In the intricate landscape of personal finance and taxation, accurate and verifiable documentation stands as a cornerstone of responsible financial management. For families utilizing a Dependent Care Flexible Spending Account (DCFSA), the precise substantiation of eligible expenses is not merely a suggestion but a mandatory requirement for reimbursement. This necessity underscores the critical importance of a well-structured and comprehensive dependent care fsa nanny receipt template, designed to capture all requisite details with clarity and precision.

Such a specialized receipt serves as a vital tool for both the care provider and the family, ensuring that every financial transaction related to dependent care is meticulously recorded. It empowers families to confidently submit claims for their DCFSA, facilitate tax credit calculations, and maintain impeccable financial records. Ultimately, this form acts as an essential bridge, connecting the service provided with the financial evidence required by administrators and tax authorities.

The Indispensable Role of Clear Financial Documentation

Meticulous record-keeping is not merely an administrative chore; it is a fundamental pillar of sound financial governance in both personal and business contexts. Comprehensive documentation, such as a robust payment receipt or an detailed invoice form, provides an irrefutable proof of transaction. This clarity is essential for establishing transparency and accountability in all financial dealings.

Beyond simple transaction verification, professional documentation is crucial for audit preparedness and dispute resolution. It acts as an authoritative sales record, a reliable service receipt, or a definitive expense record, protecting both parties involved. In an era where financial scrutiny is common, having readily accessible and well-organized business documentation minimizes risks and enhances trust.

Key Benefits of Utilizing a Structured Dependent Care Fsa Nanny Receipt Template

Adopting a specialized and structured dependent care fsa nanny receipt template offers a multitude of advantages, significantly streamlining the process of financial record-keeping for dependent care expenses. This deliberate approach ensures that all necessary information is consistently captured, leaving no room for ambiguity or oversight. It simplifies the often-complex task of managing eligible expenses for programs like the DCFSA.

Foremost among these benefits is the assurance of accuracy. Predefined fields guide the entry of specific data, reducing the likelihood of errors or omissions that could delay reimbursement or create tax complications. Furthermore, a standardized format enhances transparency, providing a clear and unequivocal breakdown of services rendered, dates, and associated costs. This consistency in documentation is invaluable for both submitting claims and maintaining a verifiable audit trail, functioning as an unparalleled financial template for critical transactions.

Essential Components of an Effective Template

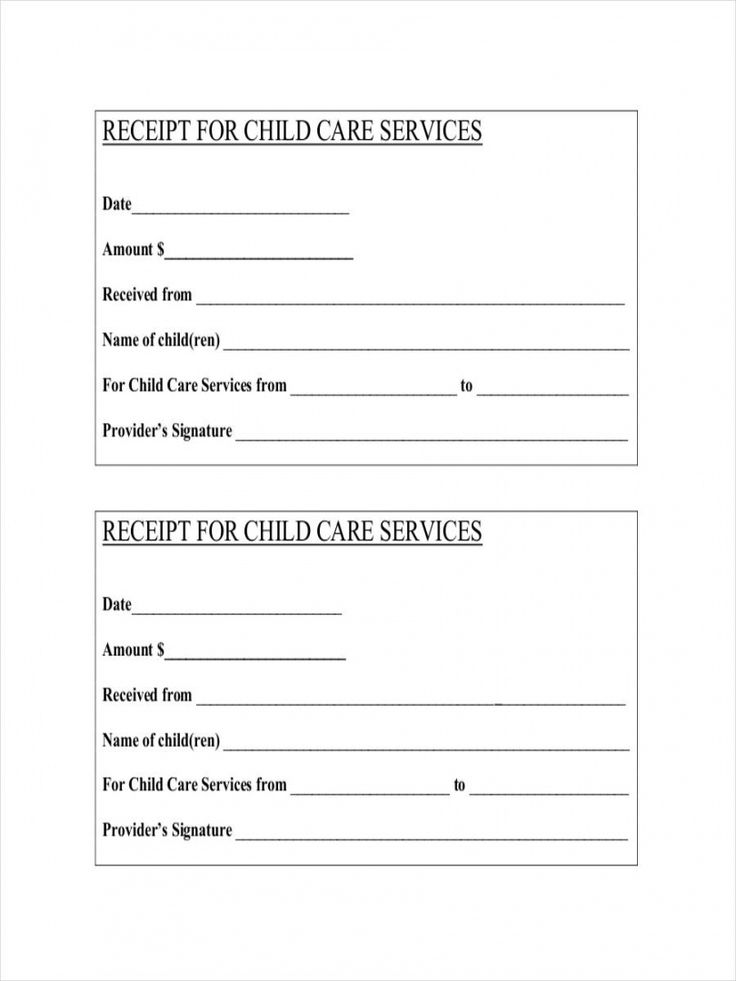

An effective template for dependent care services must include several key data points to be considered valid for DCFSA claims and tax purposes. Each element contributes to the comprehensive nature of the record, ensuring it stands up to scrutiny. Omitting any of these details could lead to delays or rejection of claims.

Key components typically include:

- Provider Information: Full legal name of the care provider (individual nanny, daycare center, or agency), complete address, and their Social Security Number (SSN) or Employer Identification Number (EIN). This is crucial for tax reporting.

- Recipient Information: Full legal name of the parent or guardian paying for the services, and their complete address.

- Child’s Information: Full legal name(s) of the dependent child(ren) receiving care, including their date(s) of birth.

- Service Details: Clear description of the services provided (e.g., "Nanny services," "Childcare services").

- Period Covered: The exact start and end dates for which the services were rendered (e.g., "Weekly care from MM/DD/YYYY to MM/DD/YYYY," or "Monthly care for [Month, Year]").

- Amount Paid: The total monetary amount received for the services, clearly stated in numerical and, ideally, written form.

- Date of Payment: The specific date on which the payment was made and received.

- Method of Payment: How the payment was rendered (e.g., cash, check number, bank transfer, online payment platform).

- Signature Line: A space for the care provider’s signature, signifying receipt of payment and confirmation of services. This adds an extra layer of authenticity to the service receipt.

- Certification Statement: An optional but highly recommended statement confirming that the services were provided for the primary purpose of enabling the parent(s) to work or look for work.

These components collectively form a robust proof of transaction, essential for substantiating an expense record.

Customization for Diverse Transaction Types

While the primary focus here is on dependent care, the underlying principles of a well-designed financial template are universally applicable. The flexibility inherent in a structured layout means this form can be readily adapted to suit a wide array of financial transactions, serving various business documentation needs. The fundamental goal of clarity and comprehensive data capture remains consistent.

For instance, this template can be customized to function as an efficient invoice form for sales transactions, detailing products, quantities, and unit prices to create a complete sales record. Businesses providing services can modify the layout to produce detailed service receipts, outlining the scope of work, hours expended, and hourly rates. Landlords might adapt the document to serve as a rent payment receipt, providing tenants with clear proof of payment for their housing expenses. Non-profit organizations can customize it into a donation acknowledgment, providing donors with the necessary documentation for tax deductions. Furthermore, companies can utilize a modified version for employee business reimbursements, ensuring all expense records are consistently documented. The adaptability of a well-conceived financial template makes it an invaluable tool across diverse sectors.

When to Leverage This Specific Documentation

The judicious use of a dedicated receipt for dependent care expenses is crucial in several specific scenarios. Employing this template proactively ensures that all parties possess the necessary documentation precisely when it is required, preventing last-minute scrambles and potential complications. Its consistent application underscores a commitment to financial diligence.

Examples of when using the template is most effective include:

- Submitting claims for a Dependent Care Flexible Spending Account (DCFSA): This is the primary use, as the form provides the essential substantiation for reimbursement requests.

- Preparing for tax season: The detailed information captured is vital for calculating and claiming the Child and Dependent Care Credit on federal income tax returns.

- Maintaining personal financial records for budgeting: Families can track their actual dependent care expenditures against their budget, offering clear insights into cash flow.

- When a childcare provider needs to track income: The template serves as an organized record for the provider’s own income, simplifying their tax preparations.

- Resolving discrepancies with payment or service dates: A clear, dated receipt can quickly clarify any misunderstandings regarding services rendered or payments made.

- Anytime proof of childcare expense is required: Whether for financial aid applications, loan documentation, or other administrative purposes, the document provides verifiable evidence.

Design, Formatting, and Usability Best Practices

The efficacy of any financial template is significantly enhanced by its design, formatting, and overall usability. A document that is difficult to understand or fill out will undermine its purpose, regardless of its underlying structure. Attention to these details ensures that the receipt is both professional and practical for all users.

For optimal clarity and professionalism, consider the following best practices:

- Clarity and Legibility: Utilize clean, professional fonts and appropriate font sizes (e.g., 10-12pt for body text). Employ clear headings and subheadings to guide the eye through the layout.

- Conciseness: Avoid overly verbose language or unnecessary jargon. The document should be straightforward, presenting information efficiently.

- Logical Flow: Arrange fields in a logical order that mirrors the flow of information typically collected during a transaction (e.g., provider details first, then recipient, then service details, then payment).

- Sufficient Space: Ensure ample space for entries, especially if the template is intended for print and manual completion. For digital versions, ensure text boxes are adequately sized.

- Branding (Optional but Recommended for Providers): Allow for the inclusion of a provider’s logo and contact information at the top. This adds a professional touch and reinforces identity.

- Digital Considerations:

- Fillable PDF: Create fillable PDF versions that can be easily completed on a computer, supporting clear, typed entries.

- Electronic Signatures: Integrate secure electronic signature capabilities to facilitate paperless transactions.

- Compatibility: Ensure the file is compatible with common software and operating systems.

- Print Considerations:

- Print-Friendly Layout: Design the layout to be clean and legible when printed, avoiding elements that consume excessive ink or obscure text.

- Margins: Ensure adequate margins for binding or filing.

- Instructions: Include brief, clear instructions on how to complete the form, if necessary, especially for fields that might require specific information (e.g., "Enter SSN or EIN").

By adhering to these design and formatting principles, the receipt becomes an intuitive and reliable tool, fostering efficient financial communication.

Conclusion

In the dynamic world of personal and family finance, the diligent management of expenses, particularly those eligible for tax benefits or reimbursements, is paramount. A meticulously designed Dependent Care FSA Nanny Receipt Template transcends the role of a simple record; it acts as a strategic instrument for financial organization, compliance, and peace of mind. Its structured nature guarantees that every relevant detail is captured consistently, providing irrefutable proof of transaction for all parties involved.

The utility of this financial template extends far beyond mere compliance with DCFSA requirements. It serves as a foundational element in robust financial planning, empowering families to accurately track expenditures and simplifying the often-complex process of tax preparation. By embracing such a reliable, accurate, and efficient financial record tool, both care providers and families foster a transparent and trustworthy environment, underscoring the value of clear communication and diligent documentation in every financial interaction.