Accurate and transparent financial record-keeping is a cornerstone of responsible organizational management, particularly for non-profit entities such as churches. For donors, receiving clear and professionally prepared documentation of their contributions is not merely a courtesy; it is often a necessity for tax purposes. A well-designed church tax donation receipt template serves as a critical instrument in this process, bridging the gap between an act of generosity and its proper financial acknowledgment.

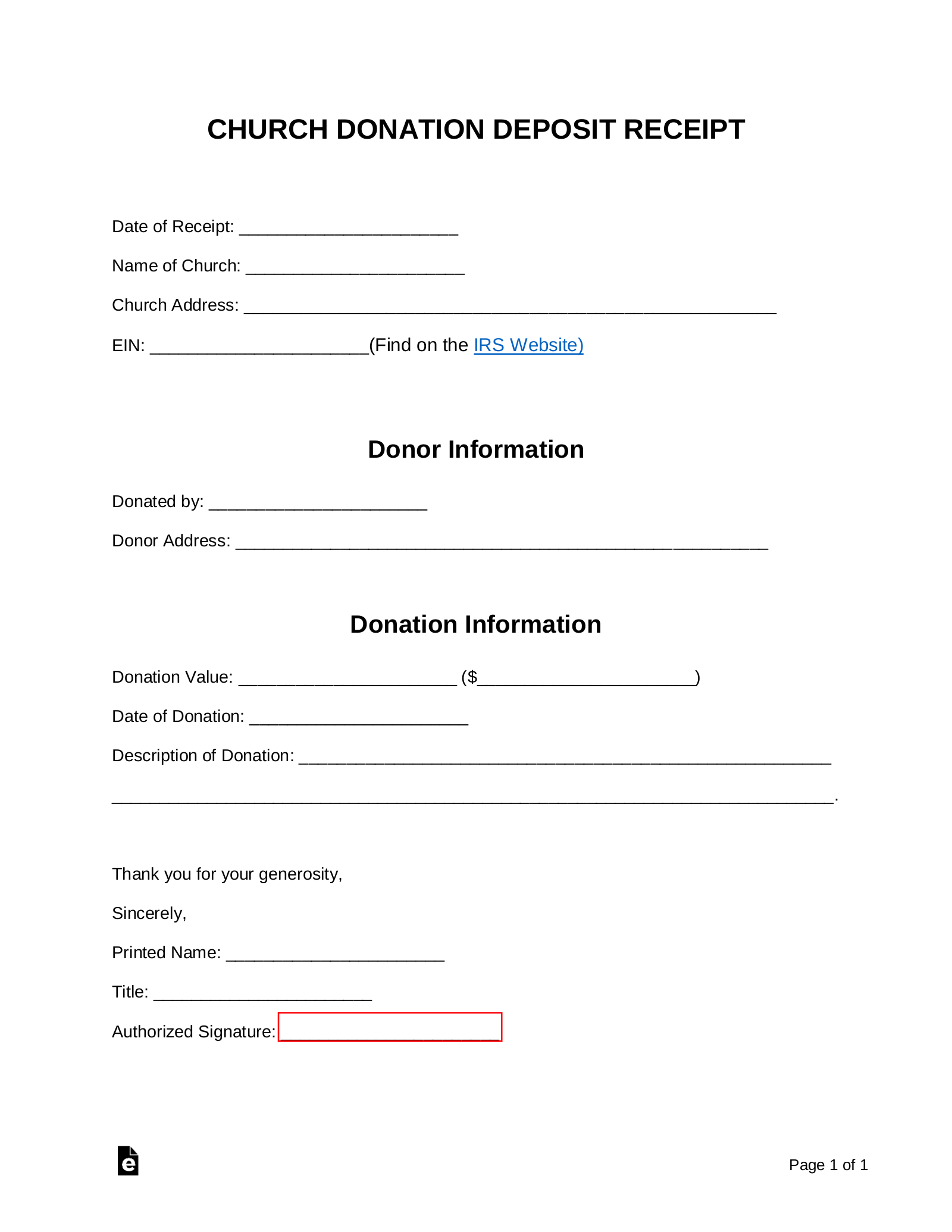

This specialized form provides a structured, standardized method for churches to acknowledge gifts received, ensuring that all requisite information is captured for both the donor’s records and the church’s internal accounting. It minimizes ambiguity, streamlines administrative tasks, and reinforces the church’s commitment to financial integrity, ultimately benefiting donors, accountants, and the organization itself by fostering trust and compliance.

The Indispensable Role of Clear and Professional Financial Documentation

In an environment increasingly focused on accountability and transparency, the importance of clear and professional financial documentation cannot be overstated. Every transaction, whether an incoming donation or an outgoing expense, contributes to an organization’s financial narrative. Properly documented transactions provide an undeniable proof of transaction, crucial for internal auditing, external reviews, and compliance with regulatory bodies like the Internal Revenue Service (IRS).

For churches and other non-profit organizations, maintaining meticulous records is particularly vital. These records validate their tax-exempt status, assure donors of their fiscal responsibility, and provide a comprehensive history of their financial activities. A robust system of documentation mitigates risks associated with discrepancies, fraud, and misinterpretation, upholding the organization’s reputation and legal standing.

Key Benefits of Structured Templates for Financial Record-Keeping

The adoption of structured templates for financial documentation, such as a well-crafted church tax donation receipt template, offers a myriad of advantages. These templates are designed to ensure accuracy, foster transparency, and promote consistency across all record-keeping activities. By standardizing the format and required fields, they eliminate guesswork and reduce the likelihood of critical information being omitted.

Implementing a consistent layout ensures that every receipt, regardless of who processes it, contains the same essential details, simplifying data entry and retrieval. This consistency is invaluable for creating reliable audit trails, reconciling accounts, and preparing comprehensive financial reports. Ultimately, the use of a predefined layout contributes significantly to the efficiency and reliability of an organization’s financial operations.

Customizing Financial Templates for Diverse Transaction Types

While often associated with charitable contributions, the underlying principles of a well-designed financial template are remarkably versatile. The structure of a robust donation acknowledgment can be readily adapted to serve various other transactional needs. By modifying specific fields and headings, the core layout can function effectively as a payment receipt, an invoice form, or even a detailed expense record.

This adaptability makes such templates invaluable tools for any entity managing multiple types of financial exchanges. Whether for sales records, service receipts, rent payments, business reimbursements, or any other financial communication requiring clear documentation, the template’s framework provides a consistent, professional foundation. It allows organizations to maintain a unified approach to their business documentation, regardless of the transaction’s specific nature.

Instances Where Using a Detailed Financial Template is Most Effective

Employing a detailed financial template is paramount in situations demanding clarity, legal compliance, and professional acknowledgment. Its structured approach ensures that all necessary information is systematically captured and presented. This ensures that the document serves its purpose effectively as a proof of transaction and a reliable financial record.

Examples of when using such a template is most effective include:

- Year-End Giving Statements: Consolidating all donations from a single donor into a comprehensive annual statement for tax filing purposes.

- Capital Campaigns: Acknowledging substantial contributions towards specific building projects or long-term initiatives, often requiring detailed breakdown of fund allocation.

- Non-Cash Contributions: Documenting the fair market value and description of donated goods, services, or property, critical for IRS compliance.

- Specific Program Donations: Providing receipts for funds earmarked for particular ministries, missions, or outreach programs, ensuring transparency in how funds are directed.

- Recurring Donations: Issuing periodic or consolidated acknowledgments for regular contributions, simplifying record-keeping for both donor and organization.

- Large Individual Gifts: For significant one-time gifts, where detailed acknowledgment is a matter of both legal requirement and donor relations.

- Event Ticket Sales/Admissions: When a portion of an event ticket is tax-deductible, a clear breakdown on the receipt is essential.

- Business Reimbursements: For internal documentation of expenses paid out to staff or volunteers, ensuring proper accounting and audit trails.

Design, Formatting, and Usability: Crafting an Optimal Financial Document

The efficacy of any financial document, including a donation acknowledgment, is significantly influenced by its design, formatting, and overall usability. A well-crafted template should be intuitive, professional, and easy to understand for all parties involved, whether printed or accessed digitally. Attention to these details elevates the document from a mere record to a clear, authoritative piece of business communication.

For design, prioritize clean lines, legible fonts, and adequate white space to prevent visual clutter. Essential elements like the organization’s logo, contact information, and clear fields for donor details, donation amount, date, and description should be prominently displayed. Consistent branding reinforces professionalism and helps the donor easily identify the source of the receipt.

Formatting should ensure a logical flow of information. Group related fields together and use bolding or distinct sections to highlight critical data points, such as the total donation amount. For digital versions, ensure the file is in a universally accessible format (e.g., PDF) and consider interactive fields for ease of data entry if it’s an internal form. Usability extends to accessibility: ensure the document is easy to read for individuals with varying visual needs, and that digital versions are navigable. For print versions, a standard letter size (8.5×11 inches) is generally preferred for filing convenience. Incorporating an authorized signature line or a digital signature placeholder adds an important layer of validation to the document.

The Enduring Value of a Reliable Financial Tool

In conclusion, the careful implementation of a well-structured financial template, specifically designed for acknowledging contributions, represents a significant asset for any organization. It is far more than a simple piece of paper or a digital file; it is a critical component of sound financial governance. By ensuring every donation receives a precise and consistent acknowledgment, this form solidifies trust, simplifies compliance, and underpins the organization’s reputation for integrity.

The systematic approach embedded within such a template transforms the often-complex task of financial documentation into a streamlined, reliable process. It serves as an accurate payment receipt, a robust proof of transaction, and an indispensable part of an organization’s overall business documentation strategy. Embracing this efficient financial template demonstrates a commitment to transparency and meticulous record-keeping, essential attributes in today’s demanding financial landscape.