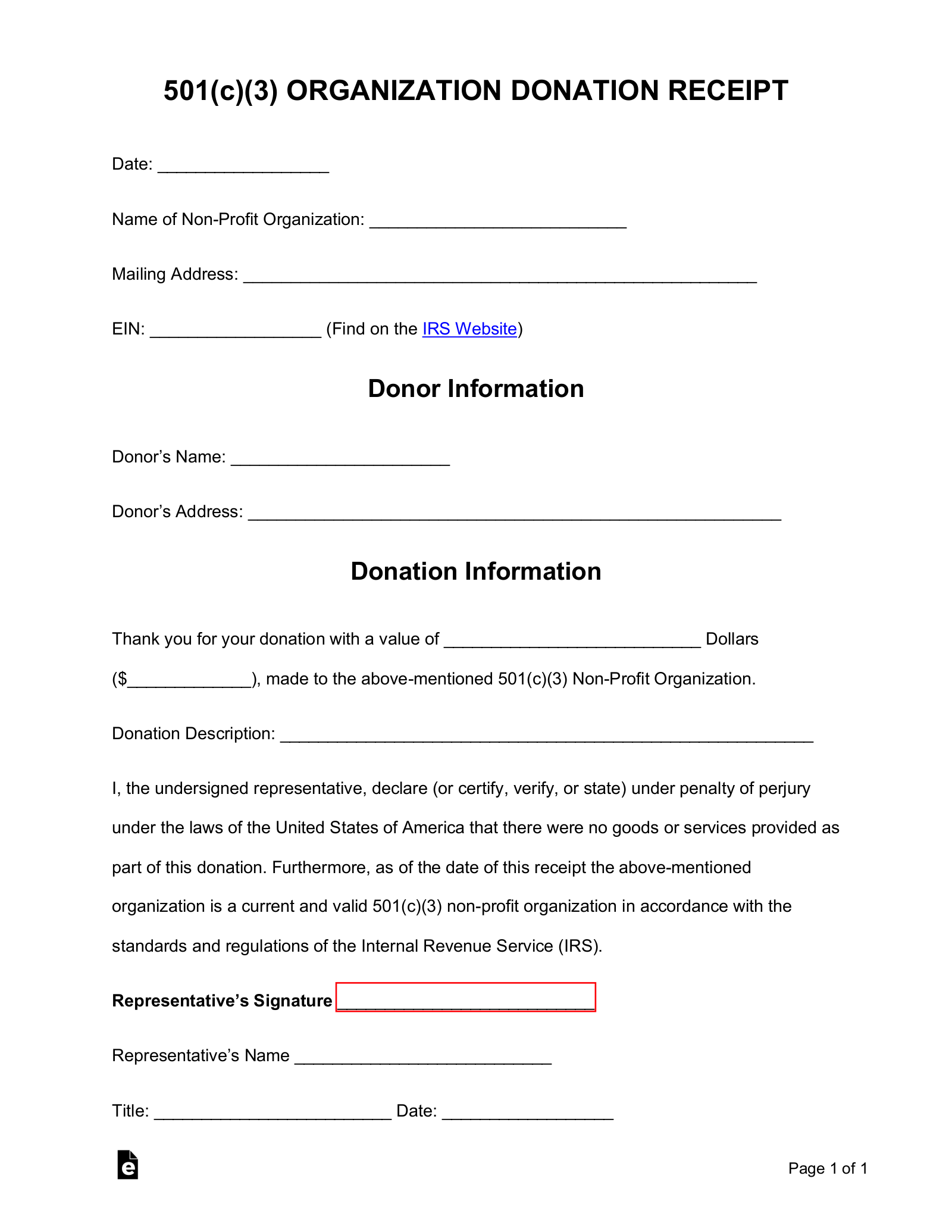

Accurate and transparent financial record-keeping is fundamental to the operational integrity of any organization, especially those involved in charitable endeavors. For non-profit organizations, the meticulous documentation of contributions is not merely a best practice; it is a critical requirement for maintaining donor trust, ensuring legal compliance, and facilitating tax deductions for generous benefactors. In this context, a meticulously designed charitable donation receipt template becomes an indispensable tool, serving as the official proof of a philanthropic transaction.

The primary purpose of such a document is multi-faceted: it provides donors with the necessary proof of their contribution for income tax purposes, formally acknowledges their generosity, and serves as an essential internal record for the receiving organization. Both donors and non-profits benefit significantly from a standardized, professional approach to donation acknowledgment. Donors gain peace of mind and the ability to claim appropriate deductions, while organizations streamline their administrative processes, bolster accountability, and present a professional image that reinforces their credibility.

The Importance of Clear and Professional Financial Documentation

In the modern business and non-profit landscape, meticulous record-keeping is not merely an administrative chore but a cornerstone of ethical operation and legal compliance. Every financial transaction, from a small donation to a major capital expenditure, requires clear, unambiguous documentation. This principle underpins the trust that stakeholders, including donors, investors, and regulatory bodies, place in an entity.

Professional financial documentation, such as a robust payment receipt or proof of transaction, safeguards against disputes, reduces the potential for fraud, and provides an auditable trail for all fiscal activities. It ensures accountability across all levels of an organization and establishes a clear narrative of its financial health and transactions. Without such diligence, an organization risks legal penalties, reputational damage, and a breakdown of public trust, underscoring why strong business documentation practices are paramount.

Key Benefits of Structured Templates for Financial Records

Utilizing structured templates for financial records offers a multitude of advantages that extend beyond simple record-keeping. These standardized forms ensure consistency in data capture, which is vital for accurate reporting and analysis. When every receipt or record follows a uniform layout, critical information is always located in predictable places, making retrieval and verification significantly faster and less prone to human error.

The benefits of employing a tool like a charitable donation receipt template are substantial, encompassing accuracy, transparency, and operational efficiency. Such a document helps reduce manual errors, automates parts of the documentation process, and provides a clear, verifiable record of every transaction. This level of consistency not only streamlines internal accounting but also enhances transparency for external stakeholders, demonstrating a commitment to responsible financial management. Ultimately, a well-designed template minimizes administrative burden, allowing organizations to allocate more resources towards their core mission rather than grappling with disorganized paperwork.

Customizing the Template for Diverse Financial Transactions

A significant advantage of a well-designed receipt template lies in its inherent adaptability. While initially conceived for specific purposes, the underlying structure and organizational principles of such a form can be readily customized to suit a wide array of financial transactions. The essential elements of a successful record—details of parties involved, date, amount, description, and unique identifier—remain constant, regardless of the transaction type.

Thus, the foundational layout inherent in a charitable donation receipt template can be efficiently repurposed for numerous other financial acknowledgments. With minor modifications, fields can be re-labeled, sections added or removed, and specific instructions tailored to meet different requirements. This versatility transforms a singular-purpose document into a dynamic tool capable of addressing diverse documentation needs across various sectors, providing a comprehensive solution for systematic record-keeping.

Effective Applications of a Comprehensive Receipt Template

A robust and adaptable receipt template proves invaluable across a broad spectrum of financial interactions, ensuring that every transaction is properly documented and acknowledged. Its utility extends far beyond mere donation confirmations, serving as a critical component in various business and personal financial scenarios. The standardization it offers simplifies processes and enhances clarity for all parties involved.

Examples of when using such a comprehensive financial template is most effective include:

- Confirming Charitable Contributions: Providing official donation acknowledgment for donors to claim tax deductions, a primary function of the template.

- Proof of Purchase: Issuing a payment receipt or sales record for customers who have bought goods or services, detailing the items purchased and the amount paid.

- Rent Payment Verification: Documenting monthly rent payments for both tenants and landlords, offering a clear record for lease agreements and financial reconciliation.

- Business Expense Reimbursements: Generating an expense record for employees who have incurred costs on behalf of the company, ensuring proper accounting and transparent reimbursement processes.

- Service Delivery Confirmation: Creating a service receipt to acknowledge the completion of professional services, detailing the work performed and fees charged.

- Invoice Form for Billing: Adapting the template to serve as an invoice form or billing statement, outlining services rendered or products supplied prior to payment.

- Internal Financial Tracking: Using the template for internal business documentation to record transfers, petty cash transactions, or other financial movements within an organization.

These diverse applications underscore the fundamental value of having a standardized, easily modifiable receipt system. It streamlines operations, reduces ambiguity, and supports transparent financial practices across various contexts.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template hinges not just on its content, but equally on its design, formatting, and overall usability. A well-designed document is intuitive to complete, easy to read, and conveys professionalism, whether presented in print or digital format. Clarity and conciseness are paramount to ensure that all critical information is immediately apparent and understandable to both the issuer and the recipient of the record.

Key design elements include clear headings, logical sequencing of information, and sufficient white space to prevent visual clutter. Essential fields such as the issuer’s identity, recipient’s details, date of transaction, detailed description of the item or service, monetary amount, and any unique transaction identifiers (e.g., receipt number) should be prominently displayed. For print versions, legibility is crucial, with appropriate font sizes and clear areas for signatures or stamps. Digital versions should prioritize fillable fields, compatibility with common software (like PDF readers), and ease of electronic distribution via email or secure portals. Incorporating an organization’s logo and branding elements consistently across all financial documentation also reinforces professionalism and brand identity. Ultimately, the goal is to create a template that is not only functionally complete but also aesthetically pleasing and highly practical for everyday use.

A well-crafted financial template is an indispensable asset for any organization or individual engaged in regular financial transactions. It transcends the basic function of merely acknowledging a payment, serving as a powerful tool for compliance, transparency, and operational efficiency. By standardizing the documentation process, such a template minimizes errors, streamlines administrative tasks, and provides a clear, indisputable record for all parties involved.

Ultimately, the value of a robust and adaptable template lies in its ability to instill confidence and foster trust. It assures donors, customers, and internal stakeholders that financial dealings are handled with the utmost professionalism and integrity. This foundational element of business documentation acts as a pillar supporting sound financial management, ensuring clarity and precision in every recorded transaction.