Effective financial documentation is paramount for both individuals and organizations, especially when navigating the complexities of charitable contributions and their corresponding tax implications. In the United States, donors seeking to claim tax deductions for their generosity must possess proper acknowledgment from the recipient organization. For churches and other non-profit entities, providing clear, compliant, and professional documentation is not merely good practice; it is a legal necessity that underpins trust and transparency.

A well-structured church donation tax deduction receipt template serves as an indispensable tool in this regard. It streamlines the process of acknowledging contributions, ensuring that all required information for IRS compliance is meticulously captured and presented. This systematic approach benefits donors by providing the necessary proof of transaction for their tax filings, and it benefits the religious institution by fostering robust record-keeping, simplifying audits, and enhancing overall financial accountability.

The Critical Role of Professional Documentation in Financial Transactions

In the realm of finance and business, clear and professional documentation forms the bedrock of credible operations. Every transaction, whether a simple payment receipt or a complex invoice form, requires meticulous recording to ensure accuracy, facilitate audits, and maintain legal compliance. This rigorous approach to business documentation is not limited to commercial enterprises; it is equally vital for non-profit organizations, including churches, which handle significant financial flows from various sources.

Proper documentation acts as undeniable proof of transaction, safeguarding both parties involved against potential disputes or misunderstandings. It provides a historical record that can be referenced for financial reporting, budgeting, and strategic planning. For organizations handling charitable contributions, such as a donation acknowledgment, the integrity of these records directly impacts their reputation and their ability to adhere to regulatory standards, which is crucial for maintaining their tax-exempt status.

Key Benefits of Utilizing a Structured Church Donation Tax Deduction Receipt Template

Adopting a specialized and structured approach, such as employing a dedicated church donation tax deduction receipt template, offers a multitude of advantages that extend beyond mere compliance. These benefits enhance operational efficiency, foster transparency, and instill greater confidence in financial dealings for both the donor and the receiving institution.

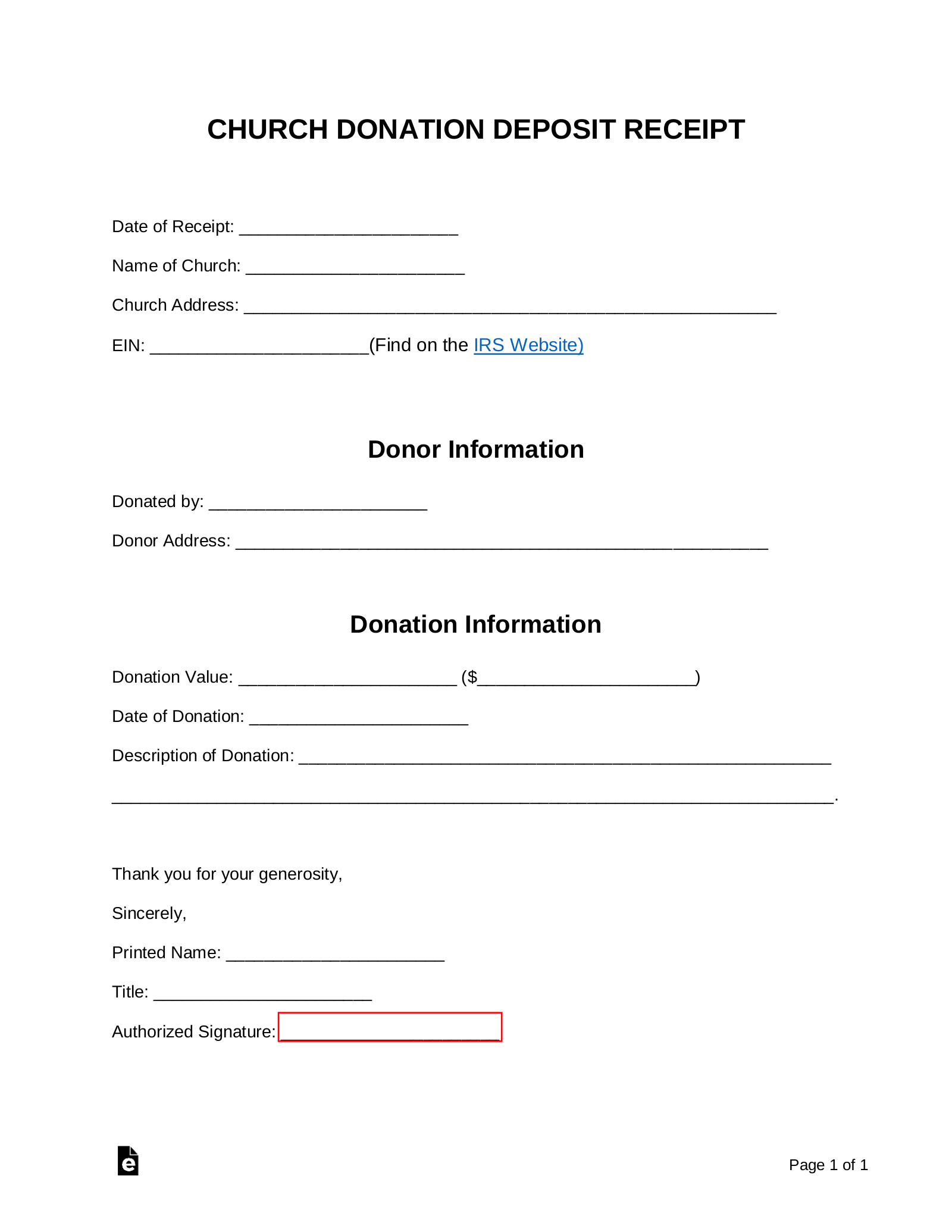

One primary benefit is the assurance of accuracy and completeness. A well-designed template guides the user through all necessary fields, minimizing omissions and errors. This standardization ensures that critical data, such as the donor’s name, the date of contribution, the amount, and the organization’s Employer Identification Number (EIN), are consistently captured, which is vital for tax purposes.

Furthermore, using this form significantly improves transparency and trust. Donors receive a professional and unambiguous record of their contribution, which clearly outlines the tax-deductible portion. This clear communication builds confidence in the organization’s financial stewardship and encourages continued support. For the organization, transparent record-keeping reinforces its commitment to ethical financial practices.

Consistency in record-keeping is another substantial advantage. When every donation acknowledgment follows the same format, it greatly simplifies internal accounting processes, reconciliation, and year-end reporting. This uniformity reduces the administrative burden on staff and volunteers, allowing them to allocate more time to the organization’s core mission rather than grappling with disparate records. This systematic approach also aids in creating a comprehensive expense record for all incoming funds.

Finally, compliance with IRS regulations is inherently built into a properly designed template. The Internal Revenue Service (IRS) has specific requirements for substantiating charitable contributions, particularly for donations exceeding certain thresholds. A robust template ensures that all required language and information, such as statements regarding goods or services received in return for the donation, are included, thereby protecting both the donor’s ability to claim deductions and the organization’s good standing.

Adaptability: Customizing Templates for Diverse Financial Transactions

While the focus here is on charitable contributions, the foundational principles that make a church donation tax deduction receipt template effective are broadly applicable across various financial transactions. The inherent structure and clear fields of such a document can be readily adapted and customized to serve a wide array of purposes, making it a versatile financial template for many organizations.

For instance, the core layout can be re-purposed as a sales record for merchandise sold by a church bookstore or an event. It can easily become a service receipt for fees collected for specific programs or counseling. Similarly, with minor modifications, this form can function as a billing statement for recurring charges, such as facility usage fees or even rent payments from tenants utilizing church properties.

Beyond revenue generation, the template’s structure is also ideal for documenting business reimbursements, providing a clear expense record for out-of-pocket costs incurred by staff or volunteers. The key is to identify the essential data points required for a specific transaction—such as payer/payee details, date, amount, and a clear description—and then tailor the descriptive fields and any specific legal disclaimers accordingly. This adaptability underscores the value of having a flexible, well-designed template as part of an organization’s overall business documentation strategy.

Optimal Scenarios for Employing This Template

The utility of a well-crafted receipt or acknowledgment template extends across numerous scenarios, providing critical proof of transaction for various financial exchanges. Adopting such a structured approach ensures clarity and compliance in diverse contexts.

Here are examples of when using this template is most effective:

- Cash Contributions: For any monetary donation, regardless of amount, providing a formal receipt ensures the donor has documentation for their records and potential tax deductions.

- In-Kind Donations: When non-cash items (e.g., property, stock, goods) are donated, the receipt serves as a detailed acknowledgment, crucial for valuing the contribution for tax purposes.

- Tax-Deductible Membership Dues: If a portion of membership dues is tax-deductible, the receipt can clearly separate the deductible amount from any non-deductible benefits received.

- Payments for Goods or Services with a Charitable Component: For events or sales where part of the payment is considered a donation, the document delineates these portions for accurate tax reporting.

- Fundraising Event Ticket Sales: While not always fully deductible, a receipt can acknowledge the payment and, if applicable, state the tax-deductible portion.

- Business Reimbursements: As an expense record, it provides formal proof of repayment for costs incurred on behalf of the organization.

- Recurring Rent or Lease Payments: For tenants, this form offers a consistent payment receipt, crucial for their financial records.

- Service Fees Collected: A service receipt confirms payment for specific programs, workshops, or professional services offered by the institution.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template, including a church donation tax deduction receipt, hinges significantly on its design, formatting, and overall usability. A well-designed layout not only looks professional but also facilitates accurate data entry and easy comprehension for both the issuer and the recipient.

Clarity and Readability: The foremost design principle should be clarity. Use clean, legible fonts (e.g., Arial, Calibri, Times New Roman) in appropriate sizes. Ample white space around text and fields prevents the document from appearing cluttered and makes it easier to read. Consistent formatting throughout the file, including alignment and spacing, enhances its professional appearance.

Essential Fields: Every effective receipt must include core data elements. These typically encompass:

- The name, address, and contact information of the receiving organization (e.g., church).

- The organization’s Employer Identification Number (EIN), crucial for tax deductions.

- The name and address of the donor.

- The date of the contribution.

- The amount of the donation (for cash contributions) or a description of the non-cash property.

- A clear statement regarding whether any goods or services were provided in return for the donation and, if so, their estimated fair market value. If no goods or services were provided, this should also be explicitly stated.

- An authorized signature line (digital or physical) and title.

- A unique receipt number for easy tracking and record-keeping.

Branding and Professionalism: Incorporate the organization’s logo and official branding elements consistently. This not only enhances the professional appearance of the receipt but also reinforces the organization’s identity. Ensure contact information, including website and email, is prominently displayed for any queries.

Usability for Digital and Print Versions:

For digital versions, which are increasingly common, ensure the file is easily fillable and savable as a PDF. Consider implementing auto-calculating fields if applicable. The layout should be responsive if accessed on various devices. Secure electronic signatures can enhance efficiency and legal validity. For storage, it’s advisable to use a robust financial template system that allows for secure, cloud-based archiving and easy retrieval.

For print versions, design the layout to be printer-friendly, avoiding excessive use of dark backgrounds or intricate graphics that consume ink unnecessarily. Ensure there is sufficient space for manual entries and signatures if not fully digital. Providing duplicate copies (e.g., a carbon copy or easy print-outs) can be beneficial for both the organization’s records and the donor. The overall business documentation should be intuitively navigable for all users.

The Enduring Value of a Strategic Financial Tool

The implementation of a meticulously designed and consistently utilized financial template, such as a robust church donation tax deduction receipt, transcends mere administrative convenience. It represents a strategic investment in an organization’s financial governance, ensuring not only compliance with intricate tax regulations but also fostering an environment of transparency and trust. This commitment to accurate and reliable financial record-keeping safeguards both the institution and its invaluable donors.

Ultimately, by standardizing the acknowledgment process through such a clear and professional document, organizations simplify their internal accounting procedures, minimize the potential for errors, and streamline year-end reporting. Donors, in turn, receive the necessary proof of transaction, granting them peace of mind and confidence in their ability to claim eligible tax deductions. The efficiency gained and the clarity provided underscore the template’s role as a cornerstone of sound financial management.

In an increasingly complex financial landscape, having a dependable and adaptable financial template is no longer optional but an indispensable asset. It ensures that every monetary exchange is professionally documented, contributing to the overall integrity and operational effectiveness of any entity reliant on public contributions. This meticulous approach to business documentation reinforces an organization’s credibility and its unwavering commitment to responsible stewardship.