending on the specific application.

When to Deploy a Cash Payment Receipt Template Effectively

A robust cash payment receipt template is most effective and often indispensable in scenarios where immediate proof of cash transfer is required and where formal documentation enhances accountability. The strategic deployment of this financial template ensures that both the giver and receiver of cash have a clear, verifiable record, mitigating potential disputes and simplifying record-keeping processes.

Consider these specific examples where employing the document is highly beneficial:

- Small Business Sales: Retailers, craft vendors, and farmers’ markets frequently handle cash, making a ready-to-use sales record essential for tracking daily income.

- Independent Contractors and Freelancers: Service providers collecting cash for completed projects benefit from issuing a formal service receipt, legitimizing their work and income.

- Landlords Collecting Rent: Providing tenants with a detailed rent payment receipt offers both parties clear proof of payment for the rental period, avoiding future misunderstandings.

- Non-Profit Organizations Receiving Cash Donations: Issuing a donation acknowledgment promptly to donors helps with their personal record-keeping and tax deductions.

- Internal Business Reimbursements: For employees seeking reimbursement for out-of-pocket expenses, the form serves as an internal expense record, simplifying the accounting process.

- Any Transaction Requiring Immediate Proof: Whether it’s a down payment on a larger purchase, payment for a used item, or a personal loan repayment, the receipt provides instant, undeniable proof of transaction.

In all these instances, the systematic use of the template transforms a simple cash exchange into a formally documented event, fortifying financial integrity and operational efficiency.

Design, Formatting, and Usability: Optimizing Your Template

The effectiveness of any financial document, including a payment receipt, is heavily influenced by its design, formatting, and overall usability. A well-designed receipt is not only professional in appearance but also intuitive to complete and easy to understand. Thoughtful consideration of these elements ensures that the form accurately captures all necessary details and serves its purpose efficiently, whether in print or digital format.

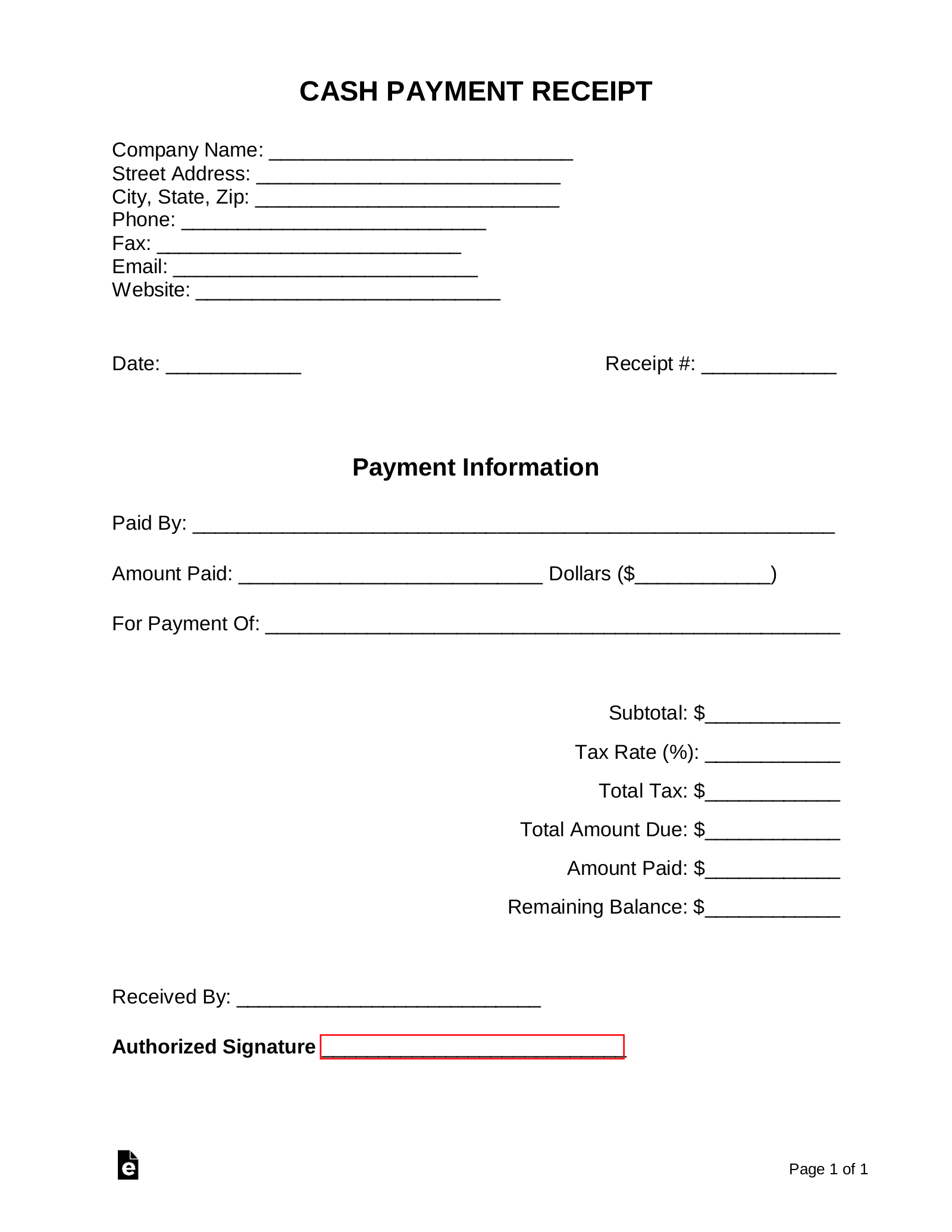

Key design elements for the receipt include clearly labeled fields for essential information: the date of transaction, the amount received (both numerically and in words), the name of the payer, the name of the payee (or company name), a precise description of the goods or services for which payment was made, and a unique receipt number for tracking. A designated space for signatures from both parties adds an extra layer of authentication. Incorporating your business logo and contact information further enhances branding and professionalism, transforming the form into a recognizable piece of business documentation.

For print versions, consider layouts that are easy to duplicate, such as carbon copy forms, or designs that facilitate quick tear-off copies. Ensure sufficient space for handwriting if the form is to be filled out manually. For digital versions, the layout should be optimized for electronic completion and storage. Utilizing fillable PDF formats or spreadsheet templates allows for easy data entry, automated calculations, and seamless integration with accounting software. Digital forms should also be designed for easy sharing via email and secure archiving, functioning as a reliable invoice form or billing statement in an electronic format. The chosen fonts should be legible, and the overall layout clean and uncluttered, promoting clarity and minimizing errors for all users.

The Indispensable Role of a Modern Cash Payment Receipt Template

In today’s fast- paced business environment, the role of a modern cash payment receipt template extends far beyond a simple handwritten note. It represents a commitment to professionalism, accuracy, and legal compliance. A thoughtfully designed and consistently utilized template serves as a powerful tool for financial management, providing a clear audit trail that is invaluable for both internal financial reporting and external regulatory requirements.

This financial template is a testament to meticulous record-keeping, transforming transient cash exchanges into permanent, verifiable records. It solidifies the proof of transaction for every party, acting as an immutable reference point that safeguards against disputes and clarifies financial obligations. Such diligence in documentation not only protects the business and its clients but also fosters an environment of trust and transparency, which are cornerstones of successful commerce.

The value derived from a reliable, accurate, and efficient financial record tool, such as a well-implemented template, cannot be overstated. It streamlines accounting processes, simplifies tax preparation, and provides undeniable evidence in the event of an audit or discrepancy. By embracing standardized payment receipt practices, businesses and individuals alike solidify their financial integrity, ensuring that every monetary interaction is handled with precision and accountability. Ultimately, the systematic use of this form empowers all stakeholders with confidence in their financial dealings and underscores a commitment to best business practices.