Effective financial documentation is an indispensable component of sound business operations, providing clarity, accountability, and a verifiable record of transactions. For catering companies, which manage a continuous flow of services, sales, and payments, a standardized approach to acknowledging financial exchanges is not merely good practice but a fundamental necessity. A well-designed catering company receipt template serves as the primary tool for this purpose, offering a professional and consistent method for documenting every payment received from clients.

This specialized form benefits not only the catering business by streamlining its accounting processes but also its clients, who receive a clear proof of transaction for their records. It aids in dispute resolution, simplifies tax preparation, and fosters an image of professionalism and transparency. By providing a structured framework for recording financial details, the template helps ensure that all parties have an accurate and shared understanding of the monetary exchange that has occurred.

The Importance of Clear and Professional Financial Documentation

In any business, meticulous financial documentation underpins legal compliance, operational efficiency, and long-term financial health. For catering services, where transaction volumes can be high and service details intricate, clear documentation like a payment receipt is paramount. It acts as an official record, validating that a specific amount of money was received for services rendered or goods provided. Without such proof, businesses face challenges in reconciling accounts, managing customer queries, and adhering to regulatory requirements.

Professional documentation extends beyond mere record-keeping; it reflects the integrity and organization of a business. A well-prepared receipt reinforces customer trust and provides a credible audit trail for internal accounting and external audits. It simplifies the often-complex process of financial reconciliation, ensuring that every inflow of funds is accurately matched against the corresponding service or product delivered. This commitment to clarity safeguards against financial discrepancies and bolsters the business’s overall credibility.

Key Benefits of a Structured Catering Company Receipt Template

Adopting a structured catering company receipt template offers numerous advantages, profoundly impacting a business’s operational efficiency and financial accuracy. Such a document inherently promotes transparency, ensuring both the service provider and the client have a clear understanding of the transaction details. This consistency in documentation is vital for maintaining robust financial records and fostering long-term client relationships.

The template plays a crucial role in ensuring accuracy by standardizing the fields for data entry, minimizing the chances of omissions or errors. This structure means essential information, such as date, client name, service description, and amount paid, is consistently captured. Transparency is enhanced as the receipt clearly itemizes services and associated costs, providing a detailed breakdown for the client. Furthermore, consistency in record-keeping is achieved, as every transaction follows the same format, making it easier for accounting teams to process and reconcile financial data, ultimately streamlining internal audits and tax preparations. This systematic approach transforms payment processing into a reliable and efficient component of business management.

Customization for Diverse Business Purposes

While fundamentally a record of payment, the underlying structure of a financial template is remarkably versatile, allowing for significant customization to serve various business purposes. A robust template can be adapted far beyond basic sales receipts to accommodate specialized financial acknowledgments. This flexibility makes it an invaluable asset for businesses with diverse operational needs. For instance, the same foundational layout used for a catering service receipt can be modified to function as an invoice form, detailing anticipated charges rather than confirmed payments.

When adapted, this form can effectively manage various types of financial acknowledgments. It can become a tailored sales record for product purchases, a comprehensive service receipt outlining specific labor and materials, or even a specialized billing statement for ongoing projects. Furthermore, its design elements can be reconfigured to create official donation acknowledgments for non-profit organizations or structured expense records for employee reimbursements. The capacity to adjust fields, branding, and legal disclaimers ensures that the document remains relevant and legally compliant across a spectrum of financial interactions, extending its utility beyond its initial scope.

Examples of When Using a Catering Company Receipt Template is Most Effective

Utilizing a standardized payment receipt template proves most effective in numerous scenarios, ensuring clear documentation and professional communication. Its systematic nature simplifies transaction recording and provides immediate proof of payment.

- Upon Full Payment for Catering Services: When a client settles the entire balance for an event, this document serves as official proof of their payment, clearly stating the services provided and the amount received.

- For Deposit Payments: Recording initial deposits ensures that partial payments are formally acknowledged, outlining the amount paid and the remaining balance due.

- As Proof of Transaction for Product Sales: If a catering company also sells related products (e.g., branded merchandise, specialty food items), the template can be adapted as a sales record for these transactions.

- For Recording Rental Fees: When equipment (tables, chairs, linens) is rented out, the template provides a clear record of rental payments and associated terms.

- Acknowledging Expense Reimbursements: For internal use, it can document reimbursements made to staff for business-related expenses, ensuring an accurate expense record.

- Tracking Donations (if applicable): While primarily commercial, non-profit arms or charitable events hosted by a catering company could use a customized version as a donation acknowledgment.

- For Recording Miscellaneous Income: Any other income streams, such as consulting fees or event planning services, can be formally documented using a modified version of the template.

- As a Final Settlement Document: After an event, the receipt can be issued as a final summary, confirming all payments have been made and the account is closed.

Tips for Design, Formatting, and Usability

The effectiveness of any financial document, including a catering receipt, hinges significantly on its design, formatting, and overall usability. A well-designed layout not only looks professional but also facilitates quick comprehension and accurate record-keeping for both print and digital versions. Clarity and accessibility should be paramount in its development.

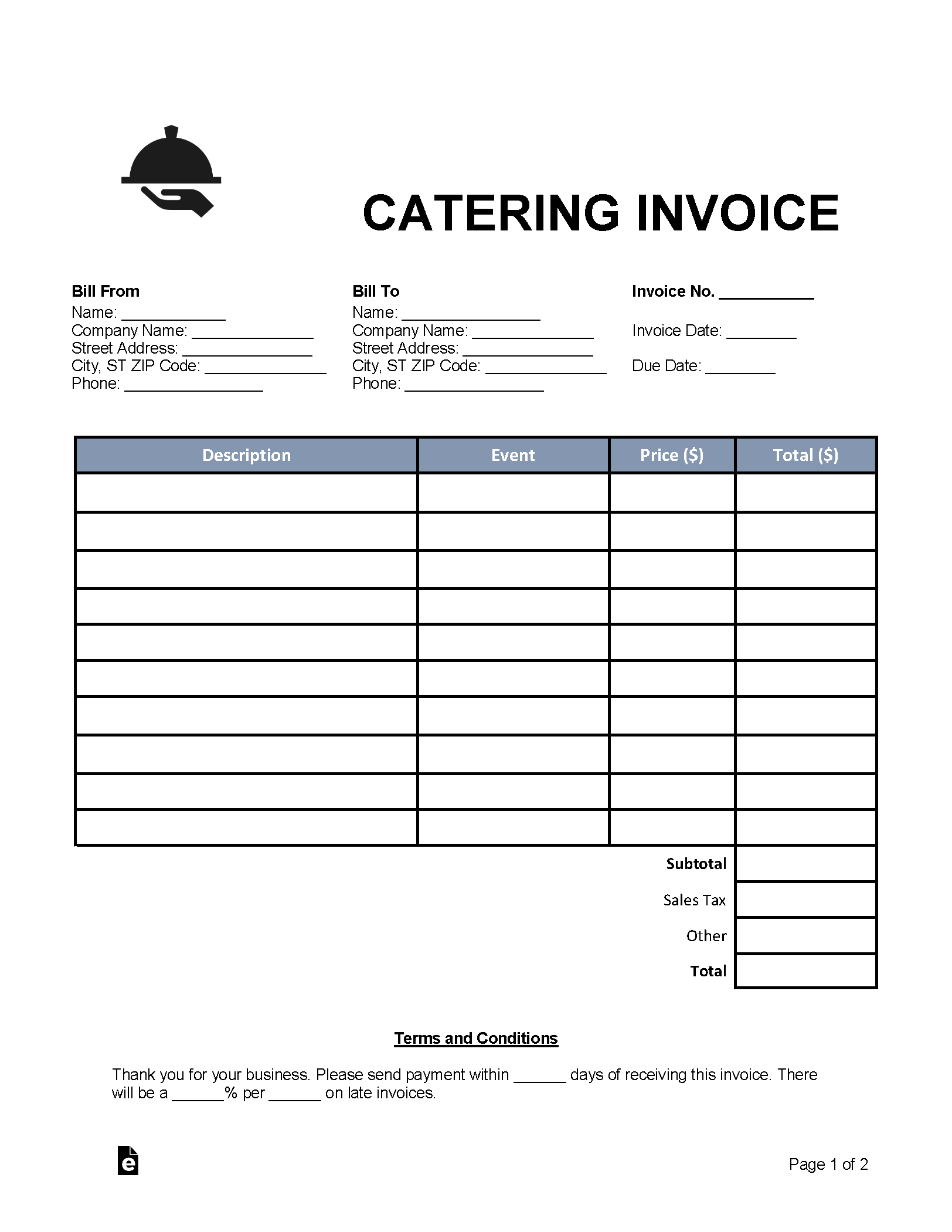

For optimal usability, the layout should prioritize essential information. Key fields such as the company name and logo, client details, unique receipt number, date of transaction, itemized list of services/products, unit prices, quantities, subtotal, taxes, discounts, total amount due, and amount paid should be prominently featured. Payment method, any outstanding balance, and terms and conditions or a brief thank-you message are also valuable additions. Use clear, legible fonts and adequate spacing to prevent clutter. For print versions, ensure the design is printer-friendly, minimizing excessive ink usage while maintaining readability. For digital versions, optimize the file for easy sharing (e.g., PDF format) and ensure it’s accessible across various devices. Implementing a consistent branding strategy, including company colors and typography, reinforces professionalism and aids in immediate recognition. Finally, consider incorporating a unique transaction ID or receipt number for each record, which vastly simplifies tracking and reconciliation, solidifying the document’s utility as a robust financial template.

Conclusion

In the dynamic world of catering, where precision and professionalism are key ingredients for success, a meticulously crafted catering company receipt template stands as an invaluable asset. It transcends the basic function of a simple payment acknowledgment, serving as a cornerstone for financial integrity, operational transparency, and robust client relations. By standardizing the documentation process, businesses can significantly reduce administrative overhead, minimize errors, and ensure every transaction is recorded with unwavering accuracy.

The adoption of a specialized receipt template signifies a commitment to excellence in business documentation. It provides indisputable proof of transaction, supports rigorous accounting practices, and facilitates seamless financial audits. Ultimately, this reliable and efficient financial record tool empowers catering businesses to maintain impeccable records, uphold a professional image, and build lasting trust with their clientele, solidifying their reputation as organized and dependable service providers.