In the intricate landscape of modern business and personal finance, precision and clarity in financial documentation are not merely advantageous; they are fundamental requirements. Every transaction, whether it involves a sale, a service, or a reimbursement, necessitates an accurate record, and none more so than a refund. A well-structured cash refund receipt template serves as an indispensable tool for individuals and organizations alike, ensuring that all financial reversals are meticulously documented, leaving no room for ambiguity or dispute.

This comprehensive guide delves into the profound utility of such a template, illustrating its pivotal role in fostering transparency, accountability, and efficiency in financial operations. It is designed for businesses, non-profits, independent contractors, and anyone who frequently handles monetary transactions that may occasionally require a refund. Adopting a standardized approach to issuing refunds not only streamlines internal processes but also reinforces trust with clients, customers, and stakeholders, underscoring a commitment to professional integrity.

The Importance of Clear and Professional Documentation in Financial Transactions

Clear and professional documentation forms the bedrock of sound financial management. In any transaction, the ability to trace, verify, and reconcile monetary movements is critical for legal compliance, accurate accounting, and dispute resolution. Without proper records, businesses risk mismanaging funds, facing auditing difficulties, and eroding client confidence. A robust system of documentation provides an undeniable proof of transaction, safeguarding both the payer and the recipient.

Moreover, meticulously maintained records contribute significantly to operational efficiency. They enable quicker reconciliation of accounts, simplify tax preparation, and offer valuable insights into financial patterns. For financial transparency, every payment receipt, invoice form, and billing statement must adhere to professional standards, ensuring that all parties possess a consistent and verifiable record of their interactions. This commitment to detailed business documentation ultimately strengthens an organization’s financial health and reputation.

Key Benefits of Using Structured Templates for Cash Refund Receipts

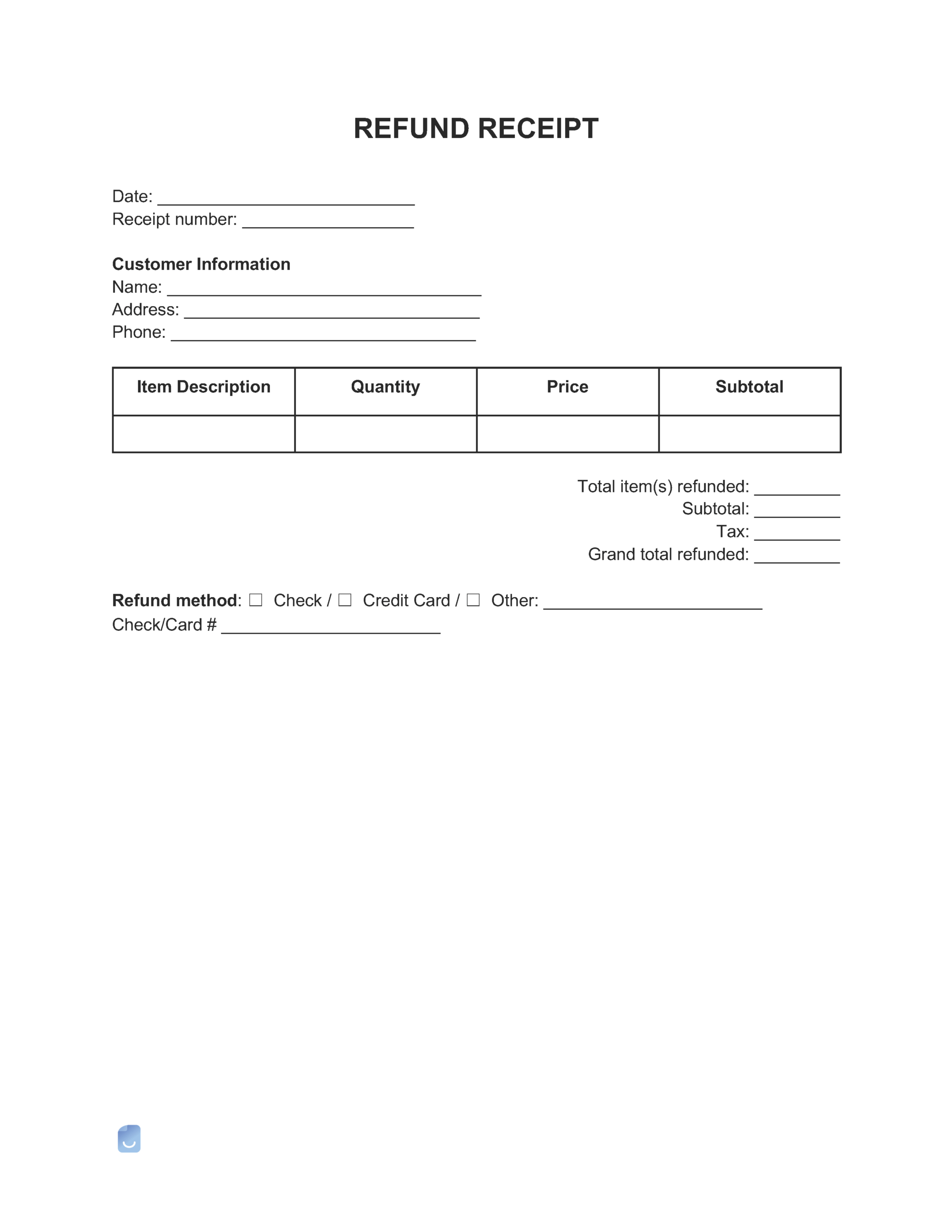

The structured approach offered by a cash refund receipt template guarantees accuracy, transparency, and consistency in record-keeping. By standardizing the information captured for each refund, organizations minimize errors that often arise from manual, ad-hoc documentation. This systematic method ensures that critical details are never overlooked, providing a complete financial narrative for every returned payment.

One primary benefit is the enhanced clarity it brings to financial audits and reconciliation processes. When every refund is recorded using a uniform financial template, it becomes significantly easier to match refund payments with original transactions, verify account balances, and prepare comprehensive financial reports. This consistency saves valuable time and resources, reducing the administrative burden associated with managing financial records. Furthermore, the use of such a template serves as a tangible proof of transaction, offering legal protection and a clear reference point should any discrepancies or disputes arise concerning a returned payment.

Customizing the Template for Different Purposes

Adapting a cash refund receipt template allows businesses and individuals to cater to a diverse array of financial scenarios while maintaining a unified documentation standard. The core structure provides essential fields, but its flexibility permits specific customization to align with particular industry needs or transaction types. This adaptability ensures the document remains relevant and effective across various operational contexts.

For instance, a retail business might integrate fields for product SKUs and return authorization numbers, whereas a service provider might include service dates and detailed descriptions of the work for which a refund is issued. Non-profit organizations could tailor the layout for a donation acknowledgment to confirm the return of funds, specifying the original donation campaign. Even in personal finance, for expense record purposes or business reimbursements, the file can be modified to include project codes or specific budget allocations. The ability to customize this form ensures it remains a versatile and indispensable tool for any entity managing financial transactions, from sales records to service receipts.

Examples of When Using This Template Is Most Effective

The strategic deployment of this template is most effective in situations where a clear, verifiable record of a returned payment is crucial for both the payer and the recipient. Its utility spans various commercial and administrative functions, establishing a precise proof of transaction for returned funds.

- Retail Product Returns: When a customer returns merchandise, the receipt documents the refund amount, the items returned, the date, and the method of refund, preventing future disputes.

- Service Cancellation Refunds: For professional services, the document confirms the partial or full refund provided due to cancellation or dissatisfaction, outlining the original service and the terms of the return.

- Overpayments on Invoices: If a client accidentally overpays an

invoice formorbilling statement, the receipt serves as a formal acknowledgment of the refund for the excess amount. - Security Deposit Returns: In rental agreements, the template can be adapted to record the return of a security deposit, detailing any deductions made for damages or cleaning.

- Erroneous Charges: When an incorrect charge is identified and reversed, this form provides official documentation of the correction and the monetary return.

- Event Ticket Refunds: For canceled events or tickets, the template clarifies the refund amount, ticket details, and the reason for the reimbursement.

- Subscription or Membership Refunds: When a subscription or membership is canceled and a prorated or full refund is due, the receipt formalizes this financial adjustment.

- Business Reimbursements: For employees or contractors being reimbursed for expenses, and an adjustment or return of a prior reimbursement is needed, the layout provides a clear audit trail.

- Donation Refunds: In rare instances where a donation must be returned, the file offers a transparent

donation acknowledgmentof the returned funds for audit and compliance purposes.

Tips for Design, Formatting, and Usability

The effectiveness of any financial document, including a refund receipt, is significantly enhanced by its design, formatting, and overall usability. A well-designed receipt is not only professional in appearance but also intuitive to complete and easy to understand for all parties involved. Whether intended for print or digital distribution, thoughtful consideration of these aspects is paramount.

For design, prioritize a clean, uncluttered layout. Utilize clear headings and logical groupings of information to guide the eye. Branding elements, such as a company logo and official colors, can enhance professionalism and reinforce corporate identity. Ensure sufficient white space around text fields to improve readability and reduce visual fatigue. Regarding formatting, employ consistent font types and sizes throughout the document. Key information, such as the refund amount, date, and transaction ID, should be prominently displayed, perhaps using bold text or a slightly larger font.

Usability is critical for both manual and automated processes. For print versions, ensure ample space for signatures, dates, and any handwritten notes. The document should be easy to print and file. For digital versions, optimize the file for common software like PDF readers or spreadsheet programs, ensuring fields are fillable and the layout translates consistently across different devices. Consider incorporating automated calculation fields for totals if using a spreadsheet-based template. The receipt should be easy to email and store electronically, supporting efficient business documentation and archival practices. Providing clear instructions on how to complete or interpret the document can further improve its usability, making this financial template a truly efficient tool.

Concluding Thoughts on the Value of a Reliable Financial Record

In an environment where financial precision dictates success, the cash refund receipt template stands as a cornerstone of reliable, accurate, and efficient financial record-keeping. Its structured approach minimizes human error, standardizes documentation across diverse transactions, and provides an undeniable proof of transaction. This commitment to meticulous record-keeping not only safeguards financial assets but also cultivates trust and transparency in all business dealings.

By embracing and customizing this robust financial template, businesses and individuals can significantly streamline their administrative processes, enhance their auditing capabilities, and fortify their legal standing. It transcends a mere piece of paper; it embodies a dedication to professional integrity and sound financial management. In every scenario requiring a refund, the template ensures clarity, consistency, and confidence, reinforcing its indispensable value as a critical component of comprehensive business documentation.