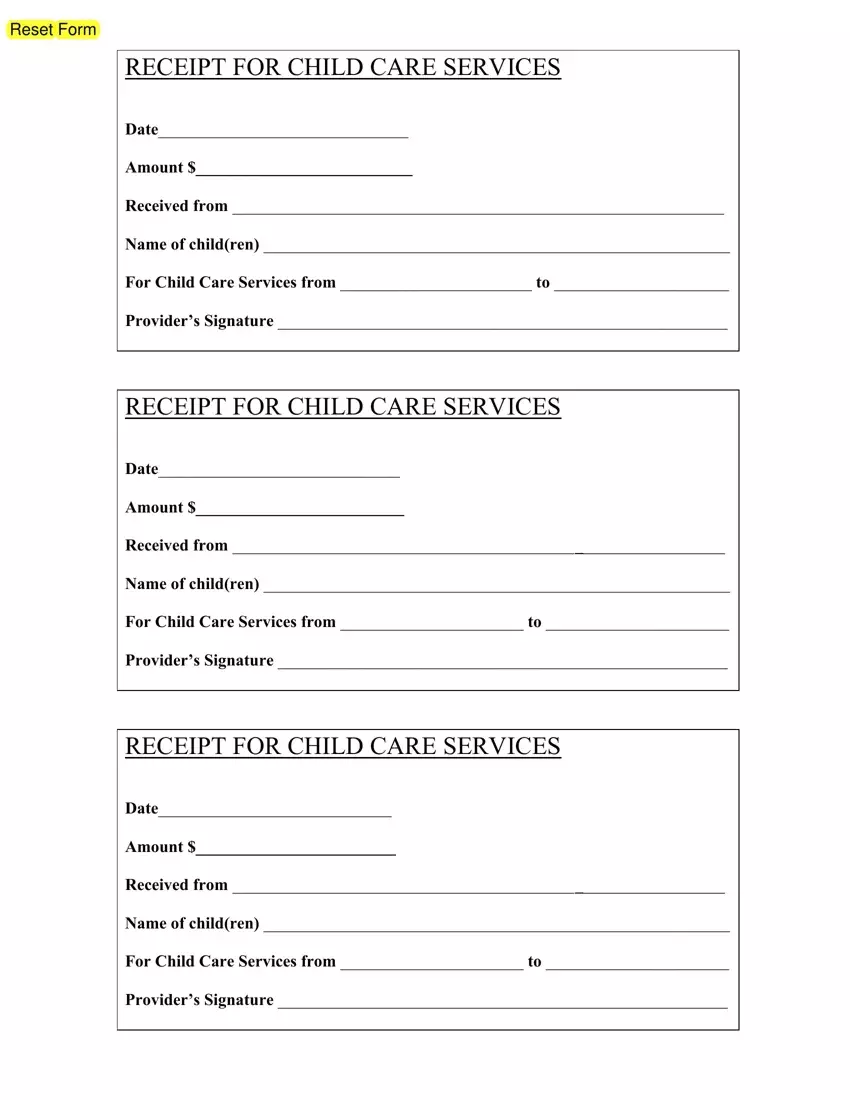

In today’s complex financial landscape, meticulous record-keeping is not merely good practice—it is an indispensable requirement for individuals, businesses, and service providers alike. For those involved in the provision or utilization of child care services, a well-structured child care expense receipt template serves as a cornerstone of financial transparency and accountability. This specialized document is designed to provide clear, irrefutable proof of payments made or received for child care services, facilitating accurate financial reporting and aiding in the process of claiming tax credits or deductions.

The primary purpose of a robust child care expense receipt template extends beyond simple acknowledgment of payment. It empowers both the service provider and the payer with an organized record that details the specifics of each transaction. Parents and guardians benefit from having a professional and comprehensive child care expense receipt template for tax purposes, such as the Child and Dependent Care Credit, while child care providers gain a streamlined method for managing their financial records, invoicing, and maintaining a professional image. This template ensures that all essential information is consistently captured, reducing potential discrepancies and administrative burdens.

The Importance of Clear and Professional Documentation in Financial Transactions

Clear and professional documentation stands as a pillar of trust and efficiency in all financial and business transactions. A well-prepared document, such as a payment receipt, not only confirms the exchange of funds but also formalizes the agreement between parties. It acts as an objective record, vital for resolving any future disputes, auditing financial statements, or demonstrating compliance with regulatory requirements. The precision embedded in such records minimizes misunderstandings and reinforces the credibility of all involved parties.

In the realm of financial accountability, an accurately completed receipt or invoice form is more than just a piece of paper; it is a legally significant proof of transaction. For businesses, this level of documentation underpins sound accounting practices, aiding in revenue recognition and expense tracking. For individuals, particularly concerning deductible expenses, clear documentation is paramount for substantiating claims to tax authorities, ensuring eligibility for various credits or deductions, and safeguarding against potential audits. The absence of such clear records can lead to significant financial and legal complications.

Key Benefits of Using Structured Templates for Child Care Expense Receipts

Utilizing a structured template for child care expense receipts offers a multitude of benefits, ensuring accuracy, transparency, and consistency in record-keeping. A predefined layout guides users to input all necessary information, drastically reducing the chances of omissions or errors that could compromise the validity of the expense record. This standardization simplifies the process for both the payer and the receiver, fostering a more organized and professional interaction.

One of the primary advantages of employing a dedicated template is the assurance of consistency. Every payment receipt issued will contain the same critical fields, presented in a uniform manner, making it easier to track and reconcile multiple transactions over time. This consistency is invaluable for financial reporting, whether for end-of-year tax preparations or for internal budgeting. The template enhances transparency by explicitly detailing services rendered, dates, amounts, and payment methods, leaving no room for ambiguity.

Moreover, a well-designed template streamlines administrative processes. Child care providers can quickly generate professional-looking receipts, saving time that would otherwise be spent on manual drafting or re-entering information. For parents, having a consistent record simplifies their financial management and tax preparation, as all required details are readily available in an organized format. This efficiency contributes significantly to the overall professionalism and reliability of the service provision.

Customizing This Template for Various Purposes

While specifically designed for child care expenses, the underlying structure of this financial template is highly adaptable and can be customized to suit a wide range of other financial transactions. The fundamental components of a receipt—details of payer and payee, date, amount, description of goods/services, and payment method—are universal. This inherent flexibility allows the document to serve diverse needs with minimal adjustments, showcasing its utility beyond its initial scope.

For instance, the layout can be modified to function as a sales record for retail transactions, detailing items purchased, quantities, unit prices, and total amounts. Similarly, it can be adapted into a service receipt for professional services like consulting or repairs, outlining the nature of the service, hours worked, and associated fees. With minor alterations, this form can also serve as a rent payment receipt, specifying the rental period and property address, or as a donation acknowledgment for charitable contributions, providing the necessary information for tax-deductible gifts.

Furthermore, businesses can customize the template for internal use, such as generating business reimbursements for employee expenses. The core design principles—clarity, comprehensive data capture, and professionalism—remain constant, ensuring that regardless of its specific application, the resulting documentation is reliable and effective. The ability to modify headings, add specific fields, or incorporate branding elements makes this document a versatile tool for various financial and operational requirements.

When Using a Child Care Expense Receipt Template is Most Effective

The strategic deployment of a dedicated template for expense recording significantly enhances financial management and compliance. It proves most effective in scenarios demanding clear, verifiable documentation for monetary exchanges, particularly when such records have legal or tax implications.

Here are specific examples where utilizing the template is highly advantageous:

- Annual Tax Preparation: When parents need to claim the Child and Dependent Care Credit on their federal income taxes, a detailed receipt is mandatory. This document provides the necessary information, including the care provider’s Employer Identification Number (EIN) or Social Security Number (SSN), the amount paid, and the period of care.

- Flexible Spending Accounts (FSAs) or Dependent Care Assistance Programs (DCAPs): Employees participating in these benefits programs require official documentation to substantiate their claims for reimbursement of eligible child care expenses. The template ensures all required data for these programs is consistently captured.

- Audits or Discrepancy Resolution: Should an individual’s tax return or an organization’s financial records be subject to an audit, having a standardized, clear set of receipts provides irrefutable proof of transactions, significantly simplifying the verification process and preventing potential penalties.

- Internal Accounting and Budgeting: Child care providers benefit from using the template for their internal accounting systems, making it easier to track income, reconcile bank statements, and prepare financial reports. It offers a clear overview of services provided and payments received.

- Proof of Payment for Legal or Custody Agreements: In cases where child care expenses are part of a divorce decree or child support agreement, the document serves as official proof that financial obligations are being met, providing clarity and preventing disputes.

- Professionalism and Trust-Building: For child care centers or individual providers, issuing professional, clear receipts builds trust with parents. It demonstrates transparency and a commitment to organized business practices, which can enhance client satisfaction and retention.

- Grant Applications or Financial Aid: In certain circumstances, individuals or organizations may need to demonstrate financial outlays for child care as part of a grant application or for eligibility for specific financial aid programs. The template provides a credible expense record.

Tips for Design, Formatting, and Usability

The effectiveness of any financial template, including this one, hinges significantly on its design, formatting, and overall usability. A well-designed document is intuitive, easy to complete, and professional in appearance, whether in print or digital format. These elements contribute to accuracy and user satisfaction.

For design, prioritize a clean and uncluttered layout. Use ample white space to ensure readability and to prevent information overload. Headings and labels should be clear and concise, guiding the user through each section. Incorporating the organization’s logo and contact information adds a professional touch and reinforces branding. Consistency in font styles and sizes across the entire form is crucial for a polished look.

Formatting should support logical data entry. Group related fields together, such as payee information in one section and payment details in another. Use bold text for key fields like "Total Amount Due" to draw attention to critical information. For digital versions, consider using fillable PDF fields or spreadsheet formats that allow for auto-calculations, minimizing manual errors. Ensure that date formats are standardized (e.g., MM/DD/YYYY) to avoid confusion.

Usability is paramount for both print and digital versions. For printed documents, ensure sufficient space for handwritten entries if that is the expected method of completion. The fields should be clearly labeled and large enough to accommodate legible writing. For digital templates, test the form’s functionality across different devices and software to ensure accessibility and ease of use. Provide clear instructions for completion, especially for fields requiring specific formats or information, such as the provider’s tax ID. Offer options for digital signatures where appropriate to expedite processes and enhance security. The goal is to create a seamless experience that encourages accurate and complete documentation without unnecessary friction.

The Enduring Value of a Reliable Financial Record Tool

The child care expense receipt template stands as an exemplary model of how a simple, well-structured financial tool can deliver profound value. It transcends being merely a proof of payment; it becomes an indispensable component of effective financial management, offering clarity, fostering trust, and ensuring compliance. By standardizing the documentation process, this template significantly reduces the potential for errors, disputes, and administrative overheads, benefiting both service providers and recipients.

In an era where precision in financial reporting is non-negotiable, the reliability, accuracy, and efficiency provided by such a template are invaluable. It underpins responsible financial stewardship, empowering individuals to confidently manage their expenses for tax purposes and enabling child care providers to maintain impeccable business records. The consistent application of this document strengthens financial transparency, making it an essential asset for anyone involved in the child care sector.