Accurate and transparent financial record-keeping is a cornerstone of responsible organizational management, particularly for non-profit entities. For religious institutions, managing contributions effectively is not only a matter of good governance but also a legal and ethical imperative. A well-designed church donation receipt template serves as a critical tool in this process, providing both donors and the organization with clear, verifiable proof of transactions. This standardized document simplifies the acknowledgment process, ensuring that all contributions are properly documented and easily retrievable for various purposes.

The utility of a robust church donation receipt template extends beyond mere compliance; it fosters trust and demonstrates accountability to the community and its benefactors. Donors rely on these receipts for their tax deductions, while the church depends on them for internal auditing, financial reporting, and maintaining a comprehensive record of support. This article will delve into the profound importance of such templates, exploring their benefits, customization potential, and best practices for design and implementation in various financial contexts.

The Importance of Clear and Professional Financial Documentation

In any organizational setting, the meticulous documentation of financial transactions is non-negotiable. It forms the bedrock of financial integrity, providing an indisputable audit trail for all incoming and outgoing funds. For churches and other non-profit organizations, this practice is particularly vital, as they operate under public scrutiny and often rely heavily on the generosity of their community. Professional documentation ensures compliance with legal and regulatory requirements, such as those set by the Internal Revenue Service (IRS) in the United States regarding charitable contributions.

Clear and professional financial documentation, including comprehensive payment receipts and donation acknowledgments, mitigates risks associated with fraud, errors, and disputes. It establishes a verifiable record for every contribution received, offering proof of transaction that protects both the donor and the recipient organization. This level of detail supports transparent financial reporting, which is essential for maintaining stakeholder confidence and demonstrating responsible stewardship of donated resources. Ultimately, well-organized documentation reflects an organization’s commitment to ethical practices and operational excellence.

Key Benefits of Structured Templates for Financial Records

Adopting structured templates for financial records, such as a dedicated church donation receipt template, offers a multitude of advantages that enhance operational efficiency and financial security. These standardized forms ensure accuracy, transparency, and consistency in record-keeping, transforming what could be a cumbersome administrative task into a streamlined, reliable process. By pre-defining the information required for each entry, templates minimize human error and guarantee that no critical details are overlooked.

One of the primary benefits is the assurance of accuracy. Templates guide users to input specific data fields, such as donor information, donation amount, date of contribution, and a clear description of the donation (e.g., cash, check, in-kind). This structured approach reduces ambiguity and ensures that all essential details for a valid donation acknowledgment are captured correctly. Consistency is another significant advantage; every receipt generated will follow the same format, making it easier for internal staff to process and for external auditors or donors to understand. This uniformity simplifies data entry, retrieval, and analysis, contributing to more efficient financial management. Moreover, the inherent structure of these forms supports transparency, as all relevant information is presented clearly and uniformly, building trust with donors and providing a verifiable expense record.

How This Template Can Be Customized for Different Purposes

While the focus here is on a church donation receipt template, the underlying principles of structured financial documentation are universally applicable. The flexibility inherent in a well-designed template allows it to be readily customized for various financial transactions beyond charitable contributions. This adaptability makes it an invaluable asset for any organization or business requiring formal proof of transaction or a detailed sales record.

For instance, this type of document can be adapted to serve as a payment receipt for services rendered, detailing the service provided, date, cost, and payment method. Businesses can modify it into an invoice form for goods sold, including product descriptions, quantities, unit prices, and total amounts. Landlords might use a customized version as a rent payment receipt, specifying the rental period, amount received, and tenant details. Even for internal business documentation, such as recording employee reimbursements or tracking petty cash transactions, the foundational layout provides a solid framework. The core components—transaction date, amount, parties involved, and a description—remain constant, while specific fields can be adjusted to suit the unique nature of each financial interaction. This versatility underscores the power of a standardized financial template in promoting organized and verifiable record-keeping across diverse contexts.

Examples of When Using Such a Template Is Most Effective

The structured nature of a well-designed financial template, whether for a church donation receipt or another transaction, makes it exceptionally effective in numerous scenarios where clear financial accountability is paramount. Its utility shines in situations demanding a formal, verifiable record of exchange. The following examples highlight instances where employing such a template proves most beneficial:

- Processing Charitable Contributions: This is the primary use case, ensuring every donation, whether cash, check, credit card, or in-kind gift, receives a formal acknowledgment for tax purposes and internal record-keeping. The donation acknowledgment provided by the church donation receipt template is crucial for IRS compliance.

- Recording Large or Regular Donations: For significant contributions or recurring giving, a detailed receipt confirms the transaction, establishes a consistent history of support, and reinforces donor confidence.

- Issuing Receipts for Fundraiser Sales: When churches or non-profits sell items or tickets for fundraising events, the template can be adapted to serve as a sales record, documenting the purchase and payment.

- Acknowledging In-Kind Donations: For non-monetary gifts, such as goods, services, or property, the document can specify the item received and its fair market value, acting as a crucial expense record.

- Confirming Payments for Services: If the church provides services for a fee (e.g., event space rental, counseling), the template can be modified into a service receipt, detailing the service, date, and amount paid.

- Documenting Business Reimbursements: Within any organization, including a church, tracking reimbursements for expenses incurred by staff or volunteers can be managed effectively with a customized form, ensuring proper financial template adherence.

- Any Transaction Requiring Proof of Payment: Generally, for any financial exchange where one party needs official confirmation of payment and the other needs an expense record, a well-structured receipt template provides the necessary clarity and documentation.

Tips for Design, Formatting, and Usability

Creating an effective receipt template involves more than just listing required fields; it demands thoughtful design and formatting to ensure optimal usability for both print and digital versions. A clear, intuitive layout enhances efficiency, reduces errors, and projects a professional image. Focusing on these elements ensures the document serves its purpose reliably.

Clarity and Readability

* **Legible Fonts:** Choose professional, easy-to-read fonts such as Arial, Calibri, or Georgia. Avoid overly decorative or small typefaces that can hinder readability, especially for printed receipts.

* **Ample Whitespace:** Utilize sufficient spacing between lines, sections, and fields. Cluttered designs are difficult to navigate and can lead to missed information.

* **Logical Flow:** Arrange fields in a logical order, typically starting with donor/payer information, followed by transaction details, and then organizational information. This intuitive progression streamlines data entry and review.

* **Clear Headings and Labels:** Use bolding or slightly larger font sizes for headings (e.g., “Donation Details,” “Donor Information”) and clear, concise labels for each data field.

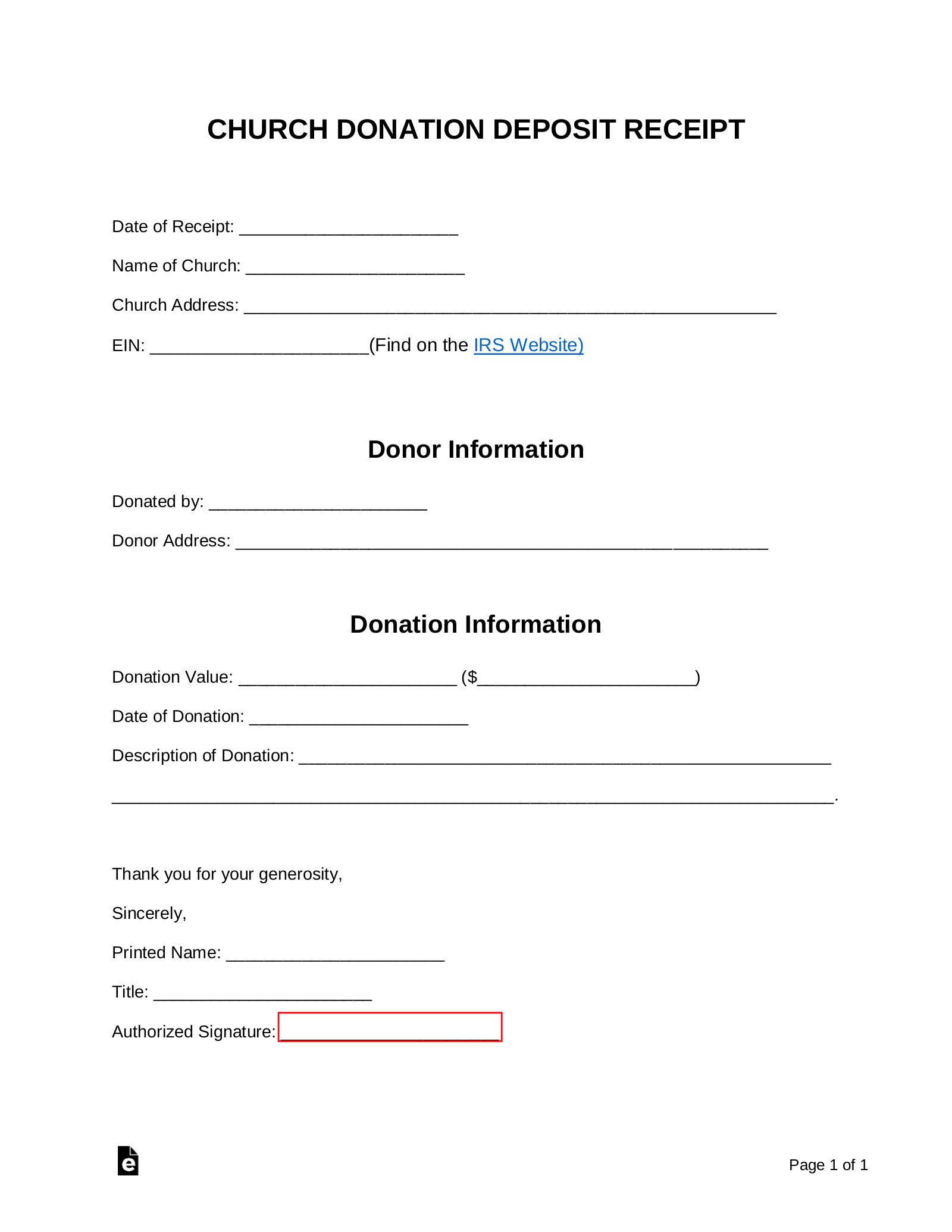

Essential Content Elements

* **Organization Identification:** Include the full legal name of the church or organization, its address, and its Employer Identification Number (EIN) for tax purposes.

* **Recipient Name and Contact:** Provide space for the donor’s or payer’s full name, address, and optionally, contact information.

* **Receipt Number:** Assign a unique sequential receipt number to each transaction for easy tracking and auditing.

* **Date of Transaction:** Clearly state the exact date the donation or payment was received.

* **Amount Received:** Specify the monetary amount in both numbers and words to prevent ambiguity.

* **Description of Donation/Payment:** Detail the purpose of the payment (e.g., “General Fund Donation,” “Tithe,” “Building Fund,” “Sale of Event Tickets”). For in-kind donations, describe the item and its estimated value.

* **Payment Method:** Note how the payment was made (e.g., cash, check number, credit card type).

* **IRS Disclosure (for donations):** Include the required IRS statement for charitable contributions, stating whether goods or services were provided in exchange for the donation and their value, or if no goods/services were provided.

* **Authorized Signature:** A designated signature line, possibly with the name and title of the signing authority, adds an extra layer of authenticity.

Print and Digital Optimization

* **Print-Friendly Design:** Ensure the layout is clean and uses minimal color if it will be frequently printed. Test printability to confirm all elements are visible and aligned correctly on standard paper sizes.

* **Fillable Digital Fields:** For digital versions (e.g., PDF forms), incorporate fillable fields to allow for easy electronic completion and reduce the need for manual handwriting.

* **Branding:** Incorporate the church’s logo and official colors (if applicable) subtly to reinforce brand identity and professionalism.

* **Accessibility:** Consider accessibility for users with visual impairments by using high-contrast colors and ensuring digital versions are compatible with screen readers.

* **Storage and Archiving:** Design the document in a way that facilitates easy digital archiving (e.g., saving as PDF) and physical filing, perhaps with a clear margin for hole-punching.

By adhering to these design and formatting principles, the receipt, whether a payment receipt, an invoice form, or a donation acknowledgment, becomes a highly functional and professional tool that streamlines financial operations and enhances trust.

Conclusion

The implementation of a meticulously designed and consistently utilized church donation receipt template is more than a mere administrative convenience; it is an essential component of sound financial management and ethical stewardship for any religious institution. Such a structured financial template ensures accuracy in record-keeping, promotes transparency with stakeholders, and establishes a robust audit trail crucial for compliance with tax regulations and internal accountability. Its adaptability allows it to serve as a versatile financial record, proving invaluable across a spectrum of transactions, from direct contributions to various payment receipts.

Ultimately, a high-quality receipt serves as a tangible expression of an organization’s commitment to professionalism and integrity. By simplifying the process of recording contributions and other financial exchanges, the document empowers organizations to focus more on their core mission, fostering greater trust within their community and among their donors. Investing in a clear, well-formatted financial template is an investment in reliability, accuracy, and efficient operations, underscoring its indispensable value as a fundamental business documentation tool.