In the intricate world of financial stewardship and regulatory compliance, the precise documentation of transactions is not merely a best practice; it is a fundamental requirement. For non-profit organizations and their generous supporters, a robust system for acknowledging gifts is paramount. This article delves into the critical role and comprehensive utility of a well-designed charitable contribution receipt template, a tool that streamlines the process of acknowledging donations while ensuring adherence to crucial IRS regulations and fostering trust.

The primary purpose of such a template is to provide donors with verifiable proof of their contributions, a document indispensable for tax deduction purposes. Simultaneously, it equips charitable organizations with a standardized, professional method for record-keeping, enhancing internal controls and audit readiness. Both parties benefit immensely from the clarity, accuracy, and efficiency that a structured charitable contribution receipt template affords, transforming what could be a cumbersome administrative task into a seamless and professional exchange.

The Importance of Clear and Professional Documentation

Clear and professional documentation stands as the bedrock of sound financial management in any organization, particularly within the non-profit sector. Every financial transaction, from a major grant to a small individual donation, necessitates an undeniable paper trail or digital record. This meticulous approach to record-keeping mitigates risks associated with discrepancies, fraud, and miscommunication, ensuring that all parties operate with transparency and accountability.

Beyond mere compliance, professional documentation reinforces an organization’s credibility and commitment to good governance. For donors, receiving a clearly articulated proof of transaction instills confidence in the charity’s operations, affirming their decision to support the cause. This attention to detail reflects an organization that values integrity and professionalism, essential attributes for sustaining donor relationships and public trust over the long term.

Key Benefits of Using Structured Templates for Financial Records

Structured templates offer a multitude of advantages that extend far beyond simple record generation. When applied to financial documentation, particularly for donation acknowledgment, they become indispensable tools for operational excellence. These templates are meticulously designed to capture all necessary information consistently, significantly reducing the likelihood of human error that can arise from manual entry or varied approaches.

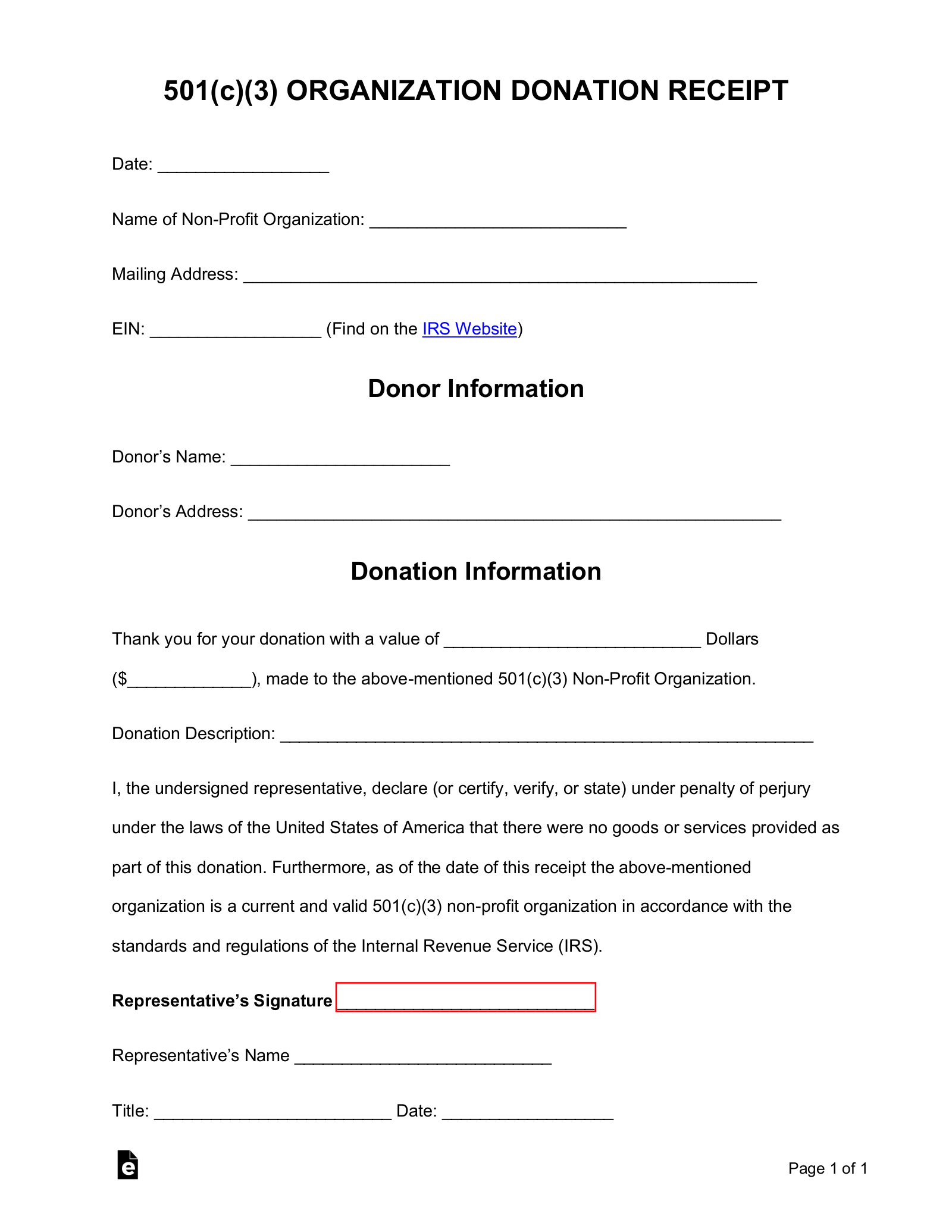

A well-crafted template ensures that every receipt issued contains the mandated details, such as the organization’s name, the donor’s name, the date and amount of the contribution, and a statement regarding goods or services received (if any). This standardization promotes transparency in all financial dealings and establishes a consistent record-keeping practice. The uniform layout simplifies auditing processes and provides a clear, comprehensive overview of an organization’s financial inflows. Utilizing a structured approach fosters a culture of accuracy, promotes efficiency in administrative tasks, and ultimately enhances an organization’s ability to maintain precise and consistent financial records.

Customization for Diverse Transactional Needs

While the focus might initially be on donations, the underlying principles of a well-structured receipt template are universally applicable across various transactional contexts. The fundamental layout and data fields can be easily adapted to suit different types of financial exchanges, making it a versatile business document. This adaptability ensures that organizations can maintain a unified and professional approach to all their acknowledgments, regardless of the transaction’s specific nature.

For example, a basic template can be customized to function as an invoice form for services rendered, a sales record for merchandise sold by a social enterprise, or a payment receipt for rent or other fees. By adjusting field labels and specific disclaimers, the same foundational structure can serve multiple administrative functions. This flexibility allows for an integrated system of financial documentation, reducing the need for numerous disparate forms and enhancing overall organizational efficiency.

Examples of When Using a Financial Template is Most Effective

The application of a robust financial template extends across a wide spectrum of scenarios, proving its utility in various business and charitable contexts. Its structured nature ensures that critical information is consistently captured and presented, supporting both operational efficiency and regulatory compliance. Here are several instances where utilizing such a template proves most effective:

- Charitable Donations: Providing official documentation for cash contributions, in-kind donations, or pledges, essential for donors claiming tax deductions and for organizations maintaining IRS compliance.

- Sales Transactions: Generating a sales record for goods sold by a non-profit’s thrift store, gift shop, or at fundraising events, ensuring accurate tracking of revenue and inventory.

- Service Payments: Issuing a service receipt for fees collected for workshops, training programs, or consulting services offered by the organization, providing proof of payment to clients.

- Membership Dues: Acknowledging the receipt of annual membership payments, which can often have partial tax-deductible components, necessitating clear documentation.

- Event Registrations: Confirming payments for event tickets, conference registrations, or gala dinners, often detailing the tax-deductible portion versus the value of goods/services received.

- Rental Payments: Documenting rent payments received for organizational property leased to other entities, providing tenants with a formal payment receipt.

- Business Reimbursements: Streamlining the process of internal expense record keeping by generating formal acknowledgments for reimbursements, aiding in accurate accounting and financial reconciliation.

- Grant Funding Receipts: Formally acknowledging the receipt of grant funds from foundations or government bodies, serving as a critical piece of business documentation for reporting requirements.

In each of these scenarios, the consistent structure and clarity offered by the template minimize administrative burden, enhance transparency, and uphold the professional image of the issuing entity.

Tips for Design, Formatting, and Usability

The effectiveness of any financial document, including a donation acknowledgment, is significantly influenced by its design, formatting, and overall usability. A well-designed receipt not only conveys professionalism but also ensures that critical information is easily digestible and accessible for both the issuer and the recipient. Thoughtful consideration of these elements can greatly enhance the utility and impact of the document, whether it exists in print or digital format.

For print versions, clarity is paramount. Use a clean, sans-serif font that is easily readable, with sufficient line spacing to avoid a cluttered appearance. Incorporate the organization’s logo prominently at the top to reinforce branding and authenticity. Essential information, such as the organization’s name, address, EIN, and contact details, should be clearly presented. Key data fields like donor name, contribution date, and amount should be bolded or highlighted to draw immediate attention. Ensure there is adequate white space around text blocks to improve readability and a professional aesthetic.

When considering digital versions, optimize the layout for various screen sizes and devices. PDF format is generally preferred for distribution, as it preserves the document’s integrity and appearance across different platforms. Implement fillable fields for easy digital completion, if applicable, making the form interactive and efficient for data entry. For email distribution, ensure the file size is manageable and the content is accessible to screen readers, aligning with broader accessibility standards. Both print and digital iterations should include clear instructions on how the recipient can use the receipt, particularly regarding tax implications, and where to direct any queries. The goal is to create a user-friendly experience that simplifies the documentation process for all involved parties, reinforcing the organization’s commitment to effective business communication.

The Enduring Value of a Reliable Financial Tool

In conclusion, the careful implementation of a structured financial template is more than just an administrative convenience; it is a strategic asset for any organization handling diverse financial transactions. This comprehensive approach to record-keeping provides a strong foundation for financial integrity, ensuring that every payment receipt, donation acknowledgment, or service receipt issued is consistent, accurate, and fully compliant with relevant regulations. It simplifies the complex process of financial documentation, offering peace of mind to donors, clients, and internal stakeholders alike.

By adopting a standardized and customizable layout, organizations can elevate their operational efficiency, reduce the potential for errors, and enhance their reputation for transparency and professionalism. Whether used as a proof of transaction for charitable giving or as an invoice form for business services, this reliable tool becomes an indispensable component of an effective financial management system. Ultimately, a well-designed template serves as a testament to an organization’s commitment to clarity, accountability, and the efficient management of its financial resources, solidifying its standing as a trustworthy and well-governed entity.