In today’s complex financial landscape, meticulous record-keeping is not merely an administrative task; it is a cornerstone of fiscal responsibility and regulatory compliance. For individuals and organizations involved in charitable giving, particularly clothing donations, a formal acknowledgment serves multiple critical purposes. This article delves into the utility and design of a specialized receipt template, an essential tool for documenting such contributions.

The primary objective of such a document is to provide verifiable proof of a donation, which can be crucial for tax deductions, internal auditing, and maintaining transparent financial records. Both donors and recipient organizations benefit significantly from this structured approach. Donors gain the assurance of a properly documented contribution, aiding in their personal tax preparation, while recipient charities can efficiently track inbound resources and acknowledge the generosity of their supporters.

The Importance of Clear and Professional Documentation

Professional documentation forms the bedrock of trust and accountability in all financial and business transactions. Whether it pertains to sales, services, or charitable contributions, a clear and well-structured record eliminates ambiguity and supports legal and financial scrutiny. In an era of increasing regulatory oversight, the absence of proper documentation can lead to significant complications, including auditing challenges and potential non-compliance penalties.

Effective documentation serves as irrefutable proof of a transaction, detailing the nature, value, and parties involved. This clarity is paramount for internal controls, external audits, and demonstrating adherence to ethical business practices. A meticulously maintained record system underscores an organization’s commitment to transparency and operational integrity, fostering confidence among stakeholders, beneficiaries, and regulatory bodies alike.

Key Benefits of Using Structured Templates

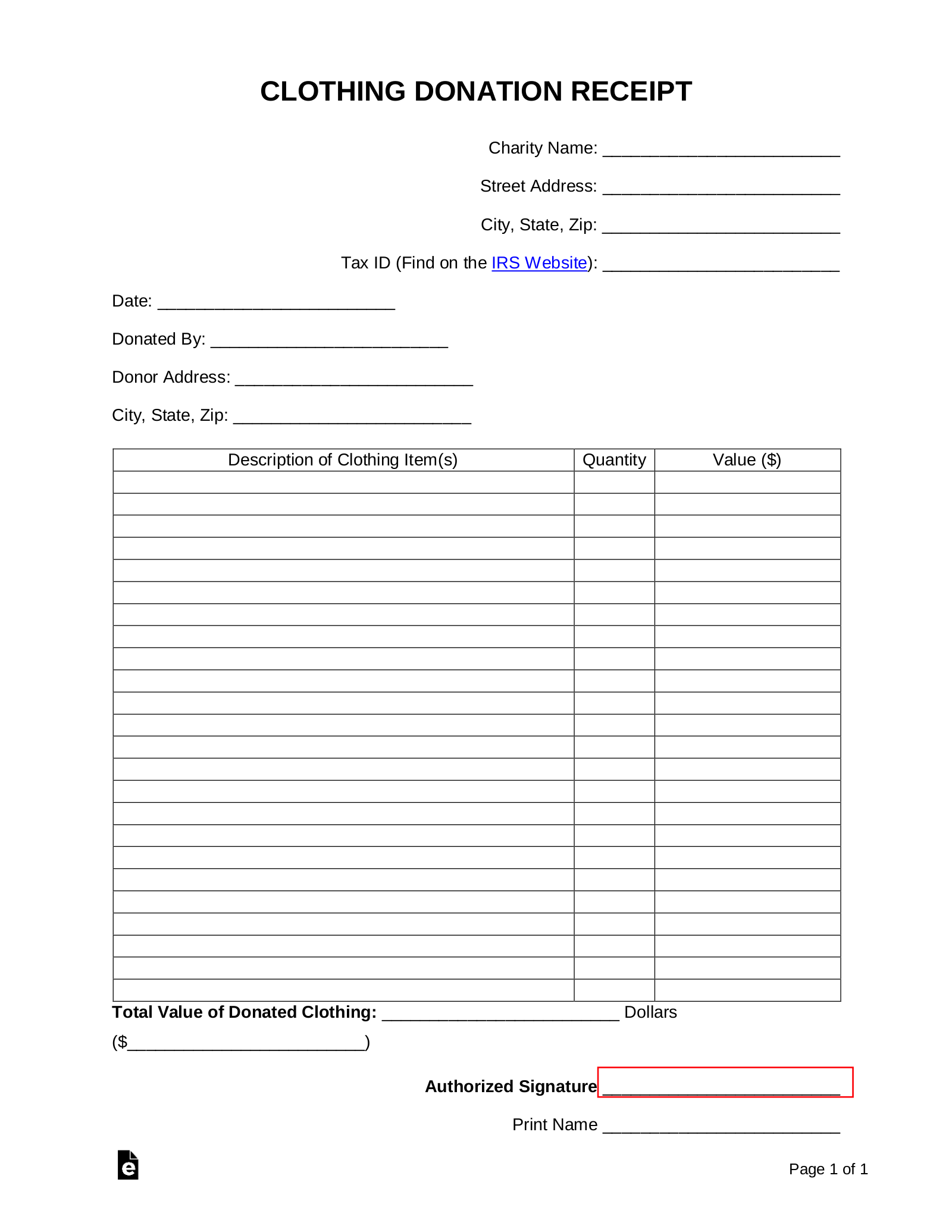

Implementing a well-designed clothing donation receipt template becomes indispensable for organizations regularly receiving non-cash contributions. Such structured forms bring a multitude of benefits, primarily ensuring accuracy, transparency, and consistency in record-keeping. They standardize the information captured, reducing the likelihood of errors and omissions that often plague manual or ad-hoc systems.

These templates promote transparency by clearly outlining all pertinent details of the donation, including date, donor information, item descriptions, and estimated values. This level of detail is vital for both internal financial reporting and external auditing processes. Furthermore, using a consistent layout across all donation acknowledgments enhances professionalism and simplifies data entry, retrieval, and analysis for accounting departments.

Customization for Diverse Financial Needs

While the focus here is on clothing donations, the underlying principles of a robust receipt template extend across a broad spectrum of financial transactions. The fundamental structure of such a document is highly adaptable, allowing for customization to suit various purposes. This versatility makes the core layout an invaluable asset for numerous business and organizational functions.

For instance, the essential components of a payment receipt, such as date, parties involved, description of goods or services, and amount, can be easily modified. This allows the template to serve as an invoice form for sales, a service receipt for professional engagements, or a formal acknowledgment for rent payments. Businesses can also adapt it for employee reimbursements, creating a standardized expense record that simplifies accounting procedures. The adaptability of a well-designed financial template ensures that organizations can maintain comprehensive and organized documentation for virtually any transaction.

Effective Applications of the Clothing Donation Receipt Template

When is utilizing a clothing donation receipt template most effective? Its value becomes evident in various scenarios where formal acknowledgment and detailed record-keeping are paramount. This document ensures that both the donor and the receiving entity have a clear, documented history of the contribution, supporting accountability and compliance.

- Individual Tax Filings: Donors require this receipt to substantiate non-cash charitable contributions claimed on their income tax returns. It provides the necessary proof of donation for IRS purposes.

- Charitable Organization Audits: For non-profits, consistent use of the document streamlines internal audits and facilitates external financial reviews, demonstrating diligent record-keeping of incoming resources.

- Donor Recognition and Engagement: Beyond tax purposes, the receipt serves as a professional acknowledgment of generosity, fostering goodwill and encouraging future donations.

- Inventory Management: For organizations that process and redistribute donated items, the detailed itemization on the form can aid in initial inventory tracking and logistical planning.

- Compliance with IRS Regulations: For donations exceeding certain monetary thresholds, specific IRS guidelines regarding valuation and documentation must be followed, and this template helps ensure compliance.

- Proof of Transaction: In any dispute or query regarding a donation, the receipt acts as definitive proof of the transaction, detailing all relevant specifics.

Design, Formatting, and Usability Considerations

Effective design and thoughtful formatting are crucial for ensuring that a receipt template is both professional and user-friendly, whether in print or digital form. A well-designed layout enhances readability, minimizes data entry errors, and reflects positively on the issuing entity. Simplicity and clarity should be guiding principles in its development.

The template should incorporate distinct sections for key information: issuer details (organization name, address, EIN), donor information (name, address, contact), donation specifics (date, type of items, quantity, estimated fair market value, condition), and a disclaimer regarding tax deductibility (e.g., "No goods or services were provided in exchange for this contribution"). Important elements include a unique receipt number for tracking, a clear date of issuance, and a designated space for an authorized signature. For digital versions, fields should be interactive and allow for auto-population where possible, while print versions should have ample space for legible handwriting. Consistent branding, including logos and fonts, reinforces professionalism. The layout should be intuitively organized, guiding the user through each field logically, ensuring all necessary information is captured efficiently and accurately.

The Enduring Value of Precise Financial Record-Keeping

In conclusion, the strategic implementation of a specialized receipt template transcends mere administrative convenience; it is an indispensable element of sound financial management. This meticulously structured form provides a robust framework for documenting transactions, safeguarding both the donor’s eligibility for tax benefits and the receiving organization’s accountability. Its consistent use underpins transparency, efficiency, and compliance across various financial operations.

Adopting and customizing such a template allows organizations to maintain precise, verifiable records that withstand scrutiny from auditors and regulatory bodies. This commitment to detailed documentation not only mitigates financial risks but also enhances operational credibility and strengthens stakeholder trust. Ultimately, a well-crafted receipt template serves as a reliable, accurate, and efficient financial record tool, embodying best practices in professional communication and fiscal responsibility.